Video game retailer GameStop (NYSE: GME) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 16.9% year on year to $732.4 million. Its non-GAAP profit of $0.17 per share was significantly above analysts’ consensus estimates.

Is now the time to buy GameStop? Find out by accessing our full research report, it’s free.

GameStop (GME) Q1 CY2025 Highlights:

- Purchased 4,710 Bitcoins between May 3, 2025 and June 10, 2025

- Revenue: $732.4 million vs analyst estimates of $754.2 million (16.9% year-on-year decline, 2.9% miss)

- Adjusted EPS: $0.17 vs analyst estimates of $0.04 (significant beat)

- Operating Margin: -1.5%, up from -5.7% in the same quarter last year

- Free Cash Flow was $189.6 million, up from -$114.7 million in the same quarter last year

- Market Capitalization: $13.57 billion

Company Overview

Drawing gaming fans with demo units set up with the latest releases, GameStop (NYSE: GME) sells new and used video games, consoles, and accessories, as well as pop culture merchandise.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

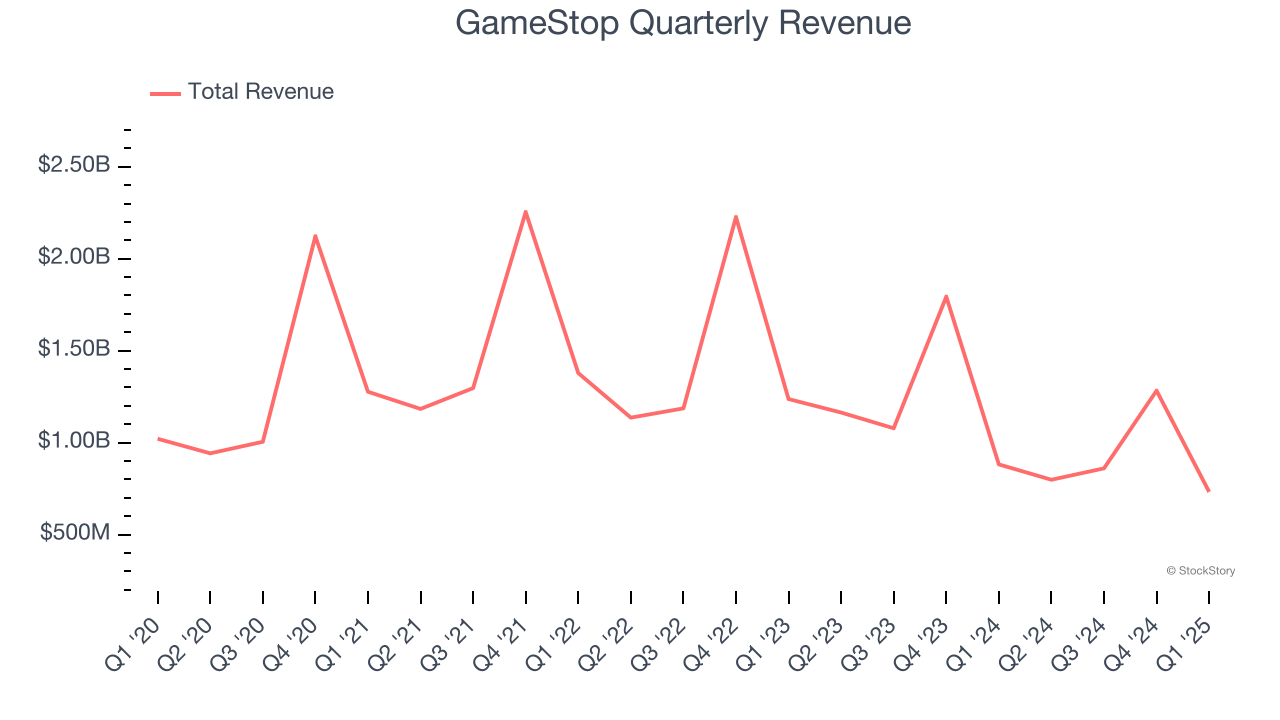

With $3.67 billion in revenue over the past 12 months, GameStop is a small retailer, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with suppliers.

