Automotive parts company LKQ (NASDAQ: LKQ) met Wall Street’s revenue expectations in Q2 CY2025, but sales fell by 1.9% year on year to $3.64 billion. Its non-GAAP profit of $0.87 per share was 5.8% below analysts’ consensus estimates.

Is now the time to buy LKQ? Find out by accessing our full research report, it’s free.

LKQ (LKQ) Q2 CY2025 Highlights:

- Revenue: $3.64 billion vs analyst estimates of $3.66 billion (1.9% year-on-year decline, in line)

- Adjusted EPS: $0.87 vs analyst expectations of $0.92 (5.8% miss)

- Adjusted EBITDA: $423 million vs analyst estimates of $446.5 million (11.6% margin, 5.3% miss)

- Management lowered its full-year Adjusted EPS guidance to $3.15 at the midpoint, a 11.3% decrease

- Operating Margin: 8.6%, in line with the same quarter last year

- Free Cash Flow Margin: 6.7%, up from 3.6% in the same quarter last year

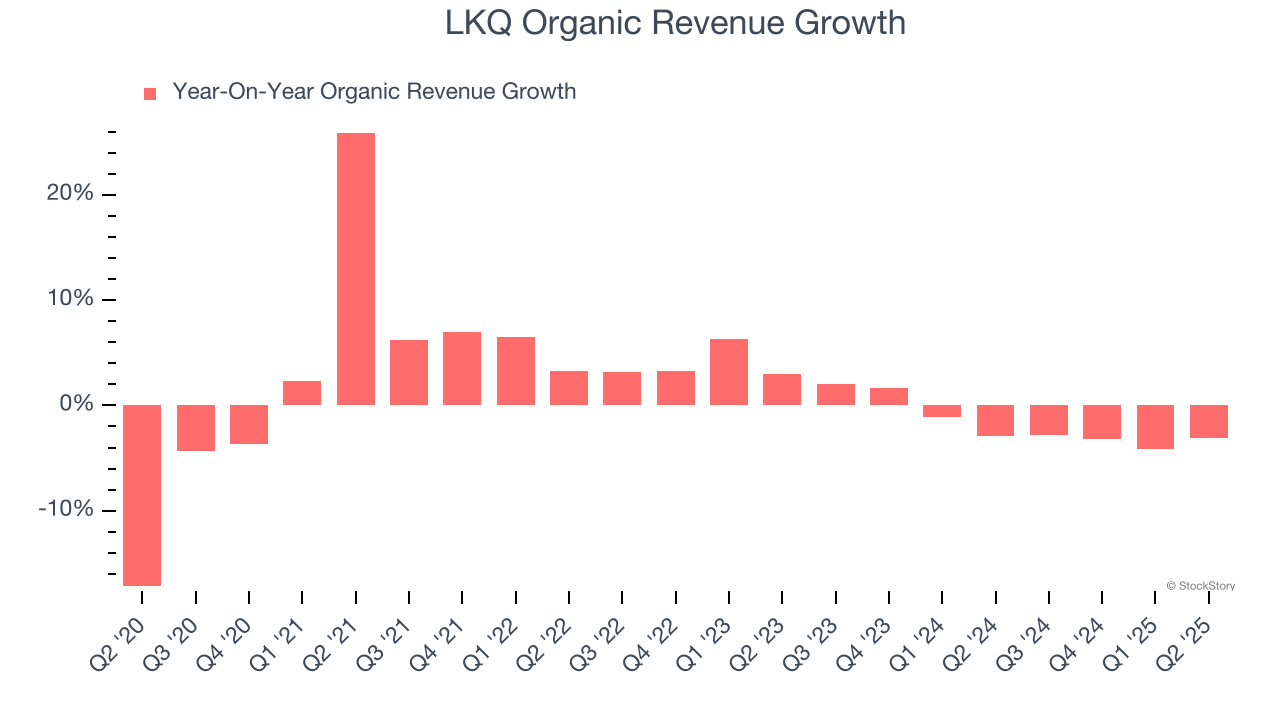

- Organic Revenue fell 3.1% year on year, in line with the same quarter last year

- Market Capitalization: $9.97 billion

“As we look ahead, we are focused on executing on our strategic initiatives to deliver improved financial results. We will continue to follow a disciplined capital allocation strategy that returns capital to shareholders. Our strategy includes driving efficiencies and simplifying our business and portfolio as we look at ROIC as a constant measure. We are navigating through the cyclical issues in our marketplace and will have a stronger Company that is well-positioned when the market turns,” stated Rick Galloway, Senior Vice President and Chief Financial Officer.

