Nucor Corporation (NUE) is a leading steel producer headquartered in Charlotte, North Carolina. The company manufactures and sells a wide range of steel and steel-related products, including sheet, plate, bar, and structural steels. Its operations span steel mills, steel products, and raw materials segments, supplying materials to construction, automotive, and infrastructure markets. Nucor’s market cap is around $42.7 billion.

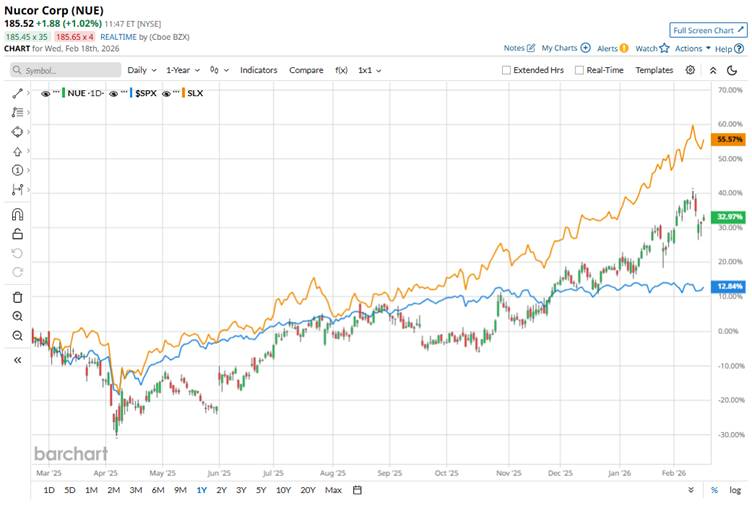

Shares of this steel giant have outpaced the broader market over the past 52 weeks. Over the past year, NUE has gained 30.4%, while the broader S&P 500 Index ($SPX) has rallied 11.9%. Also, on a year-to-date (YTD) basis, NUE stock rose 13.9%, surpassing the SPX’s marginal decline.

Narrowing the focus, NUE has lagged behind compared to the VanEck Steel ETF (SLX). The exchange-traded fund has gained about 54.3% over the past year and 17.5% YTD.

Nucor’s share price has climbed this year largely because investors are upbeat about its 2026 outlook, supported by strong order backlogs and rising steel demand, especially in construction and infrastructure markets. Nucor management emphasized that the company entered 2026 with historically strong order backlogs with steel mill backlogs up nearly 40% year-over-year and steel products backlogs up about 15%, with structural backlogs more than 15% above the prior record, signaling robust demand momentum in key markets such as infrastructure and energy-related construction.

For the current fiscal year, ending in December 2026, analysts expect Nucor’s EPS to rise 52.3% YOY to $11.74 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters, while missing on other two.

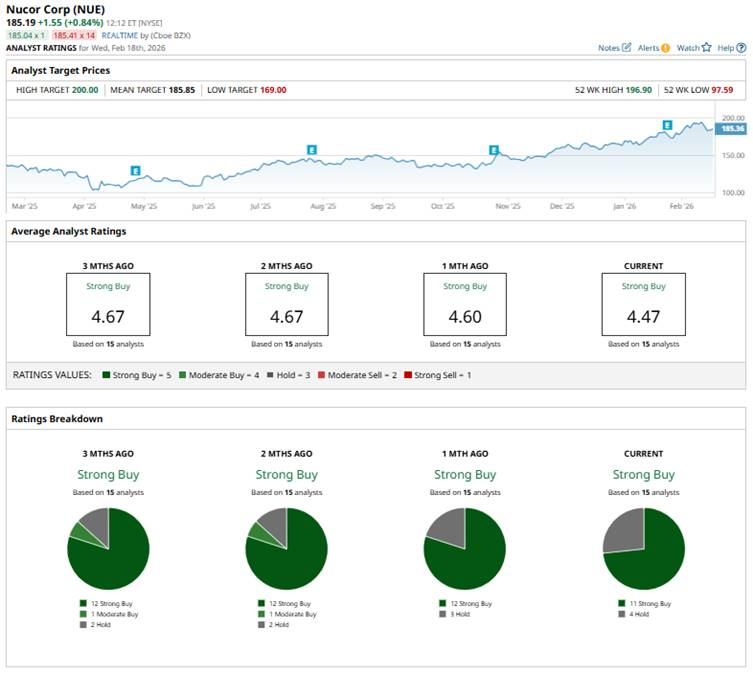

Analysts are bullish about the stock’s potential. Among the 15 analysts covering NUE stock, the consensus is a “Strong Buy.” That’s based on 11 “Strong Buy” ratings, and four “Holds.”

This configuration is slightly less bullish than one month ago, when there were 12 “Strong Buy” ratings.

UBS downgraded Nucor from “Buy” to “Neutral” but raised its price target to $183 from $168. The downgrade reflects worries that lower-cost steel imports from Southeast Asia and Brazil could increase U.S. supply, raising competition.

The mean price target of $185.85 represents just a 1.2% premium to NUE’s current price levels. The Street-high price target of $200 suggests upside potential of 8.9%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart