For the longest time now, e-commerce giant Amazon (AMZN) has been treated with neglect by the Street. Not as divisive as Tesla (TSLA) or as much loved as Nvidia (NVDA), there has been just a palpable sense of indifference towards the Seattle, Washington-based company. Unsurprisingly, the stock is down almost 13% over the past year.

However, the $2.2 trillion market cap company may just have received a timely boost from the Federal Communications Commission (FCC).

FCC Approves Amazon's Satellites

The FCC has given approval to Amazon to launch 4,500 satellites, with some specific milestones that the company has to achieve. According to some media reports, the FCC has mandated Amazon to launch 50% of the newly approved Gen 2 satellites by Feb. 10, 2032, and the rest by Feb. 10, 2035. With this, Amazon's count of approved low-earth orbit (LEO) satellites increases to about 7,700.

This acts as a massive boost for Amazon's goal of finally commencing its satellite internet services through its Leo project. Announced in 2019, the company expects to begin providing services through Leo later this year.

Notably, Leo is Amazon’s, well, LEO satellite broadband program (formerly Project Kuiper) designed to deliver high-speed, low-latency internet anywhere on the planet by combining a multi-thousand-satellite constellation with a family of flat-panel user terminals and a global ground-station network. The program is integrated with AWS for direct cloud interconnects and is being pitched as a full-stack connectivity solution for consumers, enterprises, and governments.

Leo is being built with explicit AWS integration and enterprise networking features, which can be attractive to corporate and government buyers. Amazon is also launching a tiered terminal lineup (Nano, Pro, Ultra) that targets consumers through industrial use cases and touts high throughput and phased-array antennas. Additionally, Amazon’s deep relationships with launch suppliers, terrestrial fiber, and cloud infrastructure give Leo commercial go-to-market advantages that pure-play launch-and-satcom firms lack.

However, challenges are certainly there. For instance, relative to SpaceX's Starlink, Leo's market presence is absent. SpaceX already operates the largest active LEO broadband fleet with tens of thousands of user terminals in the field and a proven, rapidly iterating hardware/software stack, which gives Starlink faster network effects, broader geographic service today, and pricing/practical experience that Amazon must catch up to. Moreover, Amazon must execute a complex industrial program (mass production of satellites, multi-provider launches, ground-network buildout) while meeting FCC deployment milestones, and any slippage or higher-than-expected build cost risks both schedule and competitive position.

Overall, the program so far represents a multi-billion-dollar investment (Amazon has disclosed roughly $10 billion invested to date and continues to commit further capital as it ramps up launches and ground infrastructure), and the customer benefit proposition is faster, lower-latency broadband in locations that lack reliable terrestrial service plus enterprise features (direct cloud connectivity, private interconnects, carrier offload) that can reduce total cost of ownership for remote sites. For end users, this can mean hundreds of Mbps to 1 Gbps class links with latencies rivaling terrestrial broadband and simplified integration into AWS workloads, although realized pricing, terminal costs, and true throughput will depend on competition, deployment density, and Amazon’s commercial plans.

All this makes the case for Leo as a business proposition for Amazon, but what is in it for the investors? Specifically, how will it lead to EPS accretion? Well, the accretion pathway occurs through three mechanisms. First, recurring subscription revenue from residential and enterprise customers drives predictable top-line growth. Second, integration with AWS creates cross-selling and stickiness, increasing customer lifetime value and cloud workloads routed through Amazon infrastructure. Third, scale economies reduce per-satellite and per-terminal costs over time, expanding gross margins once the constellation reaches steady-state utilization.

Q4 Earnings Miss (But Nothing To Worry About)

Shares of Amazon tumbled after the company revealed that it will go for a capex of $200 billion in 2026, citing strong demand for its AI offerings. So, the post-earnings decline in the share price was surprising as the Street had been fearing that Amazon was getting left behind in the AI race. This capex spend should have acted as a reassurance, but then again, strange are the ways of the Street. However, the company's fundamentals remain as strong as ever, with the slight miss in earnings not particularly worrying.

Q4 2025 saw the company increase its net sales by 14% from the previous year to $213.4 billion, with the AWS segment growing by 24% in the same period to $35.6 billion. Meanwhile, EPS increased by 4.8% from the prior year to $1.95, marking the ninth consecutive quarter of yearly earnings growth from the company. Although it missed the estimates of $1.97, over the past nine quarters, this was the first miss by the company on the bottom line.

Net cash from operating activities came in at a hefty $54.5 billion, up a substantial 19.3% on a year-over-year (YoY) basis. Overall, Amazon closed 2025 with a mammoth cash balance of $86.8 billion with no short-term debt on its books.

