The cost of a memory has gotten increasingly more expensive.

As a child, there wasn't a day that passed where I didn't play with one of two toys: Hot Wheels and GI Joe. As an adult now – and a grandfather, too – I find myself waxing nostalgic about my childhood toys, especially as I share that love with my grandson.

But as of late, I've noticed the price of these toys continues to rise. A year ago, you could purchase 4 Hot Wheels for less than $5. Today, you can pick up a 2-pack for $3 at Five Below (FIVE), which is not quite the same value.

To price-check another iconic toy, Barbie’s standard budget offering has increased from $5 to $6, and Premium kits now command prices of up to $100 or even more. Meanwhile, I'm fairly certain my parents didn't pay the equivalent of $90 in '70s dollars to buy a giant Kerplunk.

Yes, I think you have to partially blame tariffs for the rise, but are toy companies like Mattel (MAT) and Hasbro (HAS) also taking advantage of both pricing power and the "K"-shaped economy, where older generations buying for grandkids are the demographic most likely to absorb these increases comfortably?

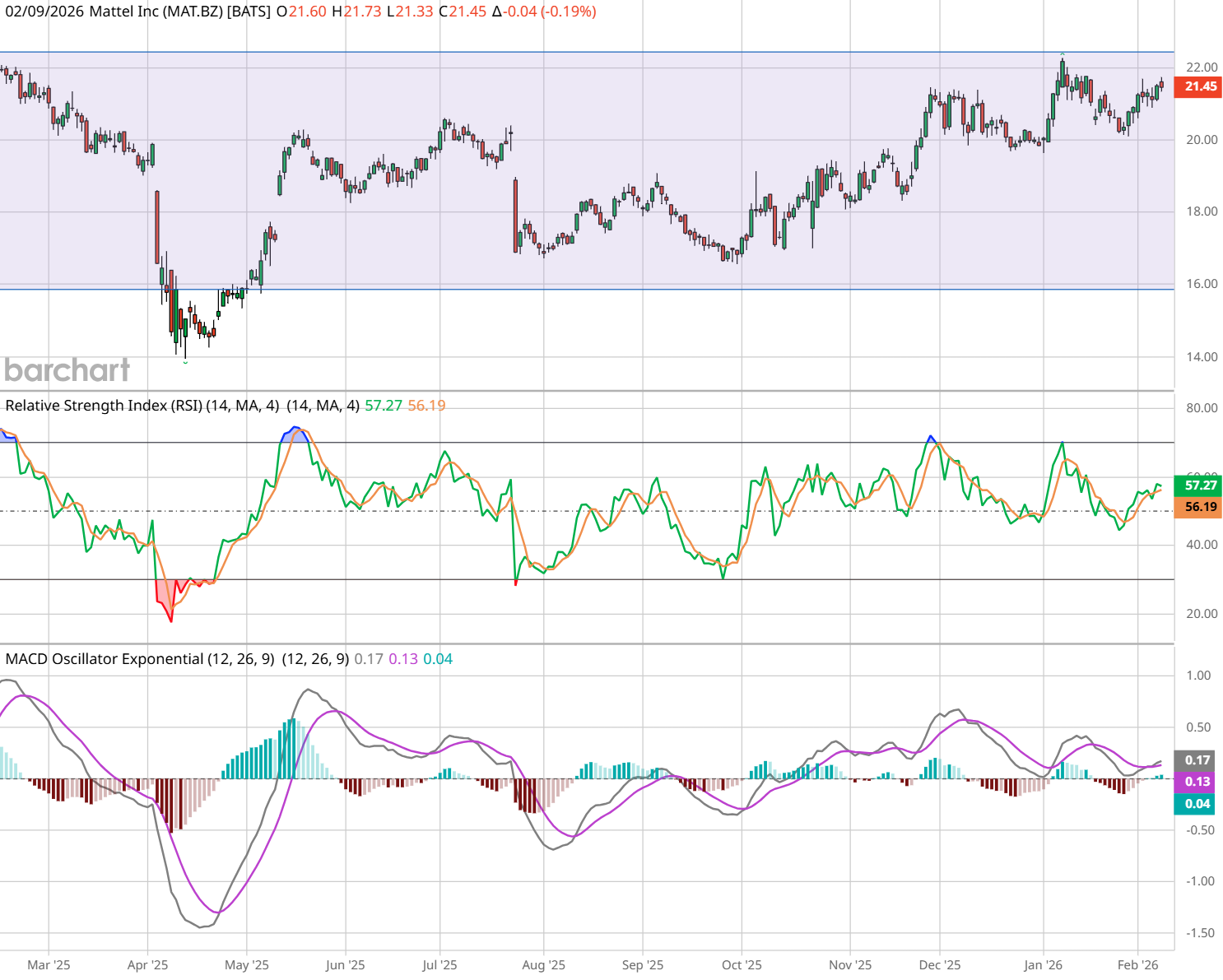

Where am I going with this? I’m hosting a live webinar this Wednesday, Feb. 11, to explain how traders can combine the Relative Strength Index (RSI) and MACD oscillator to find timely entry points.

One such signal would emerge on a basing structured stock where recent price action is supported by both (1) a rising RSI and (2) a positive MACD crossover when placed above the zero line. This signal confirms the momentum regime (via RSI) and trend expansion (via MACD).

Mattel fits the playbook:

Yes, it has more work before it breaks from recent highs around $22, but the current ATR is $0.50, and the ATR price percentage of 2.5% doesn't seem difficult in the short run and could set up for a greater run in the intermediate term.

Incidentally, my target for this would be in the range of $27-30, aiming for 20-30% price appreciation.

Maybe my wistfulness for a positive outcome is clouded by my reminiscence, although price – whether for Mattel’s classic toys or for MAT stock – does confirm a developing trend.

– John Rowland, CMT, is Barchart’s Senior Market Strategist. He also hosts educational webinars, including Wednesday’s session on RSI + MACD.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Palantir Bets on 61% Revenue Growth in 2026, Should You Buy Palantir Stock?

- Amid Capex Concerns, Should You Buy, Sell, or Hold Alphabet Stock?

- QuantumScape Just Broke Through Its 200-Day Moving Average. Should You Buy QS Stock Before Earnings?

- Oracle Heads Toward Key Resistance Levels After Analyst Upgrade. Should You Buy ORCL Stock Here?