The Walt Disney Company (DIS) is set to significantly bolster investment in its thriving parks business, with an estimated $60 billion. This decision comes as Disney continues to grapple with the rapidly evolving landscape of media and entertainment, while striving to boost the profitability of its streaming services. Recent quarters have seen a drop in subscriber numbers for Disney+.

The company reported 146.1 million Disney+ subscribers in its most recent quarter, a 7.4% decline from the previous quarter.

Amid dwindling users and declining revenues within its media and streaming distribution segment, Disney's strategy includes setting a higher price point on its ad-free streaming tier and a crackdown on password sharing.

Furthermore, Disney is reportedly in discussions with Indian magnates Gautam Adani and Sun TV Network owner, Kalanithi Maran, as well as several private equity firms, about the sale of its streaming and television business within India. This move is regarded as a response to escalating competitive pressure from other streaming superpowers.

As the prominent entertainment conglomerate struggles to rejuvenate its streaming business, the present assessment advises caution when considering stock purchase. I present a bearish stance backed by key metrics, suggesting that this stock may be best avoided at present.

Examining the Ups and Downs: A Comprehensive Analysis of The Walt Disney Company's Financial Performance (2021-2023)

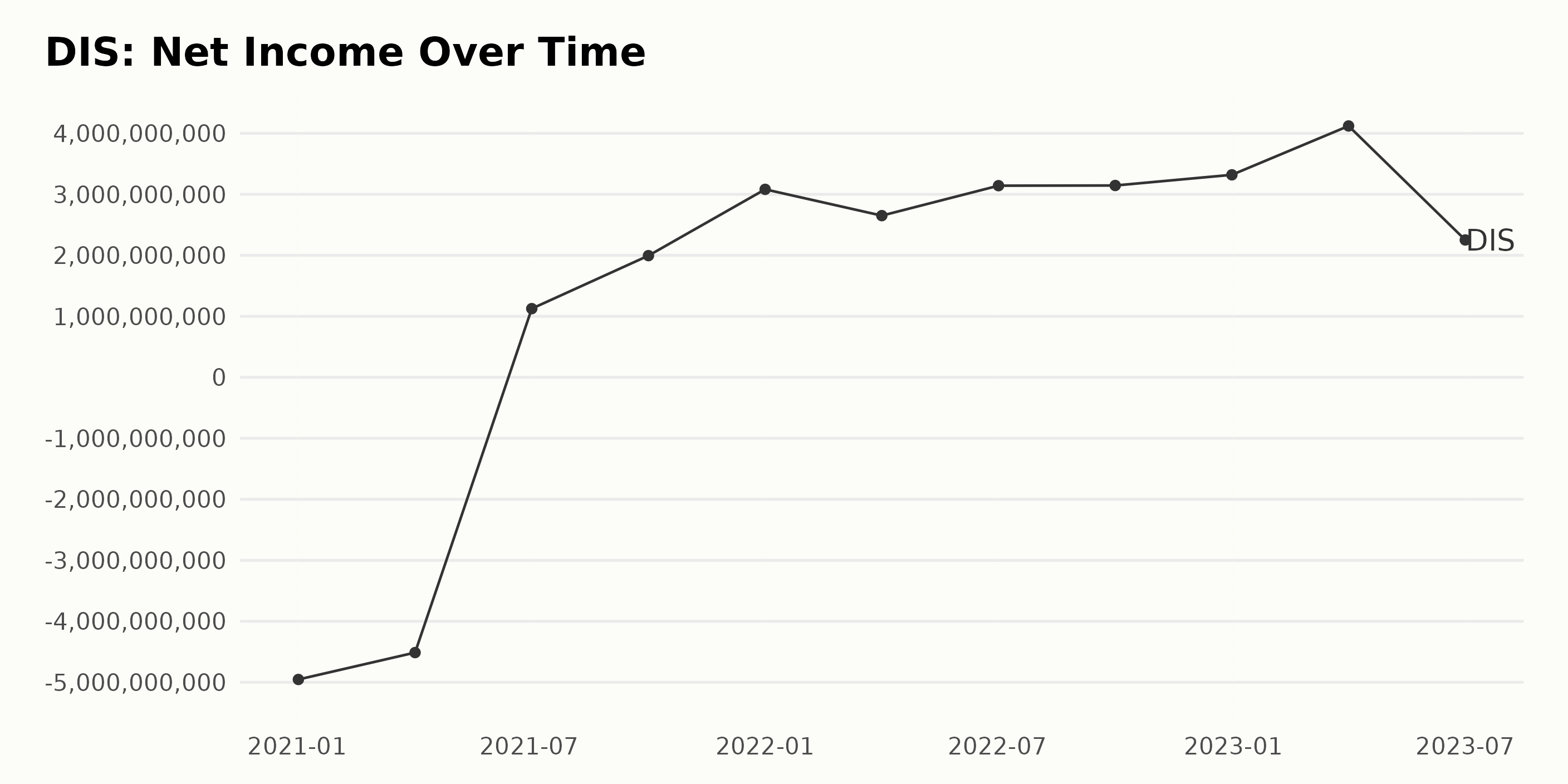

The trailing-12-month net income of DIS saw significant fluctuations from 2021 onwards, with a noteworthy growth trajectory especially evidenced in more recent data.

- Starting at a Net Income of -$4.95 billion in January 2021, DIS experienced consecutive losses until April 2021, when it reported a Net Income of -$4.51 billion.

- A positive turn was seen in July 2021 with the Net Income rising to $1.13 billion.

- In October 2021, the Net Income saw a noticeable increase to $1.99 billion.

- The upward trend continued into 2022, with notable gains each quarter, culminating in Net Incomes of $3.08 billion in January 2022, $2.65 billion in April 2022, $3.14 billion in July 2022, and $3.15 billion in October 2022.

- The last value in the series, being the most crucial, shows an impressive increment with the Net Income hitting a high at $4.12 billion in April 2023 before experiencing a downturn to $2.25 billion in July 2023.

From the initial value in January 2021 to the final data point in July 2023, The Walt Disney Company has seen an impressive total growth rate of approximately 145.48%. This highlights the company's robust recovery and resilience in the face of previous net losses. The overall trend illustrates DIS's ability to improve its financial conditions over the given period, signifying positive growth trends for the company's income generation.

