Over the past six months, Vicor’s stock price fell to $47.75. Shareholders have lost 7.9% of their capital, which is disappointing considering the S&P 500 has climbed by 4.7%. This may have investors wondering how to approach the situation.

Is now the time to buy Vicor, or should you be careful about including it in your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is Vicor Not Exciting?

Even though the stock has become cheaper, we don't have much confidence in Vicor. Here are three reasons why you should be careful with VICR and a stock we'd rather own.

1. Backlog Is Unchanged, Sales Pipeline Stalls

In addition to reported revenue, backlog is a useful data point for analyzing Electronic Components companies. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Vicor’s future revenue streams.

Over the last two years, Vicor failed to grow its backlog, which came in at $155.2 million in the latest quarter. This performance was underwhelming and shows the company faced challenges in winning new orders. It also suggests there may be increasing competition or market saturation.

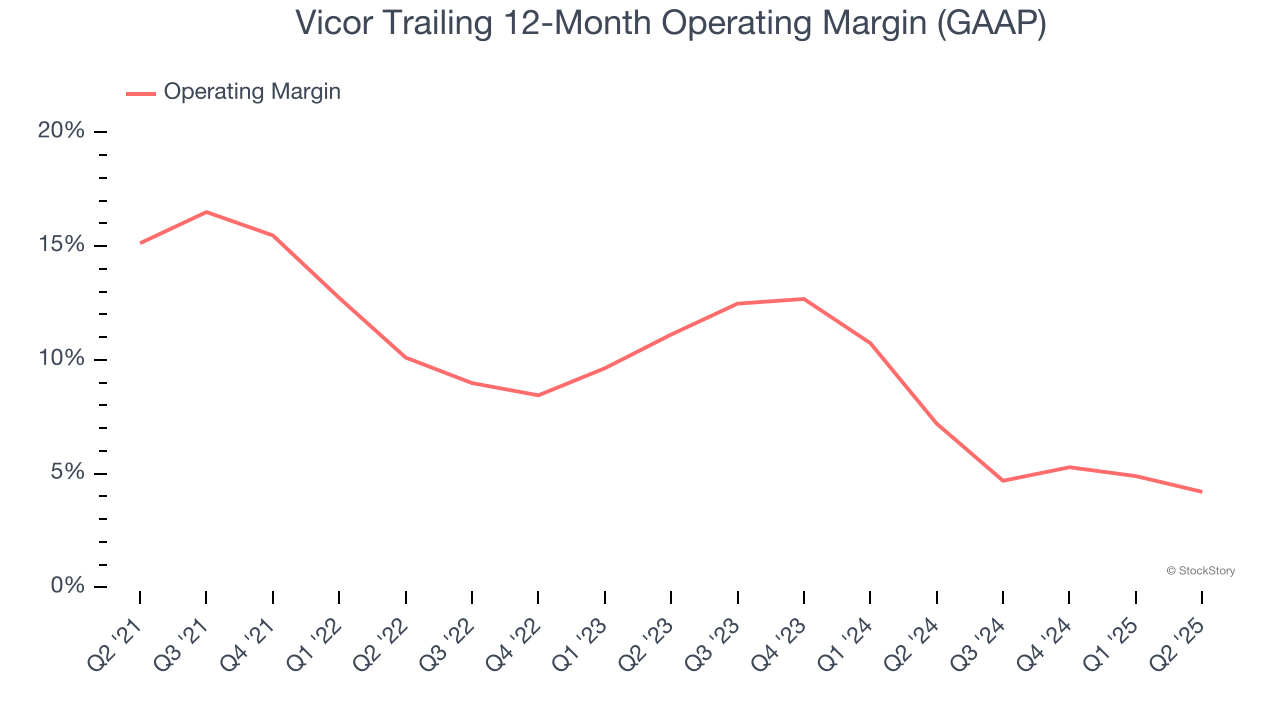

2. Shrinking Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Looking at the trend in its profitability, Vicor’s operating margin decreased by 10.9 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its operating margin for the trailing 12 months was 4.2%.

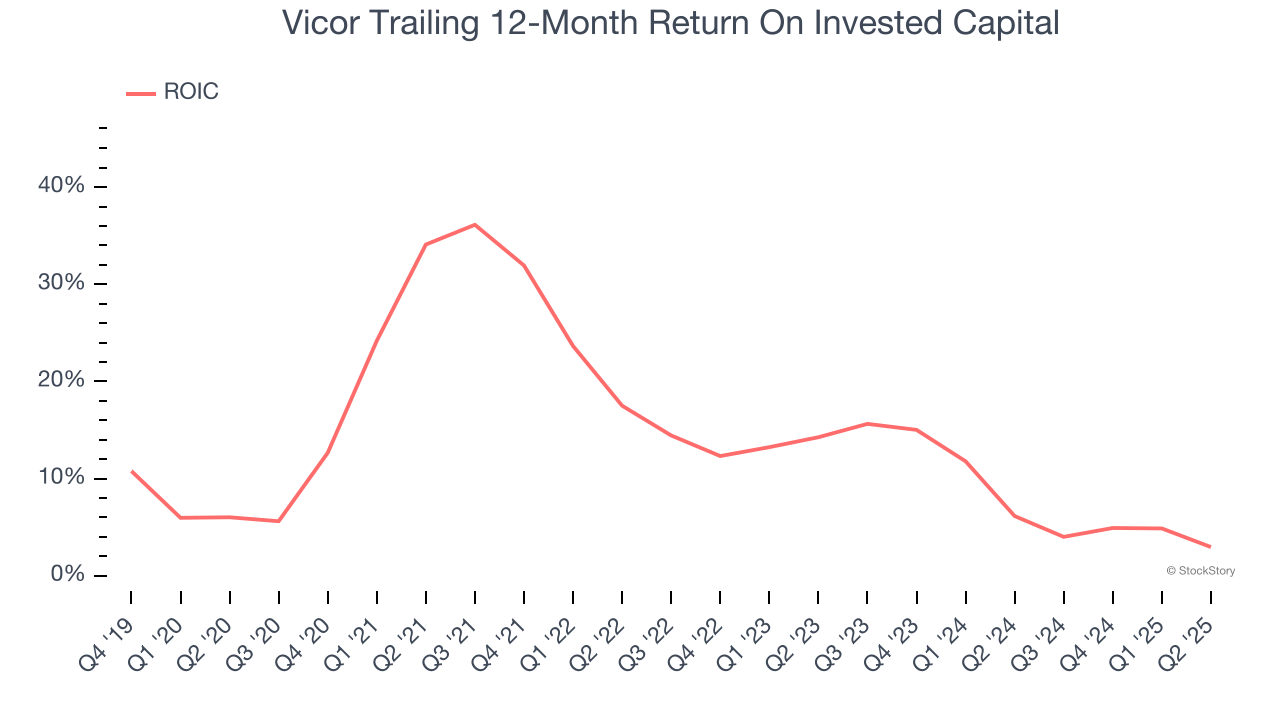

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Vicor’s ROIC has decreased significantly over the last few years. We like what management has done in the past, but its declining returns are perhaps a symptom of fewer profitable growth opportunities.

Final Judgment

Vicor’s business quality ultimately falls short of our standards. After the recent drawdown, the stock trades at 37.9× forward P/E (or $47.75 per share). This multiple tells us a lot of good news is priced in - you can find more timely opportunities elsewhere. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of Vicor

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.