The market does like a good comeback story. After being dismissed and bound for irrelevance after the emergence of OpenAI's ChatGPT, Alphabet's (GOOGL) (GOOG) Google has made a sensational splash in AI over the past year with its Gemini 3 model. And now it is starting 2026 with a bang by surpassing the $4 trillion market cap barrier for the first time. Although market fluctuations occasionally cause it to dip below the $4 trillion mark, Alphabet's market cap has now surpassed Apple's (AAPL) for the first time since 2019.

Ironically, the iPhone maker had a part to play in that when the company revealed that it would use Google's Gemini model to launch a new and improved Siri later this year. This deals another blow to generative AI bellwether OpenAI, whose ChatGPT has suddenly become the laggard in the AI race, with Gemini ahead of the Sam Altman-led company's models across various tasks.

Notably, Alphabet's market cap currently stands at almost exactly $4 trillion, with its shares up a whopping 75% over the past year, easily outperforming its Magnificent 7 peers.

So, where does all this leave the GOOGL stock as an investment? Will its home run continue, or will the search giant have to search hard for another sharp uptick? Let's find out.

Financials Strong As Ever

Alphabet's ubiquity across the tech landscape has led to the company boasting of financials that are not only robust but also identified with growth.

Alphabet has maintained a solid growth trajectory over the past ten years, with revenue compounding at an annual rate of 18.31% and earnings per share at 23.43%.

The September 2025 quarter extended this track record, delivering results that exceeded expectations across key metrics. Consolidated revenue totaled $102.3 billion, representing a 16% rise compared with the prior-year period. Google Services generated $87.1 billion, up 14%, while the Cloud segment contributed $15.2 billion, marking a 34% increase. Adjusted earnings per share rose 35.4% to $2.87, surpassing the consensus projection of $2.26. Notably, this marked the ninth consecutive quarter of earnings beat from the company.

Search advertising, the company's longstanding core revenue driver, produced $56.6 billion, a 14.5% year-over-year (YoY) gain.

Cash flow from operations remained exceptionally strong, climbing to $48.4 billion from $30.7 billion in the corresponding quarter of 2024. Overall, Alphabet concluded the period with $23.1 billion in cash and equivalents and no short-term debt outstanding.

Valuation measures, however, have moved well above historical norms and sector benchmarks. The current forward P/E ratio of 31.10, P/S of 9.91, and P/CF of 25.11 are all above the sector medians of 17.40, 1.27, and 7.65, respectively, reflecting a premium pricing that leaves limited margin for error should growth moderate.

Google Remains Poised Well for More Growth

Google's valuation may be off-putting to some. Patient investors, however, stand to be rewarded by the company's strong long-term growth prospects. The primary driver is Alphabet's uniquely integrated AI stack, which now spans energy (through nuclear and geothermal agreements), silicon (7th-generation TPUs including Ironwood), infrastructure (Google Cloud and data centers), models (Gemini), and distribution (Android, Chrome, YouTube).

The newly introduced 7th-generation TPU, Ironwood, delivers a 10x improvement in peak performance compared with the TPU v5p and a 4x gain in per-chip efficiency. As AI workloads shift from training (capital-intensive) to inference (opex-driven), the cost per query becomes the key determinant of profitability. Lower inference costs allow Google to embed sophisticated AI models, such as Gemini 3 Deep Think, into free consumer products like AI Studio, Search, YouTube, and Gmail without materially eroding margins.

Consequently, reduced inference expenses also enable Google to process significantly more tokens than its peers, currently 1.3 quadrillion per month, representing a 20-fold YoY increase. This massive data throughput feeds back into model refinement, creating a self-reinforcing data advantage that enhances TPU efficiency over time. External monetization further strengthens the position, as competitors like Anthropic now utilize up to 1 million TPUs. By leasing its silicon advantage, Google transforms a traditional cost center (infrastructure) into a high-margin revenue stream, partially offsetting Nvidia's dominance in the market.

Notably, Ironwood has already attracted notable customers, including a $10 billion AI agreement with Meta and access for Anthropic to 1 million TPUs. Reports also indicate that Apple has trained foundational models using clusters of TPU v4 pods instead of GPUs. These developments have contributed to the acceleration in Google Cloud sales during the third quarter, with committed order backlog reaching $155 billion.

The cloud business itself continues to exhibit robust momentum, posting not only higher revenues but also expanding margins. Alphabet houses nine of the top ten AI research laboratories, with proprietary models such as Gemini, Imagen, and Veo integrated directly into the Cloud platform. Approximately 70% of current cloud customers are actively utilizing Google AI products, driving higher engagement and lifetime value. In the first nine months of 2025, Alphabet secured cloud contracts exceeding $1 billion in value, more than the combined total of the previous two years.

Thus, with a presence across the whole AI arena, along with a strong presence in the domain of autonomous vehicles through Waymo (10 million-plus trips already done by late 2025, with plans to expand into international markets such as London and Tokyo also afoot) and its dominance in its traditional businesses of advertising and Search, the Google juggernaut is seemingly looking unstoppable.

