VANCOUVER, BC / ACCESSWIRE / October 25, 2021 / Diamond Fields Resources Inc. (TSX-V:DFR) ("DFR" or the "Company") is pleased to announce a maiden Mineral Resource prepared in accordance with National Instrument 43-101 ("NI 43-101") for Moydow Holdings Limited's ("Moydow") Labola Gold Project in Burkina Faso ("Labola" or the "Project"). As described in the press release of August 25, 2021 (the "Initial News Release"), DFR has entered into definitive agreements to acquire Moydow which has an option to own 100% of the Project (the "Transaction").

Highlights (See Table 1 and Figures 1-3)

- Indicated resource of 5.41 million tonnes at an average grade of 1.52 g/t Au for a total 264,000 ounces of gold; and

Inferred resource of 6.93 million tonnes at an average grade of 1.67 g/t Au for a total of 371,000 ounces of gold.

- The Mineral Resource Estimate (MRE) was estimated using ordinary kriging methodologies, standard estimation practices and constrained by an open-pit evaluation based on a US$1,900 per ounce gold price and reported using a cut-off grade of 0.5 grams of gold per tonne ("g/t Au").

- The MRE is based upon a total of 69,787 metres ("m") of drilling from 566 drill holes which includes the recent Moydow, confirmatory, twin and infill drilling of 4739m for 31 holes (23 twin holes).