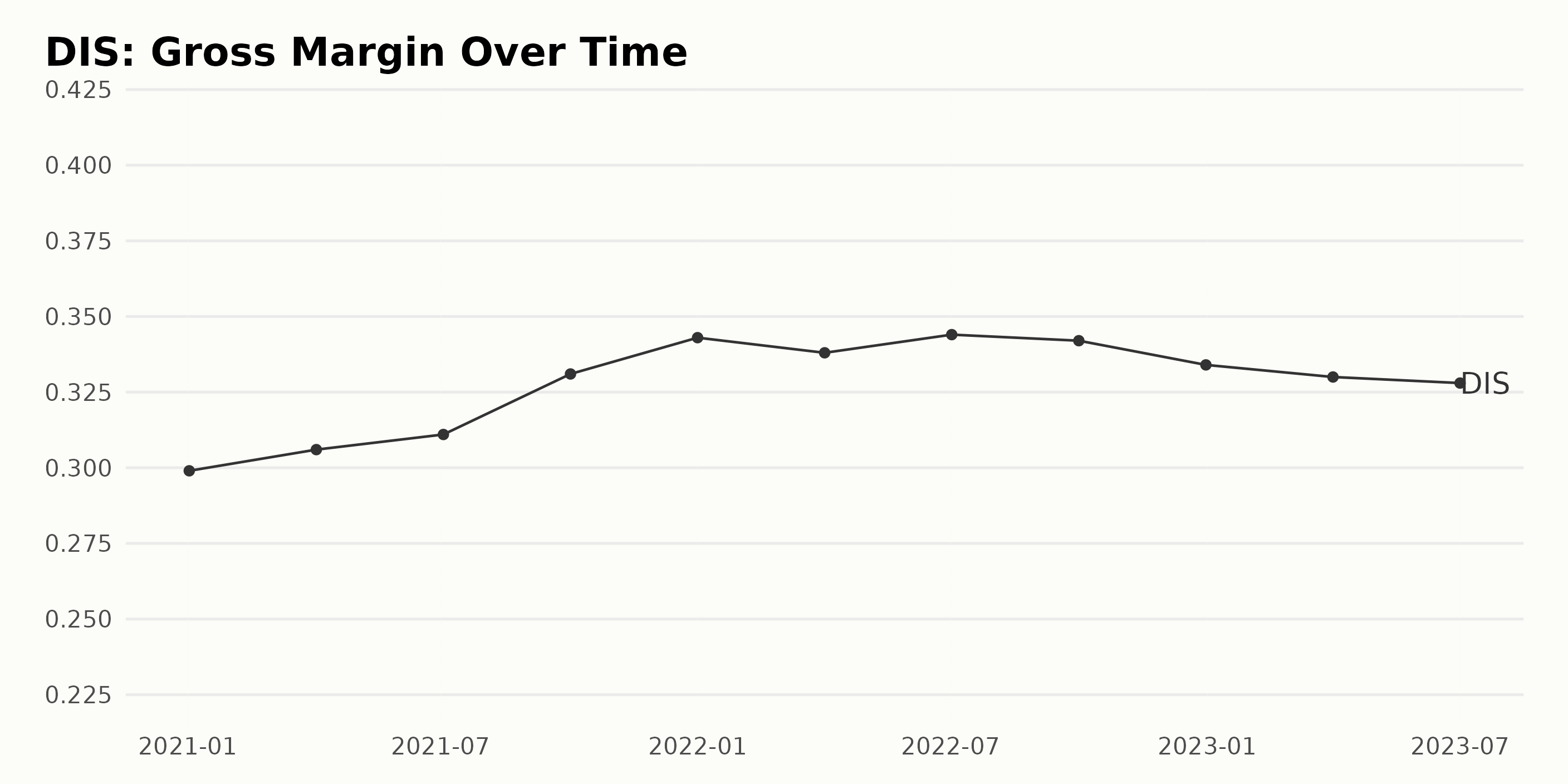

The Gross Margin of DIS has experienced several fluctuations but maintained an overall upward trend from January 2, 2021 to July 1, 2023. Here are some notable points:

- January 2, 2021, the Gross Margin was 29.9%.

- It increased slightly to 30.6% by April 3, 2021, and further to 33.1% by October 2, 2021.

- On January 1, 2022, the Gross Margin had grown to 34.3%, the highest point recorded during the series. This represented a growth rate of approximately 14.72% within a year.

- Despite a small decrease to 33.8% on April 2, 2022, the value climbed back up to 34.4% by July 2, 2022.

- The last three data points show a downward trend: 34.2% (October 1, 2022), 33.4% (December 31, 2022), and finally 32.8% (July 1, 2023).

From the first value in January 2021 to the last in July 2023, DIS’ Gross Margin has exhibited an overall growth rate of approximately 9.7%.

The dataset represents the Return on Assets (ROA) of DIS from January 2021 to July 2023. Here are the key points with reference to the trend and fluctuations in the data:

- In January 2021, the ROA for DIS was -2.4%. The value stood negative, highlighting some financial strains experienced within that period.

- From January 2021 to April 2023, there was an overall upward trend in the ROA. By April 2023, the ROA had risen to 2.0%, a significant increase from its initial negative value. This represented a considerable growth in company assets versus their corresponding liabilities.