For Q1 2026, Amazon expects revenues to be between $173.5 billion and $178.5 billion, the midpoint of which would denote an annual growth rate of 13%.

Coming to valuations, the picture is mixed, with the AMZN stock trading at a premium to the industry averages but at a discount to its own five-year averages. Its forward P/E, P/S, and P/CF of 26.89, 2.76, and 13.58 are all above the sector medians of 17.99, 0.97, and 11.67, respectively. However, its five-year averages for the same metrics are 164.49, 2.92, and 18.07, respectively.

Analyst Opinion on AMZN Stock

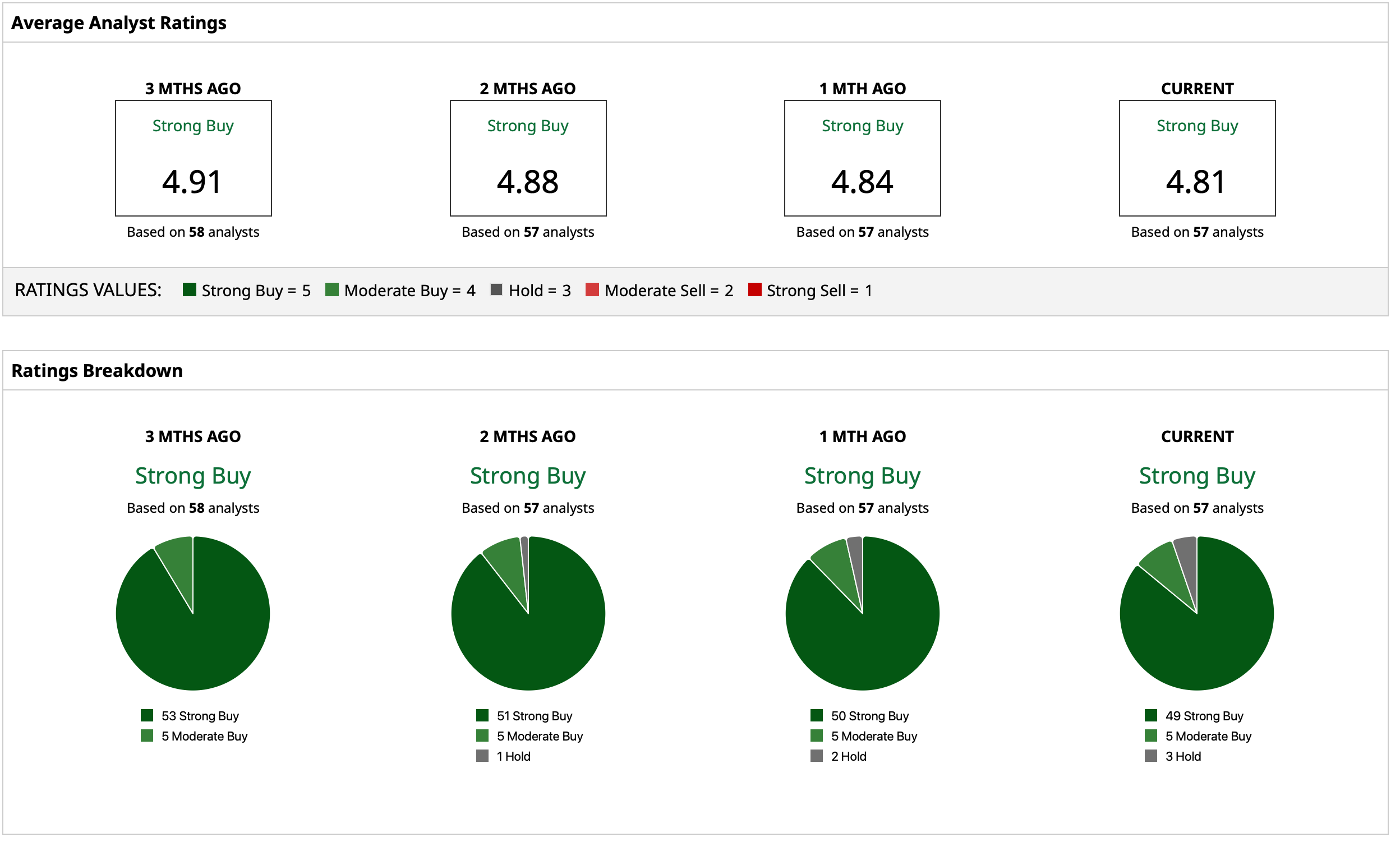

Thus, analysts have deemed the AMZN stock to be a “Strong Buy,” with a mean target price of $285.94. This indicates an upside potential of about 40% from current levels. Out of 57 analysts covering the stock, 49 have a “Strong Buy” rating, five have a “Moderate Buy” rating, and three have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart