Over the last six months, Dutch Bros’s shares have sunk to $47.65, producing a disappointing 9.4% loss - a stark contrast to the S&P 500’s 34.7% gain. This may have investors wondering how to approach the situation.

Following the pullback, is now the time to buy BROS? Find out in our full research report, it’s free for active Edge members.

Why Does Dutch Bros Spark Debate?

Started in 1992 by two brothers as a single pushcart, Dutch Bros (NYSE: BROS) is a dynamic coffee chain that’s captured the hearts of coffee enthusiasts across the United States.

Two Positive Attributes:

1. Surging Same-Store Sales Show Increasing Demand

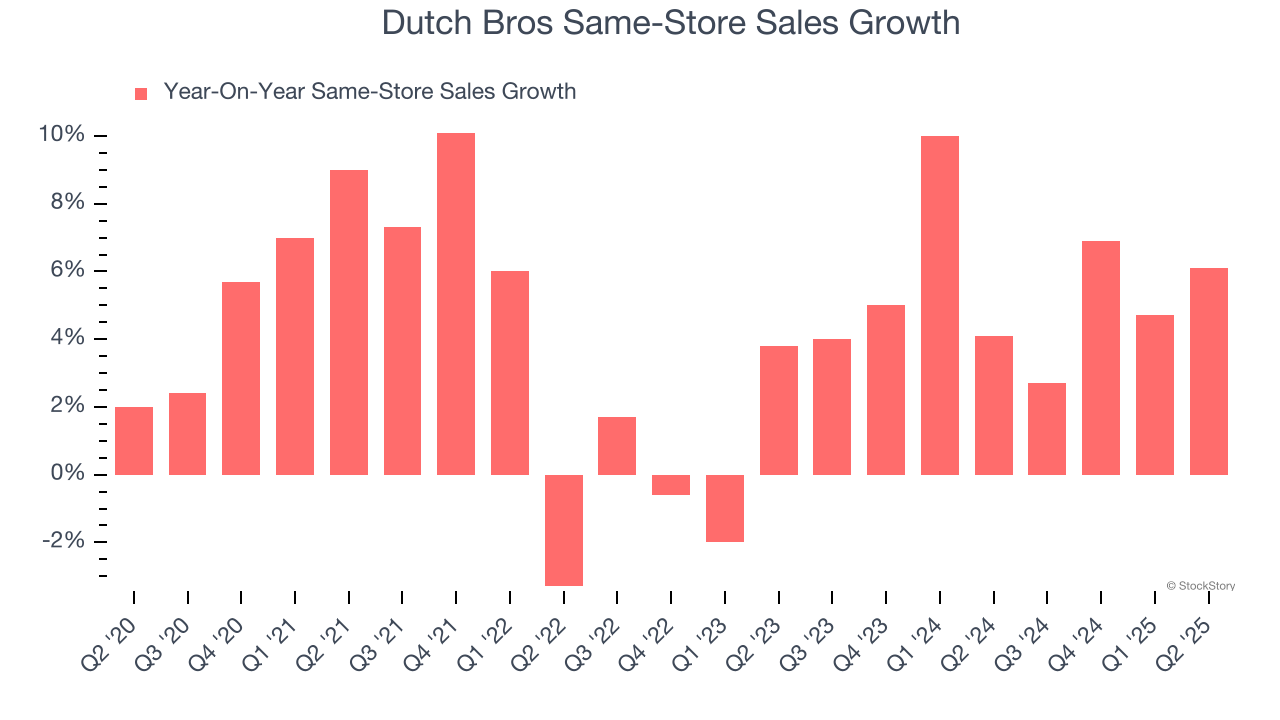

Same-store sales is an industry measure of whether revenue is growing at existing restaurants, and it is driven by customer visits (often called traffic) and the average spending per customer (ticket).

Dutch Bros has been one of the most successful restaurant chains over the last two years thanks to skyrocketing demand within its existing dining locations. On average, the company has posted exceptional year-on-year same-store sales growth of 5.4%.