- The data, however, experienced fluctuations over the given time. For instance, the rise between January to April 2021 was 0.2%. A further substantial swing occurred between April and July 2021, from -2.2% to 0.6%, indicating a positive turnaround.

- Between April 2021 and October 2022, despite minor irregularities, the ROA for DIS generally fluctuated between 1.0% and 1.5%.

- However, from January 2022 to April 2023, ROA showed small variations ranging between 1.3% and 2.0%. The highest reported ROA during this period was in April 2023 at 2.0%. But it reduced again by July 2023 to 1.1%, marking a dip.

In summary, the ROA for DIS demonstrated an overall improving trend, notwithstanding the periodic fluctuations. The company moved from an initial negative ROA of -2.4% to reach a peak of 2.0% in April 2023. Although there was a subsequent drop to 1.1% in July 2023.

The trend and fluctuations in the Current Ratio for DIS from January 2021 to July 2023 can be summarized as follows:

- Starting in January 2021, DIS had a Current Ratio of 1.31.

- In the subsequent periods, there was a general decrease in its Current Ratio, reaching 1.00 in October 2022. This represented a decline of around 23% over this period.

- However, from the end of 2022 into 2023, the data shows an uptick in the Current Ratio to 1.07 by July 2023, marking an increase of approximately 7% from its previous significant low point at the end of 2022.

