Cincinnati Financial trades at $162.19 per share and has stayed right on track with the overall market, gaining 8.9% over the last six months. At the same time, the S&P 500 has returned 10%.

Is now the time to buy CINF? Find out in our full research report, it’s free.

Why Does CINF Stock Spark Debate?

Founded in 1950 by independent insurance agents seeking stable market options for their clients, Cincinnati Financial (NASDAQ: CINF) provides property casualty insurance, life insurance, and related financial services through independent agencies across 46 states.

Two Things to Like:

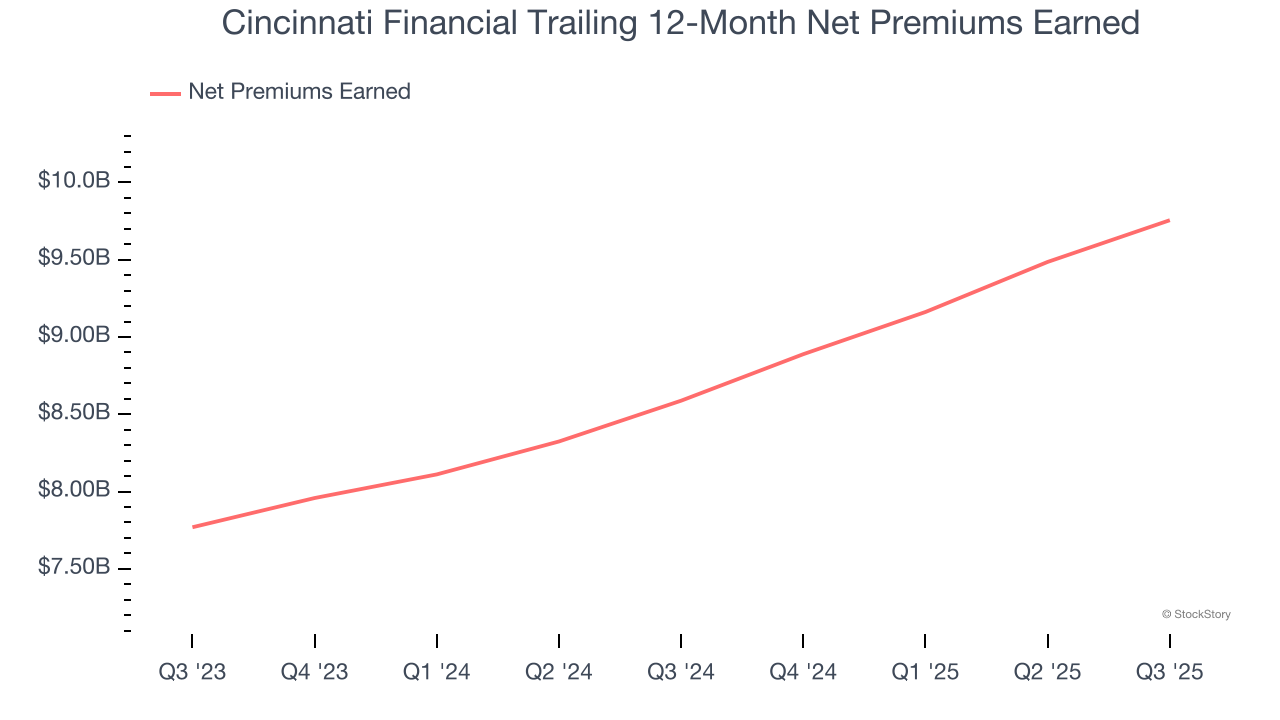

1. Net Premiums Earned Skyrocket, Fueling Growth Opportunities

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are therefore gross premiums less what’s ceded to reinsurers as a risk mitigation and transfer strategy.

Cincinnati Financial’s net premiums earned has grown at a 12.1% annualized rate over the last two years, better than the broader insurance industry and in line with its total revenue.

