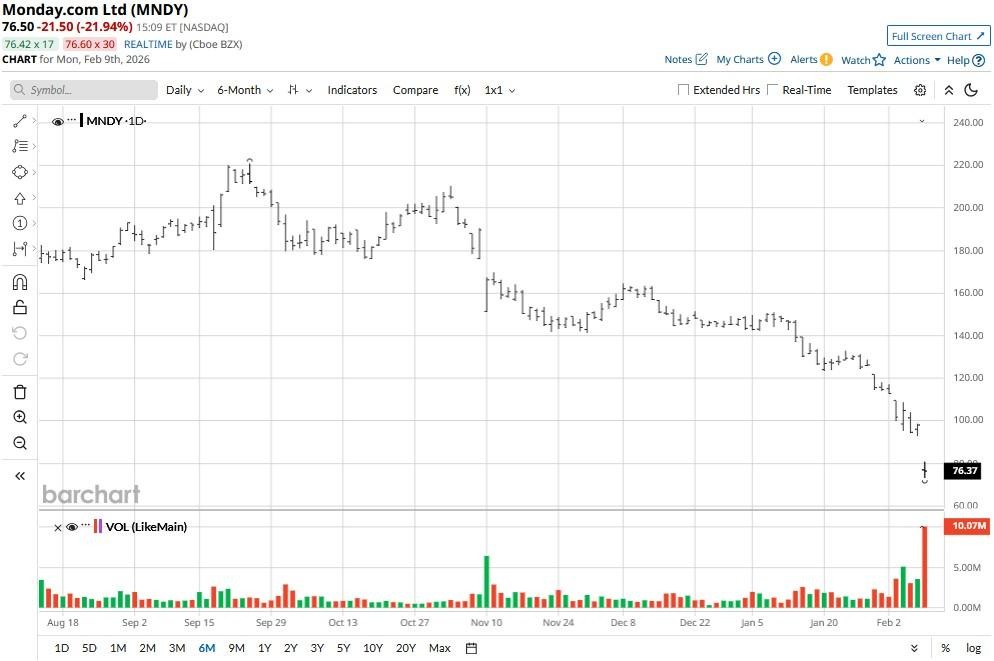

Monday.com (MNDY) shares plummeted more than 20% on Monday morning after the firm reported a market-beating Q4 but disappointed with its full-year guidance. The software company now sees its revenue coming in at about $1.46 billion in 2026 — well below the $1.48 billion that Wall Street analysts had forecast.

Following the post-earnings plunge, Monday.com stock is down about 50% versus its year-to-date high.

Should You Invest in Monday.com Stock Today?

MNDY’s stock selloff has accelerated this year mostly on artificial intelligence (AI) disruption concerns.

Investors fear large language models (LLMs) capable of coordinating tasks, generating code, and managing schedules could make the company’s offerings obsolete. However, co-chief executive Eran Zinman confirmed on the earnings call today that Monday.com is not “seeing any impact currently from any AI company.”

Still, the NYSE-listed firm is “shifting its product to be more AI native,” he added, citing new artificial intelligence capabilities, including agents and the recently launched vibe feature.

In fact, MNDY has re-architected its homepage and advertisements to focus more explicitly on its commitment to AI as well, Zinman told investors on Feb. 9.

That makes Monday.com at least a bit more attractive as a long-term holding.

Technicals and Valuation Warrants Buying MNDY Shares

Long-term investors should consider buying the dip in Monday.com shares, as their 14-day relative strength index (RSI) now sits at about 16 only, signaling extremely oversold conditions.

At 4.46x sales, the cloud-based platform doesn’t look particularly expensive either, given it’s visibly committed to positioning itself at the forefront of AI adoption. And for options traders, that seems to be enough for now.

According to Barchart, derivatives data remains skewed to the upside, with traders pricing in about a 9% move through Feb. 20, which could see MNDY going for roughly $83 within the next two weeks.

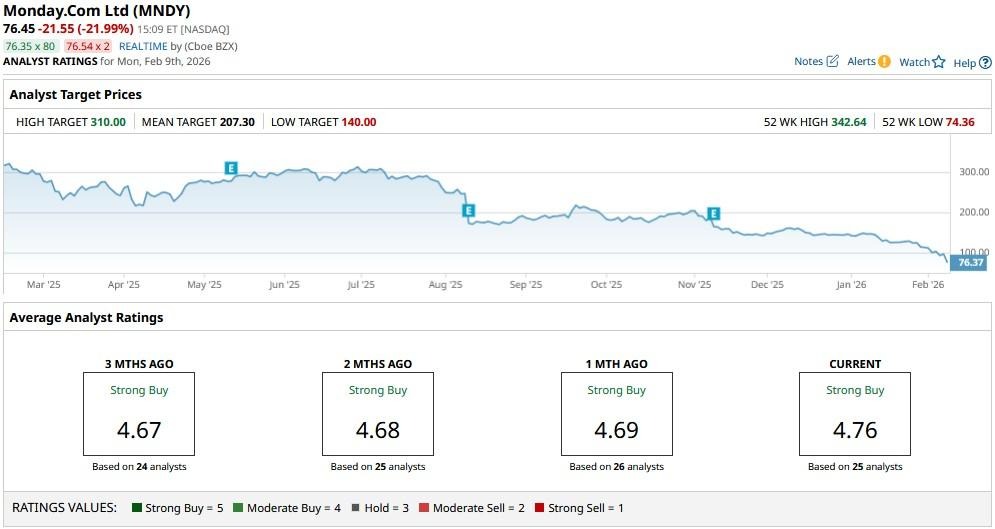

Wall Street Remains Bullish on Monday.com

While Q4 marked the third consecutive quarter that MNDY shares have tumbled after earnings, Wall Street remains largely bullish on them for the next 12 months.

The consensus rating on Monday.com remains at a “Strong Buy,” with the mean price target of about $207 indicating potential upside of nearly 180% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Palantir Bets on 61% Revenue Growth in 2026, Should You Buy Palantir Stock?

- Amid Capex Concerns, Should You Buy, Sell, or Hold Alphabet Stock?

- QuantumScape Just Broke Through Its 200-Day Moving Average. Should You Buy QS Stock Before Earnings?

- Oracle Heads Toward Key Resistance Levels After Analyst Upgrade. Should You Buy ORCL Stock Here?