Beauty, cosmetics, and personal care retailer Ulta Beauty (NASDAQ: ULTA) reported Q4 CY2024 results topping the market’s revenue expectations, but sales fell by 1.9% year on year to $3.49 billion. On the other hand, the company’s full-year revenue guidance of $11.55 billion at the midpoint came in 1% below analysts’ estimates. Its GAAP profit of $8.46 per share was 18.4% above analysts’ consensus estimates.

Is now the time to buy Ulta? Find out by accessing our full research report, it’s free.

Ulta (ULTA) Q4 CY2024 Highlights:

- Revenue: $3.49 billion vs analyst estimates of $3.46 billion (1.9% year-on-year decline, 0.8% beat)

- EPS (GAAP): $8.46 vs analyst estimates of $7.15 (18.4% beat)

- Management’s revenue guidance for the upcoming financial year 2025 is $11.55 billion at the midpoint, missing analyst estimates by 1% and implying 2.3% growth (vs 1% in FY2024)

- EPS (GAAP) guidance for the upcoming financial year 2025 is $22.70 at the midpoint, missing analyst estimates by 3.3%

- Operating Margin: 14.8%, in line with the same quarter last year

- Free Cash Flow Margin: 27.6%, similar to the same quarter last year

- Locations: 1,445 at quarter end, up from 1,385 in the same quarter last year

- Same-Store Sales rose 1.5% year on year (2.5% in the same quarter last year)

- Market Capitalization: $15.27 billion

Company Overview

Offering high-end prestige brands as well as lower-priced, mass-market ones, Ulta Beauty (NASDAQ: ULTA) is an American retailer that sells makeup, skincare, haircare, and fragrance products.

Beauty and Cosmetics Retailer

Beauty and cosmetics retailers understand that beauty is in the eye of the beholder, but a little lipstick, nail polish, and glowing skin also help the cause. These stores—which mostly cater to consumers but can also garner the attention of salon pros—aim to be a one-stop personal care and beauty products shop with many brands across many categories. E-commerce is changing how consumers buy cosmetics, so these retailers are constantly evolving to meet the customer where and how they want to shop.

Sales Growth

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

With $11.3 billion in revenue over the past 12 months, Ulta is a mid-sized retailer, which sometimes brings disadvantages compared to larger competitors benefiting from better economies of scale.