Company Overview

A global distributor of vehicle parts and accessories, LKQ (NASDAQ: LKQ) offers its customers a comprehensive selection of high-quality, affordably priced automobile products.

Revenue Growth

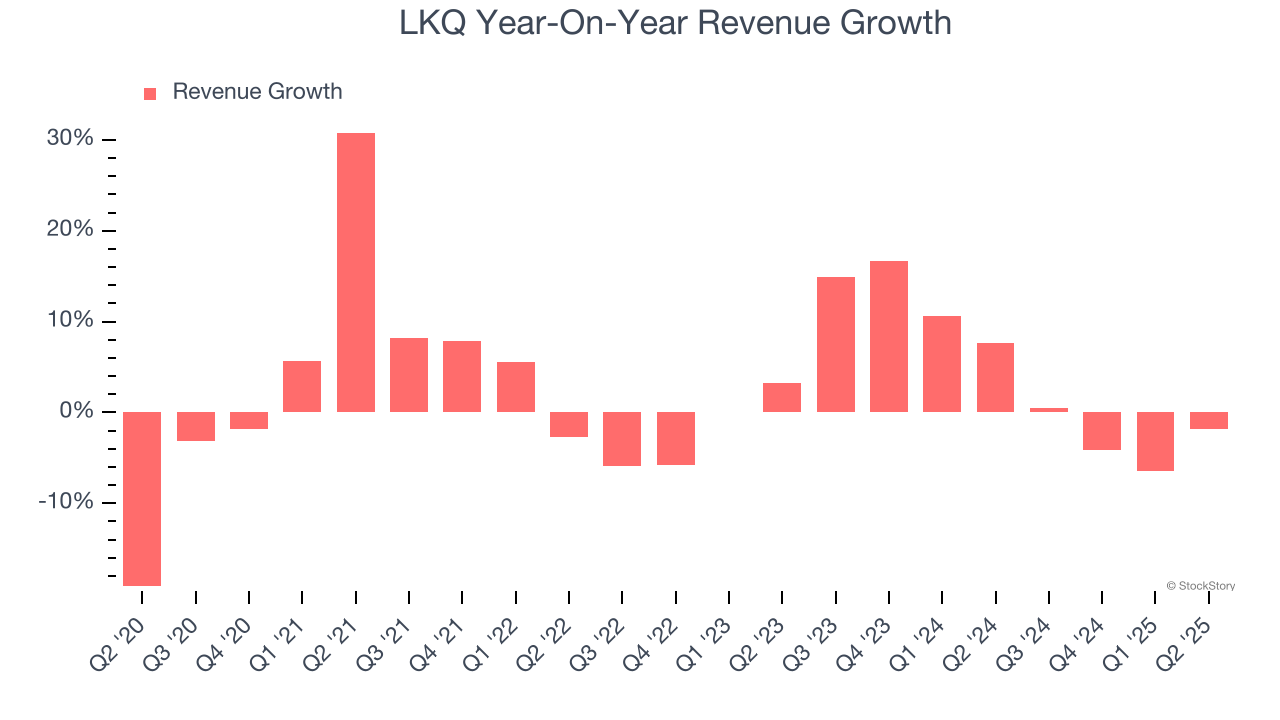

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Regrettably, LKQ’s sales grew at a sluggish 3.6% compounded annual growth rate over the last five years. This was below our standard for the consumer discretionary sector and is a tough starting point for our analysis.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. LKQ’s annualized revenue growth of 4.3% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, LKQ’s organic revenue averaged 1.7% year-on-year declines. Because this number is lower than its normal revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, LKQ reported a rather uninspiring 1.9% year-on-year revenue decline to $3.64 billion of revenue, in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 3.2% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and indicates its products and services will face some demand challenges.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

LKQ’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 8.4% over the last two years. This profitability was mediocre for a consumer discretionary business and caused by its suboptimal cost structure.