- The most recent figure for July 2023 was 1.07, which was an improvement over recent quarters, but still lower than the starting point of 1.31 in January 2021.

Overall, while there were fluctuations throughout the period studied, the long-term trend for DIS' Current Ratio appears to be a slight decrease. Thus, the emphasis on the current period shows an improved liquidity position for DIS, signaled by the upward movement in the Current Ratio. But it's paramount to note that the Current Ratio is still relatively lower in comparison with the value at the beginning of 2021. This could suggest some tightening in liquidity conditions for The Walt Disney Company.

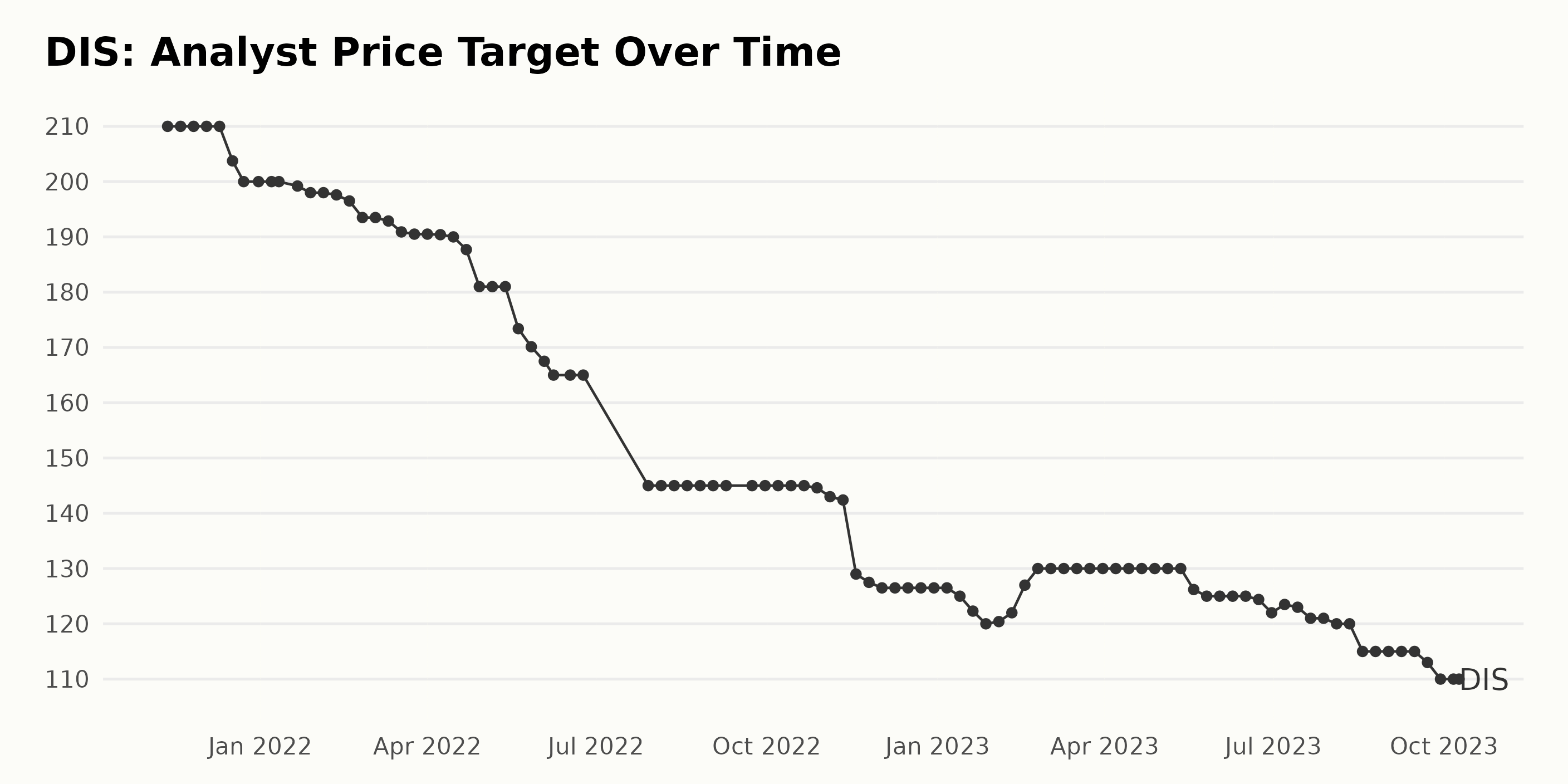

The trend and fluctuations in the Analyst Price Target value of DIS within the observed period displayed a general downward motion. Key Highlights:

- The Analyst Price Target for DIS stood at $210 on November 12, 2021, and showed consistent numbers up until December 10, 2021.

