$10Tn!

$10Tn!

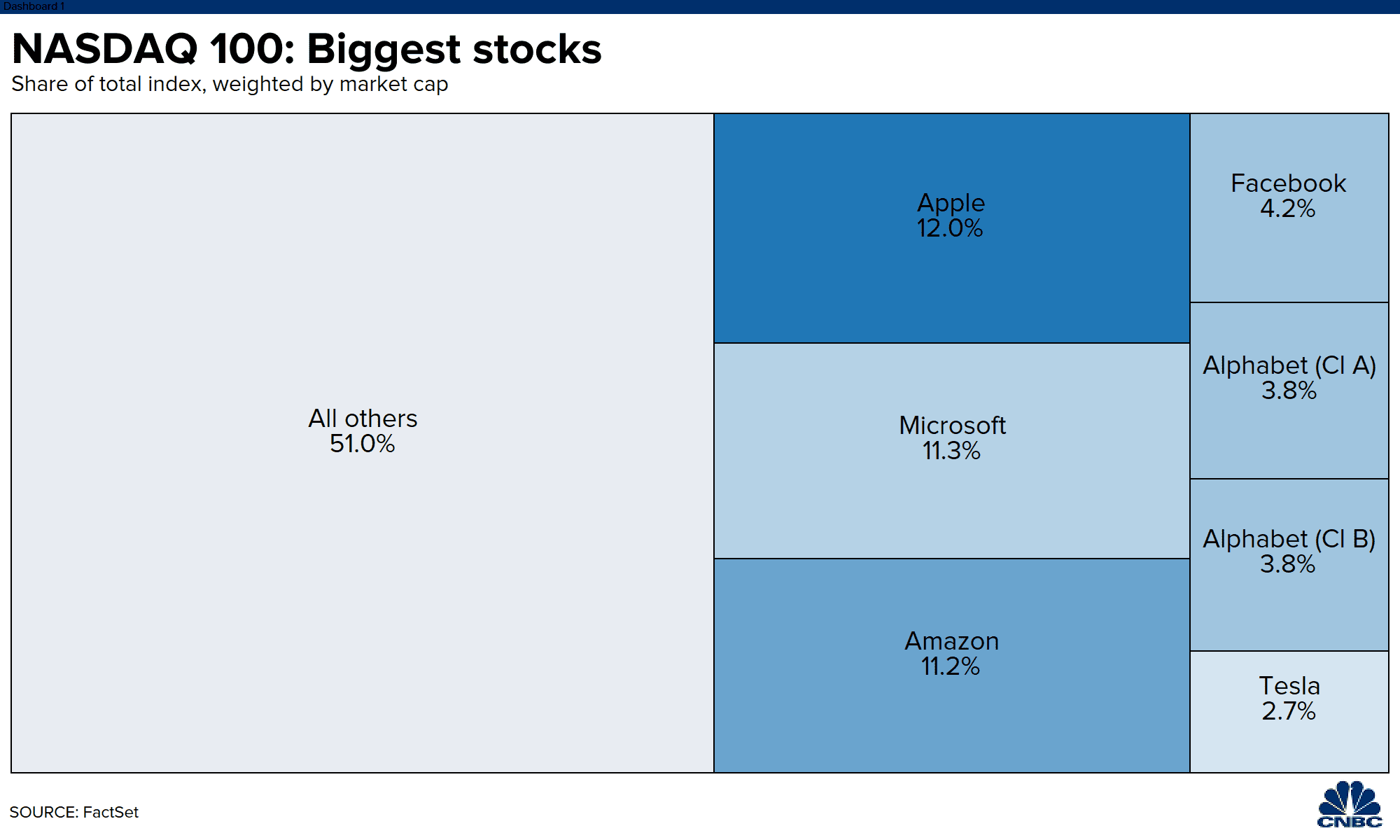

That's the market cap of Apple (AAPL), Amazon (AMZN), Alphabet (GOOGL) Facebook (FB), Microsoft (MSFT) and TSLA these days. Not only is that 25% of the S&P 500s market cap, it's closer to 1/3 of their earnings and, over at the Nasdaq, the Big 6 make up over 50% of that indexe's market cap (this chart was from earlier in the year, when they were still a bargain 49%).

