Miami, Florida-based Lennar Corporation (LEN) constructs and sells single-family attached and detached homes and buys and sells residential land. Valued at $30.2 billion by market cap, the company also provides mortgage financing, title insurance, commercial real estate, investment management, and other financial services.

Shares of this leading homebuilder have underperformed the broader market over the past year. LEN has declined 1.2% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.8%. However, in 2026, LEN stock is up 19%,surpassing SPX’s marginal fall on a YTD basis.

Narrowing the focus, LEN’s underperformance is also apparent compared to iShares U.S. Home Construction ETF (ITB). The exchange-traded fund has gained about 10.3% over the past year. However, LEN’s returns on a YTD basis outshine the ETF’s 17.9% gains over the same time frame.

Lennar's performance was hit by a challenging housing market due to affordability issues and weak consumer confidence, leading to lower sales volume and increased incentives. The company is shifting to more affordable homes and an asset-light strategy, investing in tech, and streamlining operations. Outlook is cautiously optimistic, awaiting rate moderation and government initiatives to boost affordability.

For the current fiscal year, ending in November, analysts expect LEN’s EPS to decline 20.1% to $6.44 on a diluted basis. The company’s earnings surprise history is disappointing. It missed the consensus estimate in three of the last four quarters while beating the forecast on another occasion.

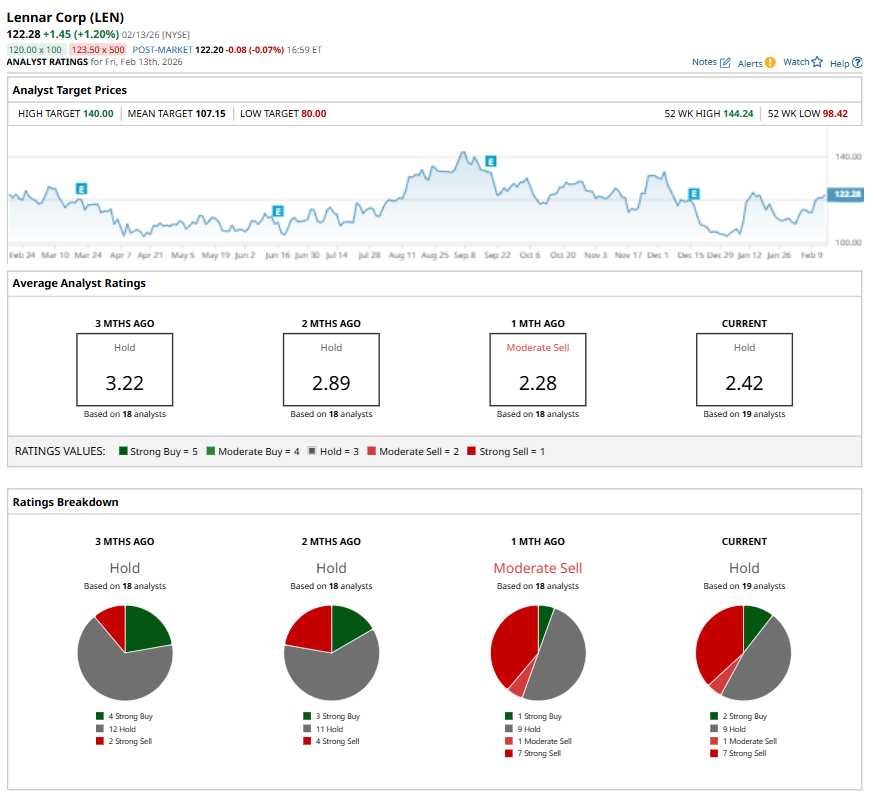

Among the 19 analysts covering LEN stock, the consensus is a “Hold.” That’s based on two “Strong Buy” ratings, nine “Holds,” one “Moderate Sell,” and seven “Strong Sells.”

This configuration is less bearish than a month ago, with an overall “Moderate Sell” rating, consisting of one analyst suggesting a “Strong Buy.”

On Jan. 16, Wells Fargo & Company (WFC) analyst Sam Reid maintained a “Hold” rating on LEN with a price target of $105.

While LEN currently trades above its mean price target of $107.15, the Street-high price target of $140 suggests an upside potential of 14.5%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart