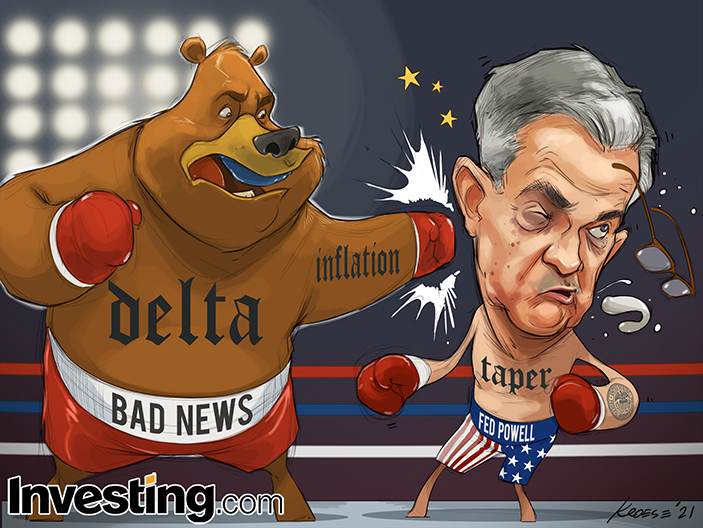

To taper or not to taper?

To taper or not to taper?

That is the question today as the Fed makes their next rate announcement at 2pm and we'll hear from Chairman Powell at 2:30. A rate hike seems out of question but tapering the Fed's $120Bn monthly bond and asset purchases is very much on the table and it's almost a certainty that the Fed will cut their monthly easing down to $110Bn and see how that goes. Just yesterday, our Government sold $24Bn worth of 20-year notes and the Fed, did in fact, buy most of them.

$4Tn worth of Treasuries are being sold in 2021 and that number will rise if the Government passses another stimulus bill. Some of that is rollover debt but $3Tn of it is our current deficit for the year and we've hit the debt ceiling, which is why it hasn't grown this quarter but Congress is working hard to extend it, so we can go 4 or maybe $5Tn into debt in 2021 – which would be bigger than the entrie GDP of any other country on Earth besides China.

$5Tn is also 1/4 of our own entire GDP which means 25% of our economy is deficit-funded. How long can that really last? Much longer than we ever dreamed is already the answer and will there ever be any consequences to our now $30Tn in total debt – that's a question we don't really ever want to know the answer to.

IN PROGRESS