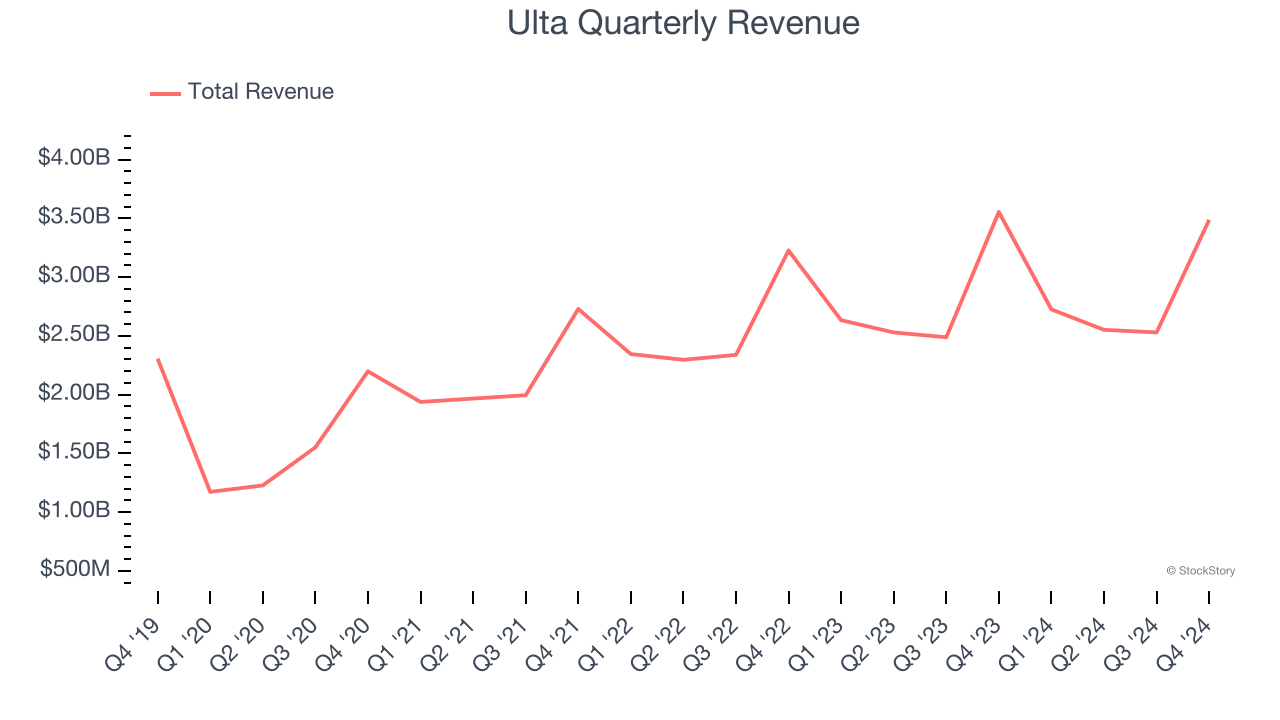

As you can see below, Ulta’s sales grew at a mediocre 8.8% compounded annual growth rate over the last five years (we compare to 2019 to normalize for COVID-19 impacts), but to its credit, it opened new stores and increased sales at existing, established locations.

This quarter, Ulta’s revenue fell by 1.9% year on year to $3.49 billion but beat Wall Street’s estimates by 0.8%.

Looking ahead, sell-side analysts expect revenue to grow 3.4% over the next 12 months, a deceleration versus the last five years. We still think its growth trajectory is satisfactory given its scale and indicates the market is baking in success for its products.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

Number of Stores

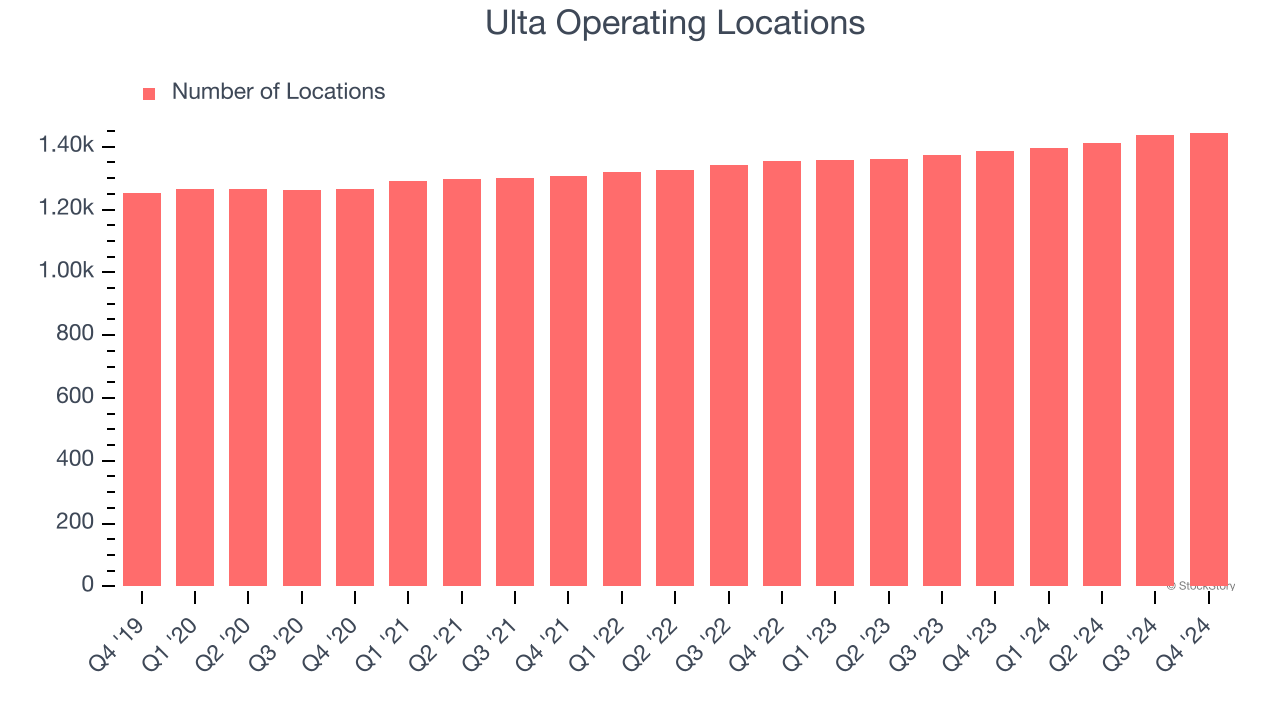

A retailer’s store count influences how much it can sell and how quickly revenue can grow.

