With gains of 70% last year, Alibaba (BABA) outperformed U.S. tech stocks by a wide margin. Incidentally, the returns were higher than Alphabet (GOOG) (GOOGL), which was the best-performing “Magnificent 7” stock in 2025. The Chinese tech giant has continued its good run in 2026 and is already up nearly 16% for the year, which is well ahead of what the average U.S. tech stock has delivered.

In my previous article, I had noted that Alibaba’s risk-reward for 2026 looked favorable despite the rally. With the stock now building on the gains, let’s explore whether there’s more to the BABA growth story this year.

Why Is Alibaba Stock Going Up?

Both positive macro developments and company-specific news have helped drive BABA stock higher this year. On the macro level, China announced an investigation into competition among food delivery companies amid an escalating price war. Alibaba is among the companies that operate food delivery platforms in China and has been incurring substantial losses in this business as competitors try to lure customers with subsidies. Alibaba, which has burned billions building that business, unsurprisingly welcomed the move. Curbs on an industry-wide price war would help platforms lower, if not outright eradicate, the cash burn.

Moreover, China’s 2028 action plan places a lot of emphasis on artificial intelligence (AI). The country has come a long way since 2020, when it cracked down on tech companies, with Alibaba being the poster child of the crackdown. Cut to 2026, and China is backing its tech companies as the U.S. and China strive for global AI dominance.

Being a planned economy—unlike the U.S., where things are largely determined by the market—China often picks up industries that it sees as strategically important and frames policies for their development. New energy vehicles (NEVs) are a case in point, as the government’s supportive policies helped drive adoption, and six out of every 10 cars sold in the communist country are now from the category that includes both battery electric and hybrid cars.

Alibaba is the leading AI play in China, as I have discussed in previous articles, and stands to benefit from the country’s supportive policies. The company's AI strategy is yielding results, and reports suggest that the downloads of its Qwen AI models have topped 700 million. Incidentally, Alibaba is going global with its AI initiatives and has announced data centers globally in countries like France, the UAE, Brazil, and Japan.

BABA Stock Forecast

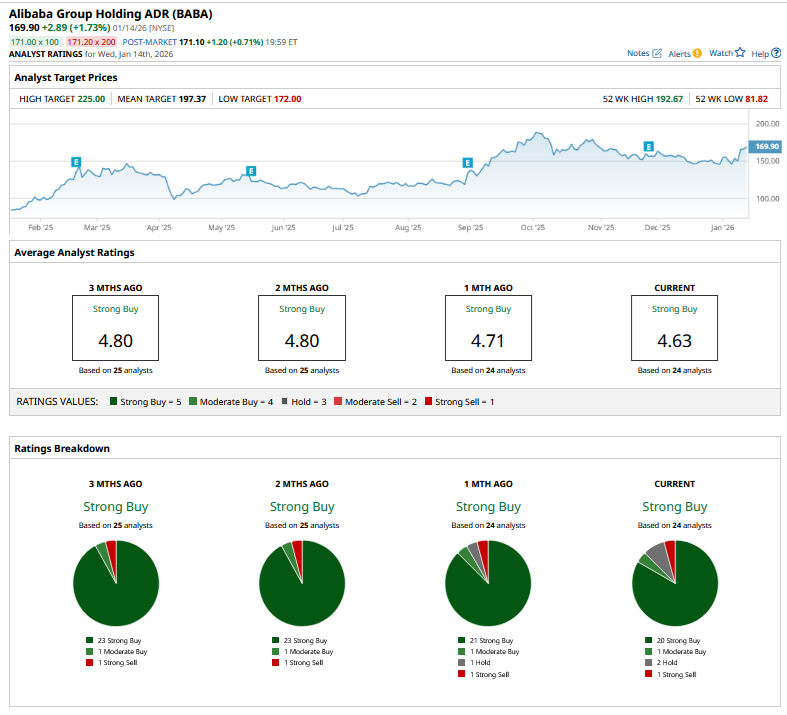

Sell-side analysts have been relatively cautious on Alibaba of late, and Freedom Capital downgraded the stock to a “Hold” from “Buy” earlier this year.

Jefferies and Morgan Stanley also lowered their target prices. While both brokerages are constructive on Alibaba’s cloud business, whose growth has received a boost from AI, they see a slowdown in the core e-commerce business. Notably, there have been intermittent concerns over the Chinese economy, which is battling a real estate crisis. Trade tensions with the U.S. haven’t helped the economy as exports to the U.S. have fallen in recent months amid the stiff tariffs imposed by President Donald Trump.

Overall, BABA has a consensus rating of “Strong Buy” from the 24 analysts polled by Barchart, while its mean target price of $197.37 is 16.2% higher than the Jan. 14 closing prices.

Can Alibaba Stock Rise Further In 2026?

The concerns over China’s slowdown and its impact on consumption and, by extension, Alibaba’s e-commerce business are not unfounded. However, I believe that it should be offset by the strength in the cloud business and the expected sanity in the instant commerce and food delivery business following the intervention from the Chinese government.

Alibaba’s efforts to go global with its AI offerings might receive impetus as several countries are now visibly trying to hedge their bets. We’re seeing something similar happen in electric cars, where traditional U.S. allies are going soft on imports from China after having previously followed the world’s biggest economy in raising tariffs.

From a valuation perspective, BABA trades at around 21x its expected earnings for the fiscal year 2027, which would end in March 2027. The valuations are still not unreasonable, even as the margin of safety is lower than it was earlier this year. I used the dips to add more positions in Alibaba late last year and remain invested in the stock. However, while I see BABA stock building on its 2026 gains, I am not too inclined to buy more shares at these levels and would sit out and await a better price.

On the date of publication, Mohit Oberoi had a position in: BABA , GOOG . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart