Wrapping up Q3 earnings, we look at the numbers and key takeaways for the waste management stocks, including Montrose (NYSE: MEG) and its peers.

Waste management companies can possess licenses permitting them to handle hazardous materials. Furthermore, many services are performed through contracts and statutorily mandated, non-discretionary, or recurring, leading to more predictable revenue streams. However, regulation can be a headwind, rendering existing services obsolete or forcing companies to invest precious capital to comply with new, more environmentally-friendly rules. Lastly, waste management companies are at the whim of economic cycles. Interest rates, for example, can greatly impact industrial production or commercial projects that create waste and byproducts.

The 9 waste management stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 2.6%.

Luckily, waste management stocks have performed well with share prices up 12.3% on average since the latest earnings results.

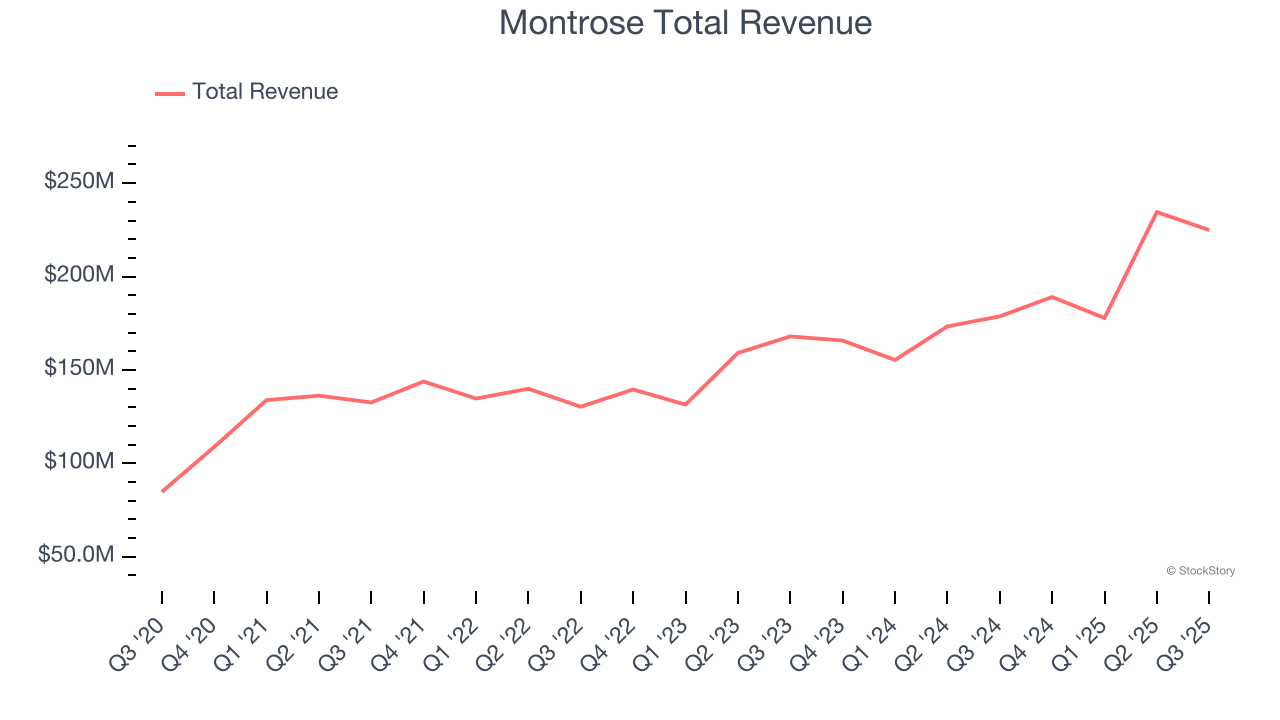

Montrose (NYSE: MEG)

Founded to protect a tree-lined two-lane road, Montrose (NYSE: MEG) provides air quality monitoring, environmental laboratory testing, compliance, and environmental consulting services.

Montrose reported revenues of $224.9 million, up 25.9% year on year. This print exceeded analysts’ expectations by 10.9%. Overall, it was an exceptional quarter for the company with a solid beat of analysts’ organic revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Montrose Chief Executive Officer and Director, Vijay Manthripragada, commented, “I am thrilled to announce another outstanding quarter as our record 2025 continues. The credit goes to our ~3,500 colleagues around the world to whom I am incredibly grateful. Demand for our services is elevated, driven by broader market forces, increased domestic industrial production in our key geographies and state and provincial regulations. This is our third consecutive quarter of record results, including free cash flow1 generation that exceeded expectations. Our outperformance year to date is primarily due to strong organic growth across all three of our segments and the resultant operating leverage, which continues to drive margin accretion. "

Montrose achieved the biggest analyst estimates beat, fastest revenue growth, and highest full-year guidance raise of the whole group. Investor expectations, however, were likely higher than Wall Street’s published projections, leaving some wishing for even better results (analysts’ consensus estimates are those published by big banks and advisory firms, not the investors who make buy and sell decisions). The stock is down 14% since reporting and currently trades at $21.12.

We think Montrose is a good business, but is it a buy today? Read our full report here, it’s free.

