UMB Financial trades at $120.73 per share and has stayed right on track with the overall market, gaining 13% over the last six months. At the same time, the S&P 500 has returned 11.5%.

Is now a good time to buy UMBF? Find out in our full research report, it’s free.

Why Does UMB Financial Spark Debate?

With roots dating back to 1913 and a name derived from "United Missouri Bank," UMB Financial (NASDAQ: UMBF) is a financial holding company that provides banking, asset management, and fund services to commercial, institutional, and individual customers.

Two Things to Like:

1. Net Interest Income Skyrockets, Fueling Growth Opportunities

While bank generate revenue from multiple sources, investors view net interest income as a cornerstone - its predictable, recurring characteristics stand in sharp contrast to the volatility of one-time fees.

UMB Financial’s net interest income has grown at a 17.8% annualized rate over the last five years, better than the broader banking industry and faster than its total revenue.

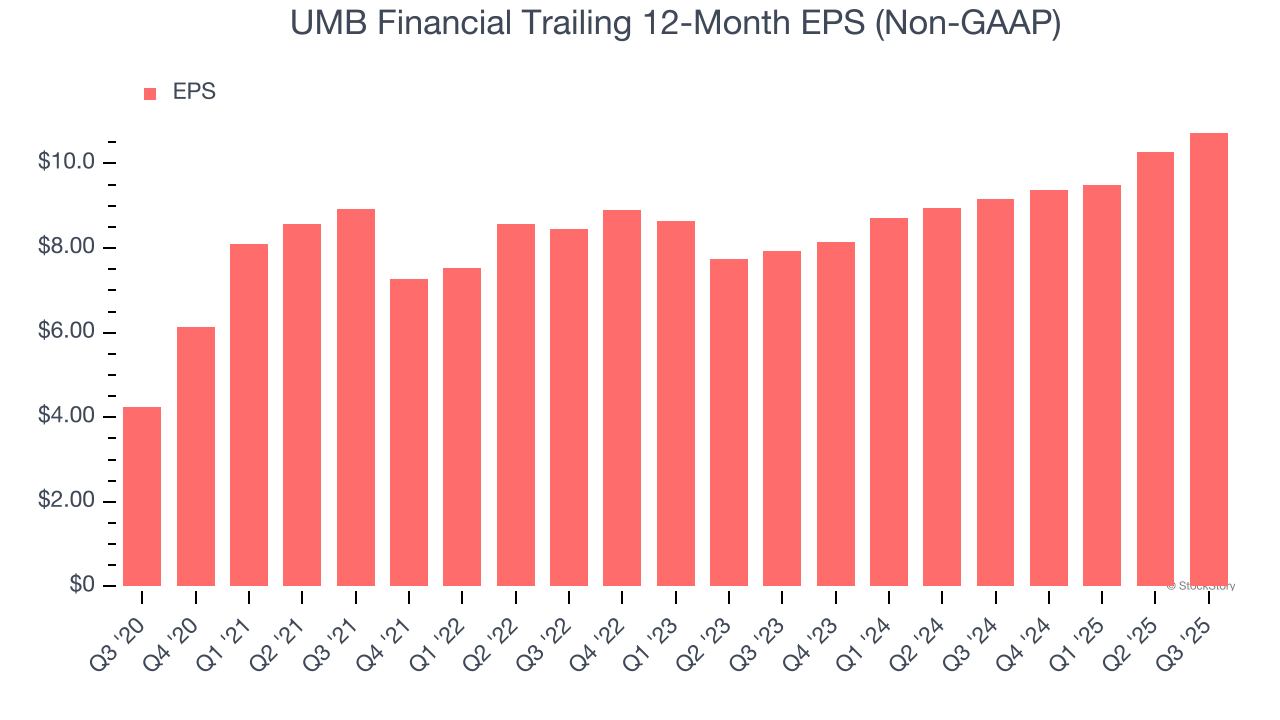

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

UMB Financial’s EPS grew at an astounding 20.4% compounded annual growth rate over the last five years, higher than its 15.5% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

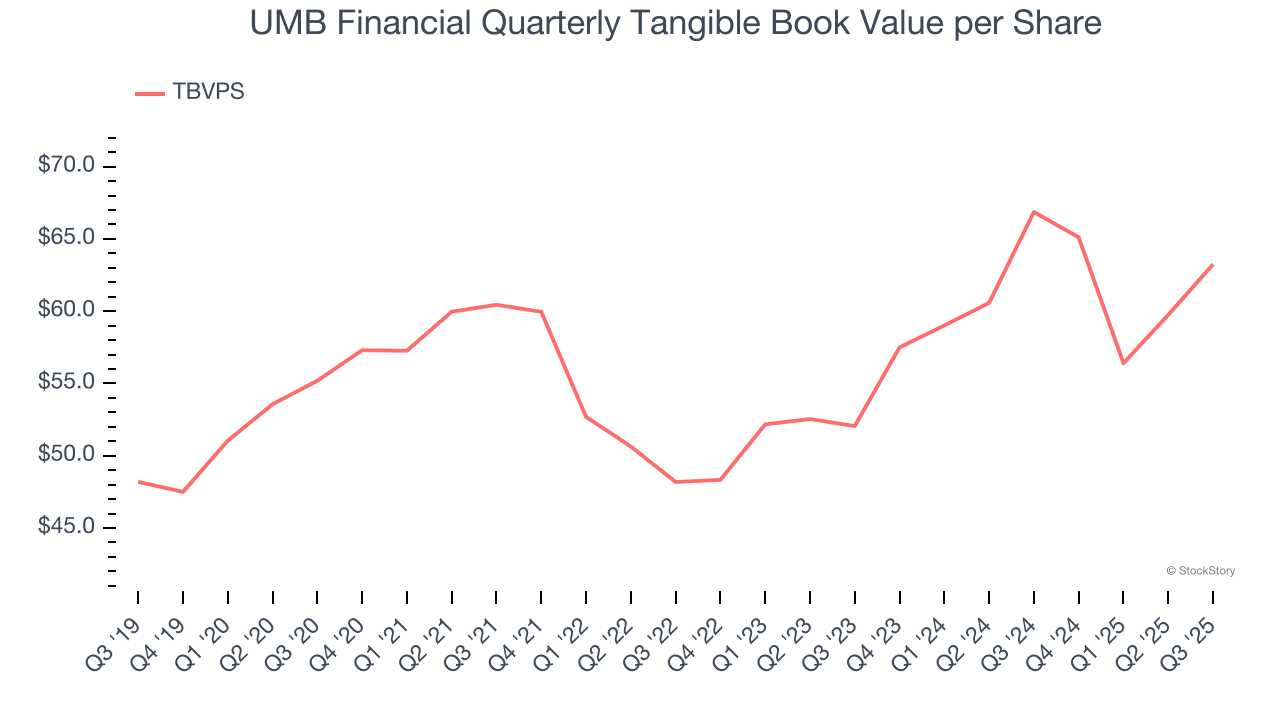

TBVPS Growth Demonstrates Strong Asset Foundation

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Although UMB Financial’s TBVPS increased by a meager 2.8% annually over the last five years, the good news is that its growth has recently accelerated as TBVPS grew at a decent 10.2% annual clip over the past two years (from $52.06 to $63.24 per share).

Final Judgment

UMB Financial has huge potential even though it has some open questions, but at $120.73 per share (or 1.2× forward P/B), is now the right time to buy the stock? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than UMB Financial

Check out the high-quality names we’ve flagged in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.