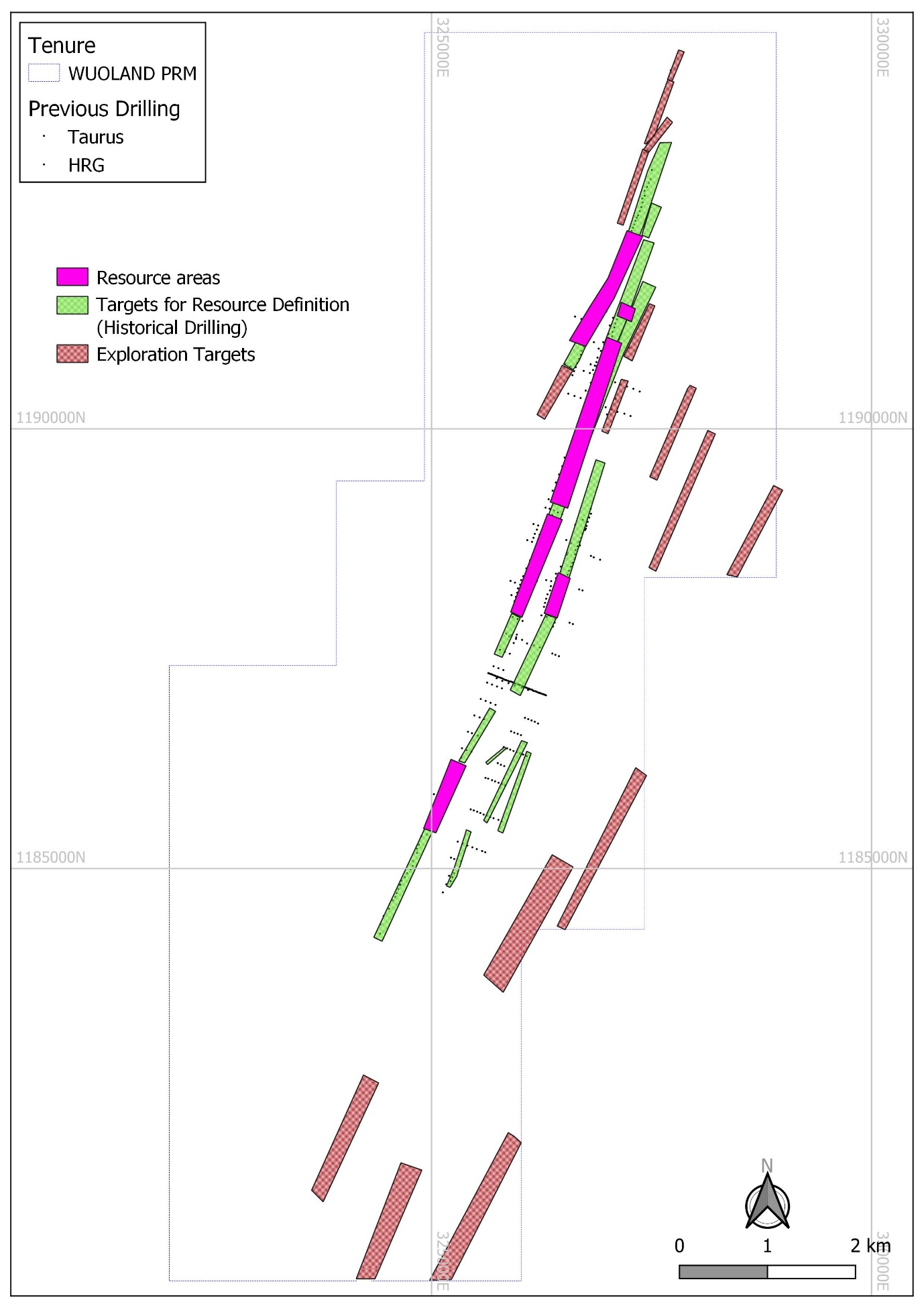

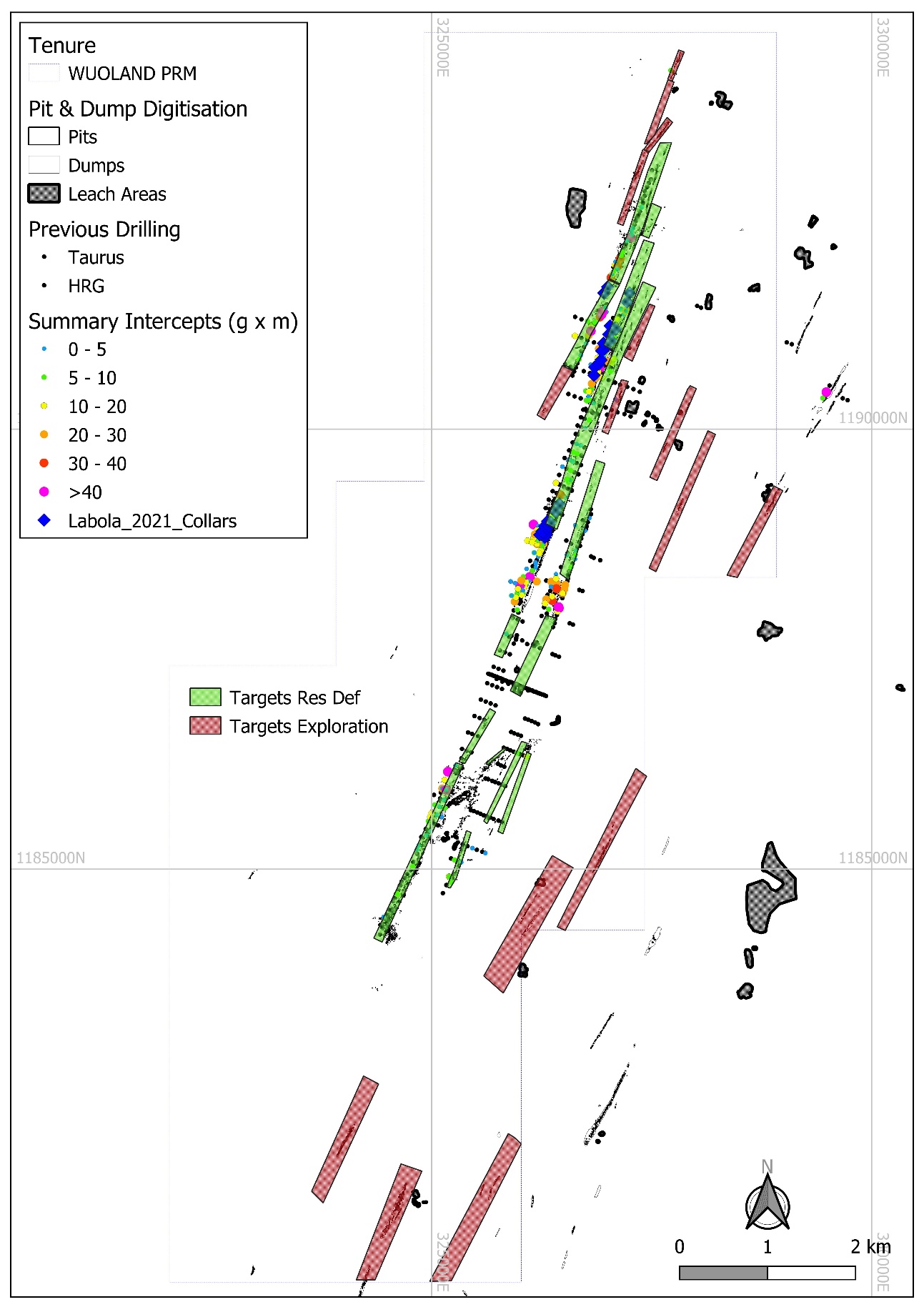

- Three mineralized zones have been outlined from the various drilling programs and each zone is open in all directions. Extensive target generative work demonstrates many opportunities for resource expansion which include extensions to the current pit constrained resources; zones with only widely spaced drilling; extensions of known mineralized zones with no drilling; untested artisanal sites and potentially new mineralized zones indicated by geophysical and geochemical anomalies.

- The Company's future exploration and development programs, following completion of the Transaction as defined in the DFR press release of August 25, 2021, will focus on resource expansion opportunities with a view to producing an updated MRE and completion of a Preliminary Economic Assessment.

"The completion of the maiden Mineral Resource is a major milestone in the progression of the Labola Project and is a testament to the work completed by the Moydow technical team over the last year. The positive results contained in the Mineral Resource Estimate confirm our belief that Labola is a highly prospective project and an exceptional opportunity for future development. Labola is a project with shallow, open pit resources of which 41% of those currently delineated are in the Indicated category. The Project has over 30 km of potential strike length along three mineralized zones and many walk-up drill targets which will enable rapid resource expansion. DFR would acquire, in addition to the maiden Mineral Resource, an extensive database of historical information which will allow the Company to add value directly through the drill bit and supporting technical studies as we progress along the pathway to further development of the project" commented Al Gourley, Chairman of DFR.

