EV charging infrastructure provider Blink Charging (NASDAQ: BLNK) missed Wall Street’s revenue expectations in Q4 CY2024, with sales falling 29.3% year on year to $30.18 million. Its non-GAAP loss of $0.15 per share was 6.3% above analysts’ consensus estimates.

Is now the time to buy Blink Charging? Find out by accessing our full research report, it’s free.

Blink Charging (BLNK) Q4 CY2024 Highlights:

- Revenue: $30.18 million vs analyst estimates of $31.5 million (29.3% year-on-year decline, 4.2% miss)

- Adjusted EPS: -$0.15 vs analyst estimates of -$0.16 (6.3% beat)

- Adjusted EBITDA: -$10.55 million vs analyst estimates of -$11.1 million (-35% margin, 4.9% beat)

- Operating Margin: -244%, down from -42.4% in the same quarter last year

- Market Capitalization: $98.85 million

“We are focused on achieving profitability and expanding our charging network globally. Our flexible business models, advanced software and network, and portfolio of diverse charging solutions position us as a charging infrastructure leader,” commented Mike Battaglia, President and Chief Executive Officer of Blink Charging.

Company Overview

One of the first EV charging companies to go public, Blink Charging (NASDAQ: BLNK) is a manufacturer, owner, operator, and provider of electric vehicle charging equipment and networked EV charging services.

Renewable Energy

Renewable energy companies are buoyed by the secular trend of green energy that is upending traditional power generation. Those who innovate and evolve with this dynamic market can win share while those who continue to rely on legacy technologies can see diminishing demand, which includes headwinds from increasing regulation against “dirty” energy. Additionally, these companies are at the whim of economic cycles, as interest rates can impact the willingness to invest in renewable energy projects.

