The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Goldman Sachs (NYSE: GS) and the rest of the investment banking & brokerage stocks fared in Q2.

Investment banks and brokerages facilitate capital raises, mergers and acquisitions, and securities trading. The sector benefits from corporate activity during economic expansion, increased retail trading participation, and advisory opportunities in emerging sectors. Headwinds include economic cycle vulnerability affecting deal flow, compressed trading commissions due to electronic platforms, and regulatory capital requirements constraining certain higher-risk activities.

The 14 investment banking & brokerage stocks we track reported an exceptional Q2. As a group, revenues beat analysts’ consensus estimates by 7.7%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

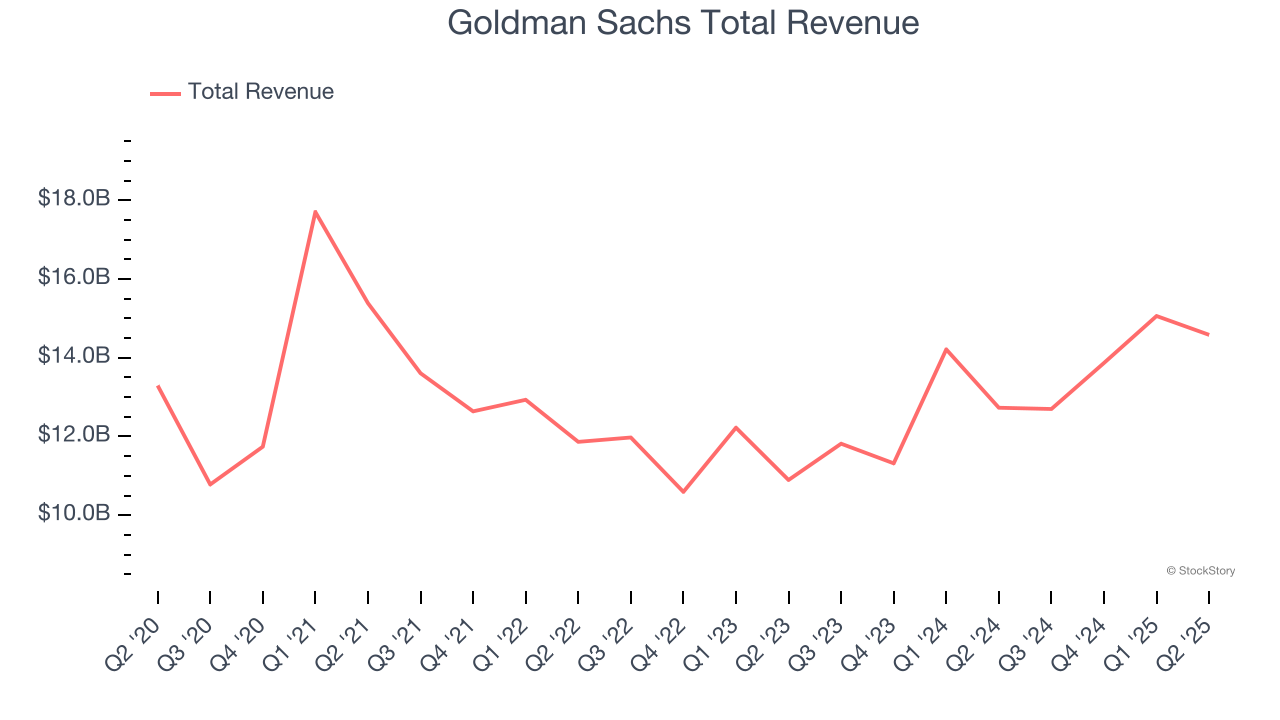

Goldman Sachs (NYSE: GS)

Founded in 1869 as a small commercial paper business in New York City, Goldman Sachs (NYSE: GS) is a global financial institution that provides investment banking, securities, asset management, and consumer banking services to corporations, governments, and individuals.

Goldman Sachs reported revenues of $14.58 billion, up 14.5% year on year. This print exceeded analysts’ expectations by 7.3%. Overall, it was a stunning quarter for the company with a beat of analysts’ EPS estimates.

Interestingly, the stock is up 3% since reporting and currently trades at $722.55.

