While the S&P 500 is up 15.5% since March 2025, Hamilton Lane (currently trading at $148 per share) has lagged behind, posting a return of 7.3%. This may have investors wondering how to approach the situation.

Taking into account the weaker price action, does HLNE warrant a spot on your radar, or is it better left off your list? Find out in our full research report, it’s free.

Why Are We Positive On Hamilton Lane?

With over $100 billion in assets under management and supervision, Hamilton Lane (NASDAQ: HLNE) is an investment management firm that specializes in private markets, offering advisory services and fund solutions to institutional and private wealth investors.

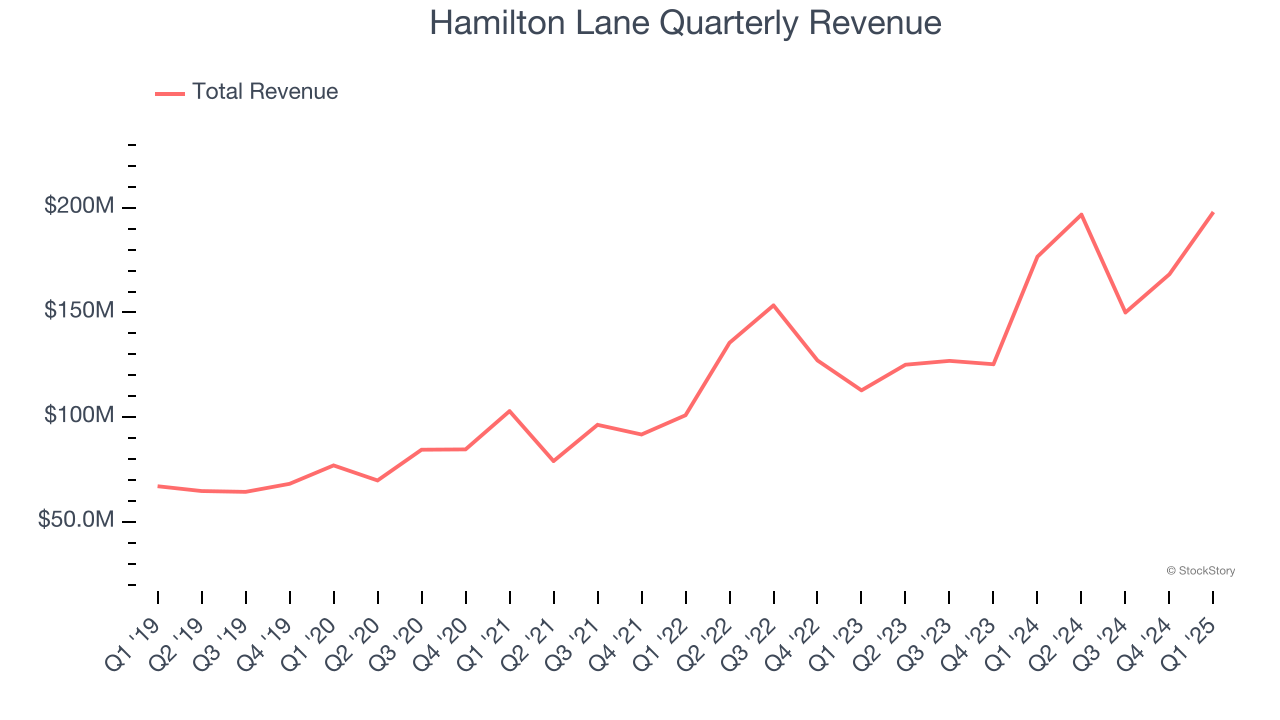

1. Skyrocketing Revenue Shows Strong Momentum

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

Over the last five years, Hamilton Lane grew its revenue at an excellent 21.1% compounded annual growth rate. Its growth beat the average financials company and shows its offerings resonate with customers.