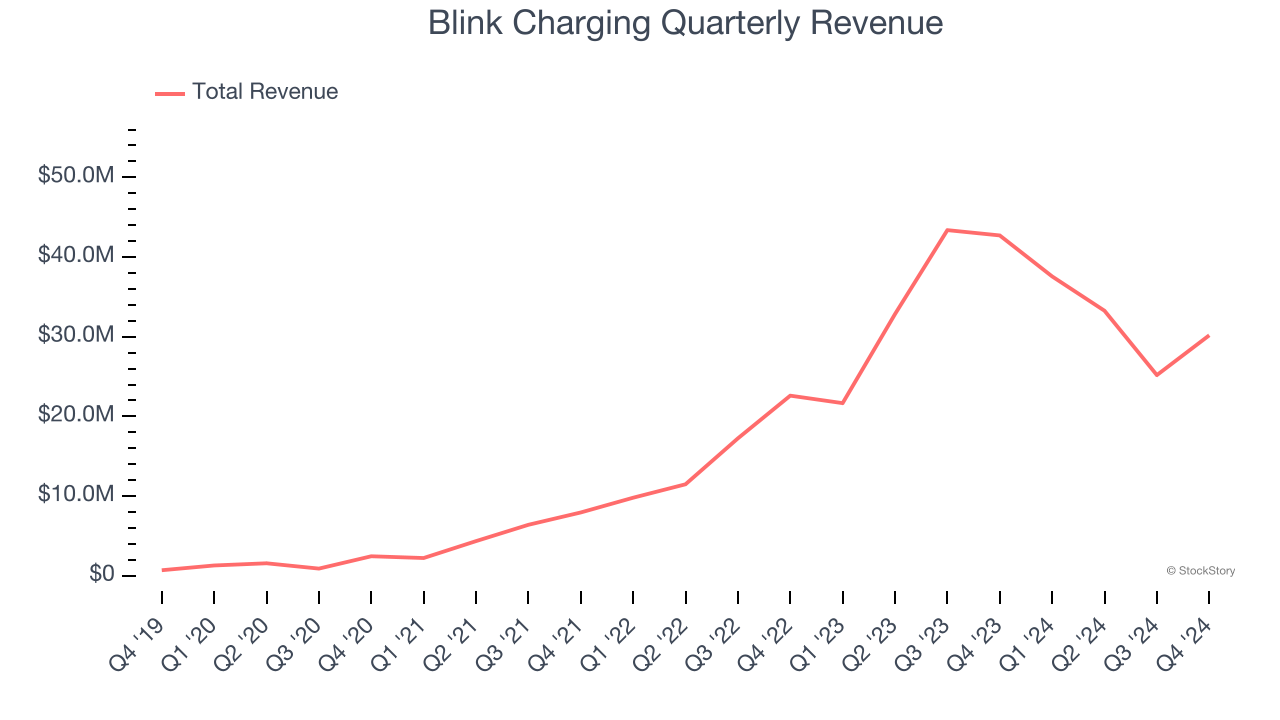

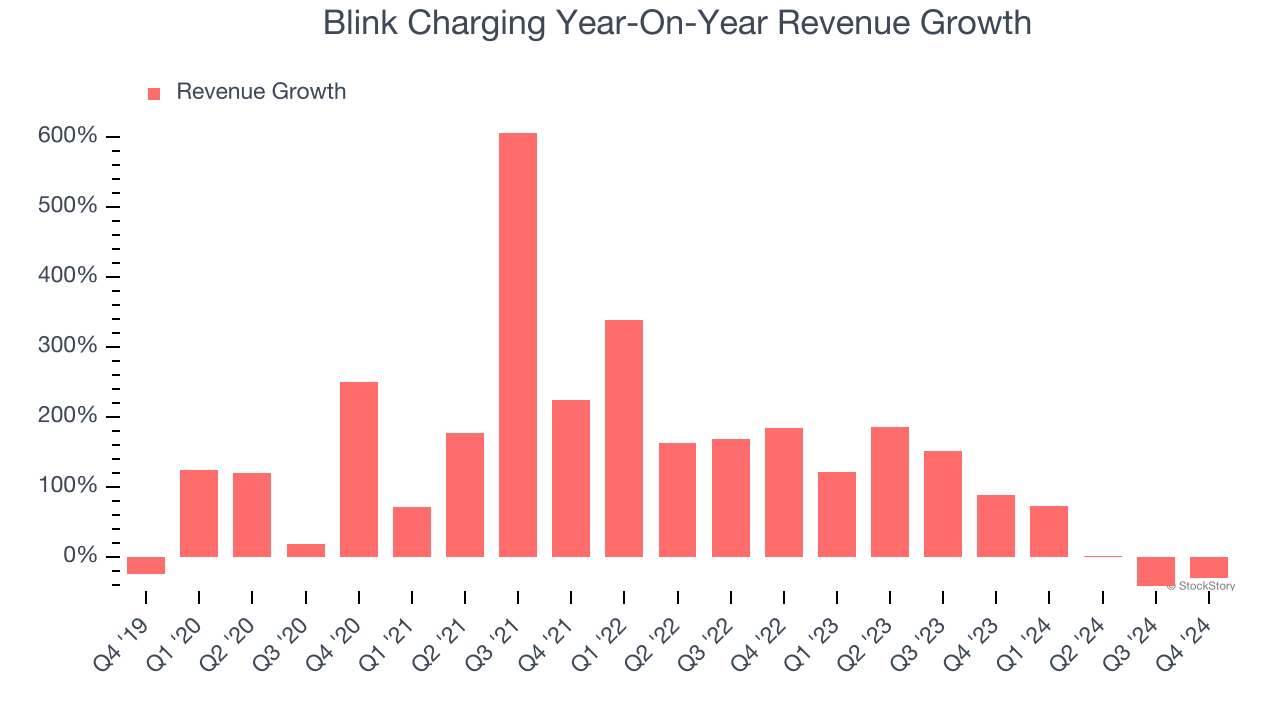

Sales Growth

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Blink Charging’s 115% annualized revenue growth over the last five years was incredible. Its growth beat the average industrials company and shows its offerings resonate with customers.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Blink Charging’s annualized revenue growth of 43.7% over the last two years is below its five-year trend, but we still think the results suggest healthy demand.