Analyst Opinion on GOOGL Stock

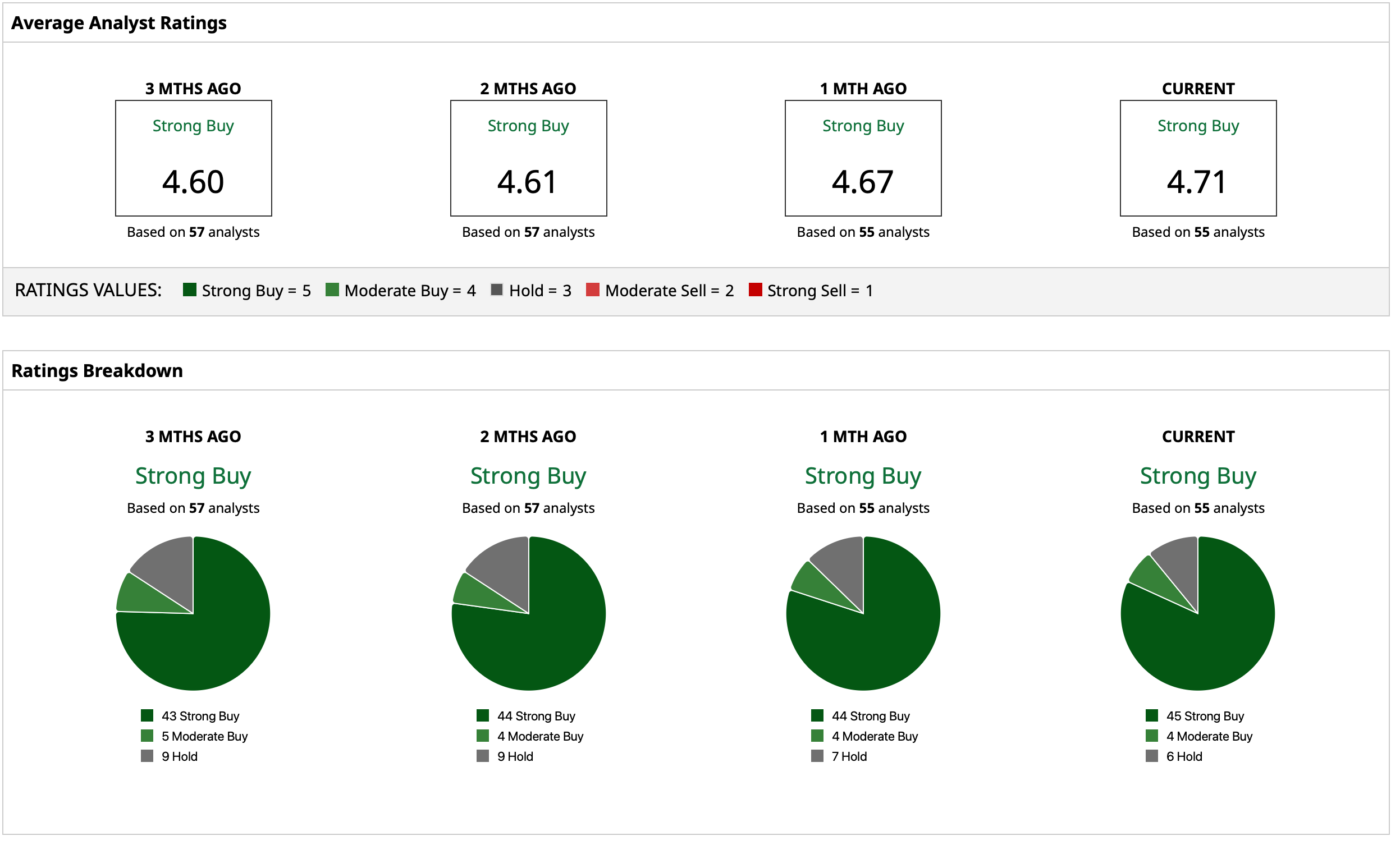

Thus, analysts have attributed the GOOGL stock to be a “Strong Buy,” with a mean target price of $334.23. Although this represents modest upside potential, the high target price of $400 denotes an upside potential of 20.5% from current levels. Out of 55 analysts covering the stock, 49 have a “Strong Buy” rating, four have a “Moderate Buy” rating, and six have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Mizuho Says This 1 Lesser-Known Chip Stock Is a Top Buy for 2026

- Citi Is Betting on Another ‘Supercycle’ in Palantir Stock. Should You Buy PLTR Here?

- Palmer Luckey Warns China’s ‘Most Powerful Weapon’ Isn’t a ‘Missile or Drone, It’s Their Ability to Control People’s Minds Through the Media’

- Analysts Say Capital One Stock Is a ‘Strong Buy.’ Did Trump Just Change That?