Beauty products company Coty (NYSE: COTY) reported Q2 CY2025 results exceeding the market’s revenue expectations, but sales fell by 8.1% year on year to $1.25 billion. Its non-GAAP loss of $0.05 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Coty? Find out by accessing our full research report, it’s free.

Coty (COTY) Q2 CY2025 Highlights:

- Revenue: $1.25 billion vs analyst estimates of $1.21 billion (8.1% year-on-year decline, 3.9% beat)

- Adjusted EPS: -$0.05 vs analyst estimates of $0.02 (significant miss)

- Operating Margin: 1.2%, down from 2.5% in the same quarter last year

- Free Cash Flow was -$131.8 million, down from $116.7 million in the same quarter last year

- Organic Revenue fell 9% year on year vs analyst estimates of 8.9% declines (14.4 basis point miss)

- Market Capitalization: $4.27 billion

"Coty is operating from a position of reinvigorated strength after five years of transformation and proven execution," said Sue Nabi, Coty's CEO.

Company Overview

With a portfolio boasting many household brands, Coty (NYSE: COTY) is a beauty products powerhouse spanning cosmetics, fragrances, and skincare.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $5.89 billion in revenue over the past 12 months, Coty carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

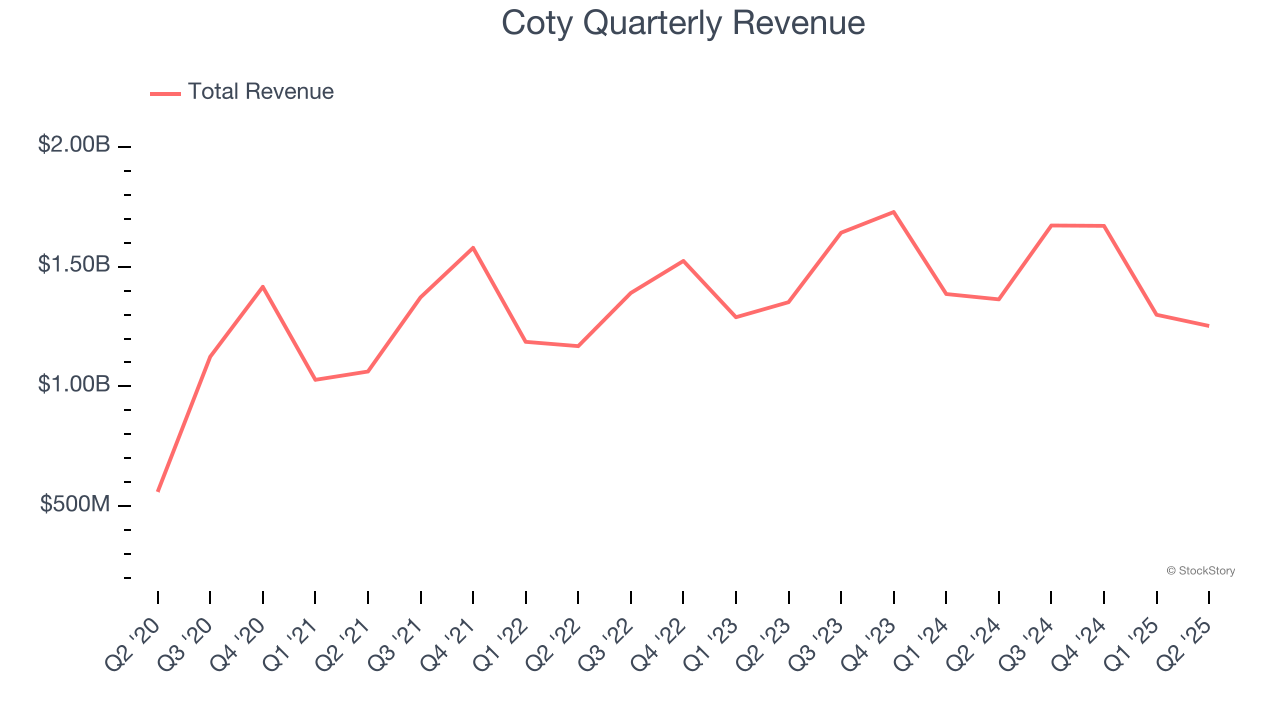

As you can see below, Coty’s 3.6% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

