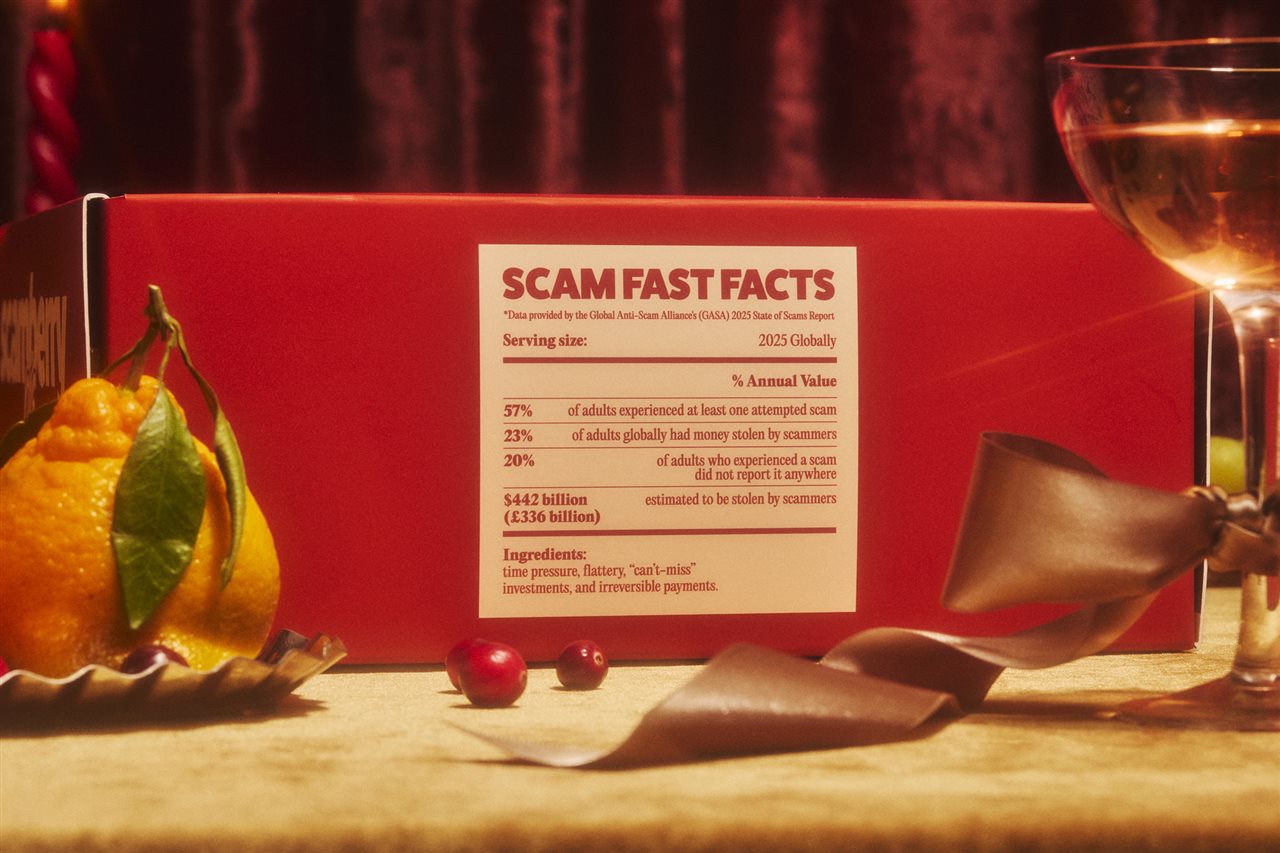

(BPT) - Did you know over half of adults worldwide (57%) faced at least one scam attempt this past year? As the holiday season kicks into high gear, scammers aren't taking time off - they're cashing in on the season of goodwill. And many of them are successful: Scammers are expected to steal an estimated $442 billion globally by the end of 2025.

A recent AARP survey found the holidays in particular see a spike in phishing and other scams, including requests from fake charities, fraudulent texts about unsuccessful deliveries, online shopping scams and more. These scams are aimed at shoppers of all ages: Reports of encountering fraud while online shopping jumped from 36% last year to 41% this year among those ages 18-34, with a 12% bump among ages 35-44 - totaling 42% reporting fraud attempts in that age group.

The good news? The more consumers recognize scam attempts, the more power they have to stop fraud in its tracks. That's the idea behind the Tech Against Scams Coalition (TASC), founded by Coinbase, a cryptocurrency company that helps protect assets with institutional-grade security, alongside other technology companies, including Cash App, Ripple and Match Group. TASC aims to educate the public about a variety of increasingly sophisticated scams, to help protect them from falling prey to fraudsters.

"Anyone can be a target, and scams are evolving constantly, but everyone can play a part in preventing fraud," said Chief Information Security Officer at Coinbase, Jeff Lunglhofer. "A scammer's biggest weakness is an informed community."

To help protect consumers this holiday season, TASC is sharing red flags to watch for during online interactions with people you don't know in person, whether you're communicating via text, social media or an app.

Avoiding in-person meetings or virtual calls

If the other person always has an excuse for not meeting or video chatting, they might not be who they say they are.

Even phone calls and video chats are not foolproof. Today's scammers can use deepfake technology to create convincing videos or manipulate their voices to make you believe they are someone they're not.

Pushing to move conversations off the original platform

Be cautious if someone wants to switch from your social media chat, marketplace or dating app to using text or another private channel. This is often done to avoid detection.

Getting too personal too soon

Scammers may also use strong emotional appeals and flattery to try to rush you into a closer relationship. Be wary of anyone who pushes for intimacy too quickly, or tries to escalate the conversation into romantic or sexual topics early on. Scammers may also urge you not to tell anyone about your interactions. If someone pressures you to keep the relationship private, they're likely hiding something.

Never send private information to anyone you haven't met in person, as scammers can use that to extort money or manipulate you into complying with their demands.

Requesting money for personal emergencies

Scammers frequently invent stories about urgent medical bills, business troubles or family issues to gain sympathy.

Don't send money to anyone - even a loved one - without first verifying their identity through an alternate means of contact, and never share information that could be used to access your financial accounts.

Asking you to co-invest in an opportunity

Fraudsters often lure victims into fake investment schemes, using promises of quick returns or insider access. Scammers may pose as financially successful individuals offering you opportunities to invest in "exclusive" ventures.

Always navigate through official channels before investing a cent.

How to protect your identity and information

Never share personal information, like your home or work address, or financial information, before meeting someone in person. Double-check privacy settings on your social media accounts and apps to limit visibility of personal details like contacts, friend lists and photos to reduce the information scammers can access about you. Finally, always set up multi-factor authentication to make it more difficult for bad actors to gain access to important accounts.

Report suspicious behavior

One in five adults who experience a scam never report it, yet open conversation is the best way to hold scammers accountable and build community awareness. Use in-app reporting tools to alert online platforms about suspicious user behavior. You can also report scams to law enforcement.

To help you recover from scams or fraud, use this Scam Survival Toolkit from the Better Business Bureau (BBB). If you've dealt with a romance scam, this Romance Scam Recovery Group offers emotional and practical support, connecting scam survivors to others with similar experiences.

This holiday season, TASC is driving a cultural wake-up call through their "Scamberry Pie" awareness campaign with events in New York City and Los Angeles, where they'll provide a tip to help consumers avoid getting scammed under each red-flag-shaped slice of pie. The goal is to be a delicious, educational way to start important conversations around the holiday table.

Stay safe from scams this holiday season. Visit Coinbase.com/security and TechAgainstScams.io to learn more about protecting yourself from online fraud.