The Transaction, as defined in the Initial News Release, is subject to approval by the TSX Venture Exchange, required shareholder approvals, and completion of satisfactory confirmatory due diligence by DFR. The Transaction remains expected to close in the first quarter of 2022.

Table 1.0. Mineral Resource for the Labola Gold Project, 25 October 2021**

Category | Mineralization | Gold grade | Contained gold |

|---|---|---|---|

Indicated Resource | 5.41 | 1.52 | 264 |

Inferred Resource^ | 6.93 | 1.67 | 371 |

- ** Mineral Resources, which are not Mineral Reserves, do not have demonstrated economic viability. The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, marketing, or other relevant issues. The Mineral Resources in this note were reported using CIM (2014) Standards on Mineral Resources and Reserves, Definitions and Guidelines and adopted by CIM Council.

- ^ The quantity and grade of reported the Inferred Resources in this estimation are uncertain in nature and there has been insufficient exploration to define this Inferred Resource as an Indicated or Measured Mineral Resource. It is uncertain if further exploration will result in upgrading the Inferred Resource to an Indicated or Measured Mineral Resource category.

- The Mineral Resource has been constrained by an open pit evaluation using a gold price of $1900 per ounce, and then reported at a cut-off of 0.5 g/t Au.

- Contained metal and tonnes figures in totals may differ due to rounding.

Moydow has estimated the amount of the resource that has been depleted by artisanal mining to be approximately 341,000 tonnes at 3 g/t Au. The quantity of mined material has been calculated from estimates of dump and leach pad volumes. The grade of the material mined has been estimated in the range of 1.5-3.0 g/t Au and is based on an evaluation of extensive rock chip, channel sampling of artisanal workings and selective sampling of adjacent dumps. The location of where the material has been mined from is not known with any degree of accuracy. As such, the artisanal mining has not been deducted from the Mineral Resource but noted here for reference.

