Satellite communications provider will be reporting results this Thursday before market hours. Here’s what to expect.

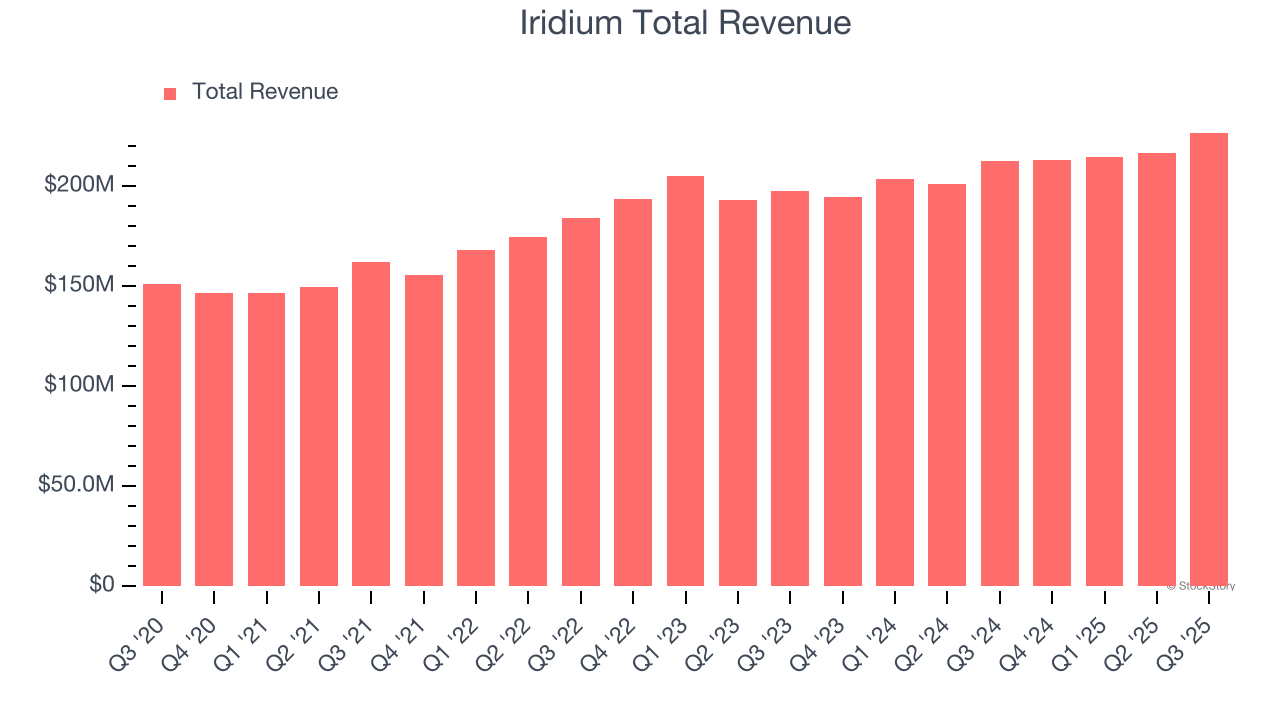

Iridium beat analysts’ revenue expectations by 1.7% last quarter, reporting revenues of $226.9 million, up 6.7% year on year. It was an exceptional quarter for the company, with a beat of analysts’ EPS estimates and a decent beat of analysts’ revenue estimates. It reported 1.99 million subscribers, up 4.7% year on year.

Is Iridium a buy or sell going into earnings? Read our full analysis here, it’s free for active Edge members.

This quarter, analysts are expecting Iridium’s revenue to grow 3.3% year on year to $219.9 million, slowing from the 9.4% increase it recorded in the same quarter last year. Adjusted earnings are expected to come in at $0.25 per share.

Analysts covering the company have generally reconfirmed their estimates over the last 30 days, suggesting they anticipate the business to stay the course heading into earnings. Iridium has a history of exceeding Wall Street’s expectations, beating revenue estimates every single time over the past two years by 2.1% on average.

Looking at Iridium’s peers in the telecommunication services segment, some have already reported their Q4 results, giving us a hint as to what we can expect. Viasat delivered year-on-year revenue growth of 3%, missing analysts’ expectations by 1%, and Lumen reported a revenue decline of 8.7%, in line with consensus estimates. Viasat traded up 11.4% following the results while Lumen was down 21.6%.

Read our full analysis of Viasat’s results here and Lumen’s results here.

Questions about potential tariffs and corporate tax changes have caused much volatility in 2025. While some of the telecommunication services stocks have shown solid performance in this choppy environment, the group has generally underperformed, with share prices down 2.6% on average over the last month. Iridium is up 3.8% during the same time and is heading into earnings with an average analyst price target of $28.13 (compared to the current share price of $20.33).

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.