Over the past six months, Globe Life has been a great trade, beating the S&P 500 by 7.1%. Its stock price has climbed to $139.10, representing a healthy 13.5% increase. This run-up might have investors contemplating their next move.

Is now the time to buy Globe Life, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Globe Life Not Exciting?

We’re happy investors have made money, but we're sitting this one out for now. Here are three reasons why you should be careful with GL and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

In general, insurance companies earn revenue from three primary sources. The first is the core insurance business itself, often called underwriting and represented in the income statement as premiums earned. The second source is investment income from investing the “float” (premiums collected upfront not yet paid out as claims) in assets such as fixed-income assets and equities. The third is fees from various sources such as policy administration, annuities, or other value-added services.

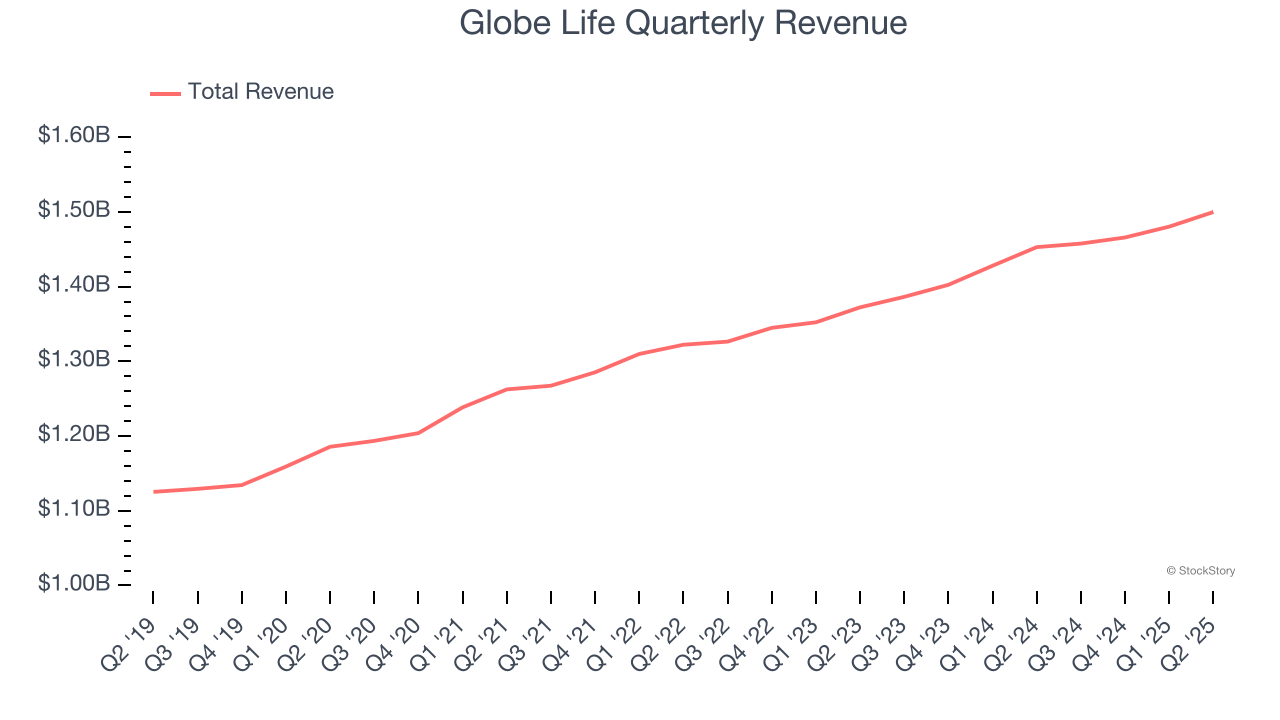

Unfortunately, Globe Life’s 5.1% annualized revenue growth over the last five years was tepid. This was below our standard for the insurance sector.

