Sport boat manufacturer MasterCraft (NASDAQ: MCFT) reported Q3 CY2025 results topping the market’s revenue expectations, with sales up 5.6% year on year to $69 million. On top of that, next quarter’s revenue guidance ($69 million at the midpoint) was surprisingly good and 3.3% above what analysts were expecting. Its non-GAAP profit of $0.28 per share was 77.2% above analysts’ consensus estimates.

Is now the time to buy MasterCraft? Find out by accessing our full research report, it’s free for active Edge members.

MasterCraft (MCFT) Q3 CY2025 Highlights:

- Revenue: $69 million vs analyst estimates of $67 million (5.6% year-on-year growth, 3% beat)

- Adjusted EPS: $0.28 vs analyst estimates of $0.16 (77.2% beat)

- Adjusted EBITDA: $6.71 million vs analyst estimates of $4.23 million (9.7% margin, 58.7% beat)

- The company reconfirmed its revenue guidance for the full year of $302.5 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $1.31 at the midpoint, a 2.4% increase

- EBITDA guidance for the full year is $32.5 million at the midpoint, above analyst estimates of $31.15 million

- Operating Margin: 5.5%, up from 1.5% in the same quarter last year

- Free Cash Flow was -$10.13 million compared to -$769,667 in the same quarter last year

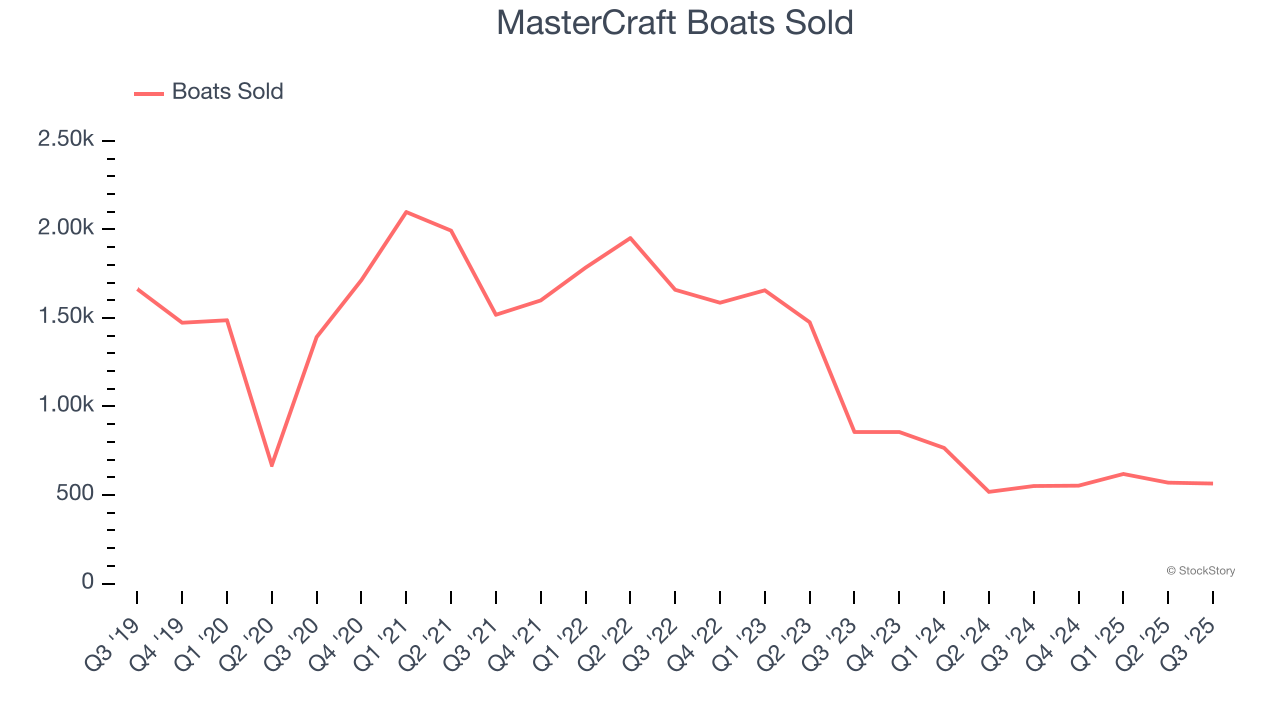

- Boats Sold: 565, up 14 year on year

- Market Capitalization: $349.9 million

Brad Nelson, Chief Executive Officer, commented, “We delivered results that exceeded our expectations despite continued macroeconomic uncertainty and a dynamic retail environment. Our team continues to execute our key operating initiatives and maintain disciplined cost controls, which contributed to our performance in the quarter. Dealer inventories across our brands have returned to normal levels, supported by disciplined production planning and proactive pipeline management. We remain encouraged by the positive energy and sentiment from our recent dealer meetings, bolstered by the fresh launch of our new MasterCraft X24 model, the first unveiling within our new X-family line of boats. Excitement and momentum around our brands is surging as we usher in the next generation of premium products.”

Company Overview

Started by a waterskiing instructor, MasterCraft (NASDAQ: MCFT) specializes in designing, manufacturing, and selling sport boats.

Revenue Growth

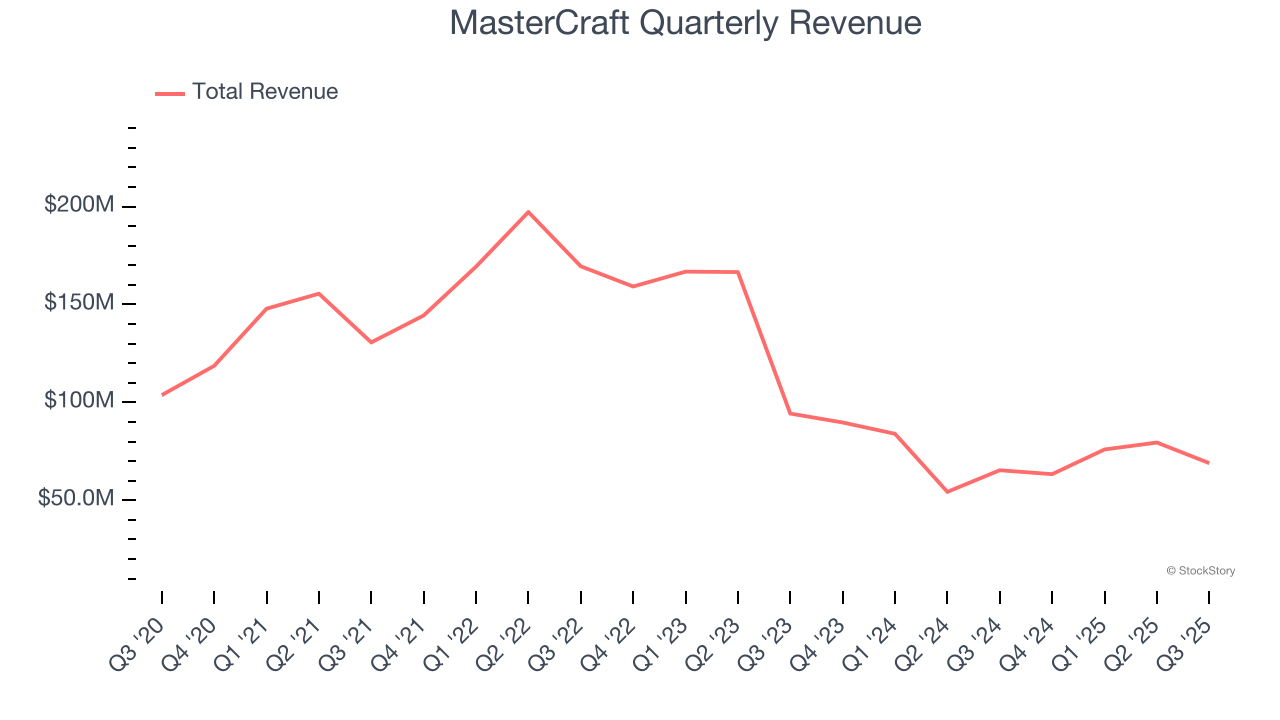

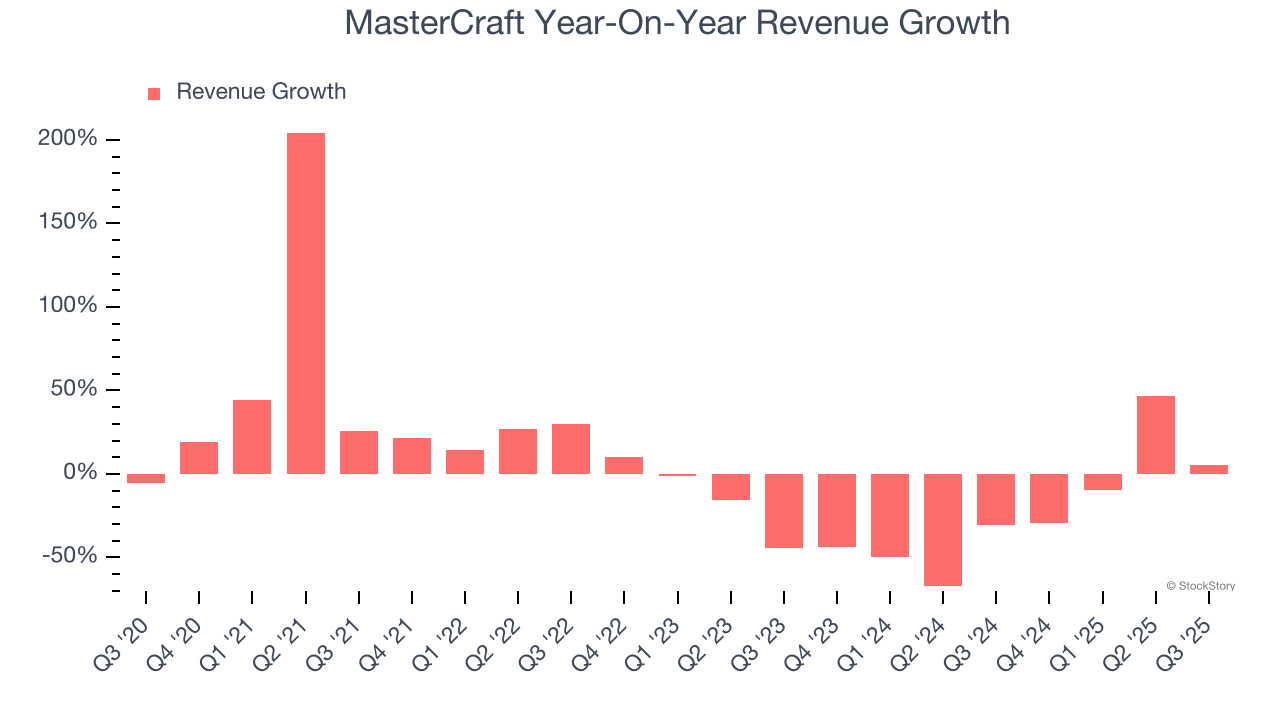

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. MasterCraft struggled to consistently generate demand over the last five years as its sales dropped at a 4.2% annual rate. This was below our standards and is a sign of lacking business quality.

Long-term growth is the most important, but within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends and consumer preferences. MasterCraft’s recent performance shows its demand remained suppressed as its revenue has declined by 30% annually over the last two years.

MasterCraft also discloses its number of boats sold, which reached 565 in the latest quarter. Over the last two years, MasterCraft’s boats sold averaged 30.3% year-on-year declines. Because this number aligns with its revenue growth during the same period, we can see the company’s monetization was fairly consistent.

This quarter, MasterCraft reported year-on-year revenue growth of 5.6%, and its $69 million of revenue exceeded Wall Street’s estimates by 3%. Company management is currently guiding for a 8.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 6.8% over the next 12 months. While this projection implies its newer products and services will catalyze better top-line performance, it is still below the sector average.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

