With a market cap of $17.8 billion, Zimmer Biomet Holdings, Inc. (ZBH) is a leading global medical technology company specializing in orthopedic implants and surgical solutions. Headquartered in Warsaw, Indiana, it designs and manufactures products for joint replacement, sports medicine, trauma, spine, and dental applications, serving hospitals and surgeons worldwide. Zimmer Biomet is best known for its knee and hip replacement systems and its growing presence in robotic-assisted and digital surgery platforms.

The medical device manufacturer has significantly underperformed the broader market over the past year. ZBH stock prices have plunged 9% over the past 52 weeks, compared to the S&P 500 Index’s ($SPX) 14.4% returns. But on a YTD basis, the stock is up 1.7%, surpassing SPX’s 1.4% rise.

Narrowing the focus, Zimmer has outperformed the US Medical Devices Ishares ETF’s (IHI) 9.3% dip over the past 52 weeks and 6% drop in 2026.

On Feb. 10, Zimmer Biomet announced its fiscal 2025 Q4 earnings and its shares rose 1.9%. The company posted net sales of $2.24 billion, up 10.9% year over year, driven by strong demand for its hip and knee implant portfolios and continued momentum across key device categories. Adjusted diluted EPS increased 4.8% to $2.42, exceeding expectations. For full-year 2025, Zimmer Biomet delivered $8.23 billion in revenue and announced a $1.5 billion share repurchase program.

Management also provided 2026 guidance of 2.5%–4.5% revenue growth and adjusted EPS of $8.30–$8.45, balancing near-term headwinds from its U.S. sales transformation with long-term strategic positioning.

For FY2026 that ends in December, analysts expect ZBH to deliver an adjusted EPS of $8.41, up 3.1% year over year. Moreover, the company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

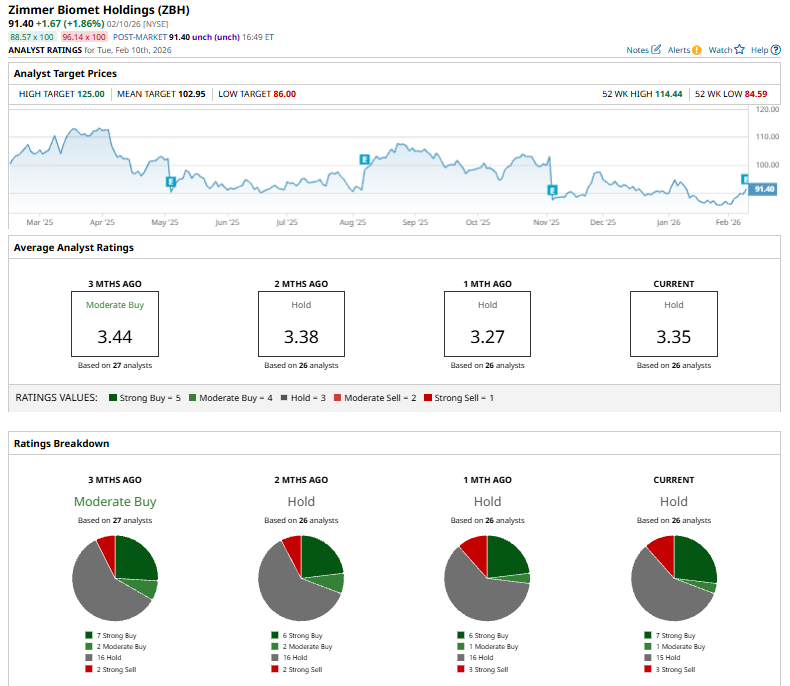

Among the 26 analysts covering the ZBH stock, the consensus rating is a “Hold.” That’s based on seven “Strong Buys,” one “Moderate Buys,” 15 “Holds,” and three “Strong Sells.”

The current consensus is bearish than three months ago, when the stock had an overall rating of “Moderate Buy.”

On Feb. 11, Ryan Zimmerman of BTIG reaffirmed a “Buy” rating on Zimmer Biomet and maintained his $112 price target, reflecting continued confidence in the company’s strategy, execution, and long-term growth potential.

Zimmer’s mean price target of $102.95 represents a 12.6% premium to current price levels. Meanwhile, the street-high target of $125 suggests a staggering 36.8% upside potential.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Is the Top-Rated Dividend Stock to Buy in February 2026

- No, AI Isn’t Killing Software: OKTA & More Top Stocks to Pull from the Ashes of ‘SaaS-pocalypse’

- 'If People in the Rest of the World Knew What I Know': MicroStrategy's Michael Saylor's Viral Message About MSTR Stock and Bitcoin to $10 Million

- As Upwork Plunges Below Key Support Levels, Should You Buy the UPWK Stock Dip?