- A slight decrease was noticed on December 17, 2021, to $203.75. From that point forward, the price target gradually dropped.

- By June 8, 2022, the price target had fallen to $165, followed by a significant drop to $145 in July, which remained steady until October 28, 2022.

- A modest decline occurred in November 2022, with the Analyst Price Target dropping to $129 on November 18, and closing at $126.5 on December 30, 2022.

- After a brief upward adjustment in February 2023 peaking at $130, the price target experienced more fluctuations and ultimately ended up at $110 on October 9, 2023.

The growth rate, calculated by measuring the last value from the first value, signifies a decrease of about 47.6% over the observed period. This is a substantial dwindle in the Analyst Price Target of DIS. The most recent data and the last recorded value of $110 on October 9, 2023, corroborate this bearish trend.

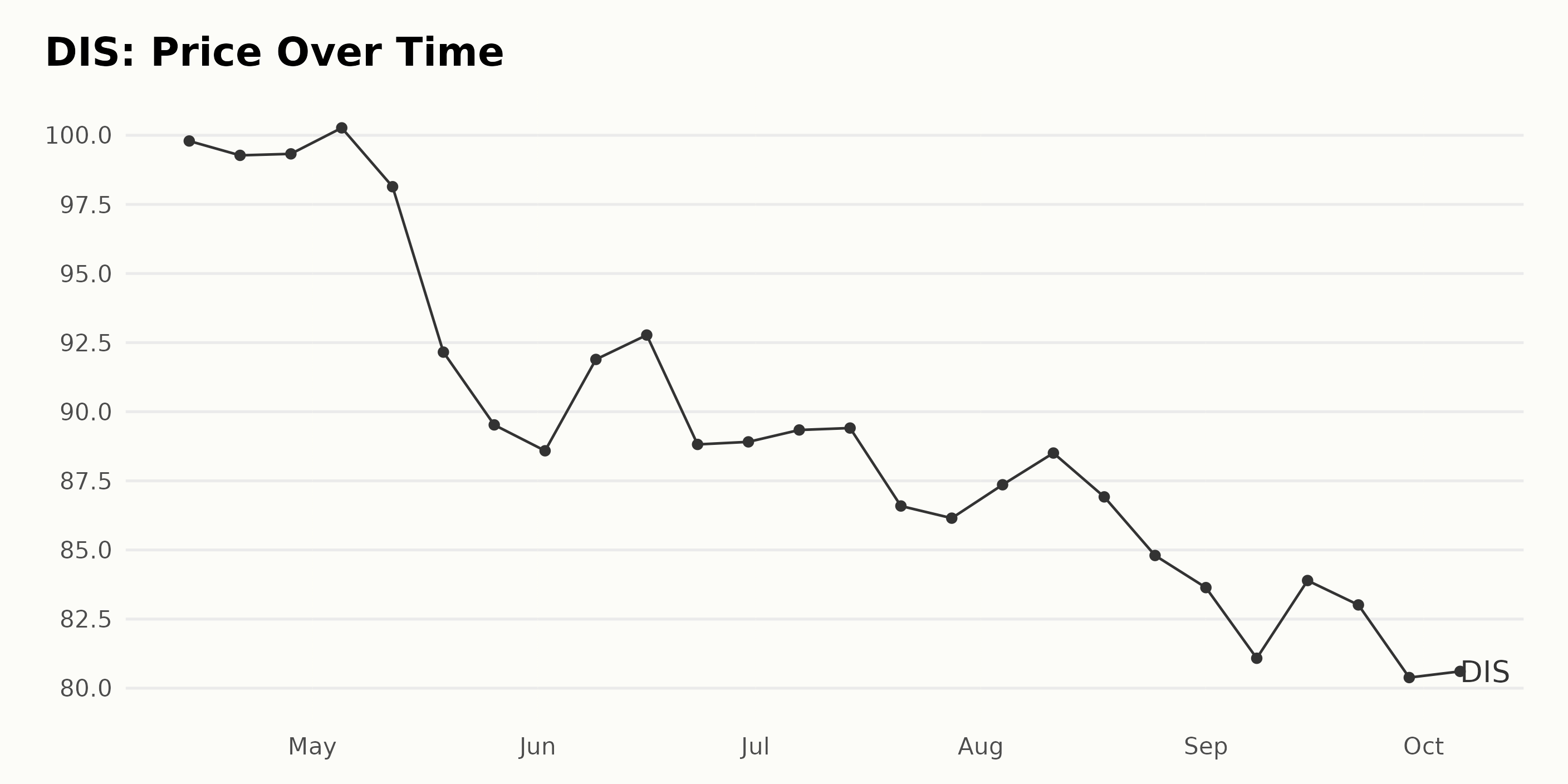

Tracking Walt Disney's Declining Share Prices: An Analysis from April to October 2023

The Walt Disney Company (DIS) share prices show a downward trend from April 2023 to October 2023. Here are some notable observations, all prices are rounded to two significant digits and dates are mentioned in Month, Day, Year format:

- On April 14, 2023, the DIS share price stood at $99.79

- There was a very slight drop of around 0.5% over a week to $99.27 on April 21 and by April 28, it recovered slightly to reach $99.33.

- The peak price during the time period under consideration was on May 5, 2023, when the DIS share price reached $100.27.

- An accelerated decrease started from May 12. Within the month, by May 26, there was a dramatic fall of nearly 9% taking the value down to $89.52.

- There was a minor recovery phase in early June 2023 - by June 16, the price rose to $92.77. However, this was followed by a steady decline throughout the rest of June and July, with the price reaching $86.15 by July 28.

- There is a slight indication of volatility with minor ups and downs noticed until September. The share price drops to as low as $81.08 on September 8 before bouncing back to $83.89 on September 15.

- Despite minor fluctuations, the overall downward trajectory continued till the end of September, with the price reaching $80.38 on September 29.

- As of October 6, 2023, the DIS share price stood at $80.61, almost 20% less than the peak price observed on May 5, 2023.

In summary, The Walt Disney Company (DIS) share prices showcase a negative growth rate over this time period from April to October 2023, with a clear declining trend. The levels of decrease appear to accelerate from May and continue till October, with minor occasional fluctuations. Here is a chart of DIS's price over the past 180 days.

