Cisco System (CSCO) is dropping today despite posting record revenue for its fiscal Q2 and beating earnings estimates.

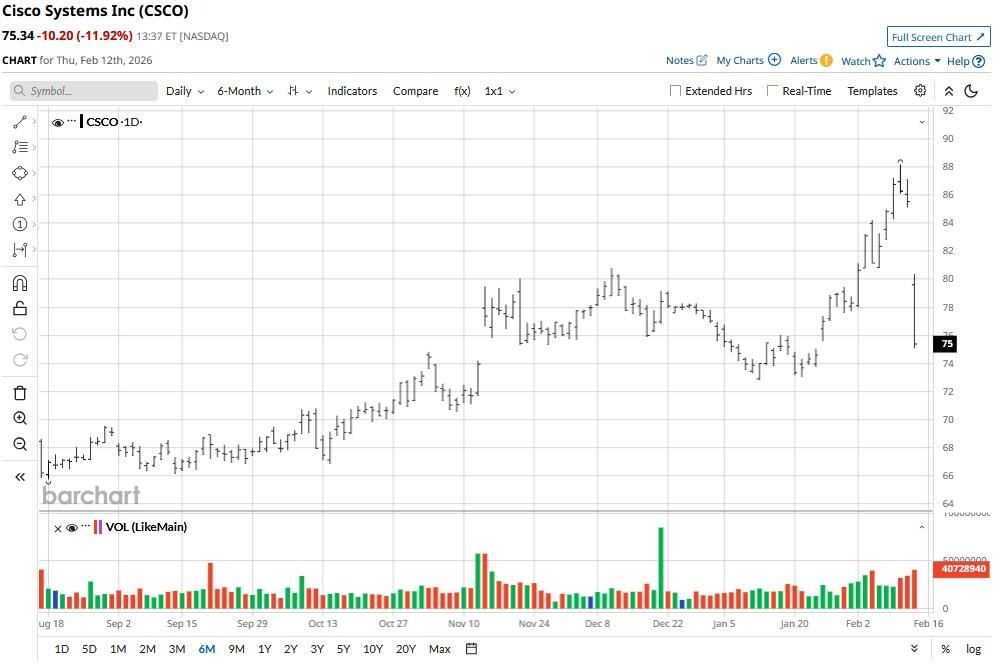

Investors have been put off by the company’s in-line guidance and a slight decline in non-GAAP gross margin, triggering a selloff that pushed it below its 50-day moving average (MA) on Feb. 12.

While that technical setup signals continued downward momentum ahead, Ray Wang, founder and chairman of Constellation Research, recommends buying the dip in Cisco shares that are now down about 14% versus their year-to-date high.

Why Cisco Stock Is Poised to Recover

Wang sees the post-earnings weakness in CSCO stock as unwarranted, given that the Nasdaq-listed firm is strongly positioned to capture a significant chunk of the more than $700 billion that U.S. hyperscalers have committed to spend on AI infrastructure in 2026.

San Jose-headquartered Cisco Systems makes high-end networking gear that serves as the critical "nervous system” for artificial intelligence clusters.

“When you look at the supply chain, Cisco is squarely in the middle of the AI boom,” Wang told CNBC.

CSCO ended its second quarter with a record $2.1 billion in AI infrastructure orders, reinforcing its successful transition from a legacy tech firm to an artificial intelligence beneficiary.

G300 Could Unlock Further Upside in CSCO Shares

On Thursday, Cisco also announced its new Silicon One G300 chip, a 102.4 Tbps powerhouse the company claims will eliminate network congestion that undermines overall AI cluster efficiency.

According to Wang, the new switch box could attract bigger orders and drive revenue growth for this tech behemoth through the remainder of 2026.

Note that Cisco shares are currently going for a forward price-to-earnings (P/E) multiple of about 26x, which makes it inexpensive to own for an AI beneficiary.

Other reasons Wang cited to stick with CSCO this year include a healthy dividend yield of 2.17%.

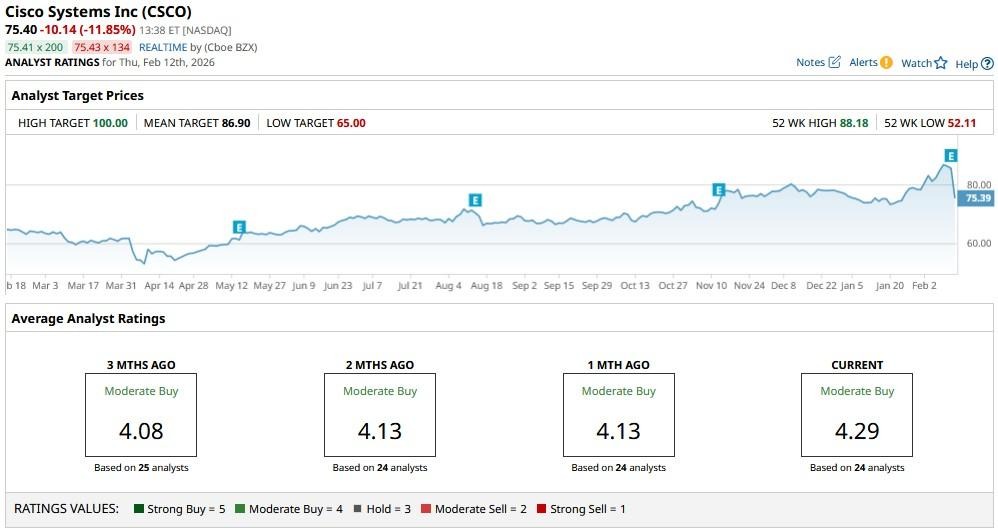

Wall Street Remains Bullish on Cisco Systems

Wall Street analysts seem to agree with Wang’s bullish view on Cisco Systems.

The consensus rating on CSCO shares remains at a “Moderate Buy,” with the mean target of roughly $86 indicating potential upside of about 14% from here.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart