Health insurance company Oscar Health (NYSE: OSCR) fell short of the market’s revenue expectations in Q4 CY2025, but sales rose 17.3% year on year to $2.81 billion. On the other hand, the company’s full-year revenue guidance of $18.85 billion at the midpoint came in 47.8% above analysts’ estimates. Its GAAP loss of $1.24 per share was 43.7% below analysts’ consensus estimates.

Is now the time to buy Oscar Health? Find out by accessing our full research report, it’s free.

Oscar Health (OSCR) Q4 CY2025 Highlights:

- Revenue: $2.81 billion vs analyst estimates of $3.12 billion (17.3% year-on-year growth, 10.2% miss)

- EPS (GAAP): -$1.24 vs analyst expectations of -$0.86 (43.7% miss)

- Adjusted EBITDA: -$307.8 million (-11% margin, 173% year-on-year decline)

- Operating Margin: -11.9%, down from -6.2% in the same quarter last year

- Free Cash Flow Margin: 23.6%, up from 14.2% in the same quarter last year

- Market Capitalization: $3.35 billion

“2025 was a reset year for the individual market, and we took decisive actions to return to profitability in 2026,” said Mark Bertolini, CEO of Oscar Health.

Company Overview

Founded in 2012 to simplify the notoriously complex American healthcare system, Oscar Health (NYSE: OSCR) is a technology-focused health insurance company that offers individual and small group health plans through its cloud-native platform.