2. Increasing Free Cash Flow Margin Juices Financials

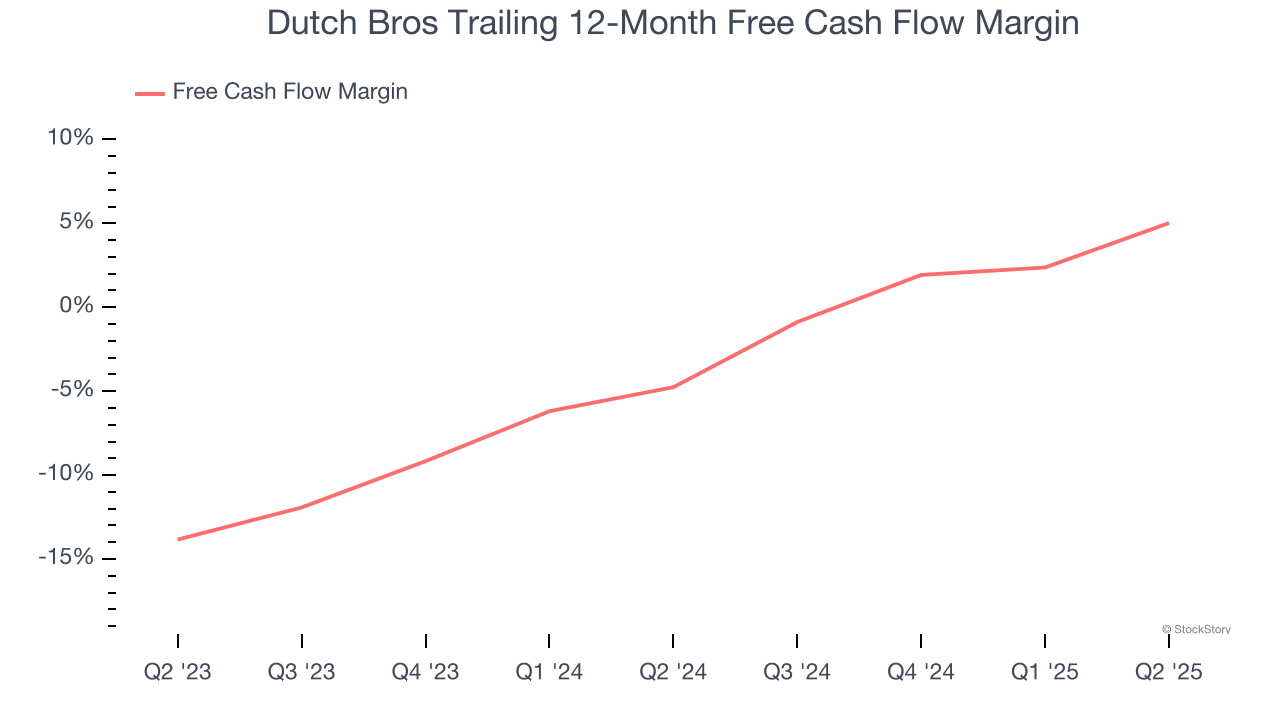

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Dutch Bros’s margin expanded by 9.8 percentage points over the last year. The company’s improvement shows it’s heading in the right direction, and we can see it became a less capital-intensive business because its free cash flow profitability rose more than its operating profitability. Dutch Bros’s free cash flow margin for the trailing 12 months was 5%.

One Reason to be Careful:

Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Although Dutch Bros has shown solid business quality lately, it struggled to grow profitably in the past. Its five-year average ROIC was negative 3.1%, meaning management lost money while trying to expand the business.

Final Judgment

Dutch Bros’s positive characteristics outweigh the negatives. After the recent drawdown, the stock trades at 61.7× forward P/E (or $47.65 per share). Is now the time to initiate a position? See for yourself in our full research report, it’s free for active Edge members.

Stocks We Like Even More Than Dutch Bros

Donald Trump’s April 2025 "Liberation Day" tariffs sent markets into a tailspin, but stocks have since rebounded strongly, proving that knee-jerk reactions often create the best buying opportunities.

The smart money is already positioning for the next leg up. Don’t miss out on the recovery - check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.