Financial services company Robinhood (NASDAQ: HOOD) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 26.5% year on year to $1.28 billion. Its GAAP profit of $0.66 per share was 3.8% above analysts’ consensus estimates.

Is now the time to buy Robinhood? Find out by accessing our full research report, it’s free.

Robinhood (HOOD) Q4 CY2025 Highlights:

- Revenue: $1.28 billion vs analyst estimates of $1.34 billion (26.5% year-on-year growth, 3.9% miss)

- EPS (GAAP): $0.66 vs analyst estimates of $0.64 (3.8% beat)

- Adjusted EBITDA: $761 million vs analyst estimates of $832.3 million (59.3% margin, 8.6% miss)

- Operating Margin: 51.5%, down from 54.8% in the same quarter last year

- Free Cash Flow was -$950 million compared to -$1.59 billion in the previous quarter

- Market Capitalization: $77.83 billion

“Our vision hasn’t changed: we are building the Financial SuperApp,” said Vlad Tenev, Chairman and CEO of Robinhood.

Company Overview

With a mission to democratize finance, Robinhood (NASDAQ: HOOD) is an online consumer finance platform known for its commission-free stock and crypto trading.

Revenue Growth

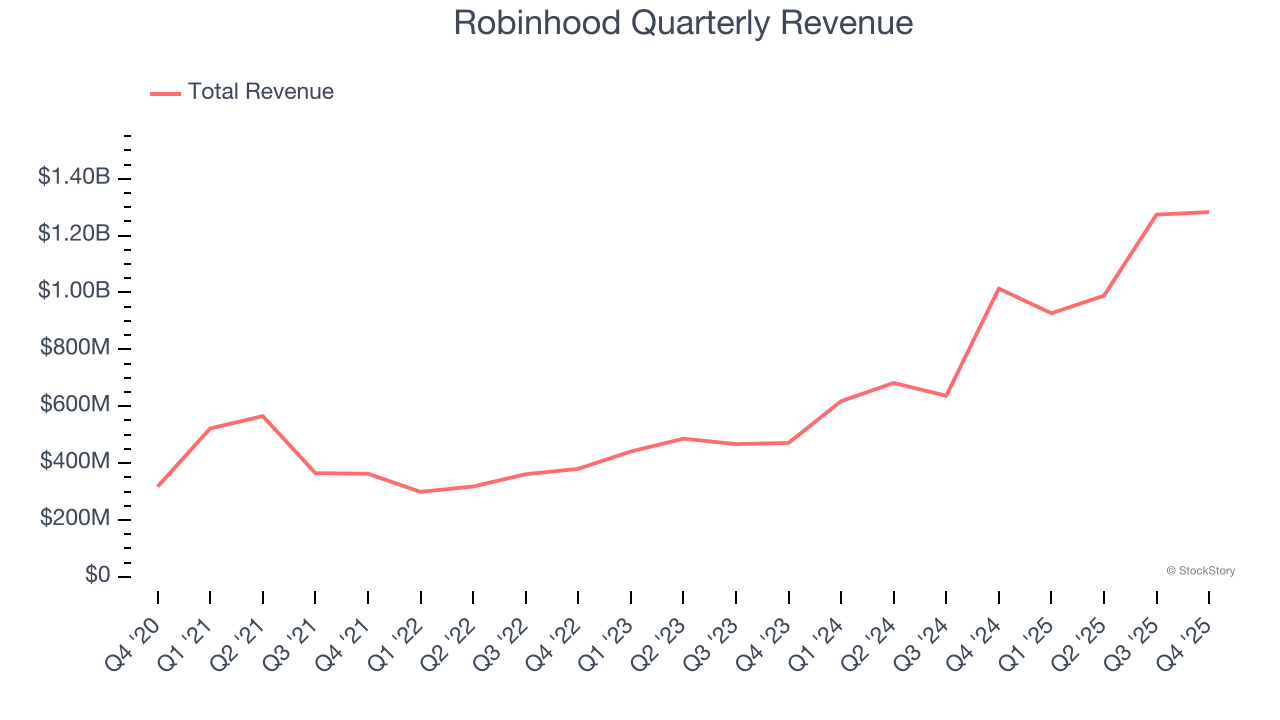

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Robinhood’s sales grew at an incredible 48.8% compounded annual growth rate over the last three years. Its growth surpassed the average consumer internet company and shows its offerings resonate with customers, a great starting point for our analysis.