This quarter, Coty’s revenue fell by 8.1% year on year to $1.25 billion but beat Wall Street’s estimates by 3.9%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will see some demand headwinds.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

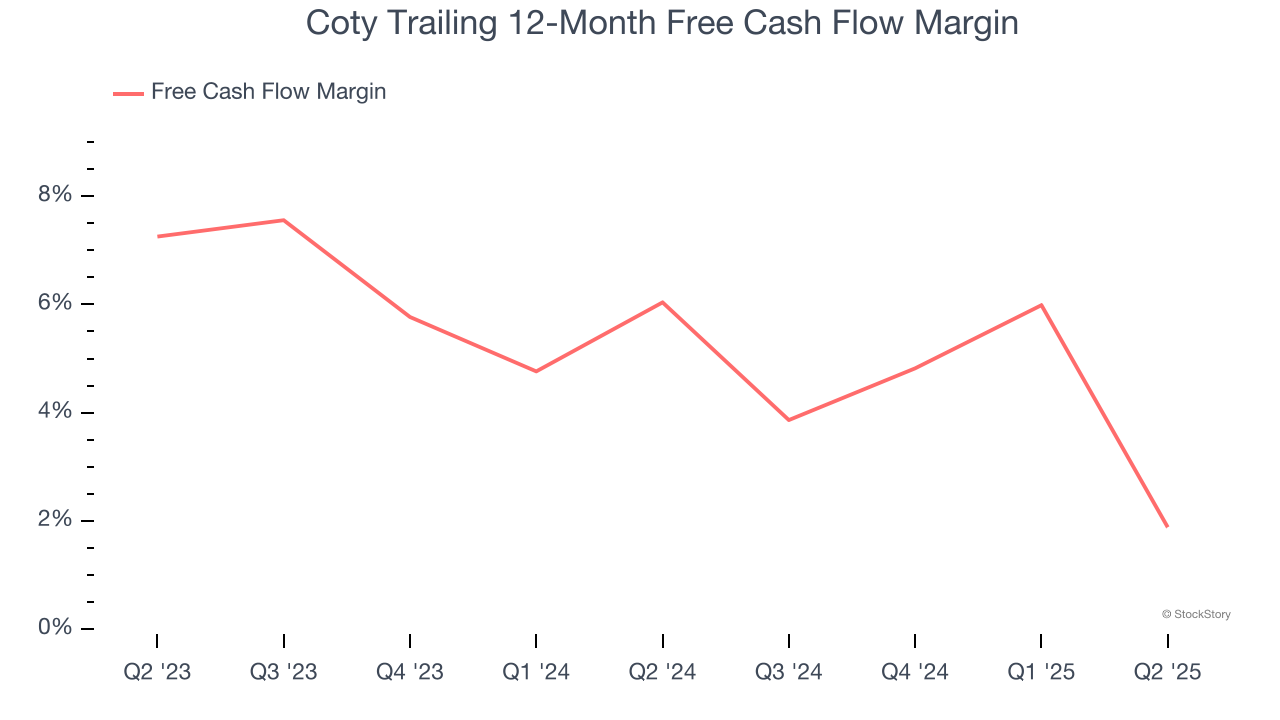

Coty has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 4%, subpar for a consumer staples business.

Taking a step back, we can see that Coty’s margin dropped by 4.2 percentage points over the last year. This decrease warrants extra caution because Coty failed to grow its revenue organically. Its cash profitability could decay further if it tries to reignite growth through investments.

Coty burned through $131.8 million of cash in Q2, equivalent to a negative 10.5% margin. The company’s cash flow turned negative after being positive in the same quarter last year, suggesting its historical struggles have dragged on.

Key Takeaways from Coty’s Q2 Results

We enjoyed seeing Coty beat analysts’ revenue expectations this quarter despite in-line organic revenue. On the other hand, its operating margin decline year-on-year and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 10.9% to $4.30 immediately following the results.

The latest quarter from Coty’s wasn’t that good. One earnings report doesn’t define a company’s quality, though, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.