Over the last six months, Cable One’s shares have sunk to $294.99, producing a disappointing 17.1% loss - a stark contrast to the S&P 500’s 9% gain. This was partly due to its softer quarterly results and might have investors contemplating their next move.

Is there a buying opportunity in Cable One, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Even with the cheaper entry price, we don't have much confidence in Cable One. Here are three reasons why we avoid CABO and a stock we'd rather own.

Why Is Cable One Not Exciting?

Founded in 1986, Cable One (NYSE: CABO) provides high-speed internet, cable television, and telephone services, primarily in smaller markets across the United States.

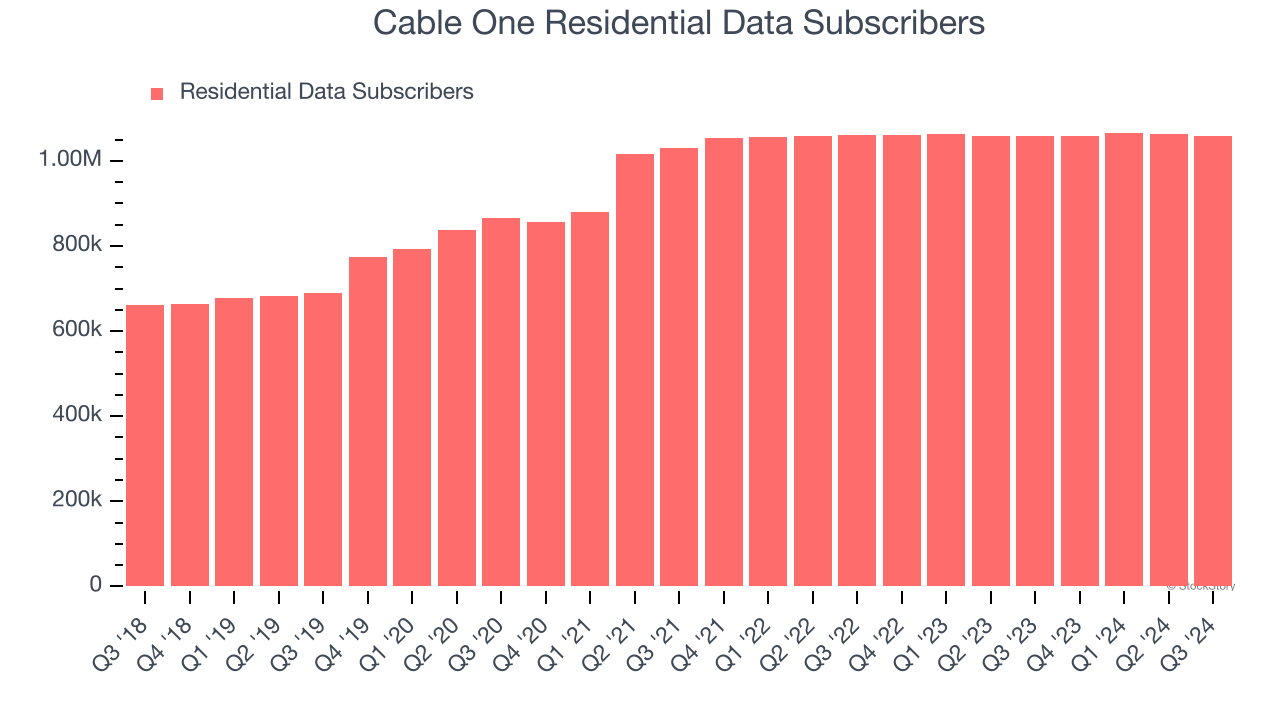

1. Inability to Grow Residential Data Subscribers Points to Weak Demand

Revenue growth can be broken down into changes in price and volume (for companies like Cable One, our preferred volume metric is residential data subscribers). While both are important, the latter is the most critical to analyze because prices have a ceiling.