This quarter, Blink Charging missed Wall Street’s estimates and reported a rather uninspiring 29.3% year-on-year revenue decline, generating $30.18 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 24% over the next 12 months, a deceleration versus the last two years. Still, this projection is admirable and indicates the market is baking in success for its products and services.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

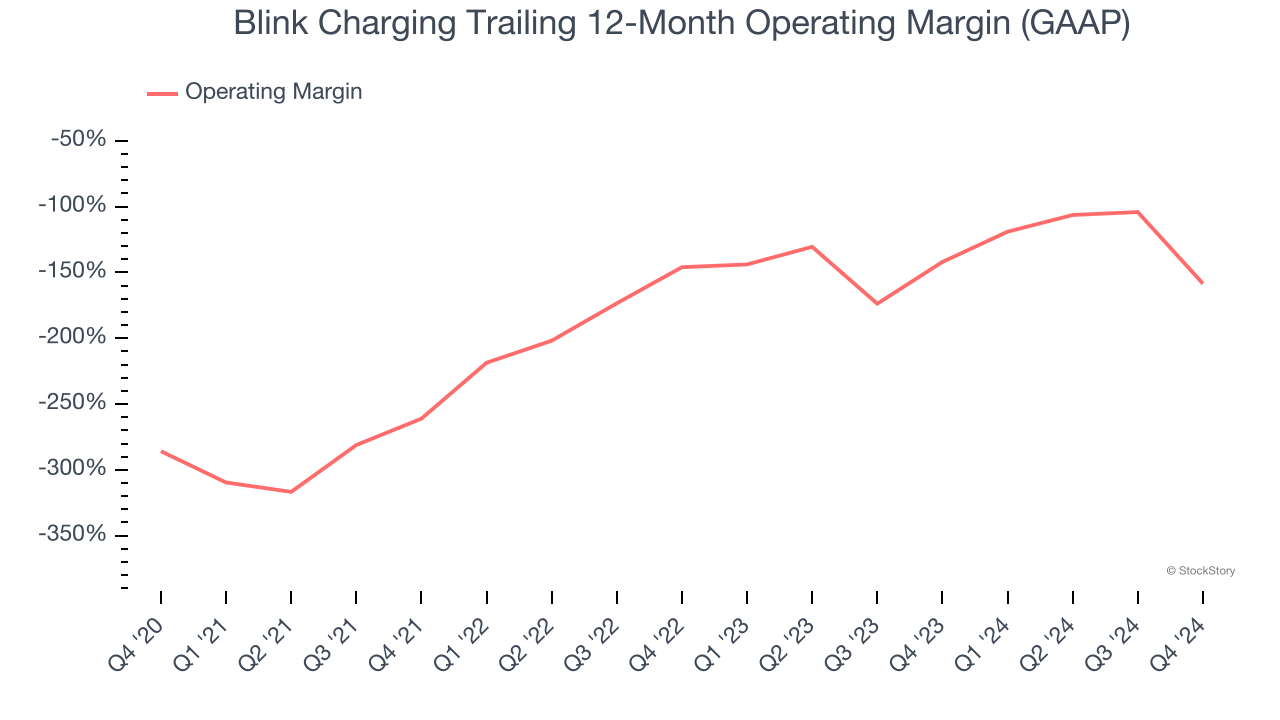

Operating Margin

Blink Charging’s high expenses have contributed to an average operating margin of negative 158% over the last five years. Unprofitable industrials companies require extra attention because they could get caught swimming naked when the tide goes out. It’s hard to trust that the business can endure a full cycle.

On the plus side, Blink Charging’s operating margin rose over the last five years, as its sales growth gave it operating leverage. Still, it will take much more for the company to reach long-term profitability.

Blink Charging’s operating margin was negative 244% this quarter. The company's consistent lack of profits raise a flag.