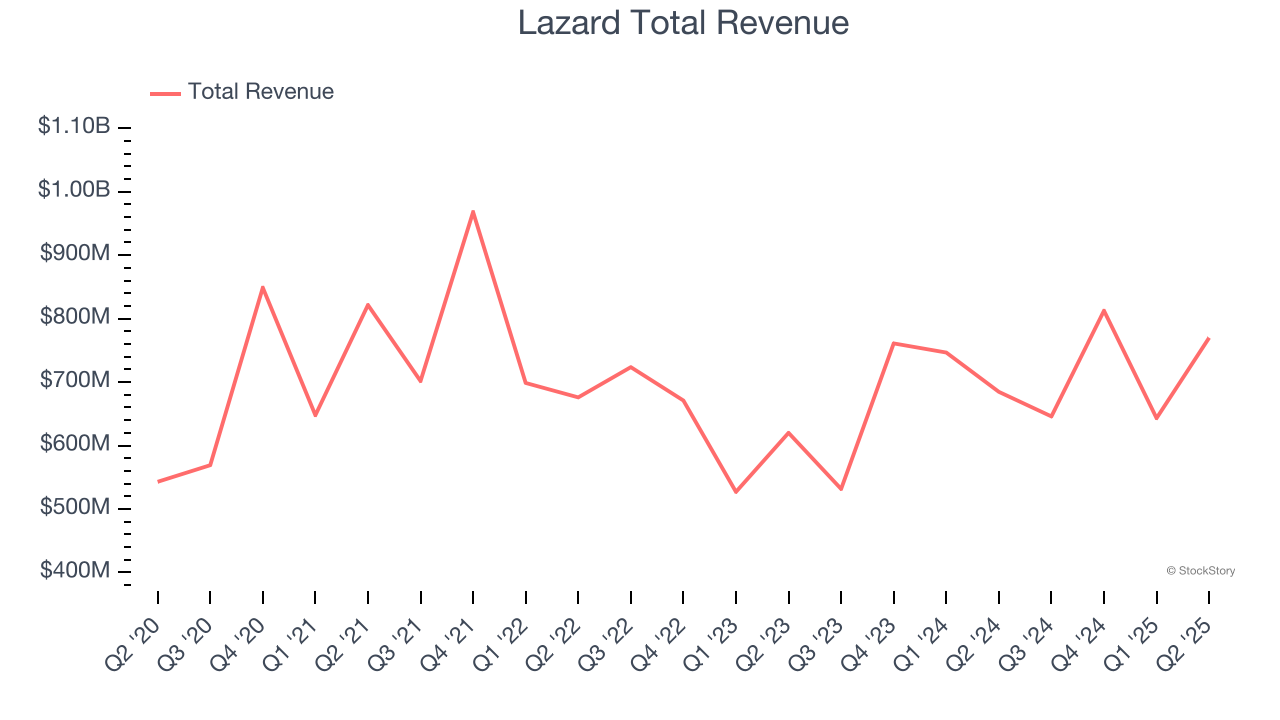

Best Q2: Lazard (NYSE: LAZ)

Tracing its roots back to 1848 when it began as a dry goods merchant in New Orleans, Lazard (NYSE: LAZ) is a global financial advisory and asset management firm that provides strategic advice to corporations, governments, institutions, and wealthy individuals.

Lazard reported revenues of $769.9 million, up 12.4% year on year, outperforming analysts’ expectations by 9.5%. The business had an incredible quarter with a beat of analysts’ EPS estimates.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.2% since reporting. It currently trades at $53.74.

Is now the time to buy Lazard? Access our full analysis of the earnings results here, it’s free.

Charles Schwab (NYSE: SCHW)

Founded in 1971 as a disruptive force challenging Wall Street's high fees and limited access, Charles Schwab (NYSE: SCHW) is a wealth management and brokerage firm that provides investment services, banking, and financial advice to individual investors and independent advisors.

Charles Schwab reported revenues of $5.85 billion, up 24.8% year on year, exceeding analysts’ expectations by 2%. It may have had the worst quarter among its peers, but its results were still good as it also locked in and a beat of analysts’ EPS estimates.

Interestingly, the stock is up 2.9% since the results and currently trades at $95.87.

Read our full analysis of Charles Schwab’s results here.

Houlihan Lokey (NYSE: HLI)

Founded in 1972 and known for its expertise in complex financial situations, Houlihan Lokey (NYSE: HLI) is a global investment bank specializing in mergers and acquisitions, capital markets, financial restructurings, and valuation advisory services.

Houlihan Lokey reported revenues of $605.3 million, up 17.9% year on year. This result beat analysts’ expectations by 2%. It was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $192.17.

Read our full, actionable report on Houlihan Lokey here, it’s free.

LPL Financial (NASDAQ: LPLA)

As the nation's largest independent broker-dealer with no proprietary products of its own, LPL Financial (NASDAQ: LPLA) provides technology, compliance, and business support services to independent financial advisors and institutions who manage investments for retail clients.

LPL Financial reported revenues of $3.84 billion, up 30.8% year on year. This number topped analysts’ expectations by 1.9%. Overall, it was a strong quarter as it also logged a beat of analysts’ EPS estimates.

LPL Financial had the weakest performance against analyst estimates among its peers. The stock is down 12.2% since reporting and currently trades at $348.

Read our full, actionable report on LPL Financial here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.