As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the renewable energy industry, including Array (NASDAQ: ARRY) and its peers.

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

The 18 renewable energy stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 5.2% while next quarter’s revenue guidance was 1.1% above.

Luckily, renewable energy stocks have performed well with share prices up 29.8% on average since the latest earnings results.

Array (NASDAQ: ARRY)

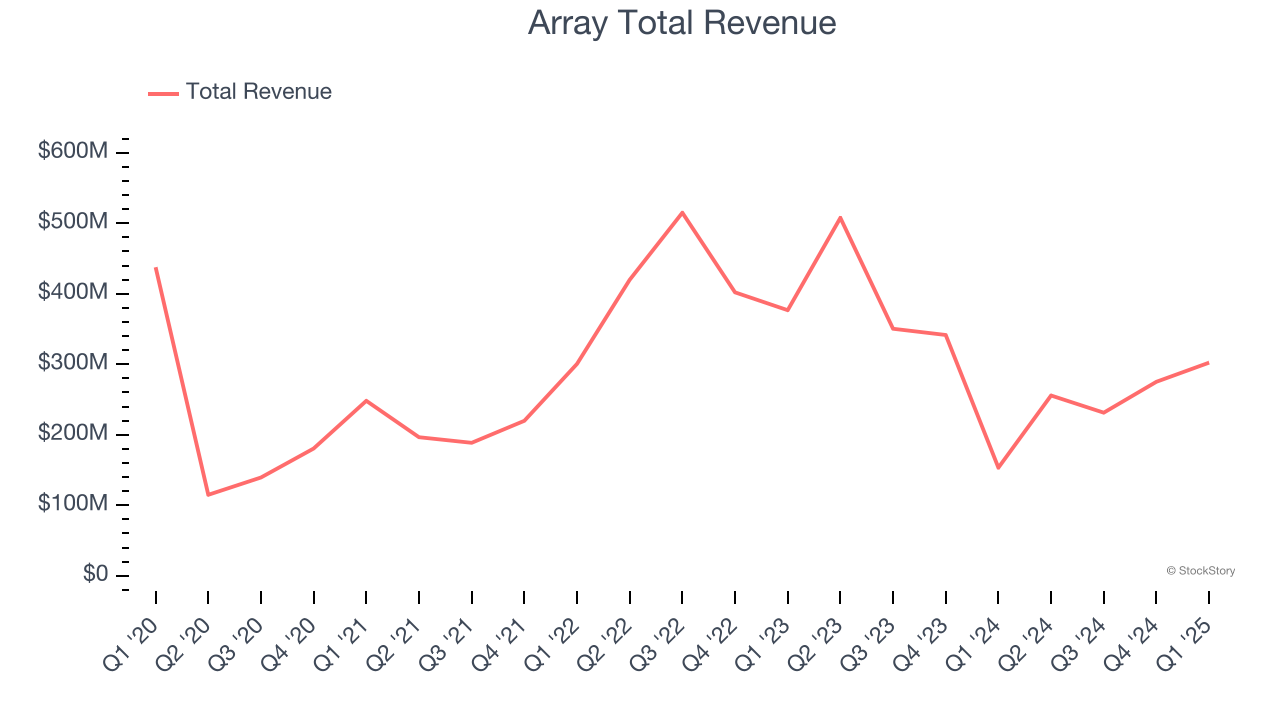

Going public in October 2020, Array (NASDAQ: ARRY) is a global manufacturer of ground-mounting tracking systems for utility and distributed generation solar energy projects.

Array reported revenues of $302.4 million, up 97.1% year on year. This print exceeded analysts’ expectations by 14.3%. Overall, it was a very strong quarter for the company with an impressive beat of analysts’ sales volume estimates and a solid beat of analysts’ EPS estimates.

“ARRAY is off to a great start for 2025 with first quarter high double digits revenue growth compared with the first quarter of 2024, and achieving the second largest quarter of volume shipped since 2023, indicating solid market share recovery and the strength of our execution capabilities. We are now able to provide customers with quotes for our 100% domestic content trackers under Table I of the Inflation Reduction Act (“IRA”), an important milestone for ARRAY, reflecting our continued commitment to supply chain resilience and ability to minimize effects of geopolitical uncertainty, including tariffs.

Array pulled off the fastest revenue growth of the whole group. Unsurprisingly, the stock is up 49.4% since reporting and currently trades at $7.35.

Is now the time to buy Array? Access our full analysis of the earnings results here, it’s free.