Preliminary metallurgical results from historical metallurgical samples, supported by extensive LeachWELL (proprietary accelerated cyanide leach technique) data from Moydow drilling samples, indicate that gold is readily treatable by conventional cyanide leaching techniques after grinding to industry standard grind-sizes of approximately 80% passing 120 microns. Recoveries are in the range of 90% and 98% in the oxide zone and between 82% and 93% in the transition/sulfide zone.

The mineral resource estimate (MRE) for the Labola Project has been prepared by Mr. Ivor W.O. Jones, M.Sc., FAusIMM, P.Geo, of Aurum Consulting, who is an independent Qualified person (QP) under NI 43-101 guidelines. The maiden Mineral Resource and its preparation will be detailed in a technical report prepared in accordance with NI 43-101 to be filed on SEDAR within 45 days of this press release.

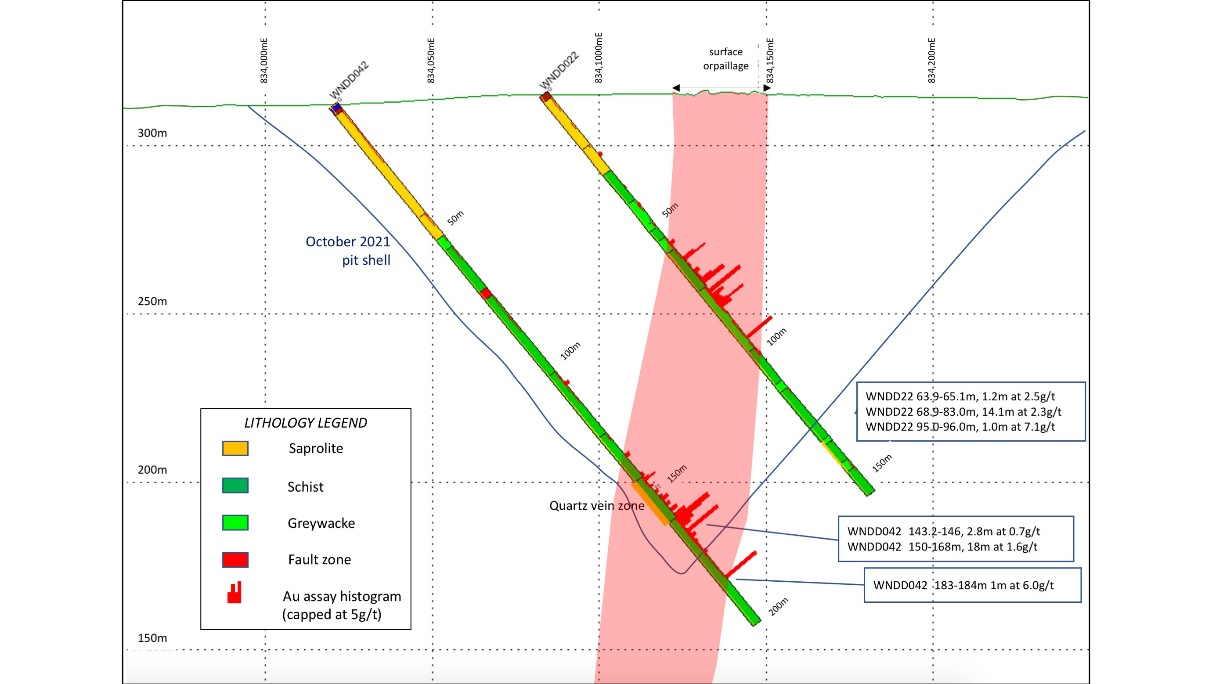

The MRE has been prepared using grades with top-caps applied in a fairly standard grade ordinary kriged estimation. Holes that had been twinned were removed, and replaced with the new drill data, but estimates also cross-checked with just the old data with very similar results. This provided significant confidence in the historical data. Validation included visual and statistical evaluations and considered to be good. Classification of the MRE was based on the guidelines of the CIM and NI 43-101 to define and report Indicated and Inferred Resources for the project.