Ulta operated 1,445 locations in the latest quarter. It has opened new stores quickly over the last two years, averaging 3.2% annual growth, faster than the broader consumer retail sector.

When a retailer opens new stores, it usually means it’s investing for growth because demand is greater than supply, especially in areas where consumers may not have a store within reasonable driving distance.

Same-Store Sales

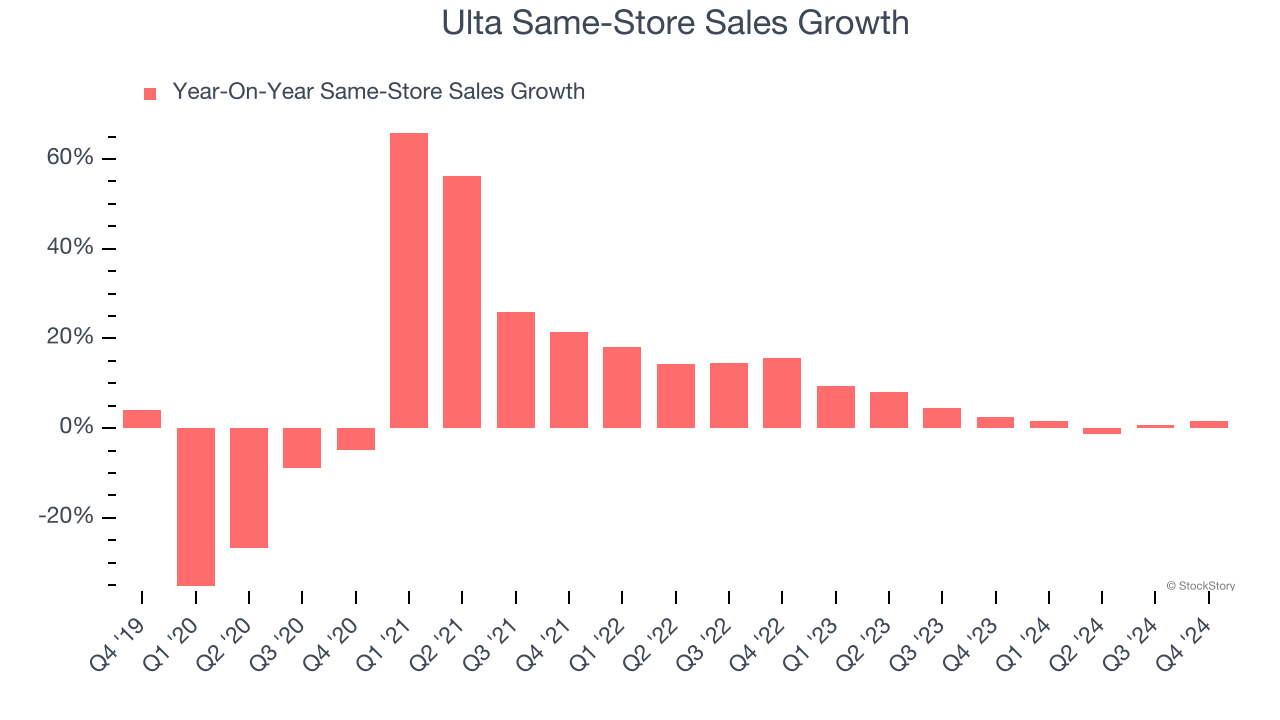

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales is an industry measure of whether revenue is growing at those existing stores and is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Ulta’s demand has been spectacular for a retailer over the last two years. On average, the company has increased its same-store sales by an impressive 3.4% per year. This performance suggests its rollout of new stores is beneficial for shareholders. We like this backdrop because it gives Ulta multiple ways to win: revenue growth can come from new stores, e-commerce, or increased foot traffic and higher sales per customer at existing locations.

In the latest quarter, Ulta’s same-store sales rose 1.5% year on year. This was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Ulta can reaccelerate growth.

Key Takeaways from Ulta’s Q4 Results

We enjoyed seeing Ulta beat analysts’ gross margin and EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year revenue and EPS guidance missed. Zooming out, we think this was a decent quarter featuring some areas of strength but also some blemishes. The stock traded up 4.5% to $328.10 immediately after reporting.

So should you invest in Ulta right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.