This quarter, Robinhood generated an excellent 26.5% year-on-year revenue growth rate, but its $1.28 billion of revenue fell short of Wall Street’s high expectations.

Looking ahead, sell-side analysts expect revenue to grow 25.7% over the next 12 months, a deceleration versus the last three years. Despite the slowdown, this projection is commendable and implies the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

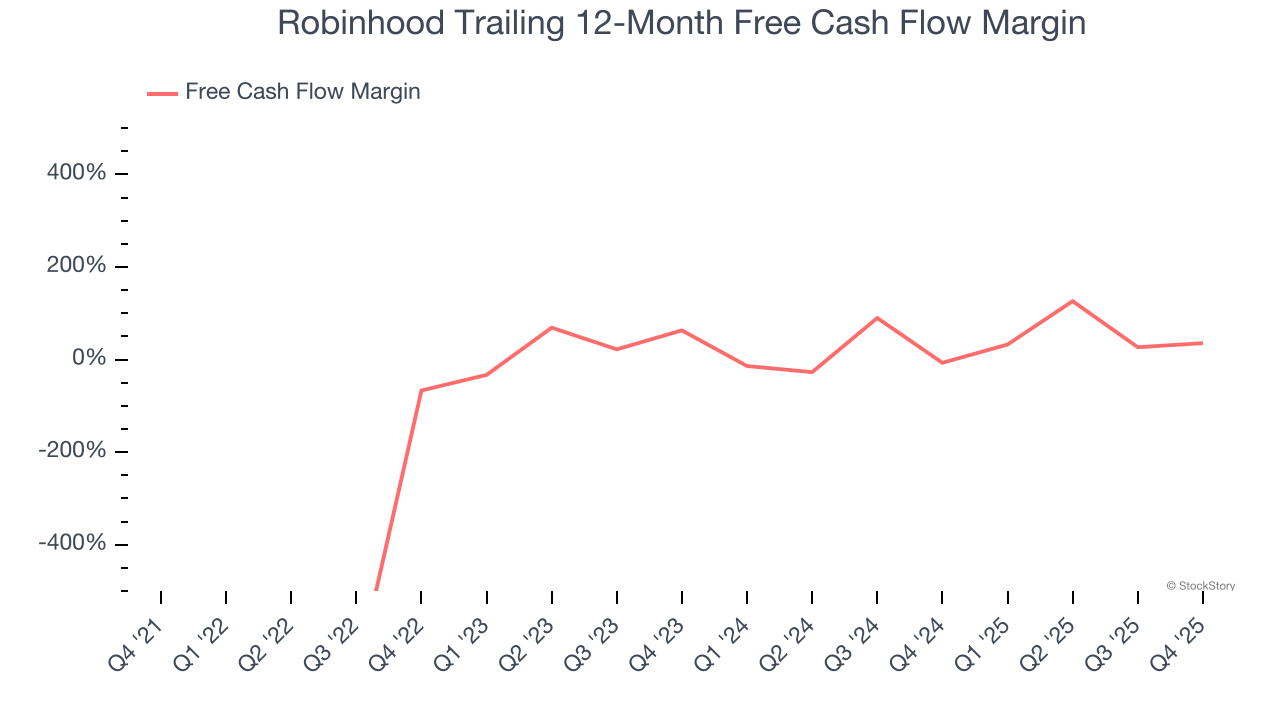

Robinhood has shown robust cash profitability, driven by its attractive business model and cost-effective customer acquisition strategy that enable it to invest in new products and services rather than sales and marketing. The company’s free cash flow margin averaged 18.5% over the last two years, quite impressive for a consumer internet business.

Taking a step back, we can see that Robinhood’s margin expanded meaningfully over the last few years. This is encouraging, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability.

Robinhood burned through $950 million of cash in Q4, equivalent to a negative 74% margin. The company’s cash burn slowed from $1.42 billion of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, but we wouldn’t put too much weight on the short term because investment needs can be seasonal, causing temporary swings.

Key Takeaways from Robinhood’s Q4 Results

We struggled to find many positives in these results. Its revenue missed and its EBITDA fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5% to $81.55 immediately following the results.

Robinhood didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).