Based in Phoenix, Arizona, Pinnacle West Capital Corporation (PNW) is a leading energy holding company. With a market cap of approximately $11.9 billion, it generates electricity from nuclear, natural gas, oil, coal, and solar facilities while overseeing a vast network of transmission lines, distribution systems, substations, and energy storage assets.

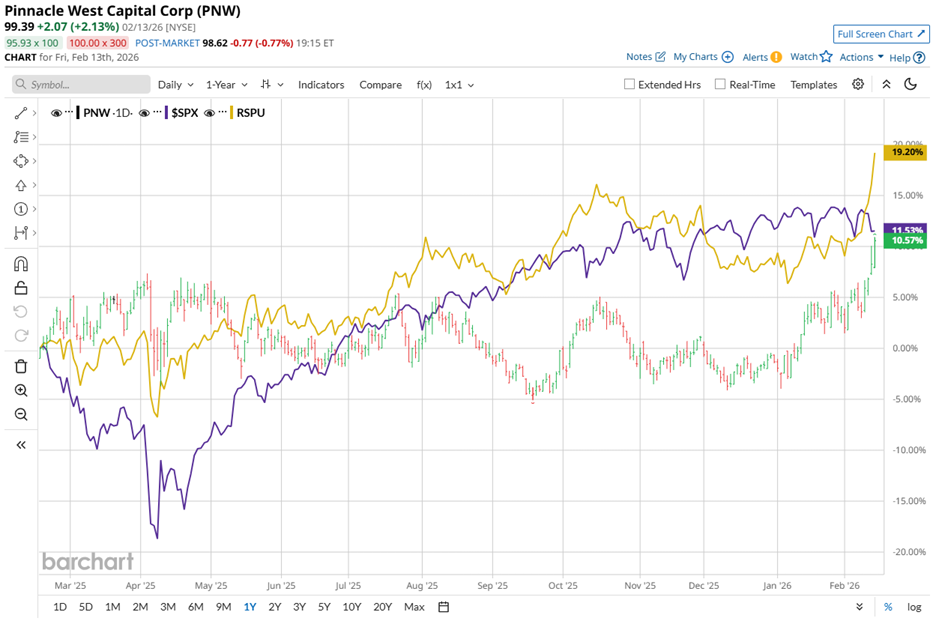

Over the past 52 weeks, PNW stock gained 11.2%, slightly trailing the S&P 500 Index ($SPX), which rose 11.8% during the same period. This year, however, the company has quietly taken the lead. Year-to-date (YTD), Pinnacle West’s shares have advanced 12.1%, while the broader index has posted a slight decline.

Utilities as a group have enjoyed their own rally. The Invesco S&P 500 Equal Weight Utilities ETF (RSPU) climbed 20% over the last 52 weeks and stands up 10.2% YTD. Against this backdrop, Pinnacle West’s annual return appears more measured. Yet its 12.1% YTD gain exceeds the ETF’s 10.2% advance.

On Jan. 27, just one day after Pinnacle West confirmed it would release its fiscal 2025 Q4 results before markets open on Wednesday, Feb. 25, shares climbed almost 2%. Investors do not typically reward a routine scheduling update. They step in when they believe the upcoming numbers will justify fresh upside.

The belief rests squarely on performance. In the third quarter of fiscal 2025, Pinnacle West generated $1.82 billion in revenue and delivered EPS of $3.39, beating analysts’ expectations on both measures. Higher transmission revenues and stronger sales powered the outperformance.

Management then strengthened the bullish case by raising fiscal 2025 EPS guidance to a range of $4.90 to $5.10, up from $4.40 to $4.60. The upward revision reflects sustained sales growth and an improved transmission revenue outlook.

For the full fiscal year 2025, which ended in December, analysts expect diluted EPS to decline 7.4% year over year to $4.85. Still, Pinnacle West has made a habit of outpacing expectations. The company surpassed earnings estimates in three of the past four quarters, missing only once.

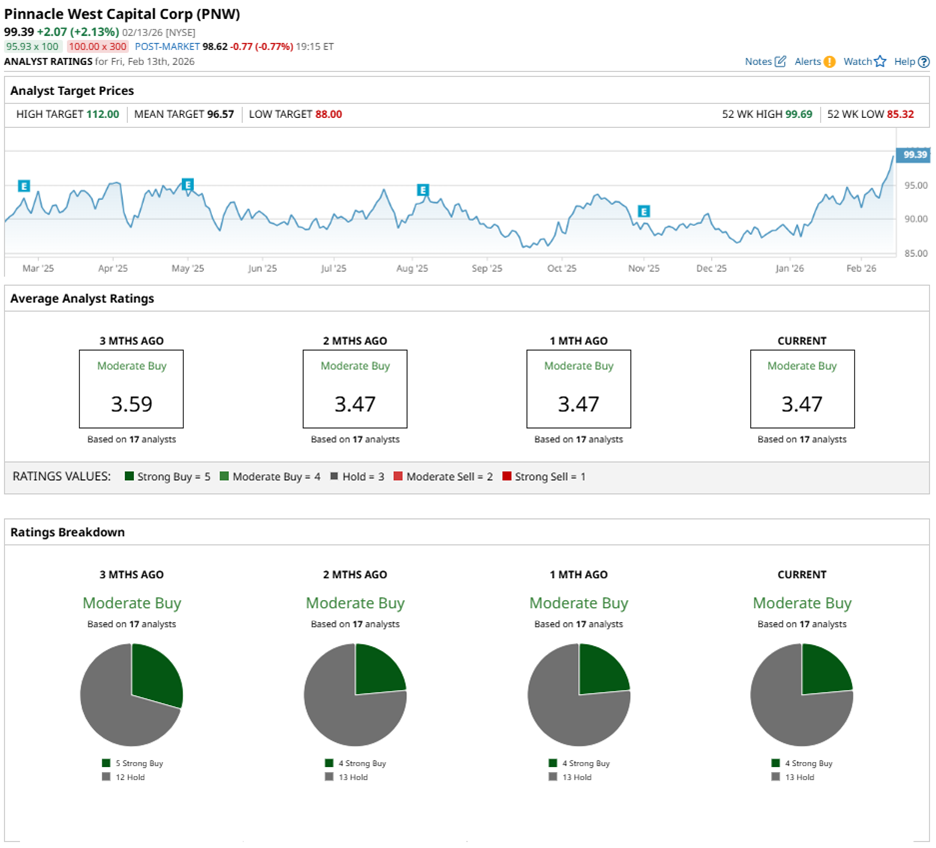

Wall Street continues to take a measured but constructive stance on Pinnacle West. Analysts have assigned PNW stock an overall rating of “Moderate Buy.” Of the 17 analysts covering the stock, four recommend “Strong Buy,” while the remaining 13 suggest “Hold.”

Sentiment has shifted only marginally from three months ago, when five analysts carried “Strong Buy” ratings.

Barclays PLC (BCS) stepped in on Jan. 15 and added a note of measured caution to the conversation. Analyst Nicholas Campanella maintained an “Equal-Weight” rating on PNW stock but lowered the price target to $90 from $95. The move suggests valuation discipline rather than operational concern.

Interestingly, PNW stock already trades above its mean price target of $96.57, which implies that shares have outpaced consensus assumptions. However, the Street-high target of $112 indicates that, despite mixed developments and a more measured tone from some analysts, the upside potential of 12.7% remains.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart