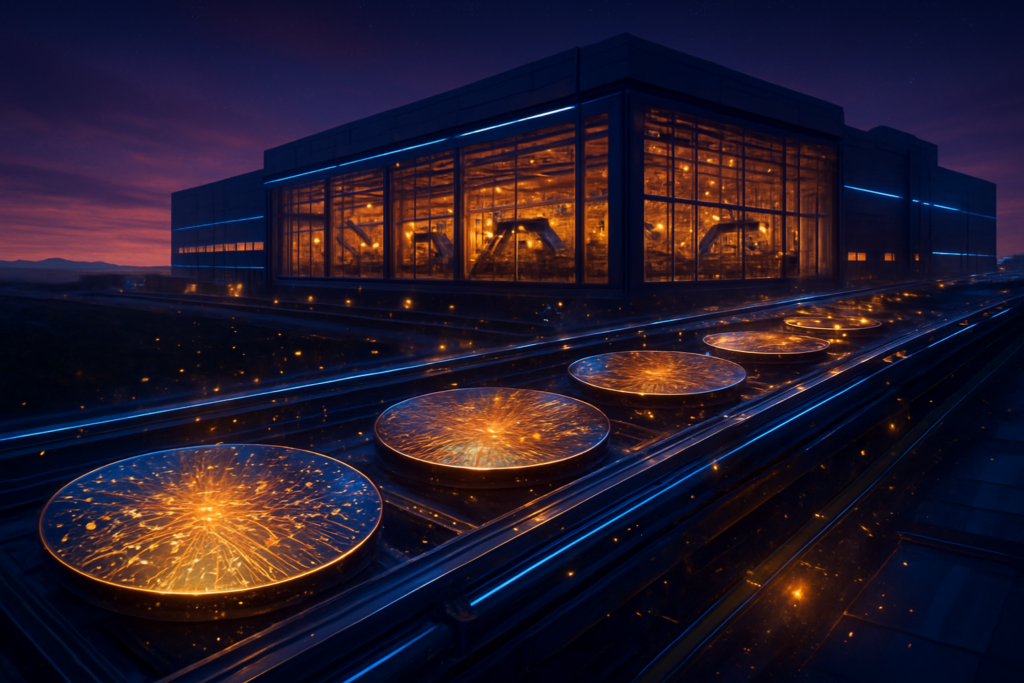

SHERMAN, Texas – In a landmark moment for American industrial policy and the global semiconductor landscape, Texas Instruments (Nasdaq: TXN) officially commenced volume production at its first 300mm wafer fabrication plant, SM1, within its massive new Sherman mega-site on December 17, 2025. This milestone, achieved exactly three and a half years after the company first broke ground, marks the beginning of a new era for domestic chip manufacturing. As the first of four planned fabs at the site goes online, TI is positioning itself as the primary architect of the physical infrastructure required to sustain the explosive growth of artificial intelligence (AI) and high-performance computing.

The Sherman mega-site represents a staggering $30 billion investment, part of a broader $60 billion expansion strategy that TI has aggressively pursued over the last several years. At full ramp, the SM1 facility alone is capable of outputting tens of millions of chips daily. Once the entire four-fab complex is completed, the site is projected to produce over 100 million microchips every single day. While much of the AI discourse focuses on the high-profile GPUs used for model training, TI’s Sherman facility is churning out the "foundational silicon"—the advanced analog and embedded processing chips—that manage power delivery, signal integrity, and real-time control for the world’s most advanced AI data centers and edge devices.

Technically, the transition to 300mm (12-inch) wafers at the Sherman site is a game-changer for TI’s production efficiency. Compared to the older 200mm (8-inch) standard, 300mm wafers provide approximately 2.3 times more surface area, allowing TI to significantly lower the cost per chip while increasing yield. The SM1 facility focuses on process nodes ranging from 28nm to 130nm, which industry experts call the "sweet spot" for high-performance analog and embedded processing. These nodes are essential for the high-voltage precision components and battery management systems that power modern technology.

Of particular interest to the AI community is TI’s recent launch of the CSD965203B Dual-Phase Smart Power Stage, which is now being produced at scale in Sherman. Designed specifically for the massive energy demands of AI accelerators, this chip delivers 100A per phase in a compact 5x5mm package. In October 2025, TI also announced a strategic collaboration with NVIDIA (Nasdaq: NVDA) to develop 800VDC power-management architectures. These high-voltage systems are critical for the next generation of "AI Factories," where rack power density is expected to exceed 1 megawatt—a level of energy consumption that traditional 12V or 48V systems simply cannot handle efficiently.

Furthermore, the Sherman site is a hub for TI’s Sitara AM69A processors. These embedded SoCs feature integrated hardware accelerators capable of up to 32 TOPS (trillions of operations per second) of AI performance. Unlike the power-hungry chips found in data centers, these Sherman-produced processors are designed for "Edge AI," enabling autonomous robots and smart vehicles to perform complex computer vision tasks while consuming less than 5 Watts of power. This capability allows for sophisticated intelligence to be embedded directly into industrial hardware, bypassing the need for constant cloud connectivity.