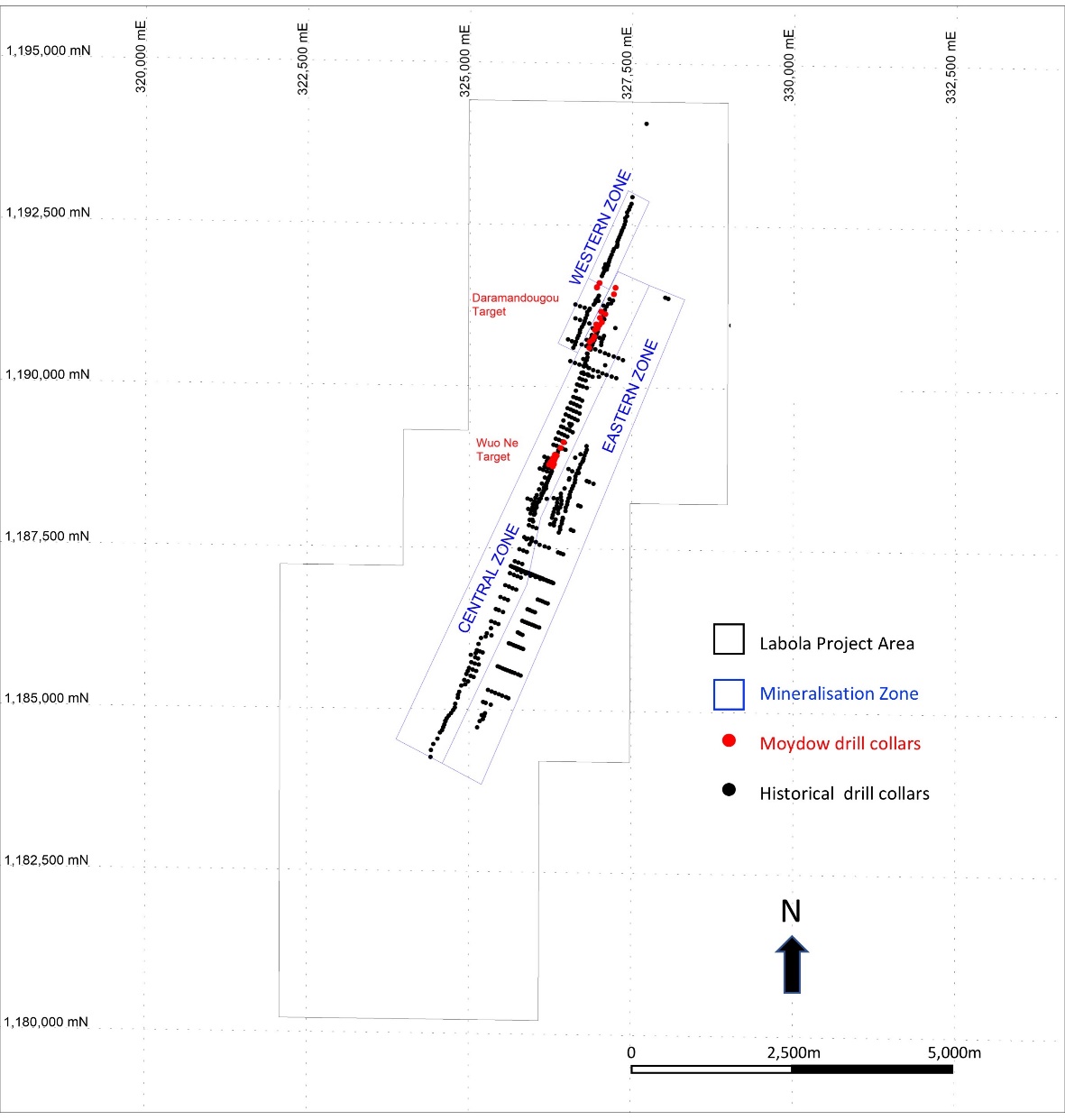

Figure 1: Location of historical and Moydow drill holes in the Labola project area

Figure 2: Representative section of the mineralized zone at Labola with grade intercepts, wireframe in red and MRE pit shell outline in black

Figure 3: Outline of areas included in resources, targets for potential resource expansion and exploration target areas

Figure 4: Outline of potential resource expansion and exploration target areas, and showing significant intercepts in drilling and 2021 drill collars

About Labola

The Labola gold exploration project is in the Banfora greenstone belt of the West African Birimian Supergroup in southwest Burkina Faso. Labola is approximately 450km west-southwest of the capital, Ouagadougou, and 100km northeast of the Wahgnion gold mine, operated by Endeavour Mining (Q2, 2021 production of 41 000 ounces gold).

