Home services online marketplace ANGI (NASDAQ: ANGI) fell short of the market’s revenue expectations in Q4 CY2025, with sales falling 10.1% year on year to $240.8 million. Its GAAP profit of $0.17 per share was 50.2% below analysts’ consensus estimates.

Is now the time to buy Angi? Find out by accessing our full research report, it’s free.

Angi (ANGI) Q4 CY2025 Highlights:

- Revenue: $240.8 million vs analyst estimates of $243.7 million (10.1% year-on-year decline, 1.2% miss)

- EPS (GAAP): $0.17 vs analyst expectations of $0.34 (50.2% miss)

- Adjusted EBITDA: $39.7 million vs analyst estimates of $40.05 million (16.5% margin, 0.9% miss)

- Operating Margin: 2.5%, up from 0.8% in the same quarter last year

- Free Cash Flow Margin: 4.7%, up from 1.9% in the previous quarter

- Market Capitalization: $504.4 million

Company Overview

Created by IAC’s mergers of Angie’s List and HomeAdvisor, ANGI (NASDAQ: ANGI) operates the largest online marketplace for home services in the US.

Revenue Growth

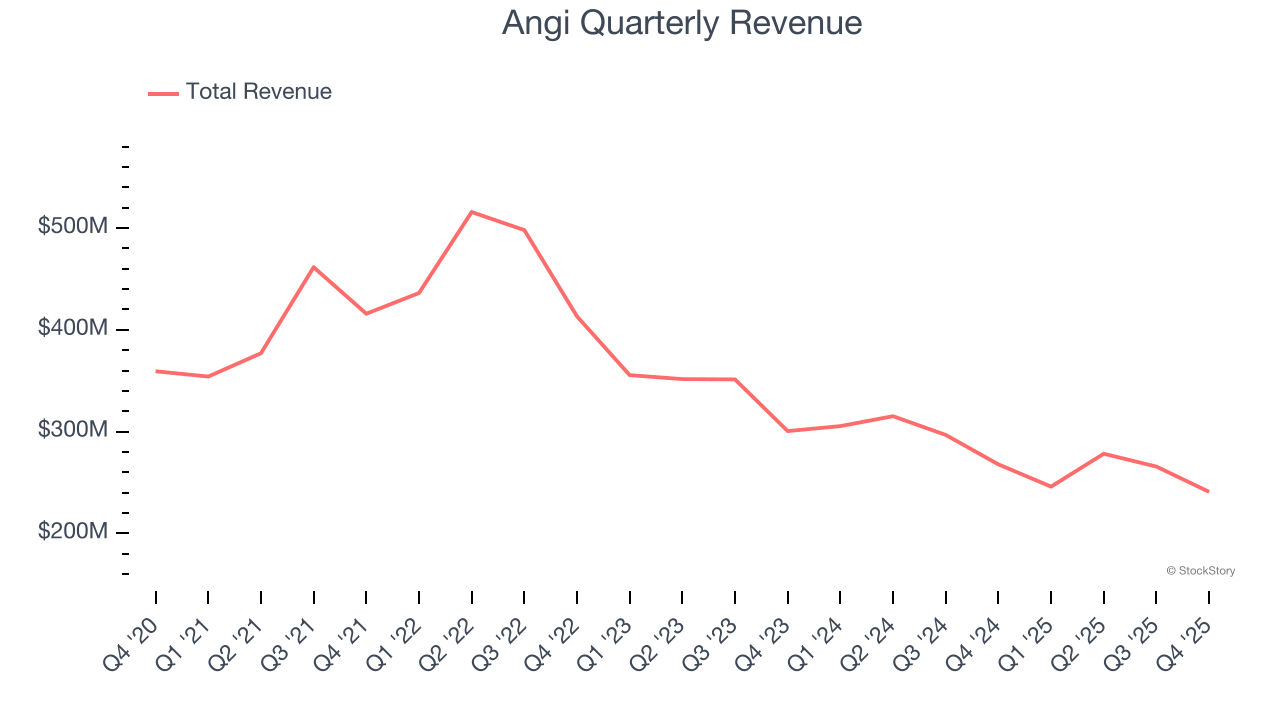

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last three years, Angi’s demand was weak and its revenue declined by 17.9% per year. This wasn’t a great result and is a rough starting point for our analysis.

