Over the past six months, EVERTEC’s stock price fell to $29.55. Shareholders have lost 10.8% of their capital, which is disappointing considering the S&P 500 has climbed by 11.5%. This might have investors contemplating their next move.

Given the weaker price action, is now an opportune time to buy EVTC? Find out in our full research report, it’s free.

Why Are We Positive On EVERTEC?

Operating one of Latin America's leading PIN debit networks called ATH, EVERTEC (NYSE: EVTC) is a payment transaction processor and financial technology provider that enables merchants and financial institutions across Latin America and the Caribbean to accept and process electronic payments.

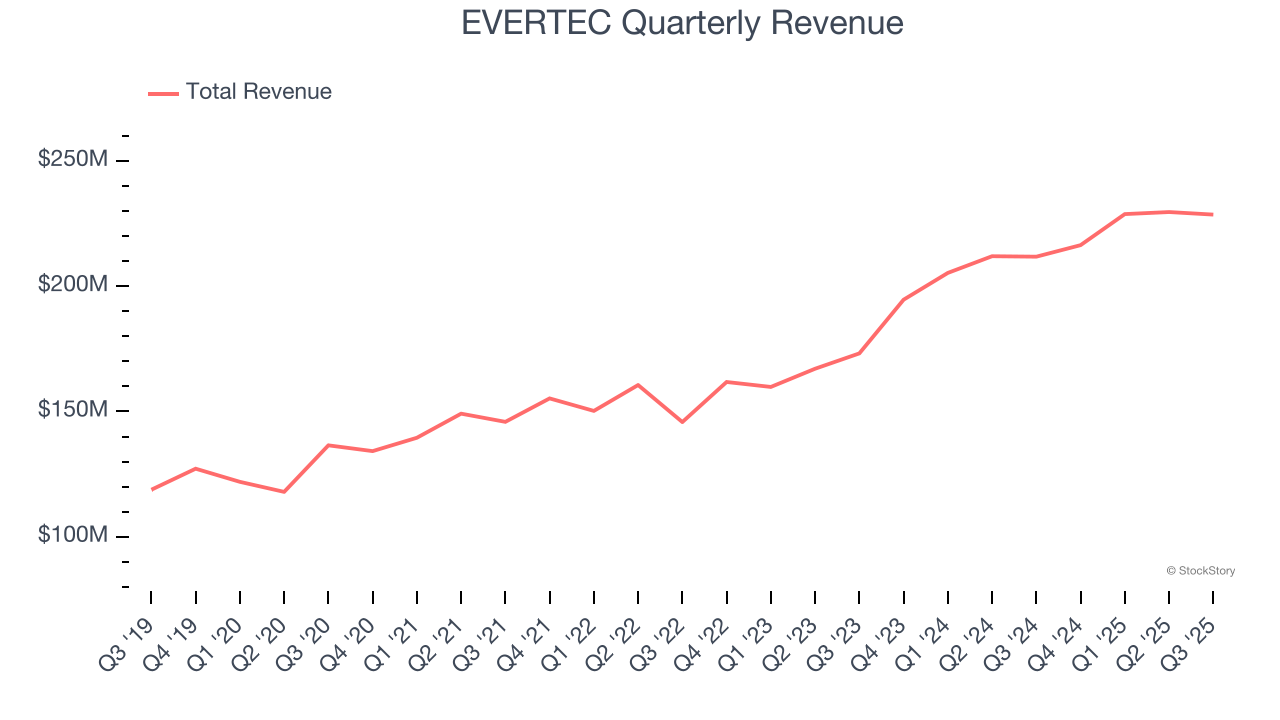

1. Long-Term Revenue Growth Shows Strong Momentum

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last five years, EVERTEC grew its revenue at a solid 12.4% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