Revenue Growth

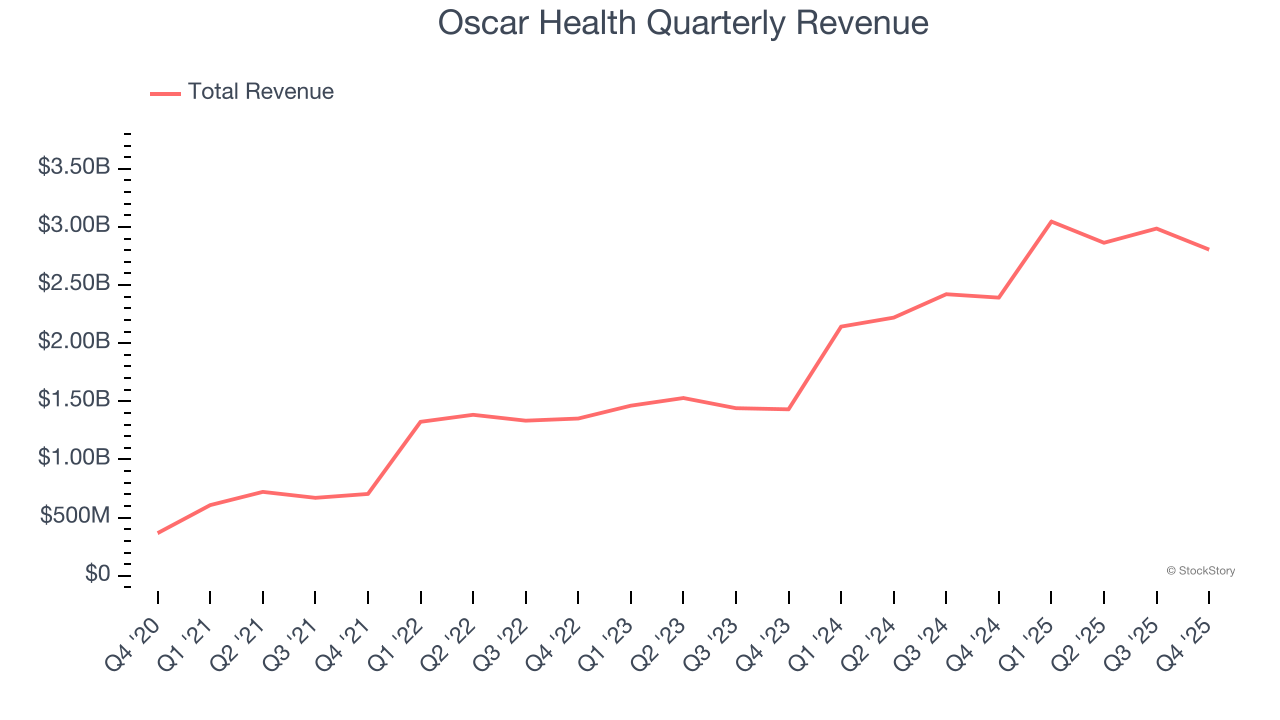

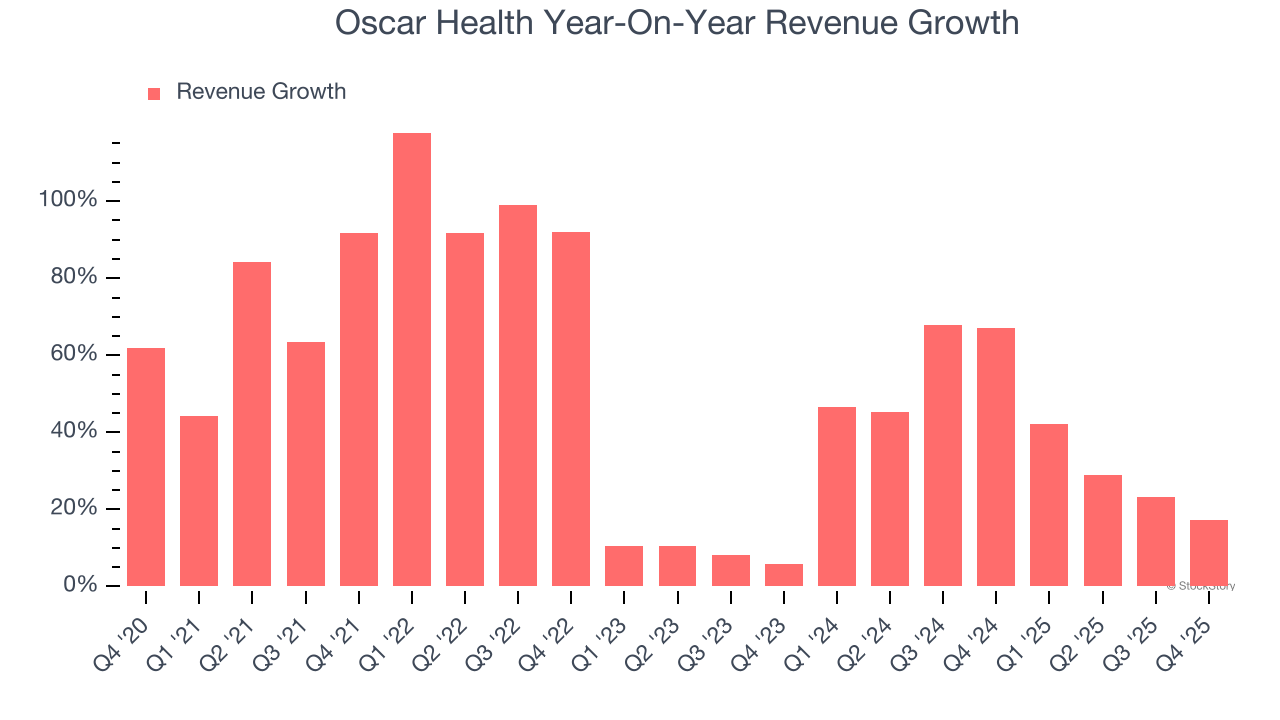

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, Oscar Health’s 49% annualized revenue growth over the last five years was incredible. Its growth surpassed the average healthcare company and shows its offerings resonate with customers, a great starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Oscar Health’s annualized revenue growth of 41.2% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Oscar Health’s revenue grew by 17.3% year on year to $2.81 billion but fell short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 9.9% over the next 12 months, a deceleration versus the last two years. We still think its growth trajectory is attractive given its scale and suggests the market is baking in success for its products and services.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