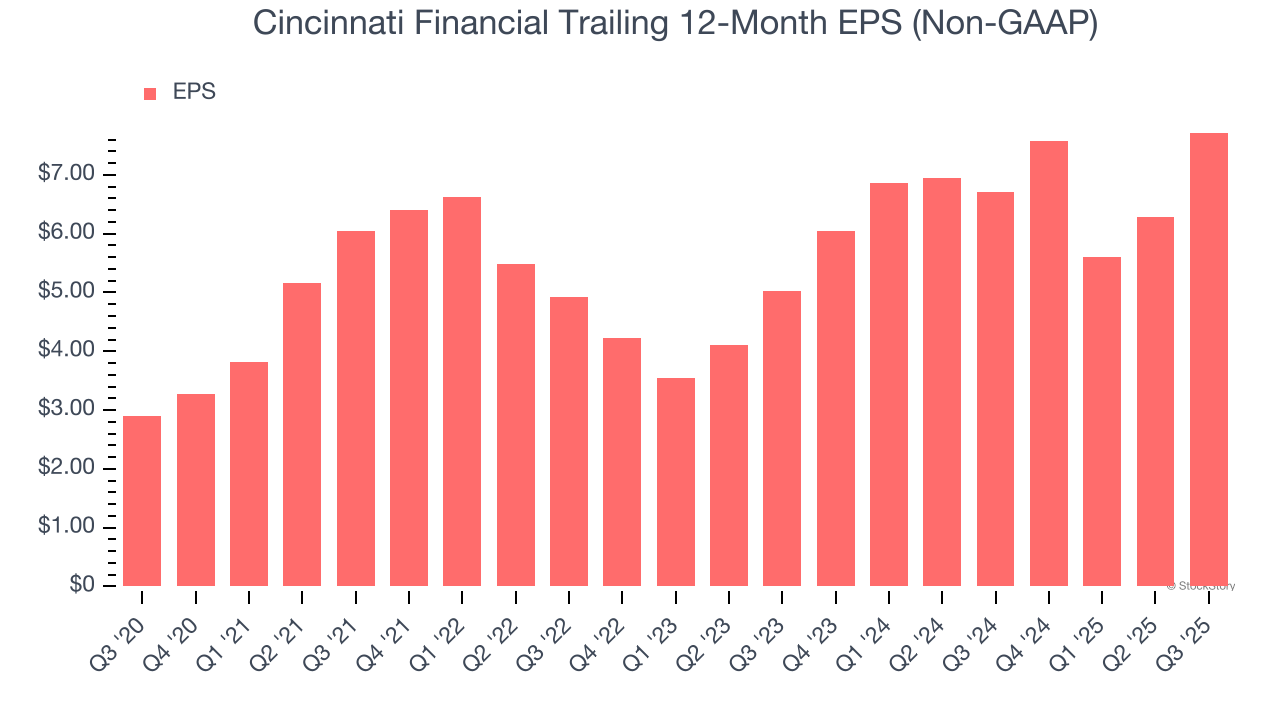

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Cincinnati Financial’s EPS grew at a spectacular 21.6% compounded annual growth rate over the last five years, higher than its 10.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

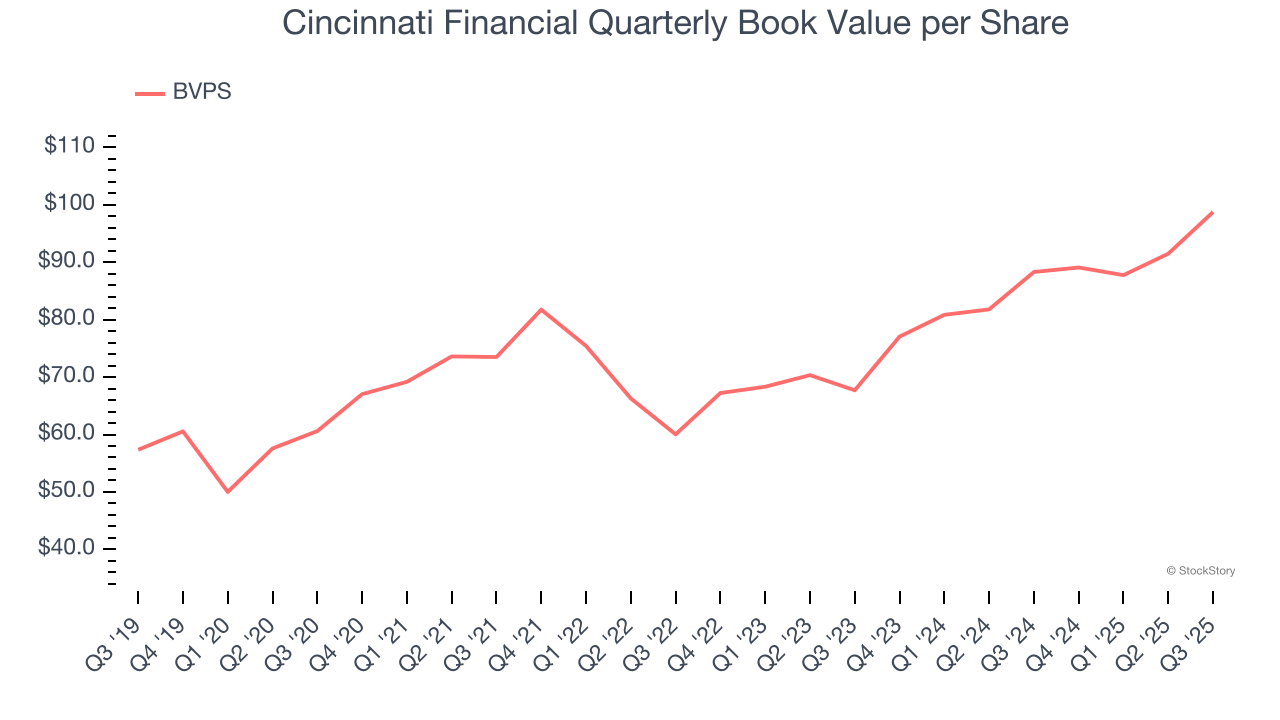

Projected BVPS Growth Is Slim

An insurer’s book value per share (BVPS) increases when it maintains a profitable combined ratio and effectively manages its investment portfolio.

Over the next 12 months, Consensus estimates call for Cincinnati Financial’s BVPS to grow by 5.1% to $93.62, lousy growth rate.

Final Judgment

Cincinnati Financial has huge potential even though it has some open questions, but at $162.19 per share (or 1.6× forward P/B), is now the right time to buy the stock? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.