Austin, Minnesota-based Hormel Foods Corporation (HRL) develops, processes, and distributes various meat, nuts, and other food products to foodservice, convenience store, and commercial customers. Valued at $13.2 billion by market cap, the company markets its products around the world under a variety of branded names like HORMEL, ALWAYS TENDER, APPLEGATE, AUSTIN BLUES, BLACK LABEL, BURKE, CAFÉ H, CHI-CHI'S, and more.

Shares of this diversified food giant have underperformed the broader market over the past year. HRL has declined 17.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.4%. In 2026, MKC stock is up 1.1%, compared to the SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, HRL’s underperformance is also apparent compared to First Trust Nasdaq Food & Beverage ETF (FTXG). The exchange-traded fund has gained about 6% over the past year. Moreover, the ETF’s 12.8% gains on a YTD basis outshine the stock’s low single-digit returns over the same time frame.

Hormel Foods' underperformance is due to input cost inflation, supply chain issues, and discrete events like a product recall and facility fire. Despite stability from brands like Jennie-O, margins and sales volumes were pressured. Looking ahead, Hormel expects continued input cost volatility, but is focused on cost savings, marketing support for core brands, and portfolio reshaping to drive growth.

On Dec. 4, 2025, HRL shares closed up by 3.8% after reporting its Q4 results. Its adjusted EPS of $0.32 exceeded Wall Street expectations of $0.30. The company’s revenue was $3.19 billion, falling short of Wall Street forecasts of $3.20 billion. HRL expects full-year adjusted EPS in the range of $1.43 to $1.51, and revenue in the range of $12.2 billion to $12.5 billion.

For fiscal 2026, ending in October, analysts expect HRL’s EPS to grow 6.6% to $1.46 on a diluted basis. The company’s earnings surprise history is mixed. It beat or matched the consensus estimate in two of the last four quarters while missing the forecast on two other occasions.

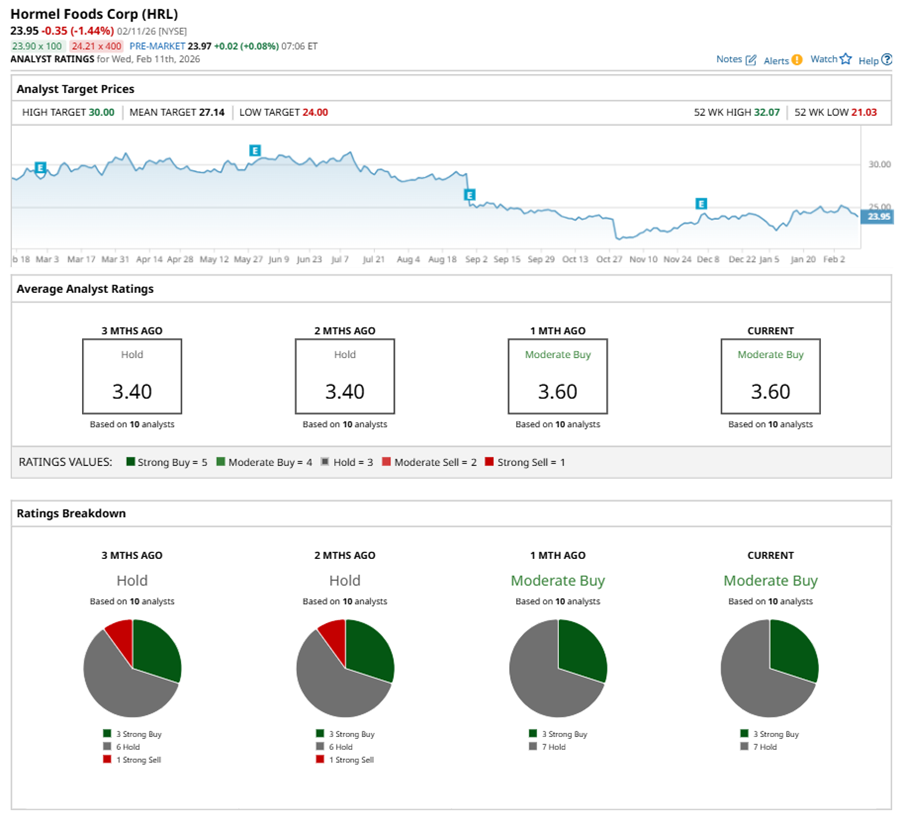

Among the 10 analysts covering HRL stock, the consensus is a “Moderate Buy.” That’s based on three “Strong Buy” ratings, and seven “Holds.”

This configuration is more bullish than two months ago, with an overall “Hold” rating, consisting of one analyst suggesting a “Strong Sell.”

On Dec. 5, 2025, Piper Sandler Companies (PIPR) analyst Michael Lavery kept a “Neutral” rating on HRL and raised the price target to $26, implying a potential upside of 8.6% from current levels.

The mean price target of $27.14 represents a 13.3% premium to HRL’s current price levels. The Street-high price target of $30 suggests an upside potential of 25.3%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart