With Alphabet's (GOOG) (GOOGL) Google Gemini seemingly poised to relegate ChatGPT to a distant second place in the consumer AI chatbot market and GOOGL stock changing hands at an attractive valuation, the shares are a buy for medium- and long-term investors.

GOOG stock should also be lifted meaningfully over the longer term by the success of its cloud, chip, and subscription businesses. And the company's stellar fourth-quarter results indicate that it is performing at a very high level overall. But investors should be aware that the Department of Justice's ongoing litigation against Alphabet, along with adverse orders that a judge recently imposed on the firm, does make GOOGL stock more risky than many other huge tech names.

About GOOGL Stock

Based in Mountain View, California, Alphabet owns the iconic Google search engine, along with YouTube and a rapidly growing cloud-infrastructure business. Its AI chatbot offering, Gemini, is winning lavish praise from many users and is growing in popularity among both techies and the broader public.

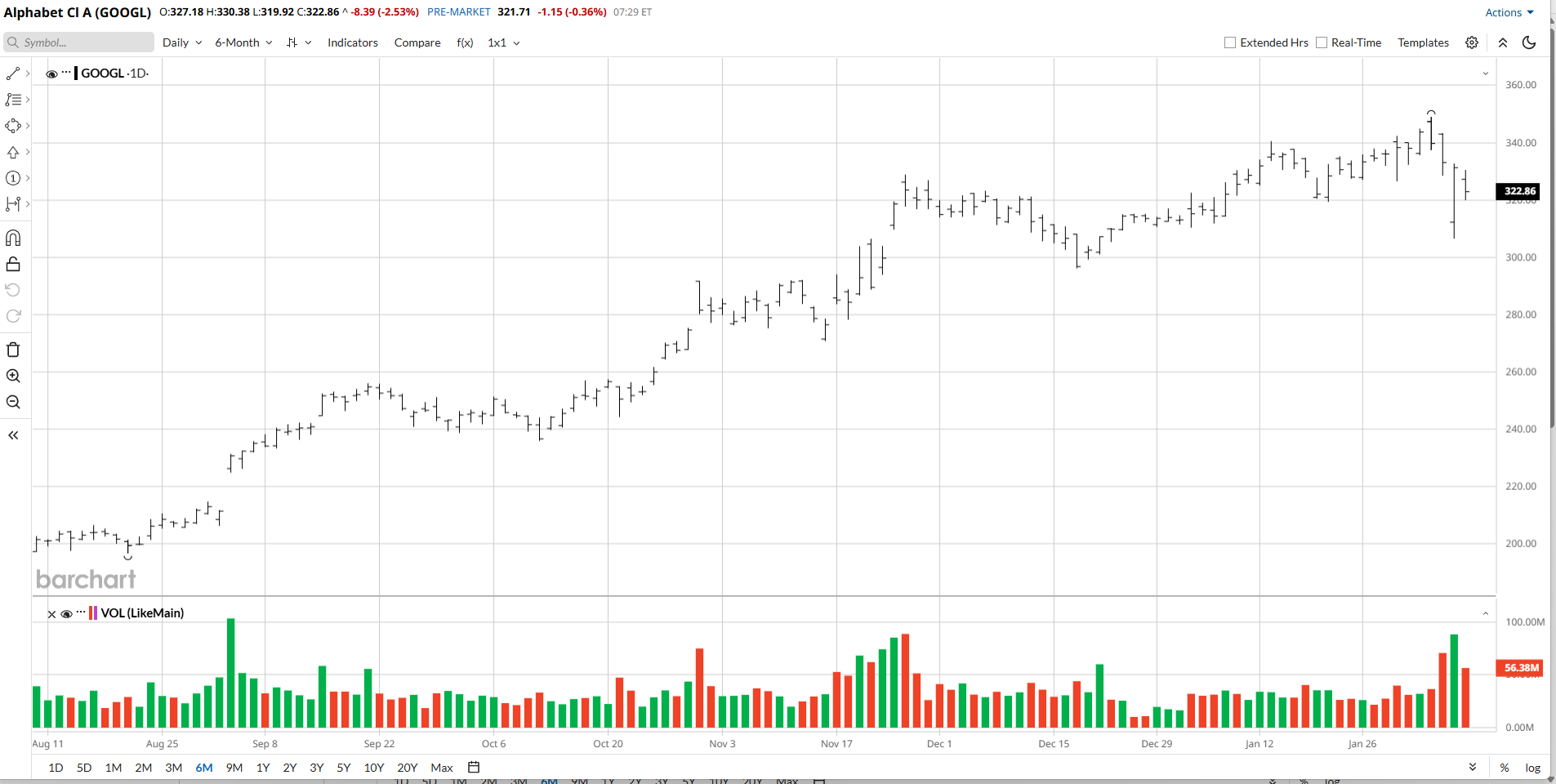

With a market capitalization of $3.9 trillion as of the market close on Feb. 6, GOOGL advanced 3% between the beginning of 2026 and Feb. 6. The S&P 500 ($SPX) rose 2% during the same period.