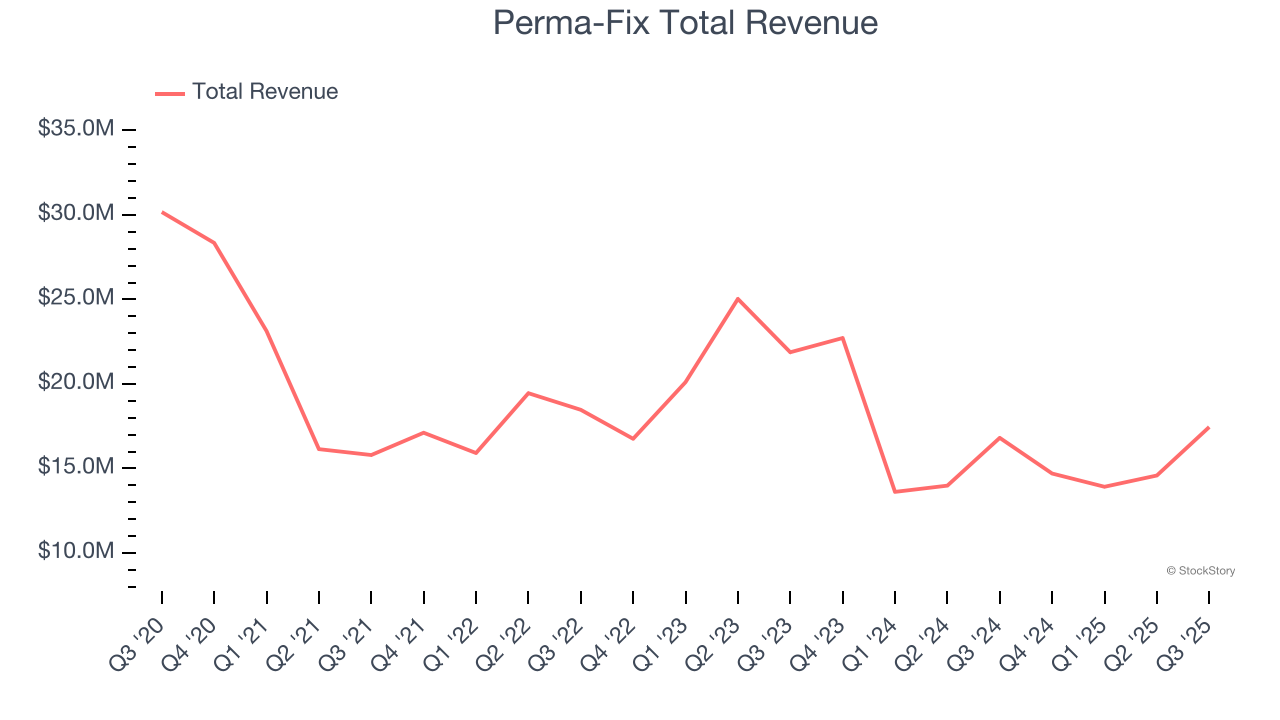

Best Q3: Perma-Fix (NASDAQ: PESI)

Tackling hazardous waste challenges since 1990, Perma-Fix (NASDAQ: PESI) provides environmental waste treatment services.

Perma-Fix reported revenues of $17.45 million, up 3.8% year on year, outperforming analysts’ expectations by 7.1%. The business had a stunning quarter with a solid beat of analysts’ EBITDA estimates and an impressive beat of analysts’ revenue estimates.

The market seems happy with the results as the stock is up 6.9% since reporting. It currently trades at $13.76.

Is now the time to buy Perma-Fix? Access our full analysis of the earnings results here, it’s free.

Weakest Q3: Clean Harbors (NYSE: CLH)

Established in 1980, Clean Harbors (NYSE: CLH) provides environmental and industrial services like hazardous and non-hazardous waste disposal and emergency spill cleanups.

Clean Harbors reported revenues of $1.55 billion, up 1.3% year on year, falling short of analysts’ expectations by 1.6%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EPS estimates.

Clean Harbors delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 4.1% since the results and currently trades at $256.30.

Read our full analysis of Clean Harbors’s results here.

Waste Management (NYSE: WM)

Headquartered in Houston, Waste Management (NYSE: WM) is a provider of comprehensive waste management services in North America.

Waste Management reported revenues of $6.44 billion, up 14.9% year on year. This print lagged analysts' expectations by 0.9%. Overall, it was a slower quarter as it also logged a miss of analysts’ adjusted operating income estimates and a slight miss of analysts’ revenue estimates.

The stock is up 3.6% since reporting and currently trades at $221.40.

Read our full, actionable report on Waste Management here, it’s free.

Republic Services (NYSE: RSG)

Processing several million tons of recyclables annually, Republic (NYSE: RSG) provides waste management services for residences, companies, and municipalities.

Republic Services reported revenues of $4.21 billion, up 3.3% year on year. This number came in 0.8% below analysts' expectations. It was a slower quarter as it also recorded a significant miss of analysts’ sales volume estimates and a slight miss of analysts’ revenue estimates.

The stock is flat since reporting and currently trades at $212.00.

Read our full, actionable report on Republic Services here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.