The start of production in Sherman creates a formidable strategic moat for Texas Instruments, particularly against its primary rivals, Analog Devices (Nasdaq: ADI) and NXP Semiconductors (Nasdaq: NXPI). By internalizing over 90% of its manufacturing through massive 300mm facilities like Sherman, TI is expected to achieve a 30% cost advantage over competitors who rely more heavily on external foundries or older 200mm technology. This "vertical integration" strategy ensures that TI can maintain high margins even as it aggressively competes on price for high-volume contracts in the automotive and data center sectors.

Competitors are already feeling the pressure. Analog Devices has responded with a "Fab-Lite" strategy, focusing on ultra-high-margin specialized chips and partnering with TSMC (NYSE: TSM) for its 300mm needs rather than matching TI’s capital expenditure. Meanwhile, NXP has pivoted toward "Agentic AI" at the edge, acquiring specialized NPU designer Kinara.ai earlier in 2025 to bolster its intellectual property. However, TI’s sheer volume and domestic capacity give it a unique advantage in supply chain reliability—a factor that has become a top priority for tech giants like Dell (NYSE: DELL) and Vertiv (NYSE: VRT) as they build out the physical racks for AI clusters.

For startups and smaller AI hardware companies, the Sherman site’s output provides a reliable, domestic source of the power-management components that have frequently been the bottleneck in hardware production. During the supply chain crises of the early 2020s, it was often a $2 power management chip, not a $10,000 GPU, that delayed shipments. By flooding the market with tens of millions of these essential components daily, TI is effectively de-risking the hardware roadmap for the entire AI ecosystem.

The Sherman mega-site is more than just a factory; it is a centerpiece of the global "reshoring" trend and a testament to the impact of the CHIPS and Science Act. With approximately $1.6 billion in direct federal funding and significant investment tax credits, the project represents a successful public-private partnership aimed at securing the U.S. semiconductor supply chain. In an era where geopolitical tensions can disrupt global trade overnight, having the world’s most advanced analog production capacity located in North Texas provides a critical layer of national security.

This development also signals a shift in the AI narrative. While software and large language models (LLMs) dominate the headlines, the physical reality of AI is increasingly defined by power density and thermal management. The chips coming out of Sherman are the unsung heroes of the AI revolution; they are the components that ensure a GPU doesn't melt under load and that an autonomous drone can process its environment in real-time. This "physicality of AI" is becoming a major investment theme as the industry realizes that the limits of AI growth are often dictated by the availability of power and the efficiency of the hardware that delivers it.

However, the scale of the Sherman site also raises concerns regarding environmental impact and local infrastructure. A facility that produces over 100 million chips a day requires an immense amount of water and electricity. TI has committed to using 100% renewable energy for its operations by 2030 and has implemented advanced water recycling technologies in Sherman, but the long-term sustainability of such massive "mega-fabs" will remain a point of scrutiny for environmental advocates and local policymakers alike.

Looking ahead, the Sherman site is only at the beginning of its lifecycle. While SM1 is now operational, the exterior shell of the second fab, SM2, is already complete. TI executives have indicated that the equipping of SM2 will proceed based on market demand, with many analysts predicting it could be online as early as 2027. The long-term roadmap includes SM3 and SM4, which will eventually turn the 4.7-million-square-foot site into the largest semiconductor manufacturing complex in United States history.

In the near term, expect to see TI launch more specialized "AI-Power" modules that integrate multiple power-management functions into a single package, further reducing the footprint of AI accelerator boards. There is also significant anticipation regarding TI’s expansion into Gallium Nitride (GaN) technology at the Sherman site. GaN chips offer even higher efficiency than traditional silicon for power conversion, and as AI data centers push toward 1.5MW per rack, the transition to GaN will become an operational necessity rather than a luxury.

Texas Instruments’ Sherman mega-site is a monumental achievement that anchors the "Silicon Prairie" as a global hub for semiconductor excellence. By successfully starting production at SM1, TI has demonstrated that large-scale, high-tech manufacturing can thrive on American soil when backed by strategic investment and clear long-term vision. The site’s ability to output tens of millions of chips daily provides a vital buffer against future supply chain shocks and ensures that the hardware powering the AI revolution is built with precision and reliability.

As we move into 2026, the industry will be watching the production ramp-up closely. The success of the Sherman site will likely serve as a blueprint for other domestic manufacturing projects, proving that the transition to 300mm analog production is both technically feasible and economically superior. For the AI industry, the message is clear: the brain of the AI may be designed in Silicon Valley, but its heart and nervous system are increasingly being forged in the heart of Texas.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.