This quarter, Angi missed Wall Street’s estimates and reported a rather uninspiring 10.1% year-on-year revenue decline, generating $240.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 3.8% over the next 12 months. While this projection implies its newer products and services will fuel better top-line performance, it is still below the sector average.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking. Go here for access to our full report.

Cash Is King

Although EBITDA is undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

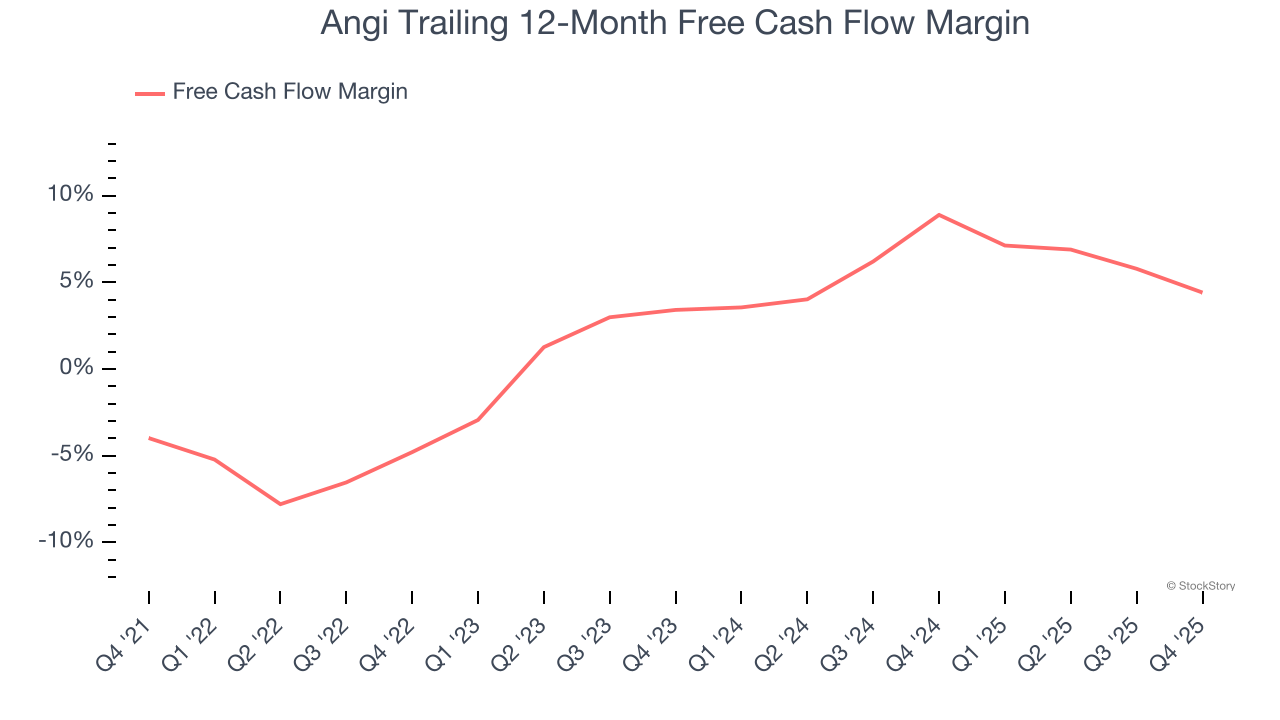

Angi has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 6.8% over the last two years, slightly better than the broader consumer internet sector.

Taking a step back, we can see that Angi’s margin expanded by 9.2 percentage points over the last few years. This is encouraging because it gives the company more optionality.

Angi’s free cash flow clocked in at $11.4 million in Q4, equivalent to a 4.7% margin. The company’s cash profitability regressed as it was 5.4 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Angi’s Q4 Results

We struggled to find many positives in these results. Its revenue slightly missed and its EBITDA fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 8.7% to $10.92 immediately after reporting.

Angi’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here (it’s free).