The so-called "software Armageddon" has arrived, and it is not being subtle about it. AI disruption fears have triggered a broad and brutal retreat across the sector, with Anthropic's recent launch of an automation tool for lawyers sending data service and software names tumbling in a single session.

Jefferies has gone as far as calling it a "SaaSapocalypse," as growing conviction that frontier AI models from OpenAI and Anthropic could eventually replace entire categories of enterprise software fuels an aggressive rush for the exits.

The damage is already visible in the numbers, as the S&P Software & Services ETF SPDR (XSW) has dropped 15.95% on a year-to-date (YTD) basis alone. Yet one of Wall Street's most vocal technology voices refuses to join the retreat.

Wedbush Securities' Dan Ives, a 25-year veteran of covering the sector, argues the market is pricing in a "doomsday scenario" that dramatically overstates the near-term threat to established software platforms. He has just added two beaten-down enterprise software giants back to his closely watched AI 30 list, betting that this Armageddon is more opportunity than obituary.

Are these names the mispriced survivors of a fear-driven selloff, or is the market sending a warning that should not be ignored? Let's find out.

ServiceNow (NOW)

ServiceNow (NOW) is a U.S.-listed enterprise software company headquartered in Santa Clara, California, focused on workflow automation and AI-driven digital operations.

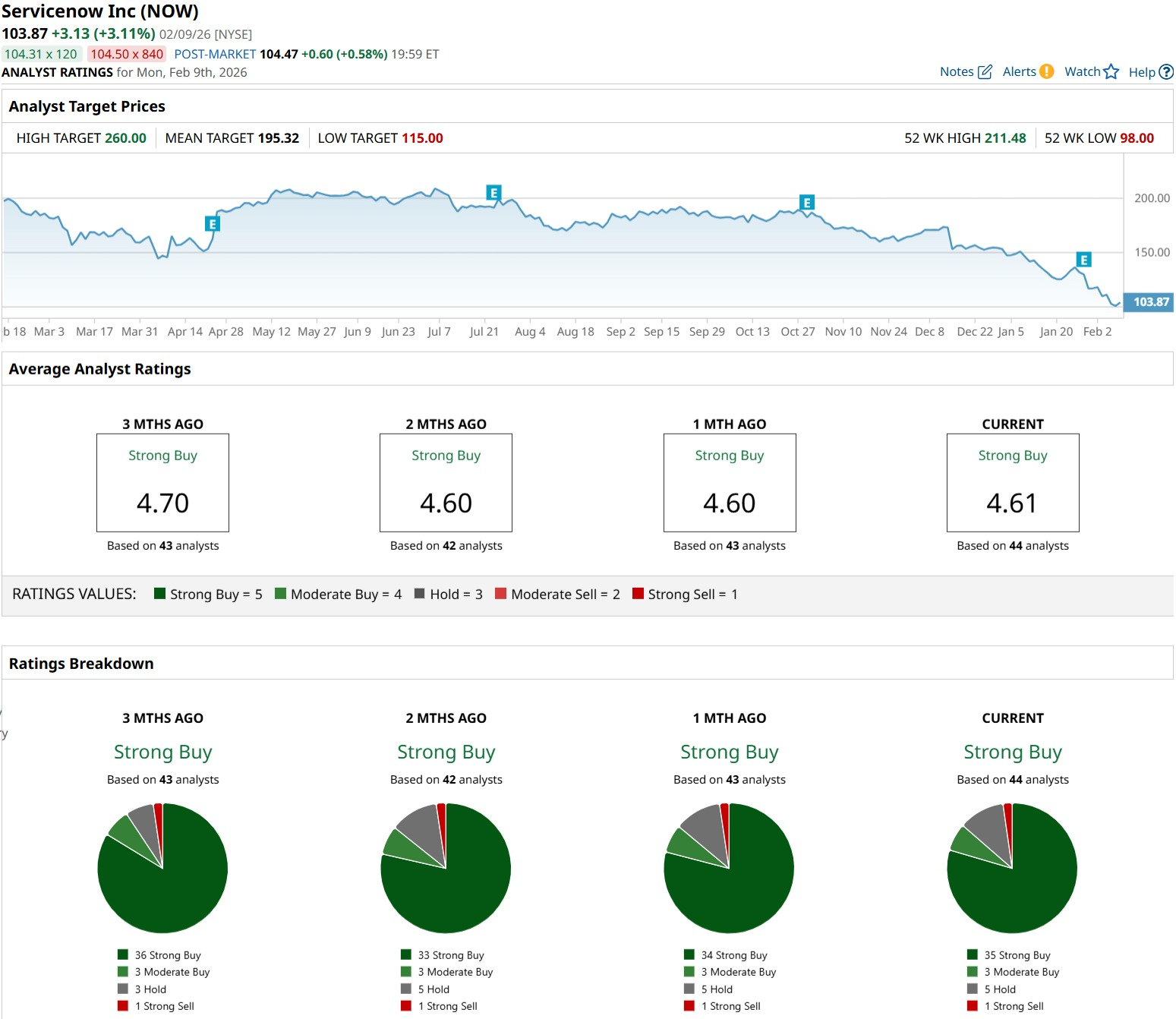

NOW stock trades at $103.87 as of Feb. 10, down 32.20% YTD and 48.49% over the past 52 weeks.

The stock now sits on a forward P/E of 41.63x versus a sector median of 29.67x and a price-to-sales of 8.08x against a sector median of 3.34x, with a market value of roughly $105.4 billion that reflects a premium.