As you can see below, GameStop struggled to generate demand over the last six years (we compare to 2019 to normalize for COVID-19 impacts). Its sales dropped by 12.3% annually, a poor baseline for our analysis.

This quarter, GameStop missed Wall Street’s estimates and reported a rather uninspiring 16.9% year-on-year revenue decline, generating $732.4 million of revenue.

Looking ahead, sell-side analysts expect revenue to decline by 6% over the next 12 months. it's tough to feel optimistic about a company facing demand difficulties.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Cash Is King

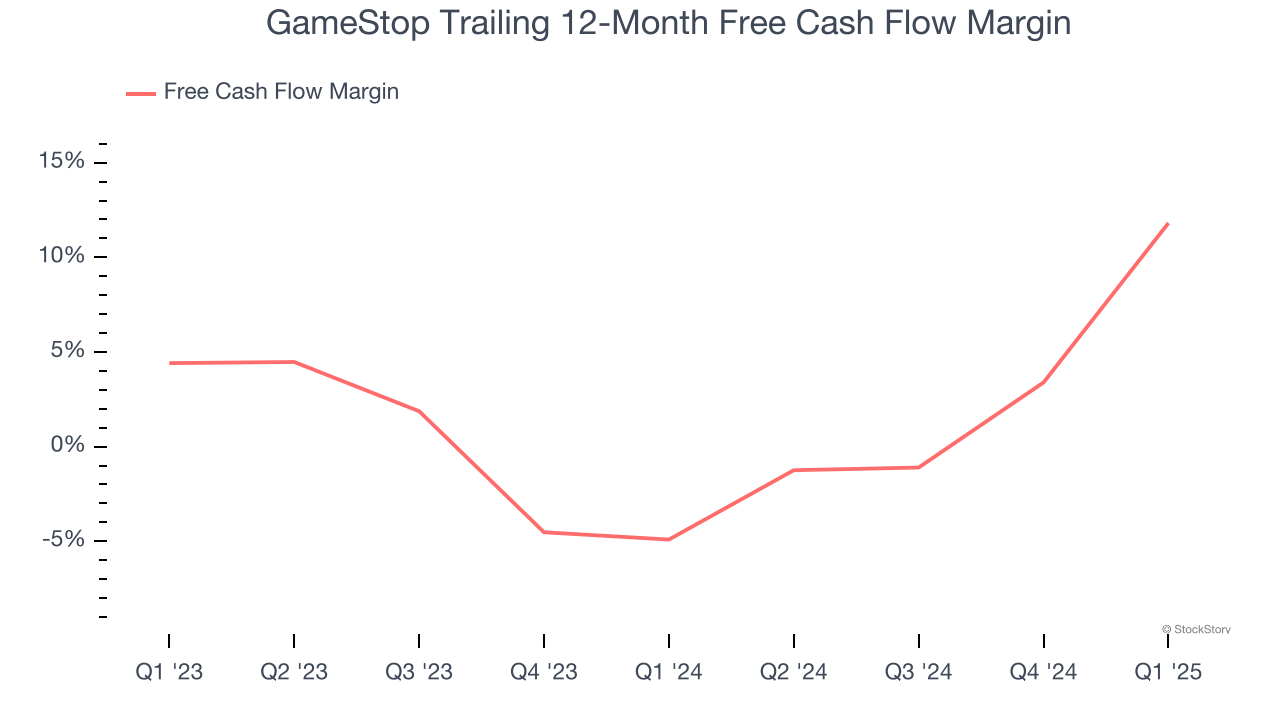

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

GameStop has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 2.2% over the last two years, slightly better than the broader consumer retail sector.

GameStop’s free cash flow clocked in at $189.6 million in Q1, equivalent to a 25.9% margin. Its cash flow turned positive after being negative in the same quarter last year, building on its favorable historical trend.

Key Takeaways from GameStop’s Q1 Results

We were impressed by how significantly GameStop blew past analysts’ gross margin and EPS expectations this quarter. It also purchased 4,710 Bitcoins between May 3, 2025 and June 10, 2025. On the other hand, its revenue missed. Overall, this print had some key positives. Investors were likely hoping for more, and shares traded down 3.2% to $29.21 immediately after reporting.

Is GameStop an attractive investment opportunity at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.