Its forward price-earnings ratio is 29.6 times.

Google Gemini Has Become a Hugely Valuable Asset for Alphabet

In a note to investors on Feb. 4, French bank BNP Paribas reported that Gemini's share of the AI platform website and AI app markets had jumped to “24.8% and 14.3%, compared to 22.5% and 13.2%” during the previous month. And in January 2024, Gemini's market share numbers came in at just 6.4% and 9.8%, respectively. Further, Alphabet reported during its Q4 earnings call that the number of monthly active users of the Gemini app had reached an impressive total of over 750 million.

Meanwhile, many tech experts and mainstream users are effusively praising Gemini. For example, tech news website Tom's Hardware has said that Gemini is superior to ChatGPT in reasoning and in a number of other areas. Also full of praise for Gemini was Forbes Senior Contributor Peter Cohan, who wrote recently that he had “found Gemini 3 to (be) far more useful (than ChatGPT) in the last few months,” adding that Gemini “is better at reasoning than ChatGPT.”

Given Gemini's rapid market share gains and the many compliments that it's obtaining from key opinion leaders, I believe that the platform, which is only trailing ChatGPT by a small margin in terms of market share, will in the medium term become the runaway leader of the space.

Gemini has put to rest any fears of Alphabet being devastated by the AI boom. Indeed, the company's ad revenue rose a healthy 13% last quarter versus the same period a year ago to $82 billion, indicating that the Google search engine, whose AI Overviews are powered by Gemini, remains an advertising juggernaut.

Gemini's strength also enabled Google to land a big AI deal with Apple (AAPL). The agreement will likely help Gemini's user base increase exponentially and could very well enable Google to obtain a share of the revenue generated by Apple's Siri. Consequently, the agreement may easily wind up being a big needle mover for GOOGL stock.

A Few of Alphabet's Other Major Businesses Are Shining

The company now has more than 325 million paid subscribers, matching Netflix (NFLX) in that area and indicating that YouTube's paid offerings are growing quickly. Further, Google Cloud's revenue shot up 48% year-over-year (YoY) in Q4, while the tech giant's AI chips business is gaining a meaningful foothold in the space.

These other businesses were key to the 14% YoY growth in the firm's sales in Q4 and the 35.6% jump in its net income. And given the huge potential of all three of these endeavors, Alphabet is likely to continue generating impressive growth going forward.

Legal Issues Create Risks

After years during which Google was the only default search engine on iPhones, Google's competitors will likely have the ability to make offers to Apple to supplant Google's status as the default search engine annually, due to a judge's recent decision. (Google is appealing the ruling, but it's unclear if the judge's orders will be postponed while the appeal is ongoing). Further, the Department of Justice is appealing that same judge's decision not to impose harsher penalties, such as forcing Google to divest its Chrome browser or prohibiting it from being the default search engine on iPhones. As a result of these issues, at some point down the road, GOOG stock could tumble tremendously, making the shares somewhat risky.

The Bottom Line on GOOGL Stock

Alphabet has many potential positive catalysts going forward, and the shares are changing hands at a low forward price-earnings ratio, given the firm's strong growth.

And although the company's remaining legal issues create significant risk, its potential reward is much higher, creating a positive risk-reward ratio and making GOOGL stock a buy for medium-to-long-term investors.

On the date of publication, Larry Ramer did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Oracle Heads Toward Key Resistance Levels After Analyst Upgrade. Should You Buy ORCL Stock Here?

- Our Top Chart Analyst on Barbieflation, the K-Shaped Economy, and 2 Indicators to Target Better Trade Entries

- The Software Armageddon Claims a New Victim as Monday.com Plunges 20%. Should You Buy the Dip in MNDY Stock?

- This Quiet AI Winner Is Heading Into a Crucial Earnings Test