Headquartered in Minnesota, UnitedHealth Group Incorporated (UNH) owns and manages organized health systems. With a market cap of $265.6 billion, the company provides employers with products and resources to plan and administer employee benefit programs serving customers worldwide.

Shares of this health insurance giant have significantly underperformed the broader market over the past year. UNH has declined 44.8% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.8%. In 2026, UNH’s stock fell 11.2%, compared to the SPX’s marginal dip on a YTD basis.

Narrowing the focus, UNH’s underperformance is also apparent compared to the iShares U.S. Healthcare Providers ETF (IHF). The exchange-traded fund has declined about 12.1% over the past year and 3.5% on a YTD basis.

On Jan. 27, UNH shares tanked 19.6% after the company released fiscal 2025 Q4 results. Revenue rose 12.3% year over year to $113.22 billion, driven by sustained expansion at Optum and continued enrollment growth in UnitedHealthcare’s government programs, but came in slightly below consensus. Adjusted EPS of about $2.11 met expectations, yet underlying profitability weakened as elevated medical utilization and care costs compressed insurance margins, particularly in Medicare Advantage. In addition, the company recorded $1.6 billion in charges tied to Optum portfolio realignment and business optimization initiatives, further weighing on reported earnings and segment margins.

For the current fiscal year, ending in December, analysts expect UNH’s EPS to rise 8.2% to $17.69 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

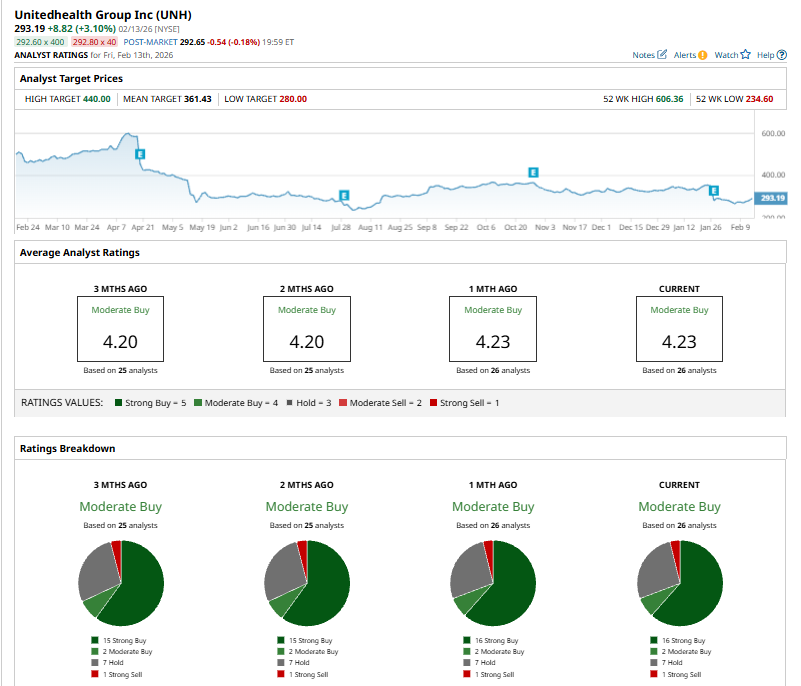

Among the 26 analysts covering UNH stock, the consensus is a “Moderate Buy.” That’s based on 16 “Strong Buy” ratings, two “Moderate Buys,” seven “Holds,” and one “Strong Sell.”

This configuration is bullish than two months ago, with 15 analysts suggesting a “Strong Buy.”

On Feb. 5, Mizuho lowered its price target on UnitedHealth Group to $350 from $430 while maintaining an “Outperform” rating, citing a slower-than-expected earnings recovery following the company’s Q4 results.

The mean price target of $361.43 represents a 19.6% premium to UNH’s current price levels. The Street-high price target of $440 suggests an ambitious upside potential of 35.7%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- What are Global Markets Watching Monday?

- Markets Don’t Bottom On Fear. They Bottom When Forced Sellers Are Done

- AI Disruption Fear, FOMS and Other Key Things to Watch this Week

- Warren Buffett Says Only Buy Stocks You’re Comfortable Holding For Ten Years, Otherwise Don’t Bother Even ‘Owning it for Ten Minutes’