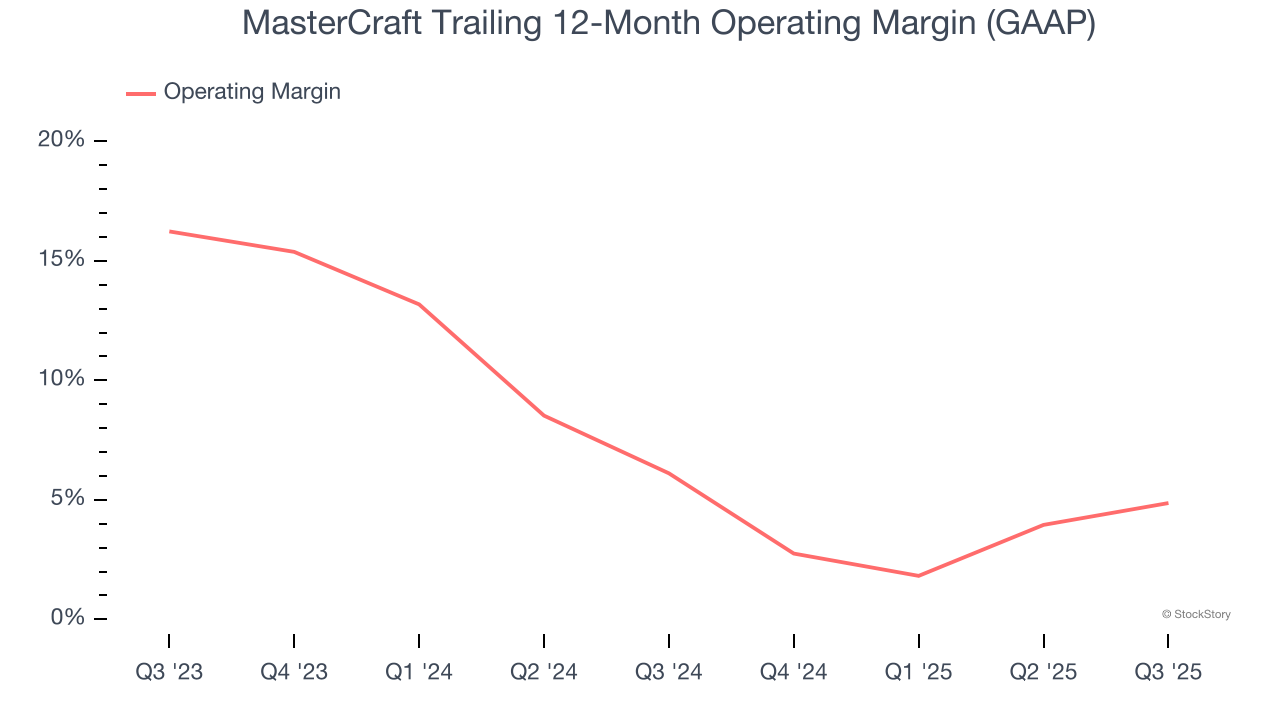

MasterCraft’s operating margin has shrunk over the last 12 months and averaged 5.5% over the last two years. The company’s profitability was mediocre for a consumer discretionary business and shows it couldn’t pass its higher operating expenses onto its customers.

This quarter, MasterCraft generated an operating margin profit margin of 5.5%, up 3.9 percentage points year on year. This increase was a welcome development and shows it was more efficient.

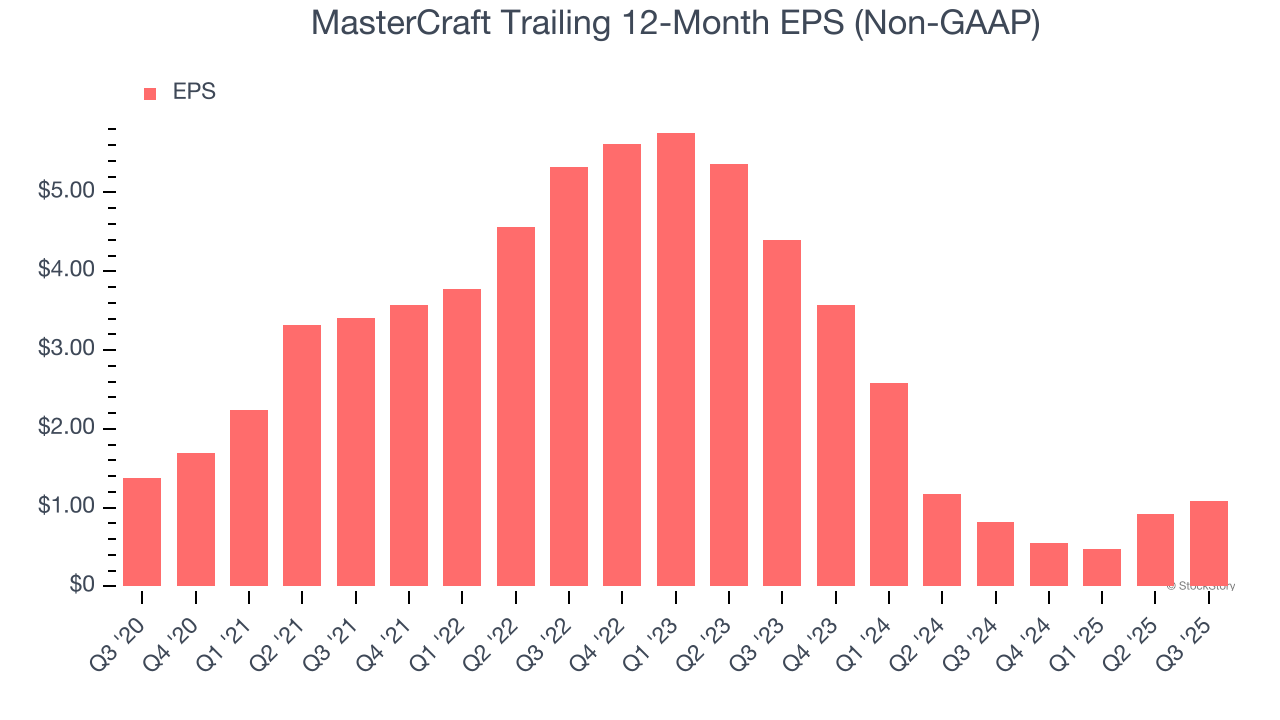

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for MasterCraft, its EPS and revenue declined by 4.6% and 4.2% annually over the last five years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, MasterCraft’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, MasterCraft reported adjusted EPS of $0.28, up from $0.12 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects MasterCraft’s full-year EPS of $1.08 to grow 19.3%.

Key Takeaways from MasterCraft’s Q3 Results

It was good to see MasterCraft beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. On the other hand, its EBITDA guidance for next quarter missed. Overall, we think this was still a solid quarter with some key areas of upside. The stock traded up 2.5% to $22.01 immediately following the results.

MasterCraft put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.