This quarter, LKQ generated an operating margin profit margin of 8.6%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

Earnings Per Share

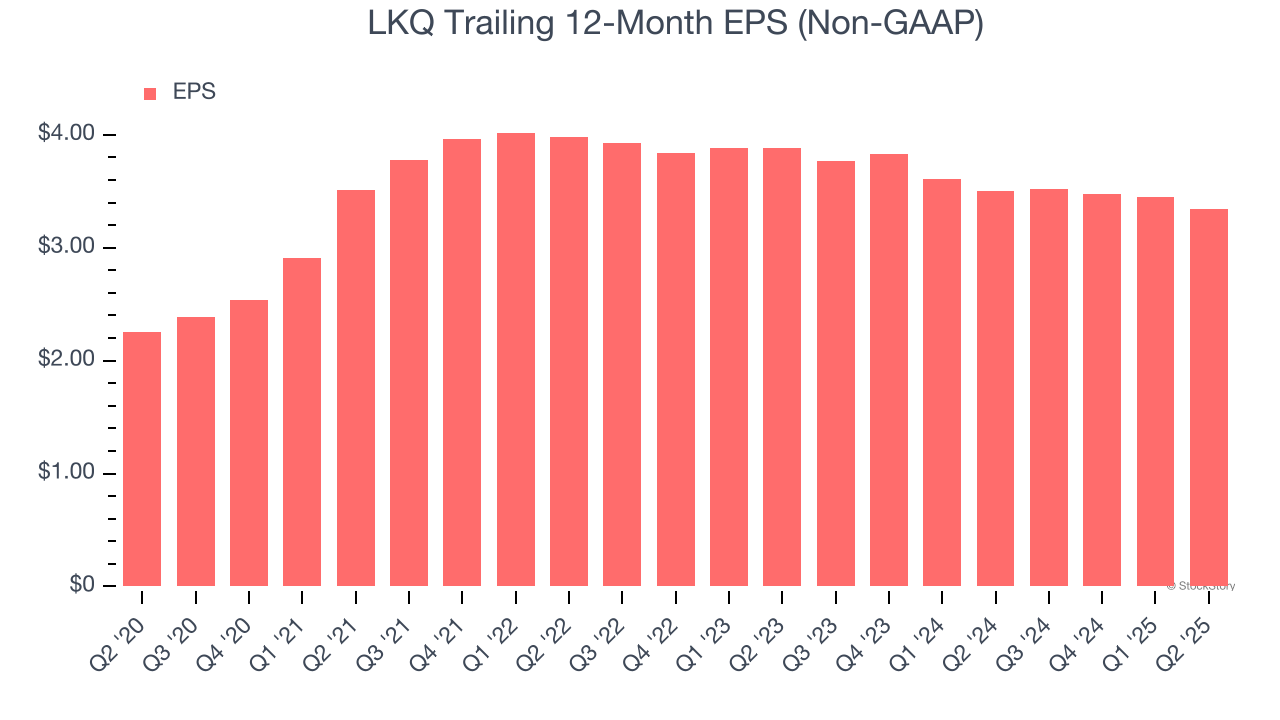

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

LKQ’s EPS grew at an unimpressive 8.2% compounded annual growth rate over the last five years. On the bright side, this performance was better than its 3.6% annualized revenue growth and tells us the company became more profitable on a per-share basis as it expanded.

In Q2, LKQ reported EPS at $0.87, down from $0.98 in the same quarter last year. This print missed analysts’ estimates. Over the next 12 months, Wall Street expects LKQ’s full-year EPS of $3.34 to grow 11.5%.

Key Takeaways from LKQ’s Q2 Results

We struggled to find many positives in these results. Its full-year EPS guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.7% to $36.40 immediately after reporting.

LKQ may have had a tough quarter, but does that actually create an opportunity to invest right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.