This year’s strategic pivot toward “agentic” AI is central to that premium. It includes a multi-year collaboration with OpenAI that will embed frontier models directly into the ServiceNow AI Platform and deepen technical work between OpenAI advisors and ServiceNow engineers. They also featured a redesigned global Partner Program that is explicitly geared toward AI agents, a refreshed Build Program, and a stronger ServiceNow Store positioned as a marketplace for partner-built AI agents.

This story is also reinforced by the numbers. This latest earnings release on Jan. 27 showed Q4 CY2025 revenue of $3.57 billion versus expectations of $3.53 billion, representing 20.7% year-on-year (YoY) growth and a 1% top-line beat. It highlighted adjusted EPS of $0.92 against estimates of $0.89, a 3.9% beat that underlined both scale and discipline, and it noted free cash flow margin at 57%, sharply higher than 17.4% in the prior quarter.

The update detailed current remaining performance obligations of $12.85 billion, growing 21% in constant currency, which shows healthy demand for long-term subscriptions. That momentum feeds into estimates, with the Street looking for EPS of $0.54 for Q1 2026 and $2.47 for FY 2026, implying YoY growth of 17.39% and 26.02%, respectively, ahead of the next earnings date on April 22, 2026.

NOW stock also carries a consensus “Strong Buy” rating from 44 analysts, and the average target price of $195.32 suggests roughly 88% upside from current levels, which helps explain why Ives continues to view this AI compounder as a core beneficiary.

Salesforce (CRM)

Salesforce (CRM) is an enterprise software company based in San Francisco that delivers cloud-based CRM, data, and AI solutions to global businesses. It has an equity of $179.3 billion and offers an annual forward dividend of $1.66, which translates to a yield of 0.88%.

