Global entertainment and media company Warner Bros. Discovery (NASDAQ: WBD) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 1% year on year to $9.81 billion. Its GAAP profit of $0.63 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Warner Bros. Discovery? Find out by accessing our full research report, it’s free.

Warner Bros. Discovery (WBD) Q2 CY2025 Highlights:

- Revenue: $9.81 billion vs analyst estimates of $9.85 billion (1% year-on-year growth, in line)

- EPS (GAAP): $0.63 vs analyst estimates of -$0.23 (significant beat)

- Adjusted EBITDA: $1.95 billion vs analyst estimates of $1.79 billion (19.9% margin, 8.9% beat)

- Operating Margin: -1.9%, up from -105% in the same quarter last year

- Free Cash Flow Margin: 7.2%, down from 10% in the same quarter last year

- Market Capitalization: $31.64 billion

Company Overview

Formed from the merger of WarnerMedia and Discovery, Warner Bros. Discovery (NASDAQ: WBD) is a multinational media and entertainment company, offering television networks, streaming services, and film and television production.

Revenue Growth

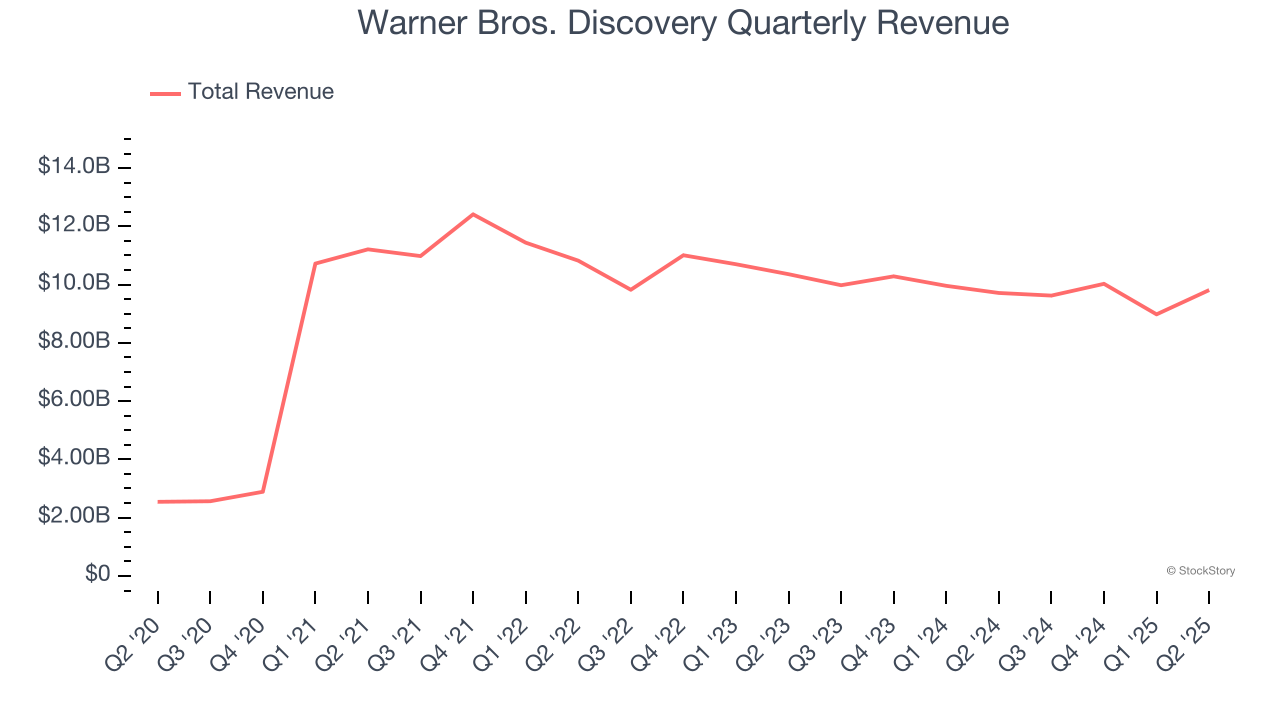

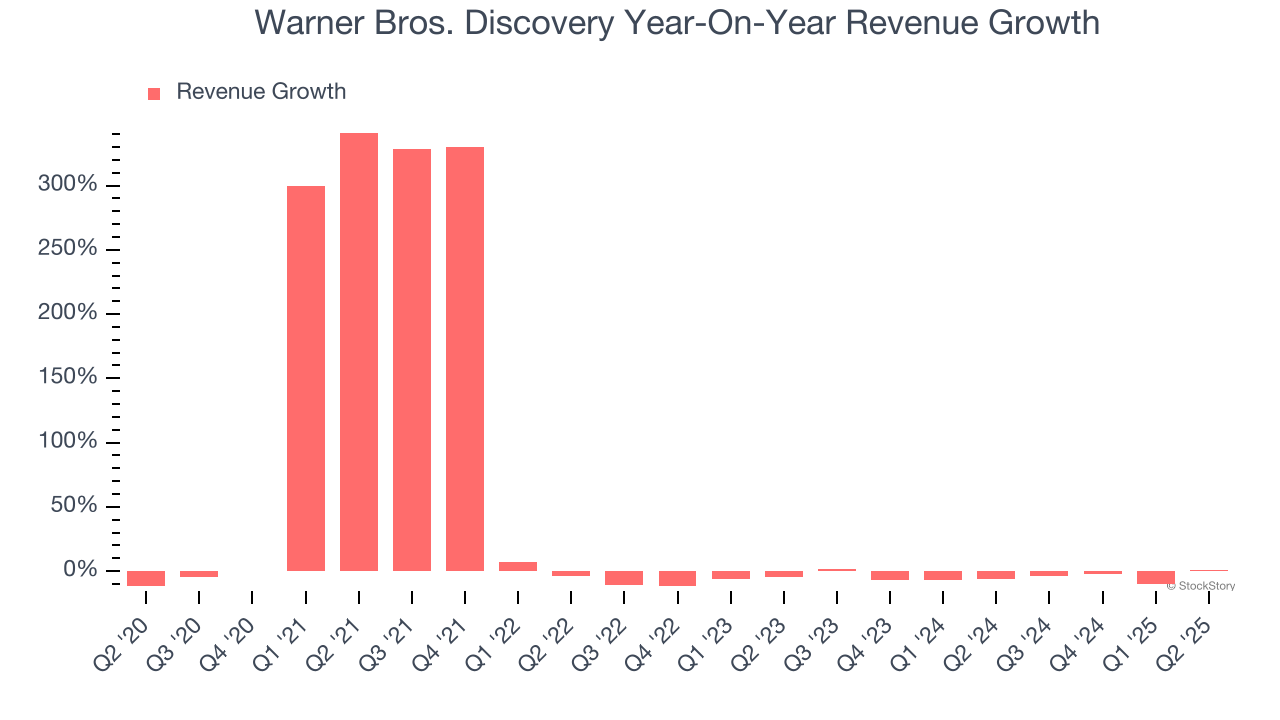

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Warner Bros. Discovery grew its sales at an exceptional 29% compounded annual growth rate. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Warner Bros. Discovery’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 4.2% over the last two years.