AAPL, GOOGL and MSFT report today, FB tomorrow and AMZN reports on Thursday. A slip from any of them could be a disaster. TSLA reported last night and made $1Bn for the quarter which, if they can do that consistently, means their $640Bn market cap is only 160 times their earnings so, Yay!, I guess…

FB should do well judging from SNAP and TWTR's results. AAPL is a monster you don't bet against and the others are pretty much cloud companies at this point – each with a different specialty core that gives them a user base of pretty much everyone on the planet (Software, Search and Stuff). If we are heading into that Dystopian Future where a few dozen corporations control every aspect of life on this planet – it makes perfect sense that, at some point, 6 companies should be worth 1/3 as much as the other 12,000. That's just a natural progression.

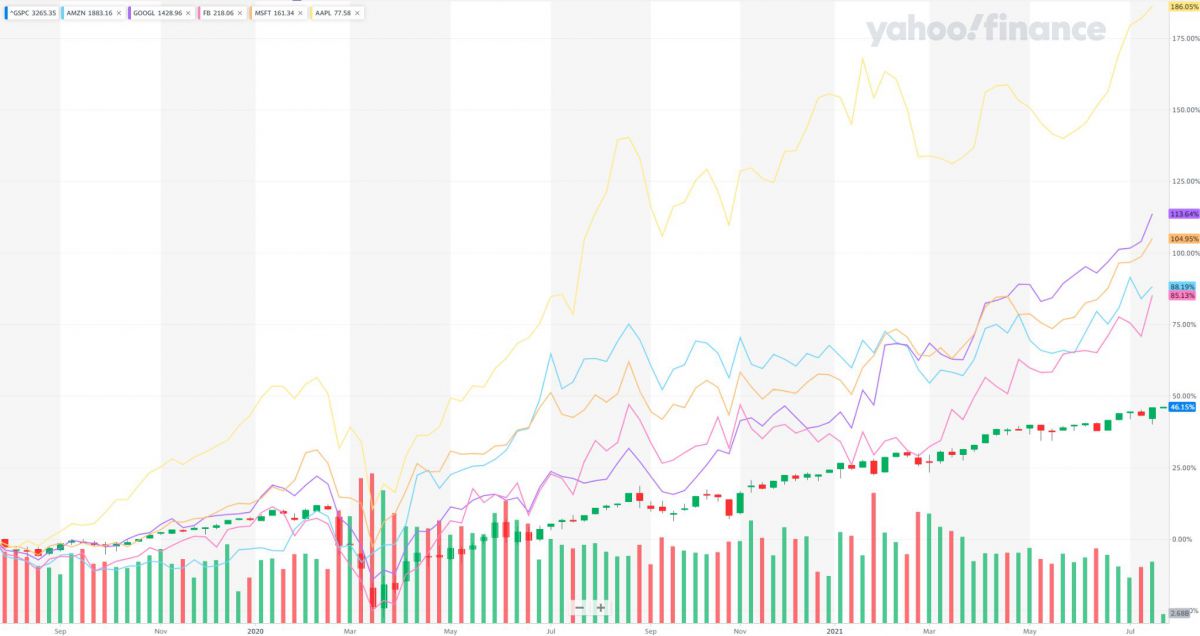

Consider the entire Nasdaq is $20Tn and it was $11.2Tn 2 years ago so it's gained $8.8Tn in market cap. TSLA (left off because it broke the chart) was at $50Bn 2 years ago and is now at $640Bn so $590Bn of the Nasdaq's gain (6.7%) came from that one stock. AAPL gained $1.6Tn (20%), MSFT gained $1.1Tn (12.5%), GOOGL gained $1Tn (11.4%), FB gained $500Bn (5.6%) and AMZN gained $900Bn (10.3%).

So our Big 6 companies gained $5.7Tn, accounting for 51% of the Nasdaq's total gain in price but NONE of those companies, except TSLA, have grown either earnings or revenues over 100% to justify the move. Even AAPL, as great as they are, are "only" on track for $86Bn in profits on $355Bn in sales while in 2019, they made $55Bn on $260Bn in sales. Yet in 2019,…