More than 65,500m of historical drilling (541 holes) has been completed across multiple drilling campaigns by previous owners, High River Gold Mines Limited ("HRG"), later acquired by Nord Gold Plc, and Taurus Gold Limited ("Taurus"), consisting of principally diamond and RC drilling (24,589m/39,339m, respectively). Mineralization has been intercepted by historical drilling and outlined by previous artisanal mining in three main zones over a 10 km strike length.

Moydow has explored the area since August 2020 including acquisition and compilation of all previous data into a single database, interpretation of this data, target generation using the database and all the acquired remote sensing information, a drilling program involving 23 twin holes and an additional six exploration and infill holes. The database of historical information has been audited, correctly coordinated and the twin drilling results demonstrate the validity of the previous data. The results of the Moydow drilling showed strong reproducibility of the HRG and Taurus drill data in both terms of location of mineralization and grade. Further, the brownfields exploration drilling showed good predictability of the location of mineralization in extensional drilling to the mineral resource. The HRG, Taurus and Moydow data was therefore taken as sufficiently accurate to be used in the estimation of the Maiden MREs for Labola.

Gold mineralization at Labola is related to quartz veining, areas of silica alteration and disseminated pyrite. A previous ground IP survey highlighted the coincidence between mineralized zones and high chargeability (sulfides) and resistivity (quartz veining and silicification) anomalies. This correlation outlines many additional opportunities for resource expansion drilling in the future.

In addition to the preparation of the maiden MRE, Moydow has compiled, integrated, and assessed all the available information and outlined future exploration targets based on each of the main data sets. Based on this, Moydow selected targets and ranked them based on their perceived proceptivity as summarized:

- Priority 1 - Taurus Resource Targets.

- Priority 2 - HRG Resource Targets.

- Priority 3 - Mineralization Extensions.

- Priority 4 - Untested Workings.

- Priority 5 - Previous Drill Intercepts.

- Priority 6 - IP Targets.

- Priority 7 - Mineralization Trends.

- Priority 8 - Geochemical Targets.

- Priority 9 - EM targets.

The main targets are along the major interpreted central shear system encompassing the three mineralized zones. There is also strong evidence that there are several sub-parallel, additional structures that also host significant gold mineralization as shown by artisanal workings. These targets can be considered as clearly defined for drill testing. Many of the targets are resource expansion opportunities as they are obvious extensions to identified resources and include areas with only widely spaced historical drilling. Additional targets include untested zones with artisanal workings and new zones as defined by soil geochemistry and/or Induced polarization surveys. Labola therefore represents an advanced exploration project with clearly defined drill targets that provide opportunities for exploration and resource expansion.

Technical Information

Mr. Ivor Jones, BSc. (Hons), MSc, FAusIMM of Aurum Consulting. is an independent Qualified Person as defined under NI 43-101 and directly undertook the preparation and estimation of the October 2021 maiden mineral resource estimate. Mr. Jones has reviewed and approved the contents of this press release. Mr. Jones has over 40 years of relevant experience in geology, exploration, mining, resource evaluation and management including operational and consulting experience in both open pit and underground mines. He was previously a Group General Manager for Snowden Mining Industry Consultants where he was responsible for the company's geoscience activities globally.

Mr. David J Reading, M.Sc., FIMM, a director of DFR and a Qualified Person as defined under Canadian National Instrument 43 101 - Standards of Disclosure for Mineral Projects ("NI 43 101"), has prepared or supervised the preparation of, or approved, as applicable, the technical information contained in this press release. Mr. Reading has over 40 years' experience in the mining industry covering all stages of mine development, including exploration, feasibility, financing, construction, and operations. He has an MSc in Economic Geology and is a Fellow of the Institute of Materials, Minerals and Mining and of the Society of Economic Geologists.

