Apple, Inc.'s (AAPL) revenue, free cash flow, and FCF margins surged in its latest quarter. This has pushed AAPL target prices higher. Two plays are attractive: short one-month out-of-the-money puts and buy longer-dated in-the-money calls.

AAPL is down to $271.83 in midday trading on Monday, Feb. 9. However, that is up from a recent trough of $246.70 on Jan. 20. That was before its Jan. 29 release of fiscal Q1 results ending Dec. 27, 2025.

Since then, AAPL skyrocketed back to $278.12 on Friday, Feb. 6. However, it could be worth considerably more, based on its strong FCF results.

Strong FCF and FCF Margins

Apple's revenue surged 15.65% YoY to $143.8 billion, up 40% from the prior quarter. As a result, given that its capex was 19% lower YoY, its free cash flow (FCF) skyrocketed 91% to $51.55 billion in Q1.

The main reason was a huge increase in iPhone sales based on “unprecedented demand” and the resulting cash flow. The WSJ reported that the “blowout” sales were due to customers excited about Apple's new iPhone 17 lineup, upgrading their devices earlier than usual.

As a result, its free cash flow (FCF) margins also rose. For the quarter, FCF represented 35.86% of sales, up from 21.72% last year in Q1, according to Stock Analysis.

Moreover, on a trailing 12-month (TTM) basis, its FCF margin rose from 24.8% last year to 28.3% of 2025 sales. For example, FCF hit $123.324 billion, which was 28.3% of $435.6 billion in revenue during 2025.

As a result, target prices (TPs) for AAPL stock have been rising.

Higher AAPL TPs

In my Dec. 1, 2025, Barchart article, I used a 25% FCF margin against analysts' revenue estimates, along with a 2.393% FCF yield (i.e., a 41.8x FCF multiple), to value AAPL stock.

That resulted in a target price of $325 per share.

But, since then, analysts have raised their revenue forecasts, and Apple's FCF margin has risen to 28.3%. That means the market will likely raise the forward FCF multiple to at least 43x.

Here is how that works out.

First, revenue projections this fiscal year are $464.49 billion (for the year ending Sept. 30, 2026), and $493.77 billion for the following year. So, the next 12 months (NTM), using 3/4ths of the 2026 FY forecast and ¼ of the 2027 FY forecast revenue will average $471.81 billion.

That means that FCF over the NTM period could be:

$471.81 b x 0.283 = $133.5 billion NTM FCF

That is 8.3% higher than the $123.3 billion in FCF Apple made in 2025.

Just to be conservative, using a 40x multiple (i.e., a higher 2.5% FCF yield metric), Apple's market value could rise to $5.34 trillion:

$133.5 billion x 40 = $5,340 billion

That is 33.5% higher than today's $4 trillion market cap.

In other words, AAPL stock could be worth 33.5% more, or $362.89 per share, higher than my prior $325 TP:

1.335 x $271.83 = $362.89 target price (TP)

Analysts have also raised their TPs. Yahoo! Finance reports that the average of 47 analysts' TPs is $292.70, and Barchart's mean survey TP is $292.81. AnaChart.com, which tracks recent analyst write-ups, reports that 26 analysts have an average TP is $292.80.

Given these higher TPs, what are some of the best plays here? Should an investor just buy AAPL and hold it?

Higher Expected Returns Using OTM Puts and ITM Calls

I discussed shorting one-month puts at strike prices which are below the trading price (i.e., out-of-the-money or OTM) in my Dec. 30, 2025, Barchart article ("Apple is an Analyst Favorite, But AAPL Stock Has Been Flat - Shorting Puts Is the Best Play").

I suggest shorting the $260 strike price put option expiring Jan. 30, 2026, when AAPL was at $273.11. The premium received was $2.70, so the net breakeven cost to buy 100 shares was $257.30.

AAPL closed at $259.48 on Jan. 30, so the collateral was assigned, and an investor would now have 100 shares with an all-in cost of just $257.30.

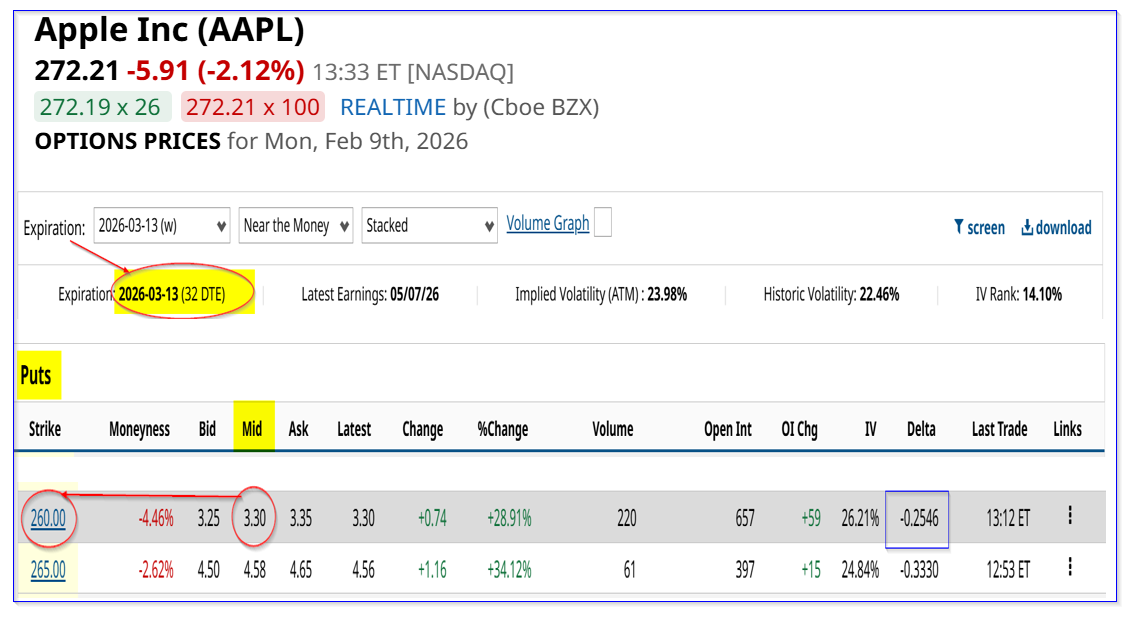

This one-month short-put play can be repeated for a similar return. For example, the March 13, 2026, expiry period shows that the $260.00 strike price put has a midpoint premium of $3.30.

That provides a one-month yield of 1.269% (i.e., $330/$26,000 invested). Note that the strike price is still over 4% lower than today's price, so it is out-of-the-money (OTM). That provides some downside protection against AAPL falling further before the short-put play can be assigned to buy AAPL shares.

I also suggested buying call options at the $260 strike price (i.e., in-the-money) for the July 17, 2026, expiry period using the short-put income. At the time, the cost was $30.08, but it has now fallen to $27.07.

Using the one-month put income to help pay for this has lowered the all-in cost. That play is another way to invest in AAPL stock on a leveraged basis. In the last 2 months, the investor would have made $6.00, or $3.00 on average.

For example, let's say AAPL rises to $300 by July. That would mean the $260.00 calls would be worth $40.00. But after collecting $3.00 on average for 7 months, the all-in cost would be just $30.08 - $21, or $9.08.

So, the expected return would be $40.00/9.08 -1, or +340%. In fact, even if AAPL stays flat at $272.21, the intrinsic value of the $260 call would be $12.21 (i.e., $272.21- $260.00), and the net expected return:

$12.21/$9.08 -1 = +34.47%

That is slightly better than the expected return of holding AAPL shares (assuming it rises to $362) in my TP above.

The bottom line is that shorting puts and buying ITM calls is a better play than just owning AAPL shares, given the company's strong FCF margins and its higher target prices.

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Apple's FCF Margins Surge and Its Target Value Rises - What's the Best AAPL Stock Play?

- Options Activity Shows Avis Budget (CAR) Could Be Cooking Up a Positive Earnings Surprise

- Option Volatility And Earnings Report For February 9 - 13

- Why Alphabet's Free Cash Flow Could Survive, Despite the Market's Fears - How to Play GOOGL