The software-as-a-service (SaaS) industry is currently facing a fundamental identity crisis that has sparked a $1 trillion selloff in the sector. For years, the narrative was that artificial intelligence (AI) would be the ultimate enhancer — a massive, powerful force that would make software more indispensable and valuable.

However, the market is now suddenly fearing a SaaS-pocalypse — where AI shifts from being a tool that improves software to a force that outright replaces it.

This shift in perception is hitting the iShares Expanded Tech-Software Sector ETF (IGV), which I wrote about in a recent article, with historic force. Since the start of the year, software stocks have been slammed, and the carnage has accelerated over the last two weeks.

Why Are Software Stock Prices So Soft?

The core fear is simple: If an AI can automate a professional workflow from start to finish, why does a company need to pay for a specialized software subscription? I’ll admit that as a technician, I don’t think much about pressing industry issues like that.

However, since it is all over the media, and certainly has made its way to the stocks, I have devoted more brain space to it. And you know what? It makes sense to me as a narrative that can spill stocks and create a sustained loss of confidence on the part of market participants — which is ultimately what investors care about. Stock prices don’t move on narratives; they move on buying and selling pressure.

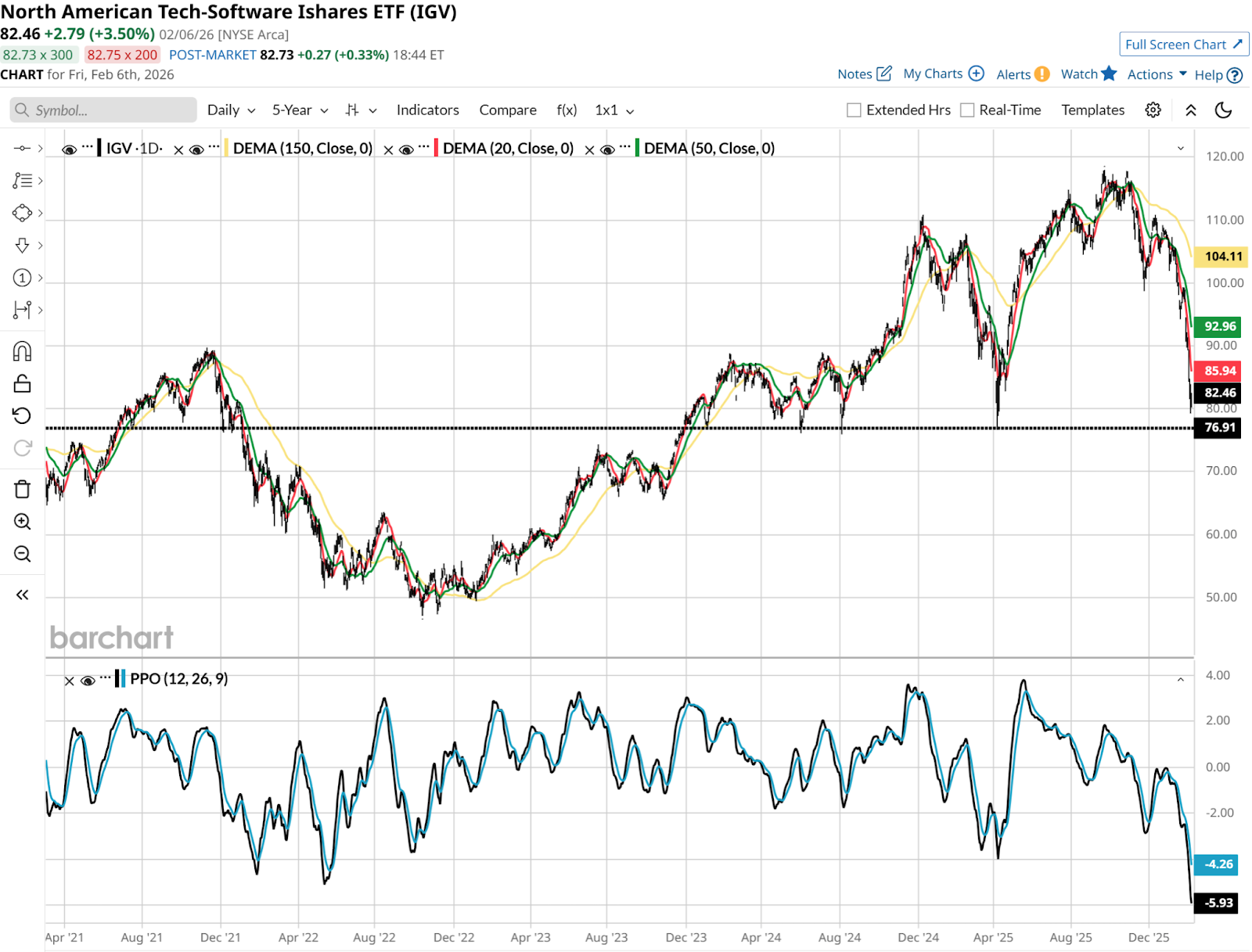

Let’s consider what the above technical chart indicates. A couple of things jump out at me right away. First, IGV has once again found its home, around $80 a share for the exchange-traded fund (ETF). If Friday’s 3.5% rally with the broad market turns out to be the end of this round of blood-letting, that will be fairly significant, since it has bottomed here multiple times.

The flip side: If I asked you to guess the return of IGV since August of 2021, four and a half years ago, I suspect your guess would not have been “near zero.” As we see, for nearly half a decade now, the software sector has returned nothing to shareholders. So the fact that its PPO momentum is washed out is of little consolation.

The Case for AI as a Replacement

The immediate catalyst for this perception problem was the release of Claude Cowork by Anthropic this week. This tool is designed to automate complex, professional workflows in the legal and financial sectors — areas that were previously the moats of major software providers. This was not the first reaction of investors and traders back in late 2022 when the AI rally started. But it is now.