Over the last two years, Cable One failed to grow its residential data subscribers, which came in at 1.06 million in the latest quarter. This performance was underwhelming and implies there may be increasing competition or market saturation. It also suggests Cable One might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Cable One’s revenue to drop by 3.7%, close to its 3.2% annualized declines for the past two years. This projection is underwhelming and implies its newer products and services will not accelerate its top-line performance yet.

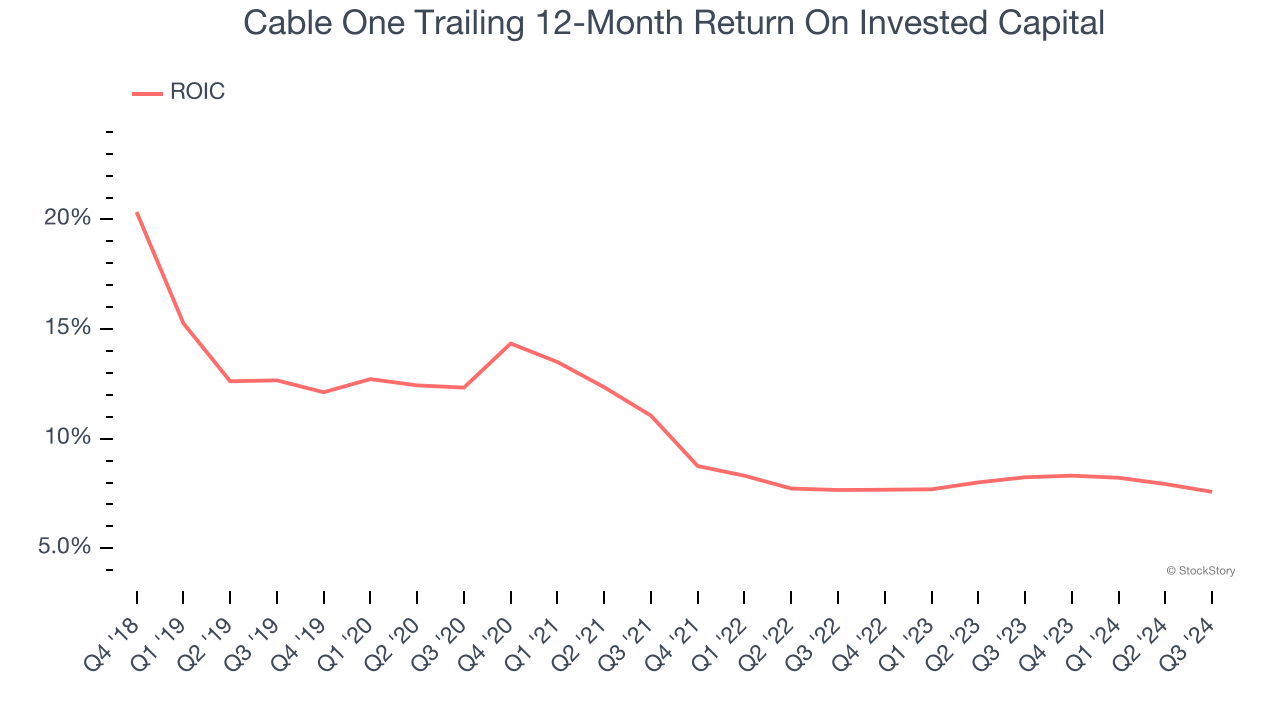

3. New Investments Fail to Bear Fruit as ROIC Declines

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. On average, Cable One’s ROIC decreased by 3.8 percentage points annually over the last few years. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

Final Judgment

Cable One isn’t a terrible business, but it doesn’t pass our quality test. After the recent drawdown, the stock trades at 6× forward price-to-earnings (or $294.99 per share). While this valuation is optically cheap, the potential downside is big given its shaky fundamentals. We're fairly confident there are better investments elsewhere. We’d recommend looking at a top digital advertising platform riding the creator economy.

Stocks We Like More Than Cable One

With rates dropping, inflation stabilizing, and the elections in the rearview mirror, all signs point to the start of a new bull run - and we’re laser-focused on finding the best stocks for this upcoming cycle.

Put yourself in the driver’s seat by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today for free.