Wrapping up Q2 earnings, we look at the numbers and key takeaways for the custody bank stocks, including Voya Financial (NYSE: VOYA) and its peers.

Custody banks safeguard financial assets and provide services like settlement, accounting, and regulatory compliance for institutional investors. Growth opportunities stem from increasing global assets under custody, demand for data analytics, and blockchain technology adoption for settlement efficiency. Challenges include fee pressure from large clients, substantial technology investment requirements, and competition from both traditional players and fintech firms entering the space.

The 13 custody bank stocks we track reported a mixed Q2. As a group, revenues were in line with analysts’ consensus estimates.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

Best Q2: Voya Financial (NYSE: VOYA)

Originally spun off from Dutch financial giant ING in 2013 and rebranded with a name suggesting "voyage," Voya Financial (NYSE: VOYA) provides workplace benefits and savings solutions to U.S. employers, helping their employees achieve better financial outcomes through retirement plans and insurance products.

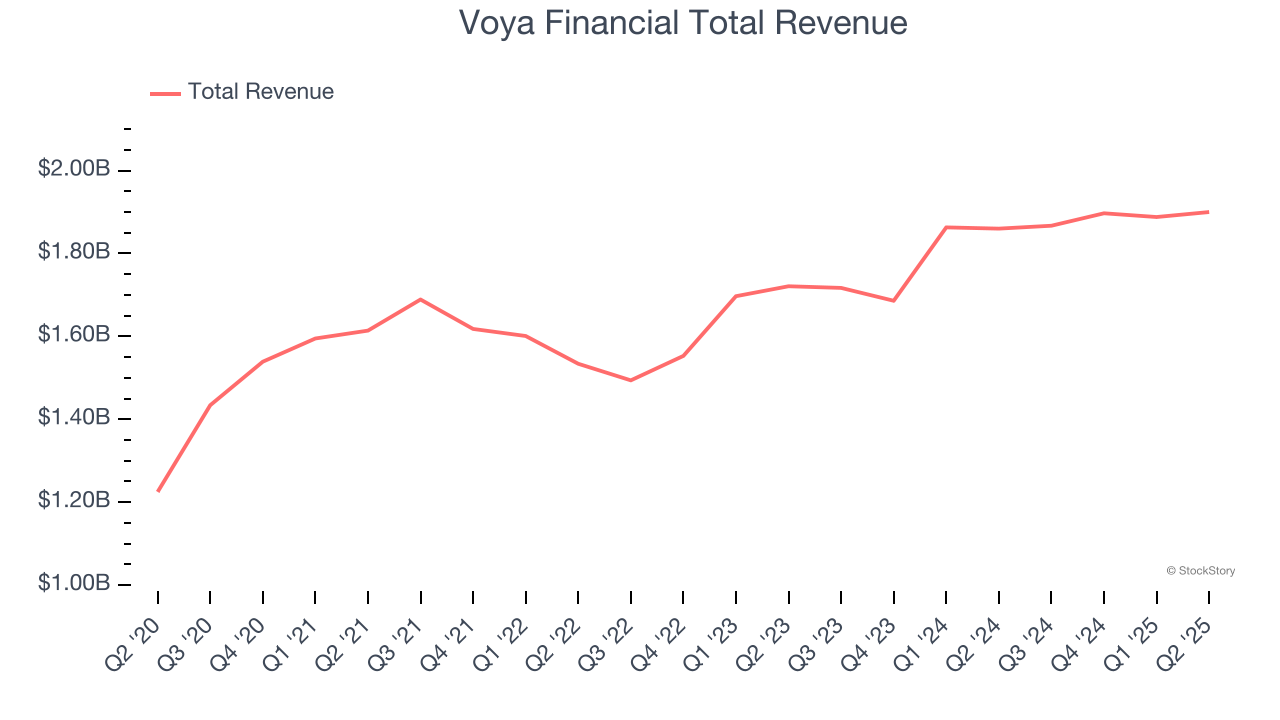

Voya Financial reported revenues of $1.9 billion, up 2.2% year on year. This print exceeded analysts’ expectations by 13.5%. Overall, it was a stunning quarter for the company with and a beat of analysts’ EPS estimates.

“We are encouraged by another solid quarter of performance across our businesses,” said Heather Lavallee, chief executive officer, Voya Financial.

Voya Financial achieved the biggest analyst estimates beat of the whole group. Unsurprisingly, the stock is up 12.7% since reporting and currently trades at $76.48.

Is now the time to buy Voya Financial? Access our full analysis of the earnings results here, it’s free.

