Valued at a market cap of $7.8 billion, The Campbell's Company (CPB) is a leading food and beverage manufacturer. With a diverse portfolio of iconic brands, it operates through Meals & Beverages and Snacks segments, serving customers across North America and internationally. CPB is expected to announce its fiscal Q2 2026 results soon.

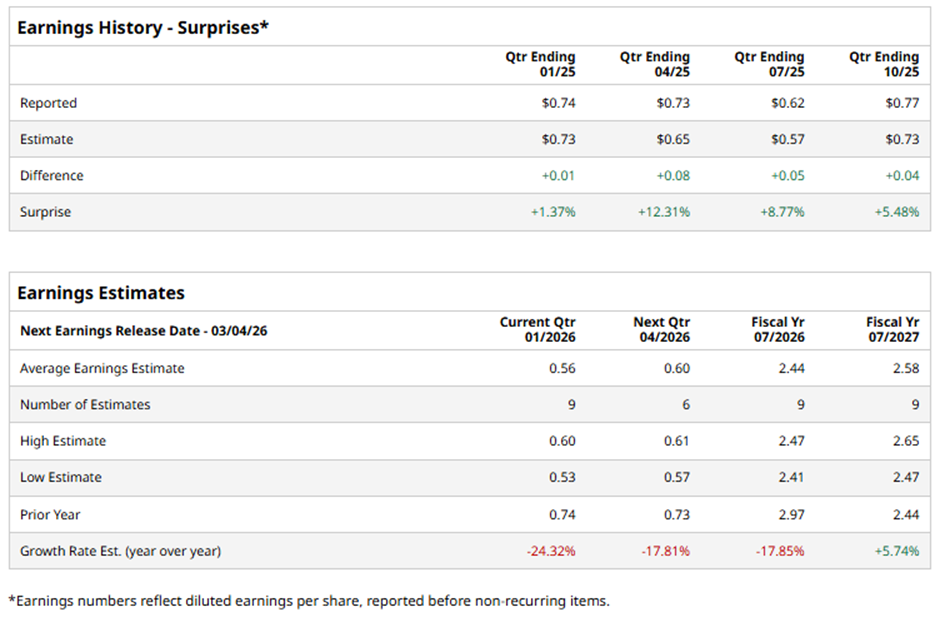

Ahead of this event, analysts expect Campbell to report an adjusted earnings of $0.56 per share, a decline of 24.3% from $0.74 per share in the year-ago quarter. However, the company has surpassed Wall Street's earnings estimates in the last four quarters.

For fiscal 2026, analysts expect the Camden, New Jersey-based company to report an adjusted EPS of $2.44, down 17.9% from $2.97 in fiscal 2025. Nevertheless, adjusted EPS is projected to rise 5.7% year-over-year to $2.58 in fiscal 2027.

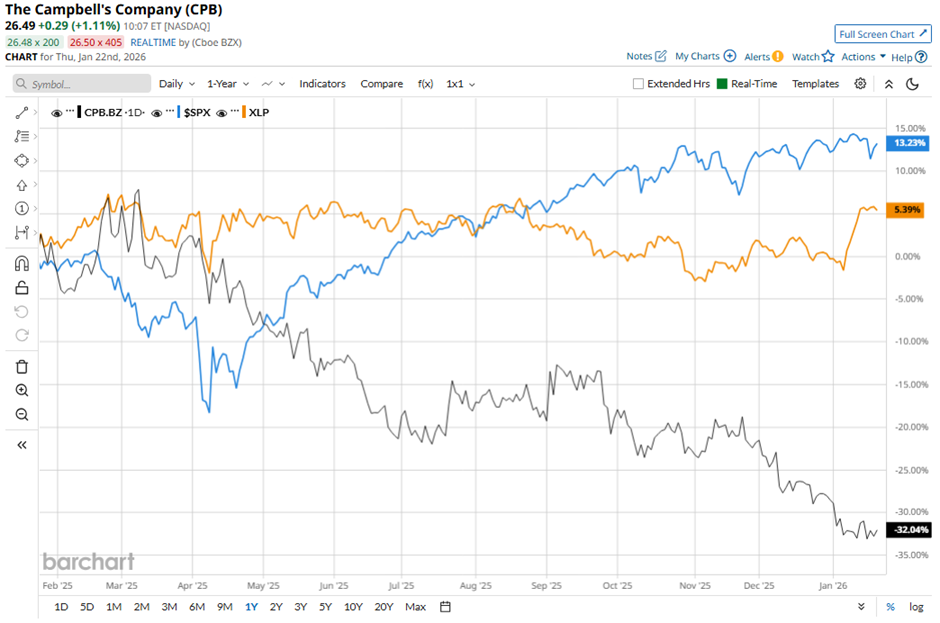

CPB stock has dropped 31.2% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 13.7% gain and the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 6.7% return over the same period.

Shares of Campbell’s fell 5.2% on Dec. 9 after the company reported weaker Q1 2026 results, including a 3% decline in net sales to $2.7 billion, an 11% drop in adjusted EBIT to $383 million, and a 13% decrease in adjusted EPS to $0.77. Additionally, full-year fiscal 2026 guidance implied significant declines, with adjusted EBIT expected to fall 9% - 13% and adjusted EPS projected at $2.40 - $2.55, down 12% - 18% from fiscal 2025 levels.

Analysts' consensus view on CPB stock is cautious, with a "Hold" rating overall. Among 19 analysts covering the stock, two recommend "Strong Buy," 13 suggest "Hold," one advises "Moderate Sell," and three "Strong Sells." The average analyst price target for Campbell’s is $30.35, suggesting a potential upside of 14.6% from current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?

- KHC Is Low-Hanging Fruit for Greg Abel: Which Warren Buffett Stock Will He Sell Next?

- The ‘Trump Effect’ Makes Intel’s Earnings Report Tonight Very Special. Why You Should Brace for a Double-Digit Move in INTC Stock.

- As SoFi Stock Drops Below $30, Is it a Buy Ahead of Q4 Earnings?