Operating Margin

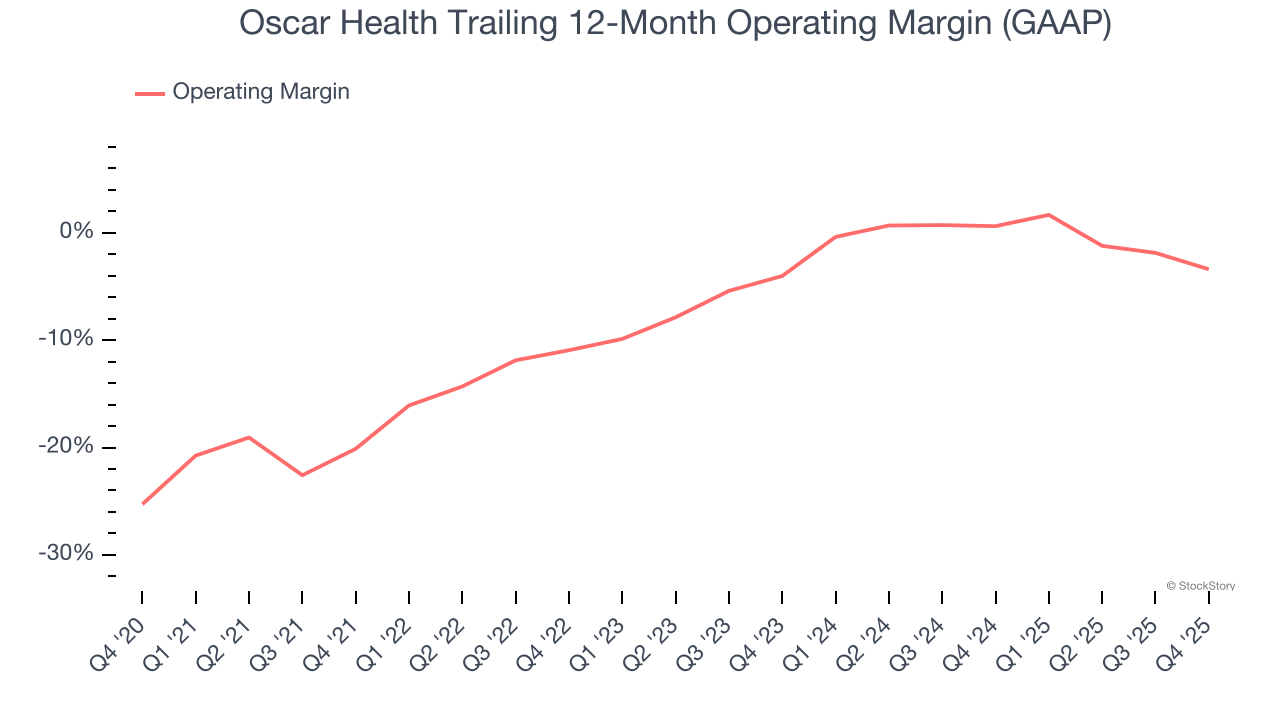

Oscar Health’s high expenses have contributed to an average operating margin of negative 4.9% over the last five years. Unprofitable healthcare companies require extra attention because they could get caught swimming naked when the tide goes out.

On the plus side, Oscar Health’s operating margin rose by 16.7 percentage points over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Oscar Health’s operating margin was negative 11.9% this quarter.

Earnings Per Share

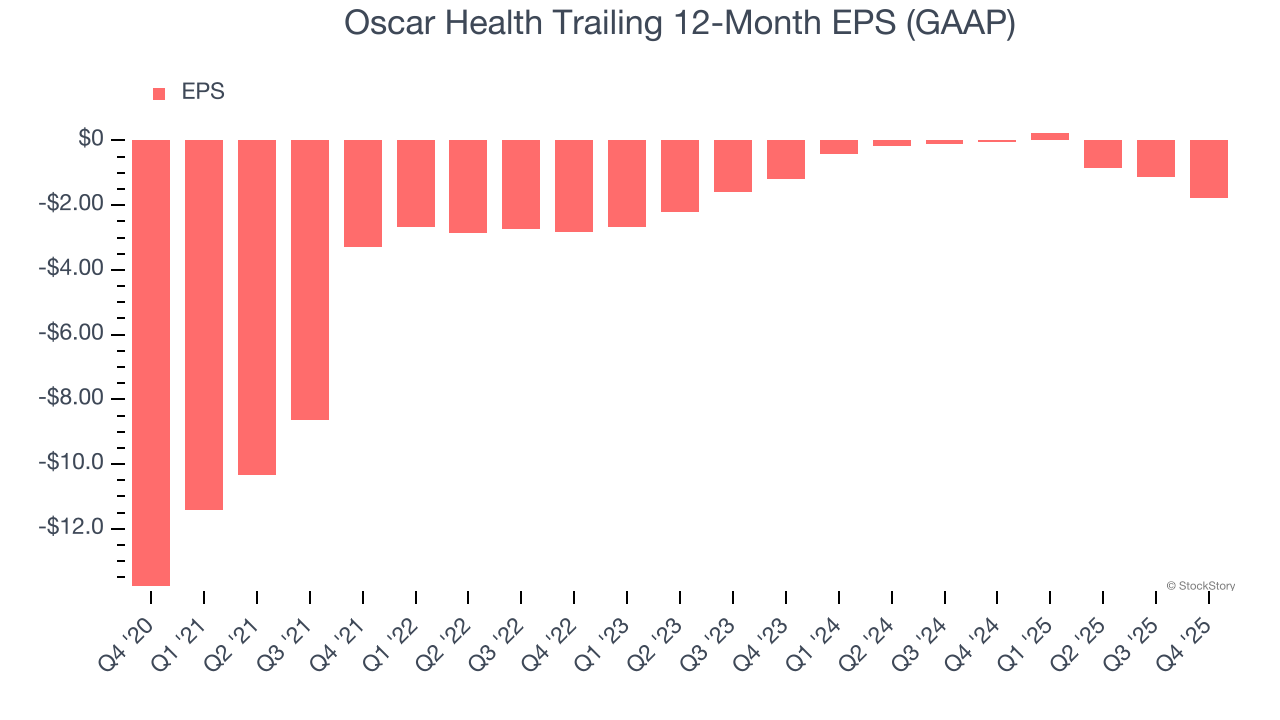

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Although Oscar Health’s full-year earnings are still negative, it reduced its losses and improved its EPS by 33.7% annually over the last five years. The next few quarters will be critical for assessing its long-term profitability. We hope to see an inflection point soon.

In Q4, Oscar Health reported EPS of negative $1.24, down from negative $0.62 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects Oscar Health to improve its earnings losses. Analysts forecast its full-year EPS of negative $1.76 will advance to negative $0.07.

Key Takeaways from Oscar Health’s Q4 Results

We were impressed by Oscar Health’s optimistic full-year revenue guidance, which blew past analysts’ expectations. On the other hand, its revenue missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 1.4% to $12.49 immediately after reporting.

Oscar Health didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).