Earnings Per Share

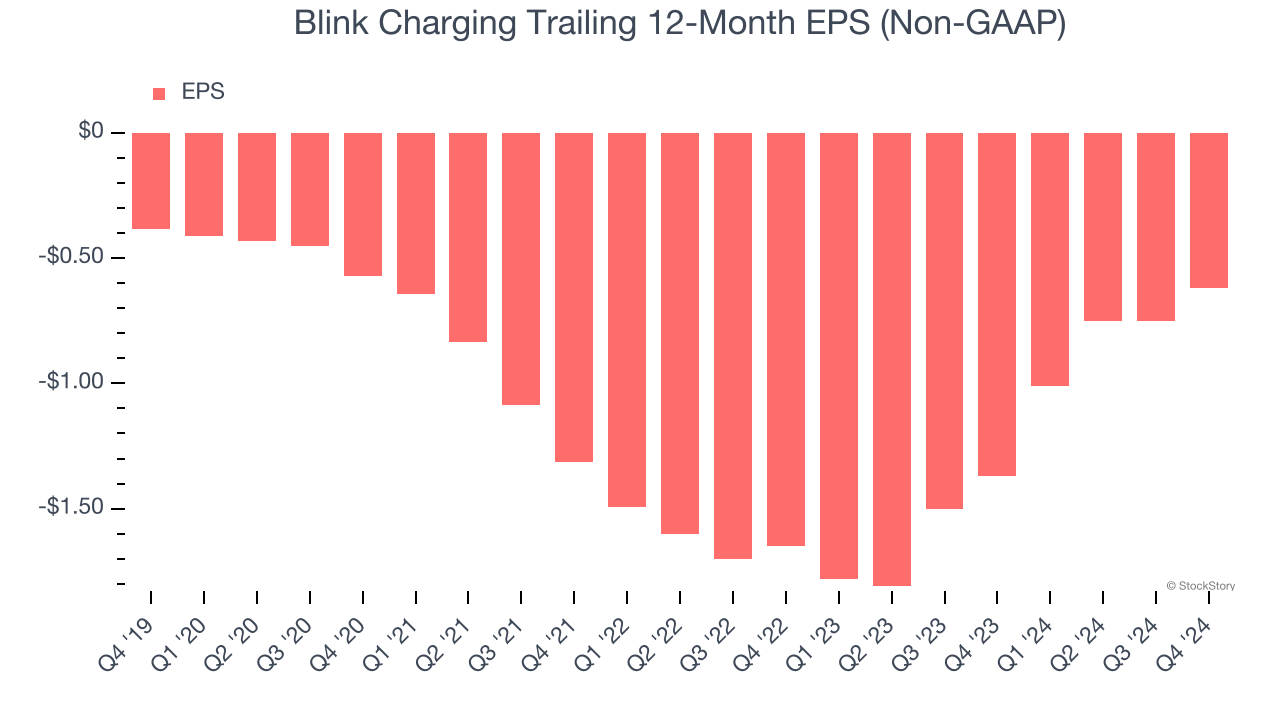

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Blink Charging’s earnings losses deepened over the last five years as its EPS dropped 10% annually. We’ll keep a close eye on the company as diminishing earnings could imply changing secular trends and preferences.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Blink Charging, its two-year annual EPS growth of 38.7% was higher than its five-year trend. Its improving earnings is an encouraging data point, but a caveat is that its EPS is still in the red.

In Q4, Blink Charging reported EPS at negative $0.15, up from negative $0.28 in the same quarter last year. This print beat analysts’ estimates by 6.3%. Over the next 12 months, Wall Street is optimistic. Analysts forecast Blink Charging’s full-year EPS of negative $0.62 will reach break even.

Key Takeaways from Blink Charging’s Q4 Results

We enjoyed seeing Blink Charging beat analysts’ EBITDA expectations this quarter. We were also happy its EPS outperformed Wall Street’s estimates. On the other hand, its revenue missed significantly. Overall, this was a softer quarter. The stock traded up 2.2% to $0.92 immediately after reporting.

Is Blink Charging an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.