Cambridge, Massachusetts-based Akamai Technologies, Inc. (AKAM) engages in the provision of security, delivery, and cloud computing solutions in the United States and internationally. With a market cap. of $13.6 billion, it offers security solutions that include web application and application programming interface (API) protection.

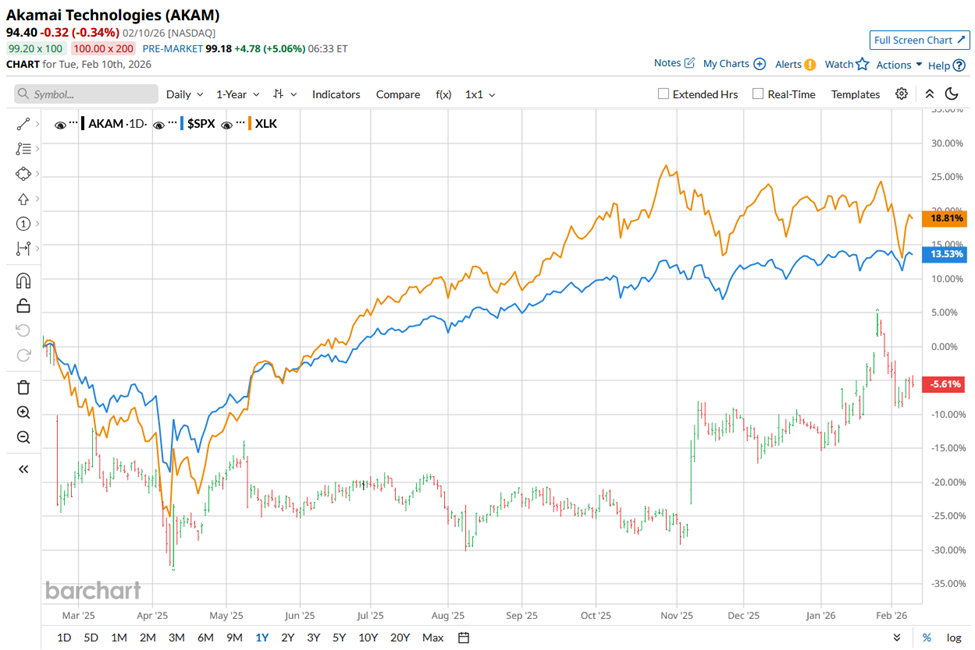

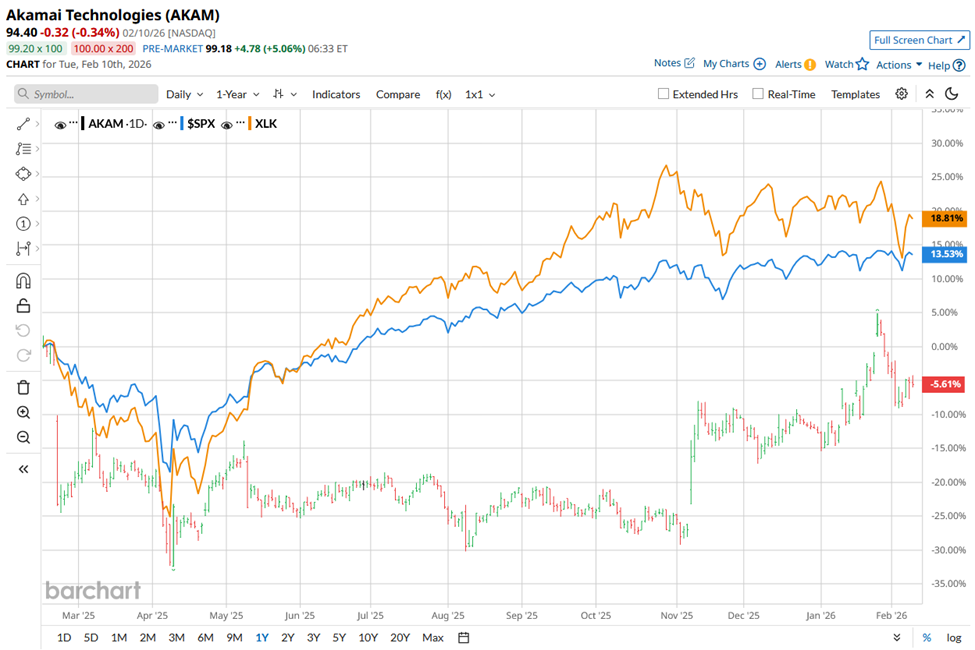

Shares of Akamai Technologies have lagged behind the broader market over the past 52 weeks. AKAM stock has declined 6% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 14.3%. However, shares of the company are up 9.2% on a YTD basis, compared to SPX's 1.3% gain.

Narrowing the focus, AKAM stock has also underperformed the State Street Technology Select Sector SPDR ETF (XLK), which has increased 20.5% over the past 52 weeks.

Shares of Akamai jumped 14.7% following its strong Q3 2025 results on Nov. 6, highlighted by revenue of $1.06 billion (up 5% year-over-year) and GAAP EPS of $0.97 (up 155% year-over-year), reflecting sharp margin expansion and operating leverage. Investors were especially encouraged by accelerating growth in Cloud Infrastructure Services revenue, which rose 39% to $81 million, alongside solid performance in security revenue of $568 million, up 10% year-over-year.

The rally was further fueled by upbeat guidance, with Akamai projecting full-year 2025 adjusted EPS of $6.93 - $7.13 and continued margin strength, as well as strategic optimism around the launch of its NVIDIA-powered Akamai Inference Cloud for AI at the edge.

For the fiscal year that ended in December 2025, analysts expect AKAM's EPS to rise marginally year-over-year to $4.56. The company's earnings surprise history is mixed. It beat the consensus estimates in the last four quarters.

AKAM has a consensus “Moderate Buy” rating overall. Of the 22 analysts covering the stock, opinions include 10 “Strong Buys,” one “Moderate Buy,” nine “Holds,” and two “Strong Sells.”

On Jan. 16, Citi analyst Fatima Boolani maintained a “Hold” rating on Akamai stock and set a price target of $103.

The mean price target of $100.70 represents a premium of 6.7% to AKAM's current levels. The Street-high price target of $134 implies a potential upside of 41.9% from the current price levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Should You Buy, Sell, or Hold HOOD Stock in February 2026?

- Pfizer Reports Strong Earnings Outlook - Unusual Call Options Activity Shows Investors are Bullish

- Strategy Keeps Buying Bitcoin as Crypto, MSTR Stock Prices Plunge. How Should You Play It Here?

- Down 18% From Its Recent High, Should You Buy the Dip in Sandisk Stock?