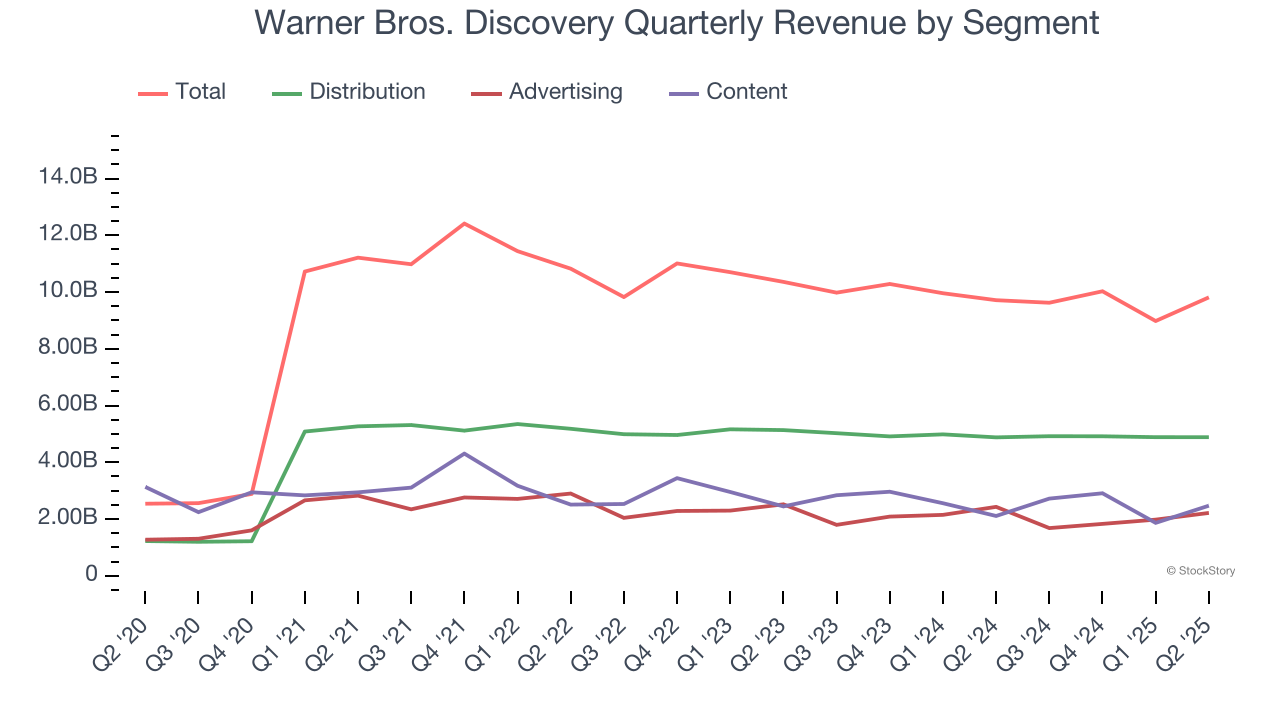

We can dig further into the company’s revenue dynamics by analyzing its three most important segments: Distribution, Advertising, and Content, which are 49.8%, 22.6%, and 25.2% of revenue. Over the last two years, Warner Bros. Discovery’s revenues in all three segments declined. Its Distribution revenue (licensing fees) averaged year-on-year decreases of 1.6% while its Advertising (marketing services) and Content (films, streaming, games) revenues averaged drops of 8.3% and 5.6%.

This quarter, Warner Bros. Discovery grew its revenue by 1% year on year, and its $9.81 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection implies its newer products and services will spur better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

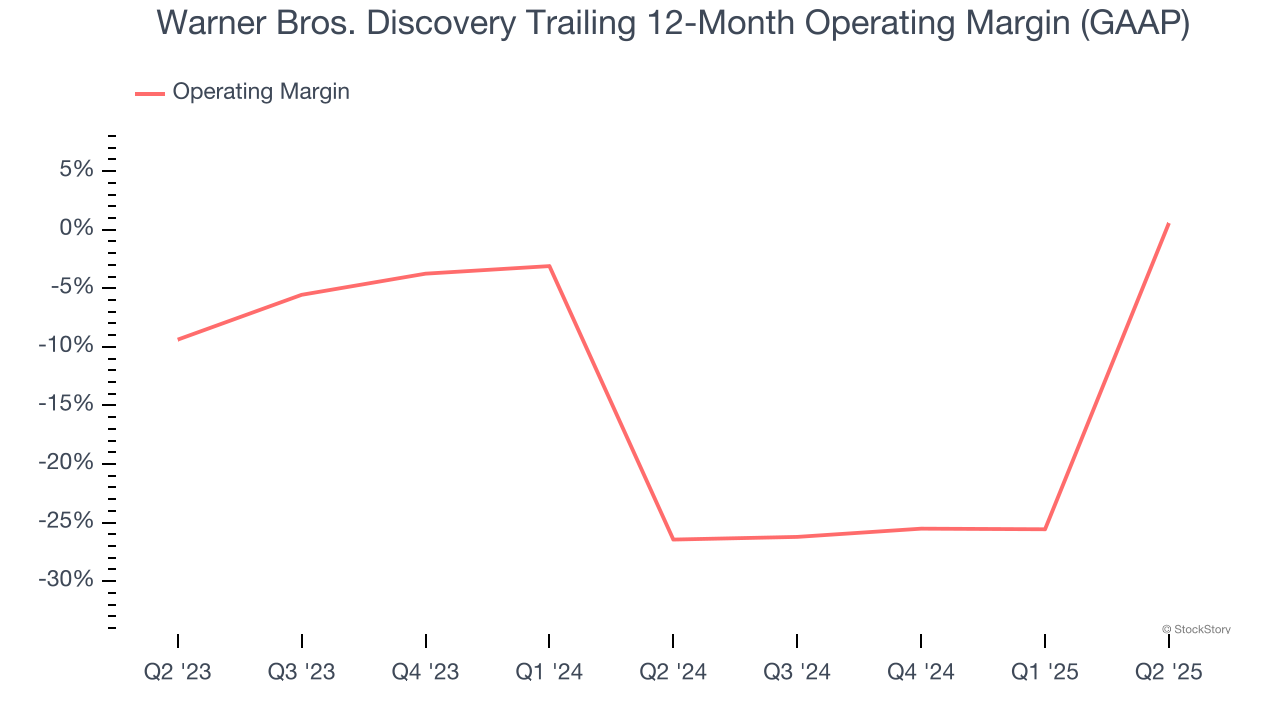

Warner Bros. Discovery’s operating margin has been trending up over the last 12 months, but it still averaged negative 13.2% over the last two years. This is due to its large expense base and inefficient cost structure.