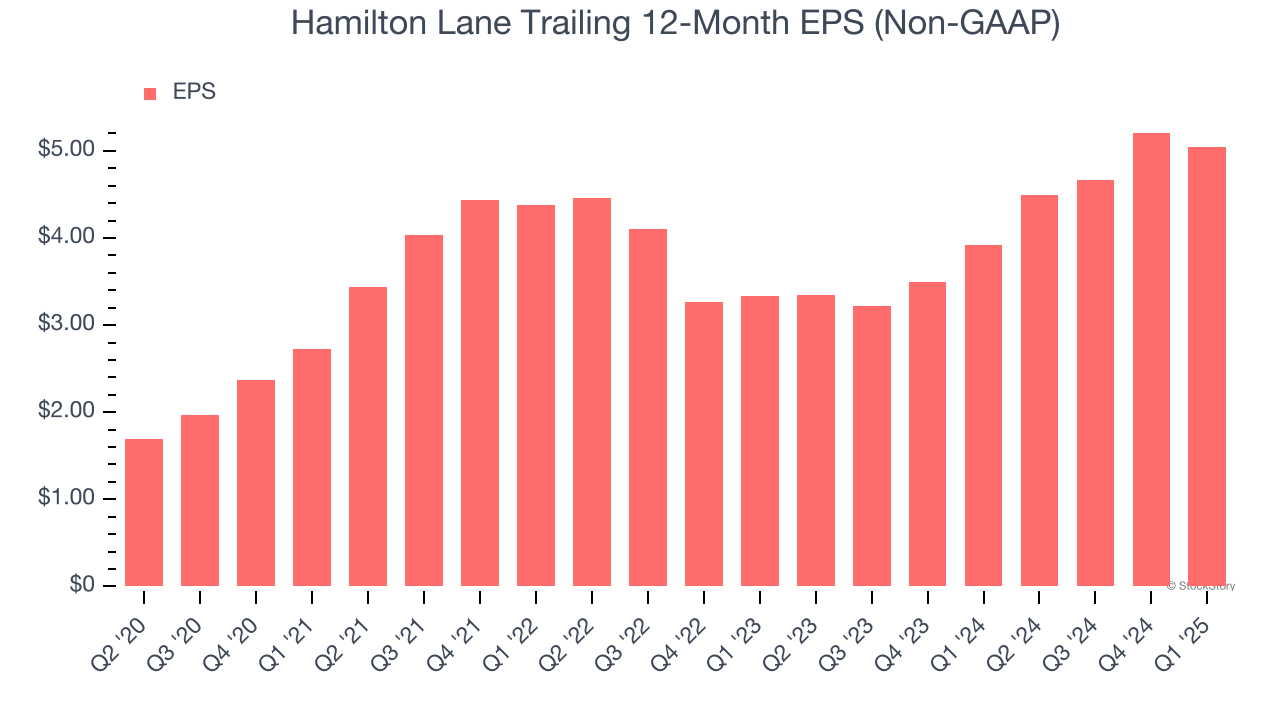

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Hamilton Lane’s EPS grew at a remarkable 17.7% compounded annual growth rate over the last five years. This performance was better than most financials businesses.

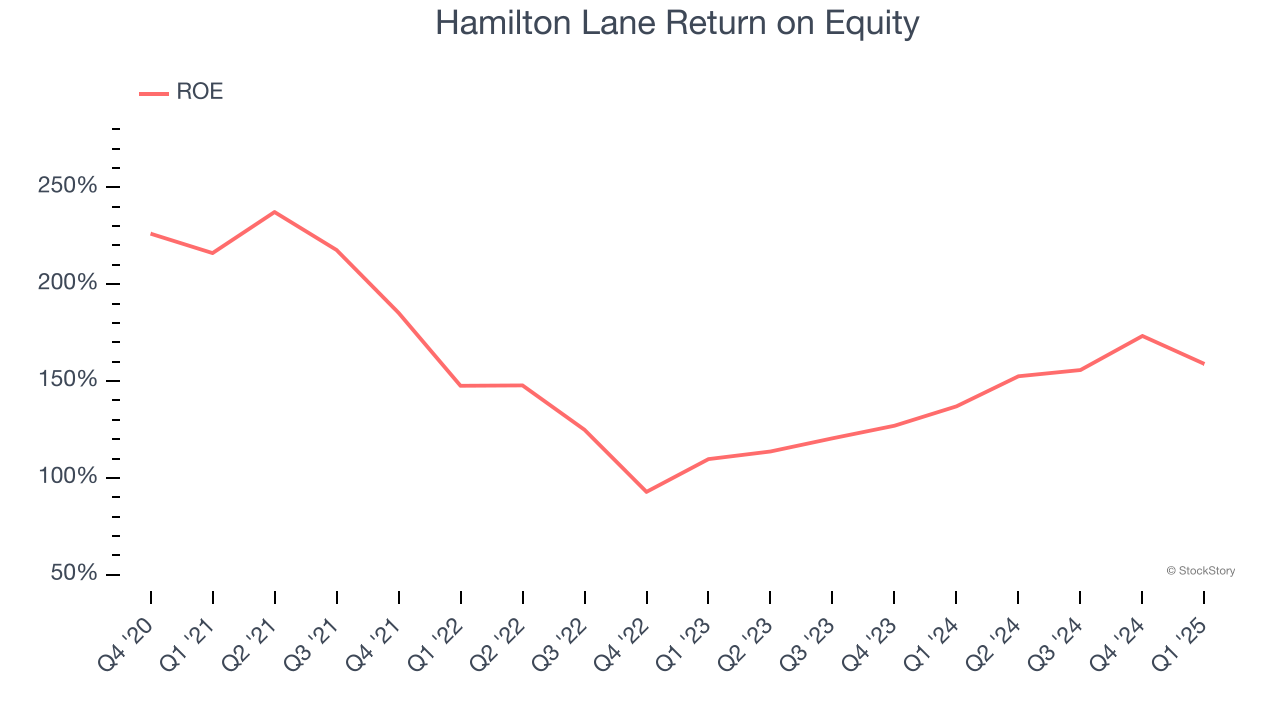

3. Stellar ROE Showcases Lucrative Growth Opportunities

Return on equity (ROE) measures how effectively banks generate profit from each dollar of shareholder equity - a critical funding source. High-ROE institutions typically compound shareholder wealth faster over time through retained earnings, share repurchases, and dividend payments.

Over the last five years, Hamilton Lane has averaged an ROE of 38.5%, exceptional for a company operating in a sector where the average shakes out around 10% and those putting up 25%+ are greatly admired. This shows Hamilton Lane has a strong competitive moat.

Final Judgment

These are just a few reasons why we think Hamilton Lane is an elite financials company. With its shares underperforming the market lately, the stock trades at 30.6× forward P/E (or $148 per share). Is now a good time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Hamilton Lane

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.