BNY Mellon (NYSE: BK)

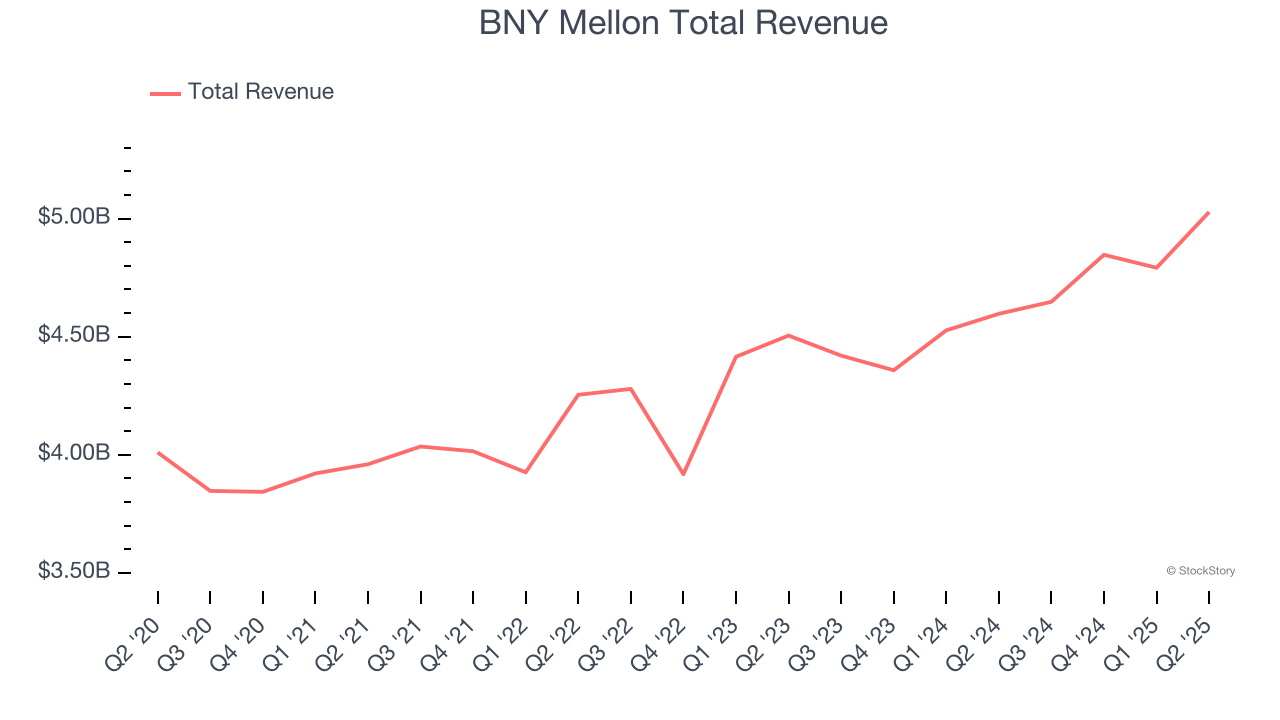

Tracing its roots back to 1784 when it was founded by Alexander Hamilton, BNY Mellon (NYSE: BK) is a global financial institution that provides asset servicing, wealth management, and investment services to institutions, corporations, and high-net-worth individuals.

BNY Mellon reported revenues of $5.03 billion, up 9.4% year on year, outperforming analysts’ expectations by 3.9%. The business had a very strong quarter with a beat of analysts’ EPS estimates.

The market seems happy with the results as the stock is up 6.3% since reporting. It currently trades at $101.25.

Is now the time to buy BNY Mellon? Access our full analysis of the earnings results here, it’s free.

Slowest Q2: Franklin Resources (NYSE: BEN)

Operating under the widely recognized Franklin Templeton brand since 1947, Franklin Resources (NYSE: BEN) is a global investment management organization that offers financial services and solutions to individuals, institutions, and wealth advisors worldwide.

Franklin Resources reported revenues of $1.59 billion, down 3.7% year on year, falling short of analysts’ expectations by 18.8%. It was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Franklin Resources delivered the weakest performance against analyst estimates in the group. Interestingly, the stock is up 3.2% since the results and currently trades at $24.73.

Read our full analysis of Franklin Resources’s results here.

StepStone Group (NASDAQ: STEP)

Operating as both an advisor and asset manager with over $100 billion in assets under management, StepStone Group (NASDAQ: STEP) is an investment firm that provides clients with access to private market investments across private equity, real estate, private debt, and infrastructure.

StepStone Group reported revenues of $237.5 million, up 27.4% year on year. This number missed analysts’ expectations by 1.1%. Overall, it was a slower quarter as it also logged a significant miss of analysts’ EPS estimates.

StepStone Group achieved the fastest revenue growth among its peers. The stock is up 1.9% since reporting and currently trades at $58.67.

Read our full, actionable report on StepStone Group here, it’s free.

SEI Investments (NASDAQ: SEIC)

Founded in 1968 as Simulated Environments Inc. to train bank loan officers using computer simulations, SEI Investments (NASDAQ: SEIC) provides technology platforms, investment management, and operational solutions for financial institutions, wealth managers, and investors.

SEI Investments reported revenues of $559.6 million, up 7.8% year on year. This print lagged analysts' expectations by 0.7%. Zooming out, it was actually a very strong quarter as it put up a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $89.59.

Read our full, actionable report on SEI Investments here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.