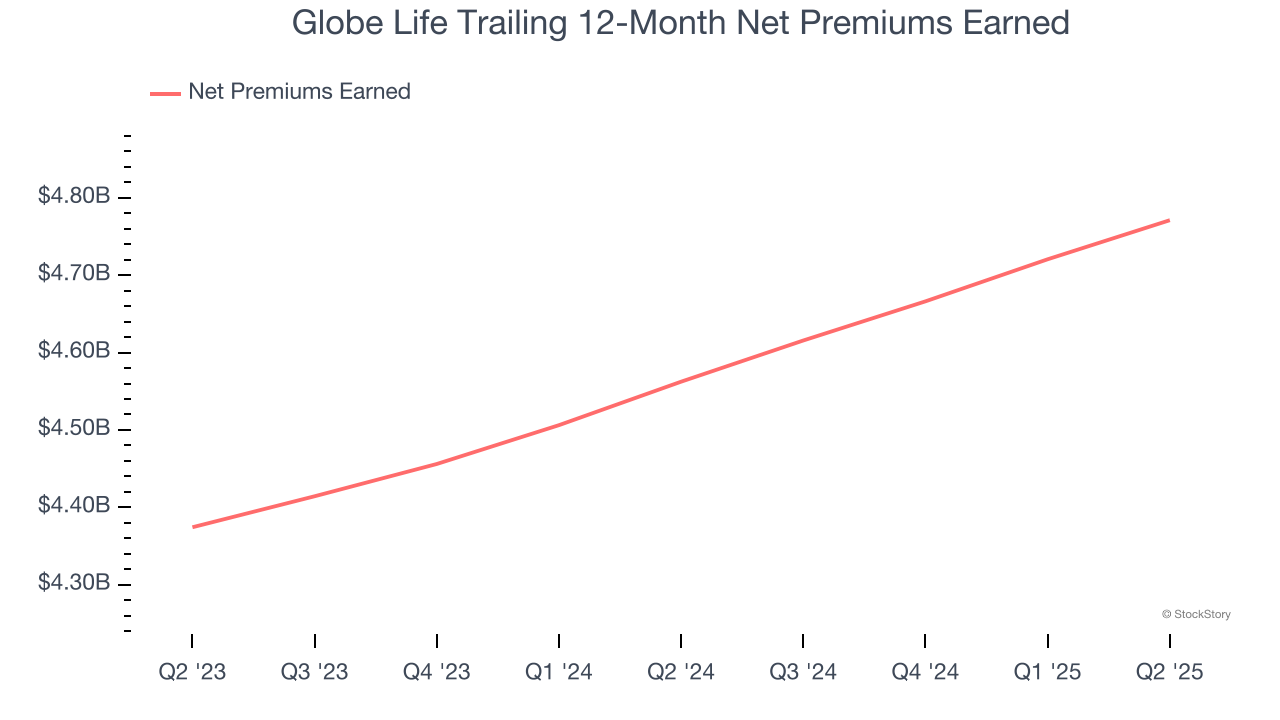

2. Net Premiums Earned Point to Soft Demand

When insurers sell policies, they protect themselves from extremely large losses or an outsized accumulation of losses with reinsurance (insurance for insurance companies). Net premiums earned are:

- Gross premiums - what’s ceded to reinsurers as a risk mitigation and transfer strategy

Globe Life’s net premiums earned has grown at a 4.4% annualized rate over the last two years, worse than the broader insurance industry and in line with its total revenue.

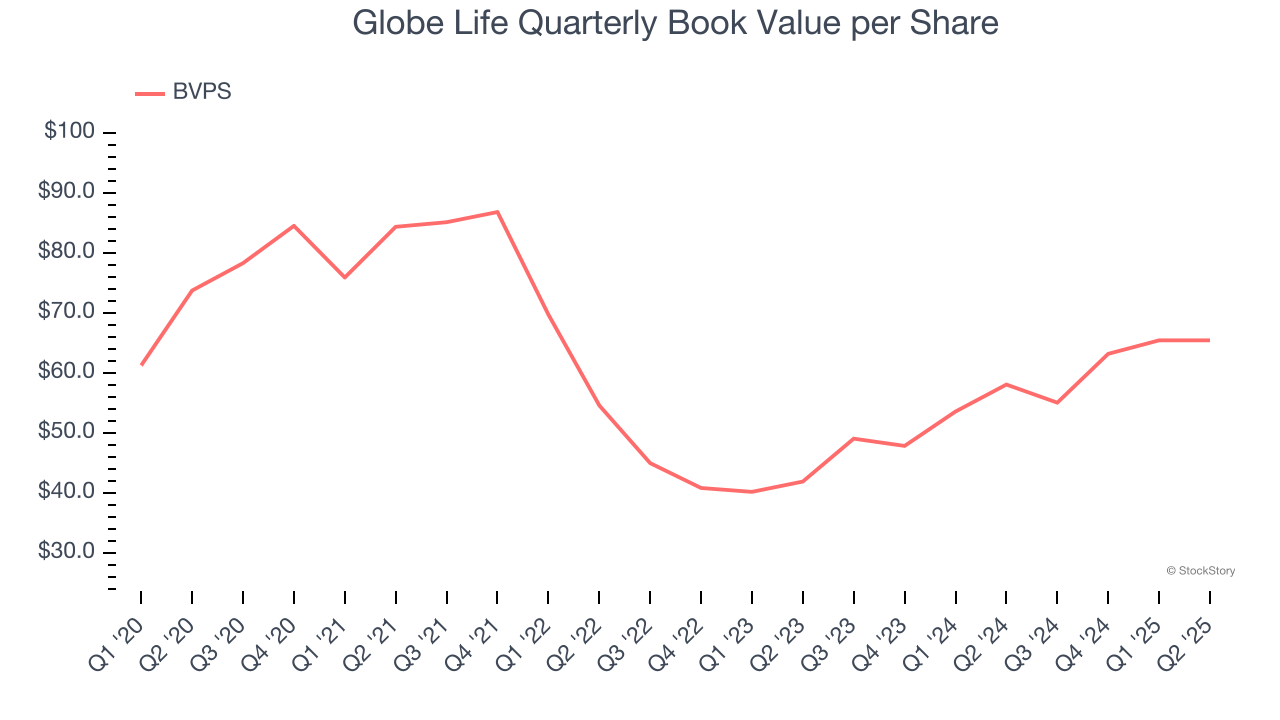

3. Growing BVPS Reflects Strong Asset Base

We consider book value per share (BVPS) a critical metric for insurance companies. BVPS represents the total net worth per share, providing insight into a company’s financial strength and ability to meet policyholder obligations.

Although Globe Life’s BVPS declined at a 2.4% annual clip over the last five years. the good news is that its growth inflected positive over the past two years as BVPS grew at an exceptional 25% annual clip (from $41.90 to $65.43 per share).

Final Judgment

Globe Life’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 1.9× forward P/B (or $139.10 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. Let us point you toward one of our top software and edge computing picks.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.