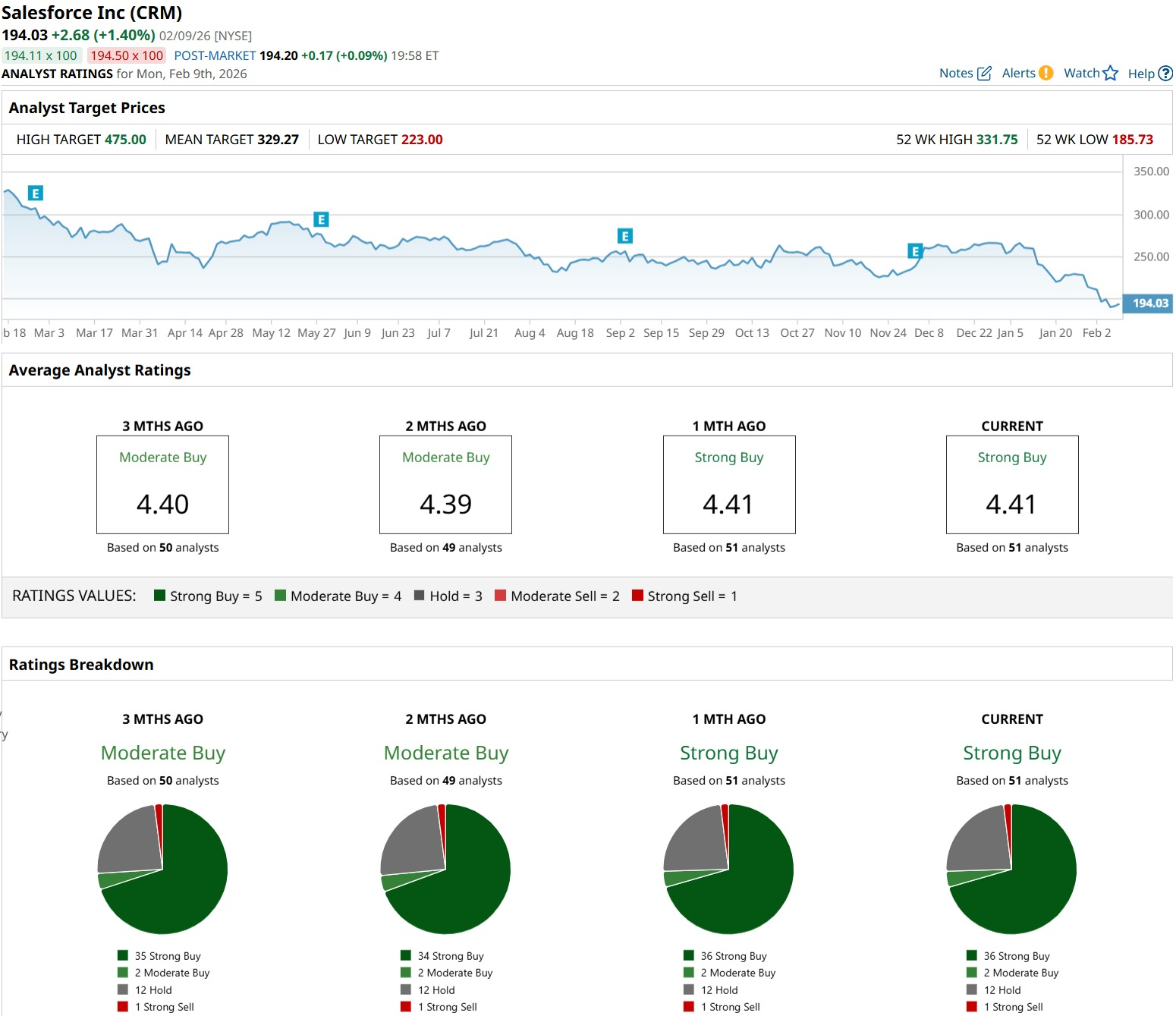

The stock’s current price is $194.03 as of Feb. 10, down 26.76% YTD and 40.45% over the past 52 weeks.

CRM is trading at 20.90x trailing earnings and 19.48x forward earnings versus sector medians of 23.43x and 23.78x, signaling a discount multiple on a franchise still central to enterprise software spending.

This discount is harder to reconcile with the contract momentum Salesforce is securing. It recently won a landmark $5.6 billion deal from the U.S. Army to support military modernization and the Department of War Readiness, using its trusted data fabric and compliant cloud stack to help the service move toward an “agentic enterprise.” The same AI-first positioning was on display at Davos, where Salesforce and the World Economic Forum rolled out a first-of-its-kind “agentic assistant” for the 2026 Annual Meeting.

This confidence is echoed in the earnings record. This last reported quarter, for the period ending October 2025, delivered EPS of $2.66 versus estimates of $2.15, a 23.72% upside surprise.

The company’s upcoming results on Feb. 25 (after market close) carry consensus EPS expectations of $2.14 for the January 2026 quarter and $8.92 for the full fiscal year, compared with $2.22 and $7.89 a year earlier. This setup implies a modest 3.6% decline near term but a 13.05% full-year increase.

The Street has translated that trajectory into a consensus “Strong Buy” rating from 51 covering analysts, while an average target of $329.27 points to roughly 70% upside from the current price.

Conclusion

Dan Ives’ stance boils down to this. If enterprise AI continues to scale as the data suggests, ServiceNow and Salesforce look more mispriced than broken and still sit firmly in strong‑buy territory for many on the Street. It is more likely that execution, contract wins, and AI agent adoption may tilt the odds toward a grind higher rather than another sustained leg down, though short‑term swings are almost guaranteed. Over a multiyear horizon, the risk and reward still seem skewed in favor of patient buyers willing to lean into this so‑called “software Armageddon.”

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Astera Labs Plunges Below Key Support Levels. Should You Buy the Dip in ALAB Stock?

- Can a New CEO Save Workday Stock from the Software Apocalypse?

- A Crypto Collapse Sends Robinhood Stock Back into Oversold Territory. Should You Buy the Dip?

- Unity Software Stock Is Back in Oversold Territory. Is There Any End in Sight for the Bloodshed in U Shares?