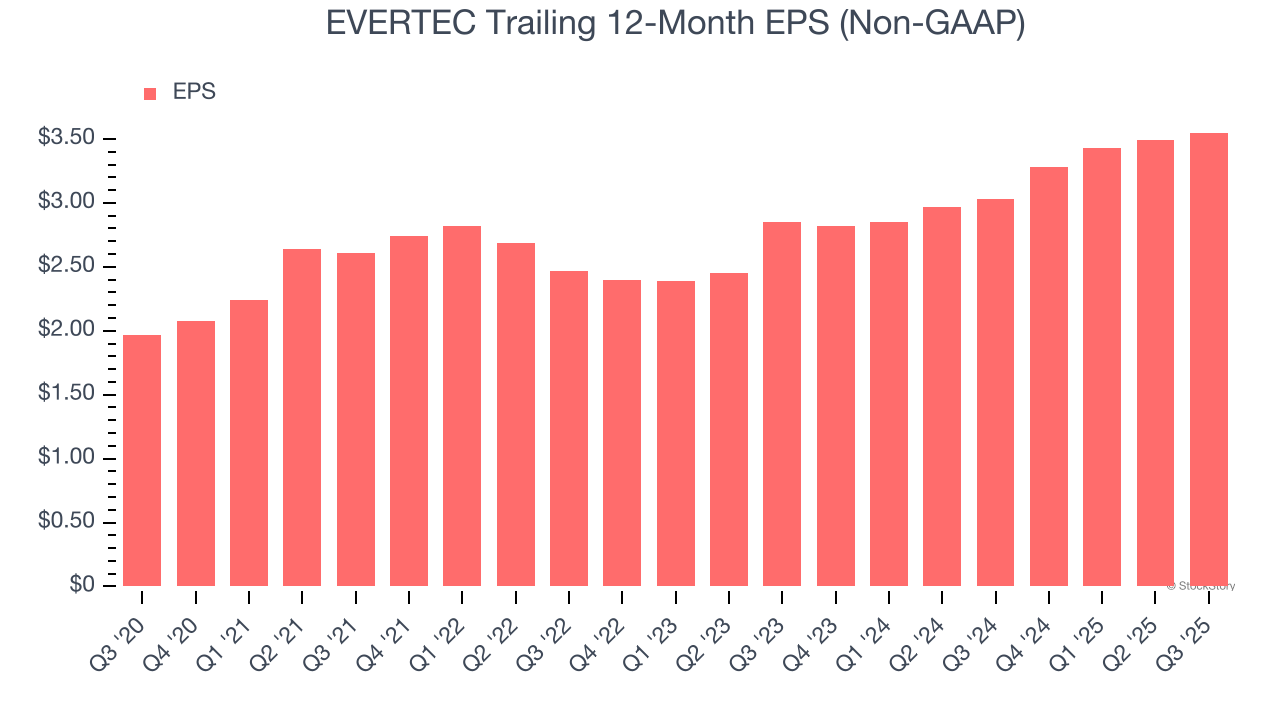

2. EPS Moving Up Steadily

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

EVERTEC’s decent 12.5% annual EPS growth over the last five years aligns with its revenue performance. This tells us it maintained its per-share profitability as it expanded.

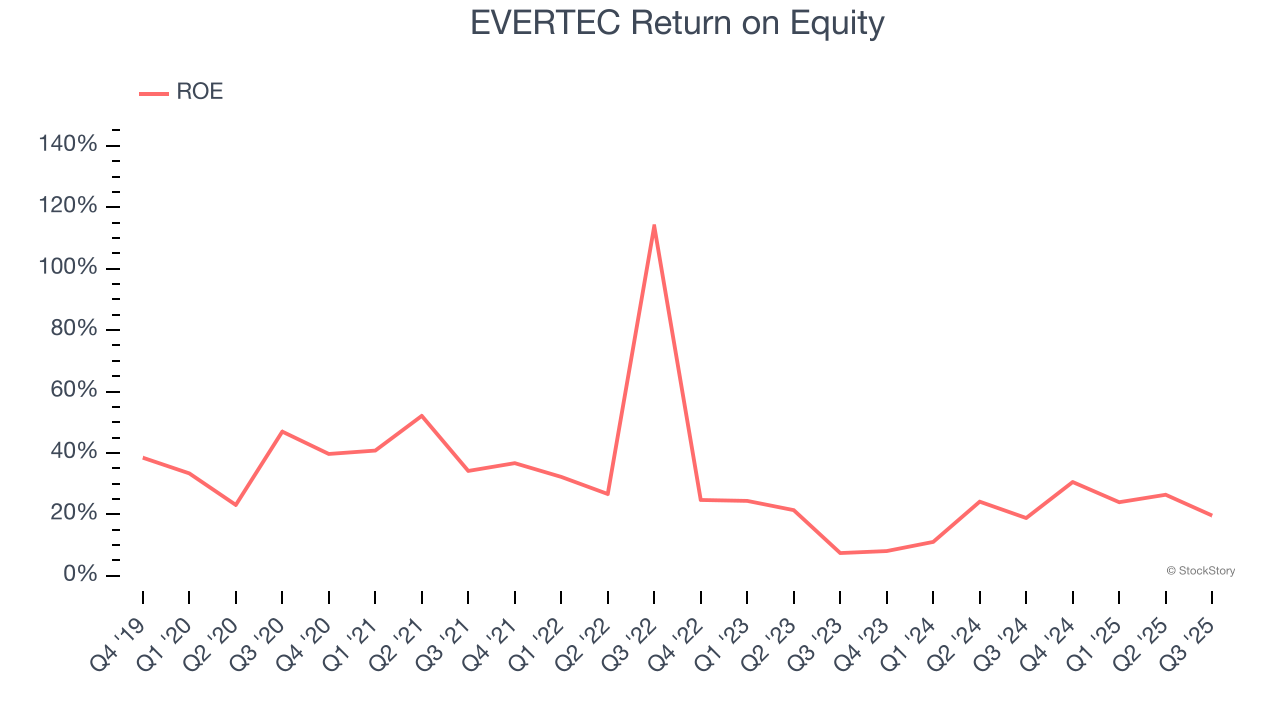

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, EVERTEC has averaged an ROE of 30.8%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows EVERTEC has a strong competitive moat.

Final Judgment

These are just a few reasons why EVERTEC ranks highly on our list. With the recent decline, the stock trades at 8× forward P/E (or $29.55 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.