The SaaS-pocalypse argument suggests that the traditional SaaS business model — selling seats and subscriptions for human-operated tools — is being cannibalized. If AI can perform the task of a tax preparer or a legal assistant, the software built to help those professionals becomes obsolete. \

This narrative has hit mid-tier software names the hardest, as they lack the massive data sets required to compete with the foundational AI models.

The Case for AI as an Enhancer

On the other side of the debate are the software bulls, who argue that this selloff is a classic overreaction. They point out that mission-critical enterprise software isn't just about a task. Rather, it is about governance, compliance, and data ownership.

While an AI can write a piece of code or draft a legal document, it cannot provide things like the integrated workflow that software firms do now. If you have used these early forms of AI, you know you can’t automatically count on it for pristine, systematic accuracy.

ROAR Score Analysis of IGV

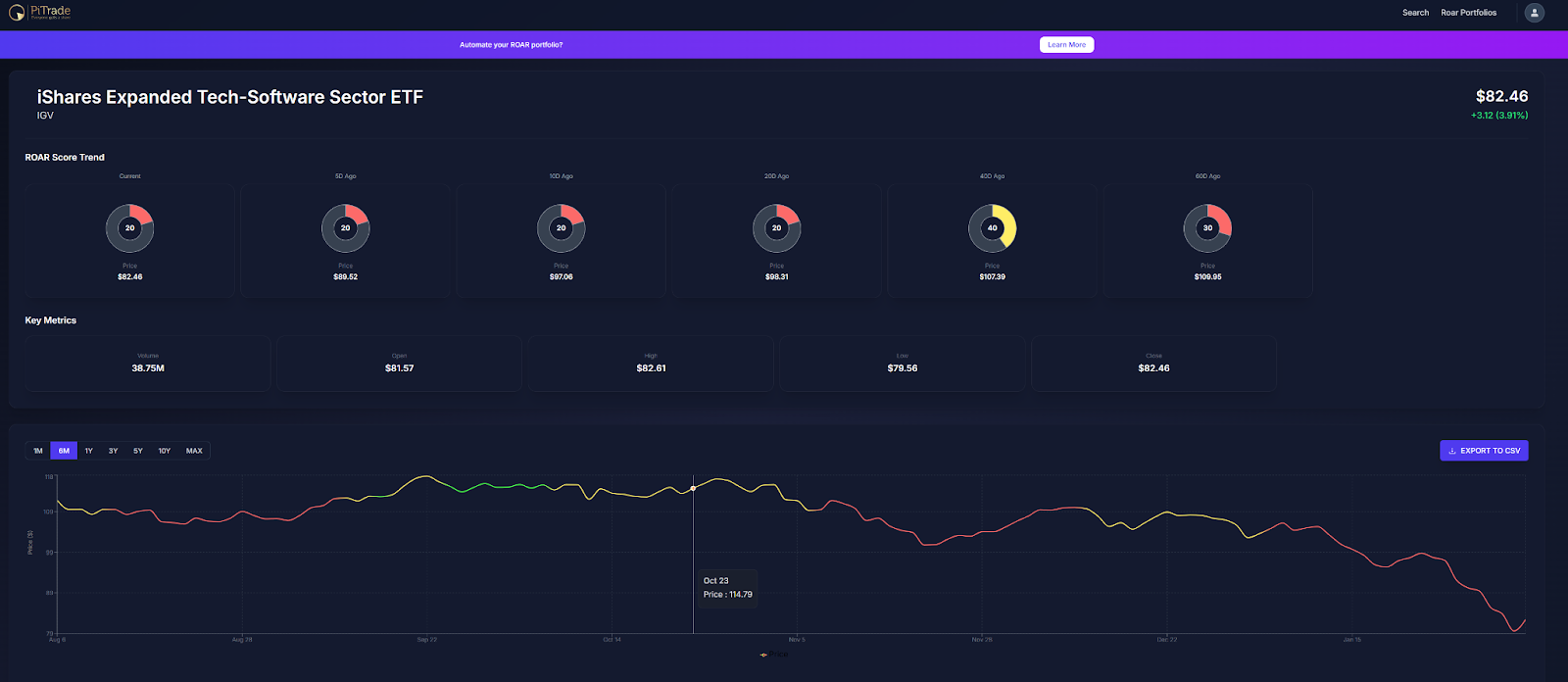

As we can see across the top of this graphic, IGV has been in a state of higher-than-normal risk since the ETF traded north of $115 last October. It only briefly flirted with neutral risk territory (yellow line on graph and circle across the top) since that time. It currently sits in ROAR’s version of the dungeon, with a score of 20.

And with the price per share at $82.46 at Friday’s close, after a nearly 4% one-day rally, it will take more than a whiff of optimism to turn this around soon. Until IGV at least regains neutral territory (ROAR score of 40-60), it is in a lower-lows, lower-highs predicament.

The Bottom Line

The software industry is navigating, or, more appropriately, muddling through, a major reset in its perceived relationship with AI. This has created a massive performance gap. The companies building the AI tools are soaring, while the companies that were supposed to use those tools are being hung out to dry.

Until the market sees these software companies report actual earnings growth derived from AI — rather than just talking about it — the bearish narrative will remain the dominant force.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google Gemini Is Just Getting More Popular. Does That Make GOOGL Stock a Buy Here?

- Should You Buy the Post-Earnings Dip in Amazon Stock?

- As Kyndryl Stock Plunges Into Deeply Oversold Territory, Should You Buy the Dip?

- Nvidia Reportedly Faces Gaming GPU Delays: Does That Weaken the Bull Case for NVDA Stock Here?