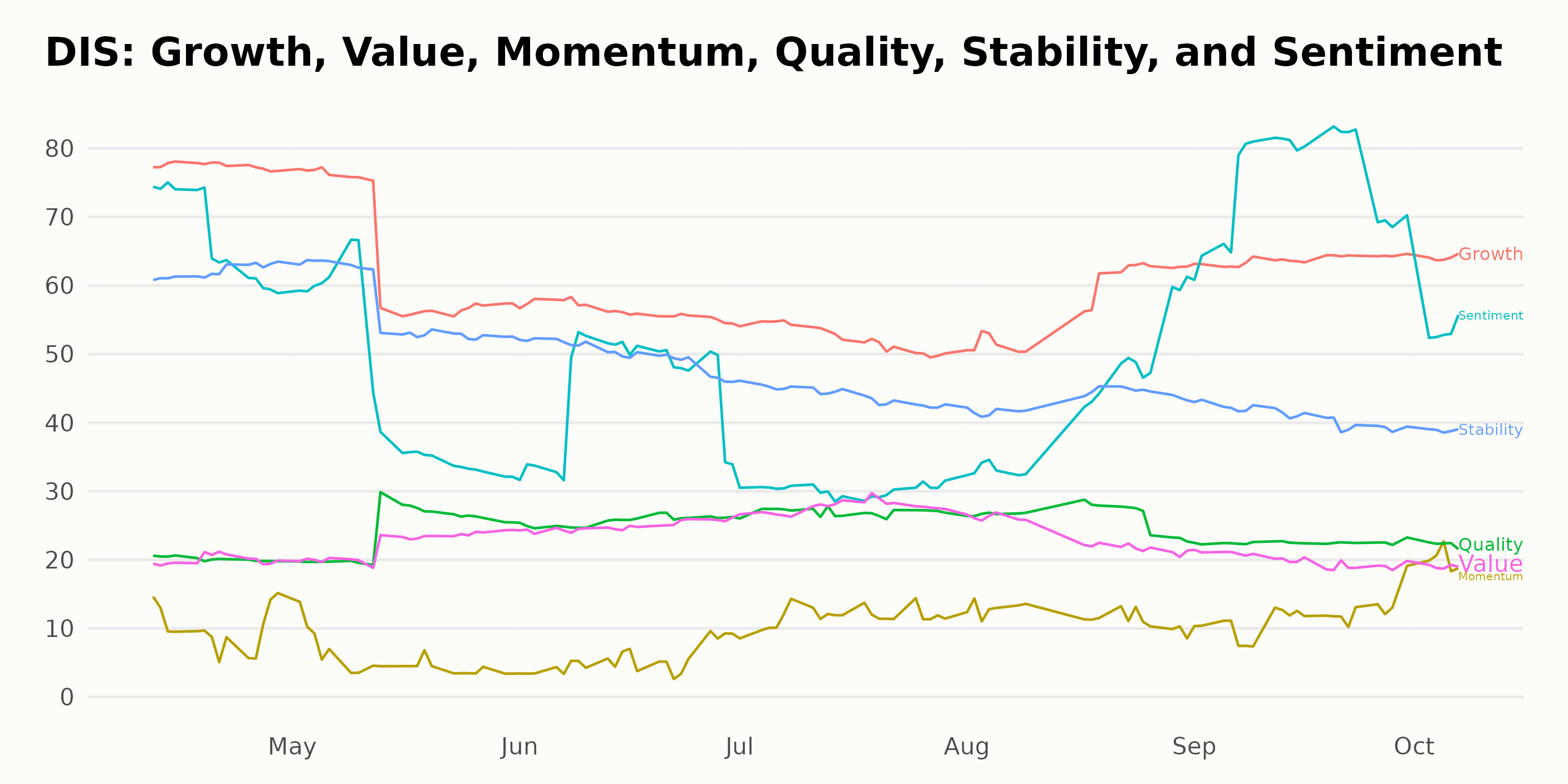

Analyzing Disney's Performance: Growth, Sentiment, and Stability Trends Over Time

DIS has an overall D rating, translating to a Sell in our POWR Ratings system. It is ranked #8 out of the 10 stocks in the Entertainment - Media Producers category.

The POWR Ratings for The Walt Disney Company (DIS) reveal interesting insights when we focus on the three most noteworthy dimensions: Growth, Sentiment, and Stability. Here are how these dimensions performed over time:

Growth - In April 2023, the company recorded a high growth rate of 77. However, there seem to be a downward trend with a decrease to 64 in May 2023, further reduced to 52 by July 2023. There appears to be a slight bounce back in August and September 2023 as the growth was recorded at 58 and 64 respectively.

Sentiment - The sentiment dimension observed a mixed trend. Starting relatively high at 67 in April 2023, it decreased to 30 by July 2023. However, there was a significant increase to 76 in September 2023 before settling down to 53 in October 2023.

Stability - Stability for DIS started reasonably strong at 62 in April 2023 and then seemed to be on a consistently declining trend reaching 39 by October 2023.

These trends show that while the Growth and Sentiment ratings for The Walt Disney Company experienced some fluctuations, the Stability dimension demonstrated a clear downward trend over these respective months of assessment.

Stocks to Consider Instead of The Walt Disney Company (DIS)

Other stocks in the Entertainment - Media Producers sector that may be worth considering are News Corp (NWSA), Discovery Inc. (DISCK), and Lizhi Inc. (LIZI) -- they have better POWR Ratings.

What To Do Next?

43 year investment veteran, Steve Reitmeister, has just released his 2024 market outlook along with trading plan and top 11 picks for the year ahead.

DIS shares were trading at $84.70 per share on Monday afternoon, up $1.76 (+2.12%). Year-to-date, DIS has declined -2.51%, versus a 14.30% rise in the benchmark S&P 500 index during the same period.

About the Author: Subhasree Kar

Subhasree’s keen interest in financial instruments led her to pursue a career as an investment analyst. After earning a Master’s degree in Economics, she gained knowledge of equity research and portfolio management at Finlatics.

The post Disney (DIS) Magic in October: Buy or Sell? appeared first on StockNews.com