Best Q1: Generac (NYSE: GNRC)

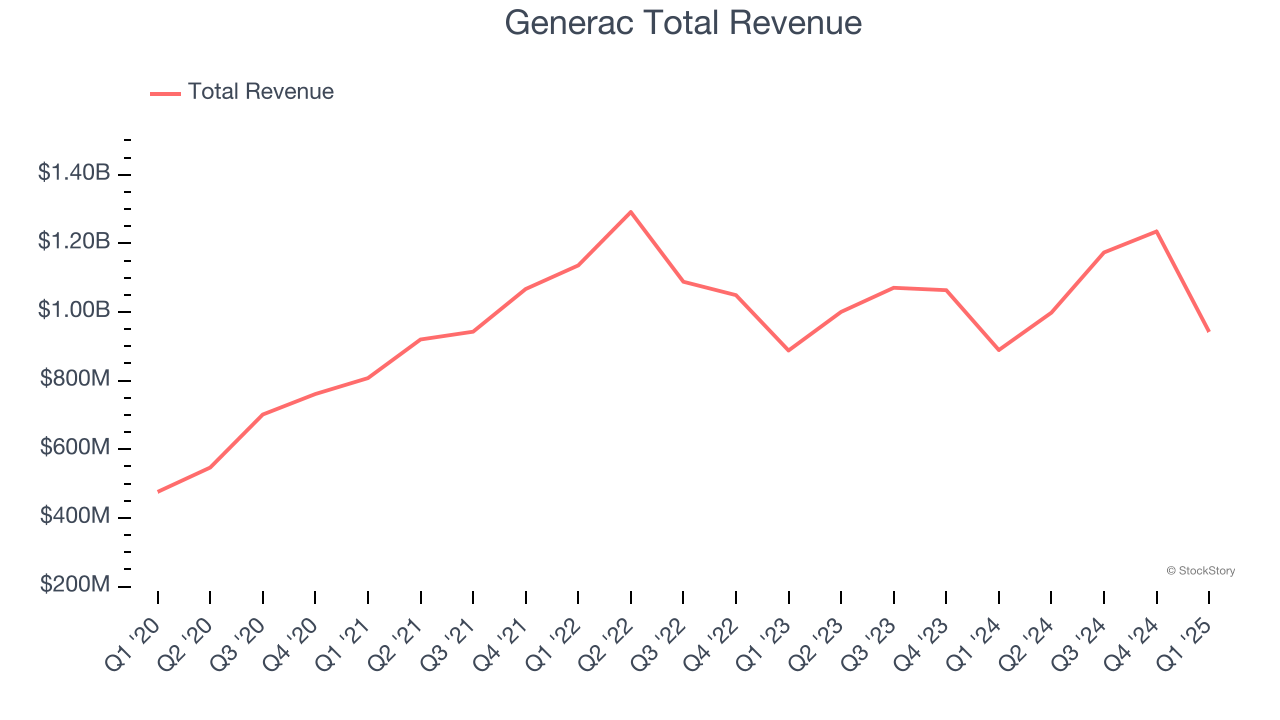

With its name deriving from a combination of “generating” and “AC”, Generac (NYSE: GNRC) offers generators and other power products for residential, industrial, and commercial use.

Generac reported revenues of $942.1 million, up 5.9% year on year, outperforming analysts’ expectations by 2.3%. The business had a stunning quarter with a solid beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 29.6% since reporting. It currently trades at $146.71.

Is now the time to buy Generac? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Blink Charging (NASDAQ: BLNK)

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Blink Charging reported revenues of $20.75 million, down 44.8% year on year, falling short of analysts’ expectations by 24.3%. It was a disappointing quarter as it posted a significant miss of analysts’ adjusted operating income estimates and a significant miss of analysts’ EBITDA estimates.

Blink Charging delivered the weakest performance against analyst estimates and slowest revenue growth in the group. Interestingly, the stock is up 11.3% since the results and currently trades at $0.96.

Read our full analysis of Blink Charging’s results here.

Nextracker (NASDAQ: NXT)

With its technology playing a key role in the massive 1.2 gigawatt Noor Abu Dhabi solar farm project, Nextracker (NASDAQ: NXT) is a provider of solar tracker systems that help solar panels follow the sun.

Nextracker reported revenues of $924.3 million, up 25.5% year on year. This number surpassed analysts’ expectations by 11.3%. Aside from that, it was a satisfactory quarter as it also logged a solid beat of analysts’ EPS estimates but a significant miss of analysts’ adjusted operating income estimates.

Nextracker achieved the highest full-year guidance raise among its peers. The stock is up 14.1% since reporting and currently trades at $62.90.

Read our full, actionable report on Nextracker here, it’s free.

Sunrun (NASDAQ: RUN)

Helping homeowners use solar energy to power their homes, Sunrun (NASDAQ: RUN) provides residential solar electricity, specializing in panel installation and leasing services.

Sunrun reported revenues of $504.3 million, up 10.1% year on year. This result topped analysts’ expectations by 4%. It was a very strong quarter as it also recorded a solid beat of analysts’ customer base estimates and an impressive beat of analysts’ EPS estimates.

The company added 25,428 customers to reach a total of 1.07 million. The stock is up 45% since reporting and currently trades at $10.71.

Read our full, actionable report on Sunrun here, it’s free.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.