In Q2, Warner Bros. Discovery generated a negative 1.9% operating margin.

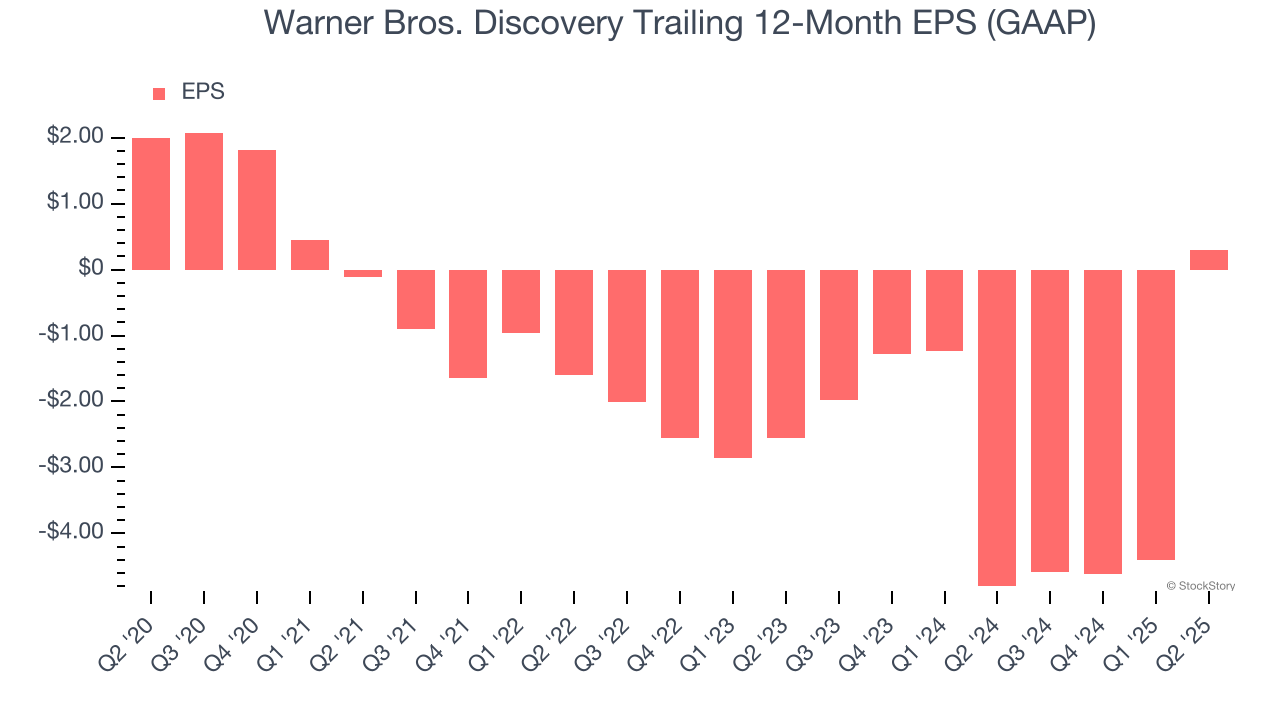

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for Warner Bros. Discovery, its EPS declined by 31.6% annually over the last five years while its revenue grew by 29%. This tells us the company became less profitable on a per-share basis as it expanded.

In Q2, Warner Bros. Discovery reported EPS at $0.63, up from negative $4.07 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Warner Bros. Discovery to perform poorly. Analysts forecast its full-year EPS of $0.30 will hit negative $0.21.

Key Takeaways from Warner Bros. Discovery’s Q2 Results

We were impressed by how significantly Warner Bros. Discovery blew past analysts’ EPS expectations this quarter. We were also happy its EBITDA outperformed Wall Street’s estimates. On the other hand, its Advertising revenue missed. Overall, we think this was still a solid quarter with some key areas of upside. The market seemed to be hoping for more, and the stock traded down 6.6% to $11.97 immediately after reporting.

Is Warner Bros. Discovery an attractive investment opportunity at the current price? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.