DIAMOND FIELDS RESOURCES INC.

Sybrand van der Spuy, CEO and Director

Contact: +27 78 4558700

Michael Oke/Andy Mills: +44 20 7321 0000

Aura Financial LLP: www.aura-financial.com

Notes to Editors:

DFR is a TSX Venture Exchange listed exploration and mine development company with assets in Madagascar and Namibia. In Madagascar, DFR is developing the Beravina Project, an advanced high-grade hard rock zircon exploration prospect located in the west of the country, approximately 220km east of the port of Maintirano and close to a state road. DFR acquired Beravina from Pala Investments and Austral Resources in 2016. In Namibia, the Company owns several offshore diamond mining licenses including the ML 111 concession which has a ten-year mining license, effective until 4 December 2025. In 2018 and early 2019 mining undertaken by a contractor on the Company's ML111 license area produced two parcels of rough diamonds totalling 47,318.41 carats.

Moydow is a privately owned, BVI registered, West African focused gold exploration business, which was formed in 2019 and subsequently in 2020 acquired, from AIM listed Panthera Resources Plc, its interest in the Labola project (Burkina Faso), followed by the Kalaka (Mali) project interest in 2021. At closing of the Transaction Moydow would be controlled by DFR. Moydow has interests in gold projects in West Africa; Labola in Burkina Faso, Kalaka in Mali, Dagma, Paimasa/Mint and Dext in Nigeria. Moydow has active exploration programs underway in all three countries.

Website: www.diamondfields.com

The Company's public documents may be accessed at www.sedar.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements:

This release contains certain "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements other than statements of historical fact in this release that address activities, events, or developments that DFR expects or anticipates will or may occur in the future are forward-looking statements or information. Often, but not always, forward-looking information can be identified using words such as "aim", "aspire", "strive", "will", "expect", "intend", "plan", "believe" or similar expressions as they relate to DFR. Forward- looking information is subject to a variety of risks and uncertainties which could cause actual events or results to materially differ from those reflected in the forward-looking information.

The forward-looking statements and information in this release include but are not limited to statements and information relating to the terms, conditions and completion of the Transaction; the obtaining of all required regulatory approvals in connection with the Transaction and Founder Investments; technical information; drilling and exploration programs; political risks; statutory and regulatory compliance;

Such statements and information reflect the current view of DFR. By their nature, forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause DFR's actual results, performance or achievements or other future events, to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements.

There are several important factors that could cause DFR's actual results to differ materially from those indicated or implied by forward-looking statements and information. Such factors include, among others: the ability to satisfy the conditions to the consummation of the Transaction and the Founder Investments; the ability to obtain requisite shareholder and regulatory approvals; the potential impact of the announcement or consummation of the Transaction on relationships; including with regulatory bodies, employees; suppliers customers and competitors; changes in general economic, business and political conditions, including changes in the financial markets; changes in applicable laws; compliance with extensive government regulation and the diversion of management time on the Transaction and the Founder Investments. Should one or more of these risks, uncertainties or other factors materialize, or should assumptions underlying the forward-looking information or statement prove incorrect, actual results may vary materially from those described herein as intended, planned, anticipated, believed, estimated, or expected.

DFR cautions that the foregoing list of material factors is not exhaustive. When relying on DFR's forward-looking statements and information to make decisions, shareholders should carefully consider the foregoing factors and other uncertainties and potential events. DFR has assumed that the material factors referred to in the previous paragraph will not cause such forward looking statements and information to differ materially from actual results or events. However, the list of these factors is not exhaustive and is subject to change and there can be no assurance that such assumptions will reflect the actual outcome of such items or factors. The forward-looking information contained in this release represents the expectations of DFR as of the date of this release and, accordingly, is subject to change after such date. Readers should not place undue importance on forward looking information and should not rely upon this information as of any other date. While DFR may elect to, it does not undertake to update this information at any time except as required in accordance with applicable laws.

SOURCE: Diamond Fields Resources Inc.

View source version on accesswire.com:

https://www.accesswire.com/669383/Diamond-Fields-Announces-Maiden-Mineral-Resource-for-Labola-Gold-Project