The semiconductor industry remains at the center of the artificial intelligence (AI)-led investment cycle, fueled by massive cloud spending, accelerating infrastructure buildouts, and a multi-year push toward advanced computing. While market sentiment has wavered at times, the long-term demand backdrop for chips tied to AI remains firmly in place.

NVIDIA Corporation (NVDA) has been the defining winner of this boom, transforming itself from a graphics pioneer into the backbone of modern AI data centers. After a historic run, however, 2025 brought a noticeable slowdown. Shares trailed several chip peers as investors grew cautious, weighed valuations, and questioned whether the AI trade had moved too far, too fast.

That pause has only heightened interest at Cantor Fitzgerald. With AI-linked stocks pressured by risk-off conditions and bubble fears, the brokerage firm argues the market is losing sight of the broader opportunity. Analyst C.J. Muse believes those concerns are overdone, pointing instead to a fresh AI demand inflection taking shape. With next-generation architectures approaching, demand visibility improving, and valuations resetting, Cantor foresees Nvidia’s current setup as increasingly attractive heading into 2026, making it “top pick.” Let’s look at it closely.

About NVIDIA Stock

Santa Clara-based Nvidia has spent decades building itself into one of the most influential technology companies on the planet. What began as a gaming graphics specialist evolved into a computing powerhouse spanning data centers, networking, automotive, and advanced software.

Its CUDA platform entrenched Nvidia deeply within developer workflows, shifting the company from a component supplier to an industry standard. Today, under Jensen Huang, Nvidia stands as a dominant force with global reach and immense financial scale, currently boasting a market capitalization of nearly $4.6 trillion.

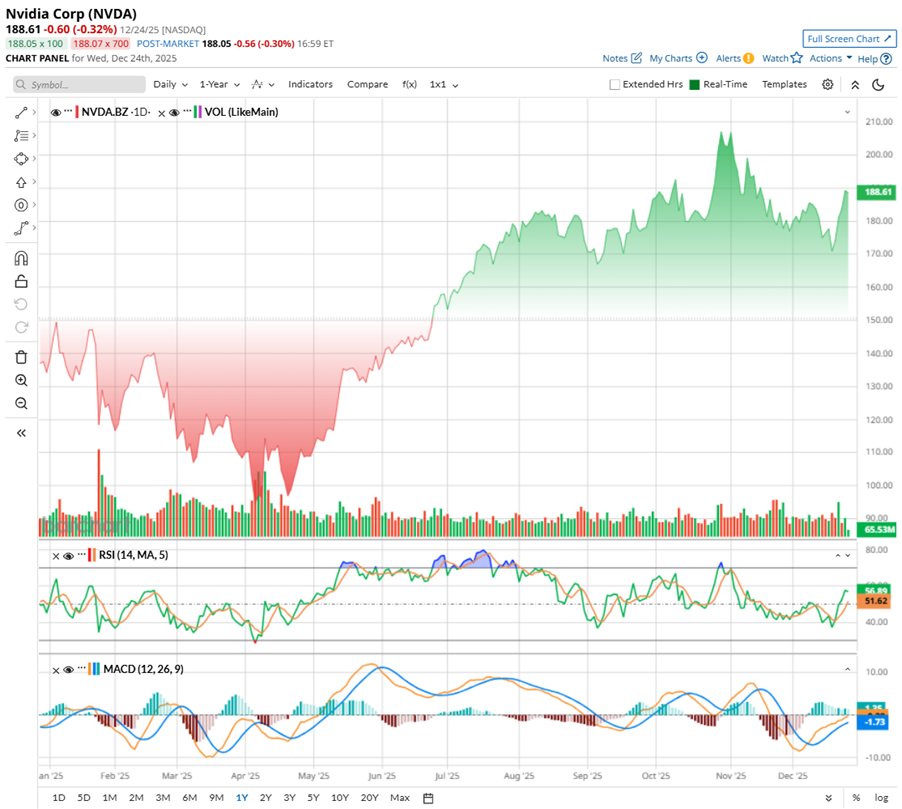

Nvidia's operational dominance has translated into a stock story marked by sharp runs, healthy pauses, and strong long-term structure. NVDA has rallied aggressively through 2025, only stopping periodically to consolidate gains. After peaking near $212.19 in late October, the stock is down by 11.67%. Even after that dip, shares of the chip giant remain firmly in an uptrend, up over 41.9% year-to-date (YTD), and 22.9% over the past six months.

Plus, NVDA has surged recently on a mix of analyst optimism and strategic developments. For instance, after Cantor named it a top 2026 pick, and BofA reiterated a “Buy” with a $275 target on NVDA after a new licensing deal with AI firm Groq, the stock price rose.

Momentum also followed reports that NVDA plans to resume H200 AI chip shipments to China by mid-February, pending approvals, marking the first major U.S. export of advanced AI chips since prior restrictions, boosting investor confidence despite lingering regulatory risks.

Technically, the chart suggests stabilizing momentum. The 14-day Relative Strength Index (RSI), which pushed into overbought territory above 70 in October, has eased back toward the mid-to-high 50s. That’s a constructive zone, indicating excess froth has been worked off. More importantly, the RSI is turning upward again, signaling improving momentum and renewed buyer interest rather than fading demand. Trading volume has returned to normal levels, suggesting the stock is taking a breather and moving sideways rather than seeing heavy selling or investors rushing for the exits.

The MACD oscillator reinforces that view. The MACD line remains above its signal line, indicating a bullish broader trend. Meanwhile, the histogram has flipped back into positive territory this month, signaling strengthening upside momentum. Taken together, NVDA’s technical setup signals the stock is catching its breath and not losing momentum, with the overall trend still looking solid as it prepares for the next move.

Nvidia’s valuation can seem rich at first pass. The stock is priced at 42.85 times forward earnings and roughly 21.5 times sales, levels that tower over most peers. But context matters.

At the same time, Blackwell-based deployments are only beginning to scale, with a broader rack-level upgrade cycle forming around Blackwell and the upcoming Vera Rubin GPUs. With earnings growth still accelerating, the premium reflects forward visibility rather than excess, suggesting valuation is being anchored by what lies ahead, not just what’s already priced in.

Nvidia Beats Q3 Revenue and EPS Estimates

Nvidia’s third-quarter update had a familiar ring to it – strong numbers, confident outlook, and little sign of fatigue. On Nov. 19, the stock rose nearly 3% as the company delivered results that comfortably cleared Wall Street’s bar and were backed by confident guidance. Revenue grew 62.5% year-over-year (YOY) to $57.01 billion, while adjusted EPS rose 60.5% annually to $1.30, signaling that size has not dulled Nvidia’s execution.

The data center segment remained the backbone of the business, with sales jumping 66% to $51.2 billion. Networking emerged as a standout, posting a massive 162% revenue jump to $8.2 billion as products like NVLink, InfiniBand, and Spectrum-X Ethernet saw rising adoption. Gaming continued to show resilience with 30% growth, while the automotive unit quietly built momentum, advancing 32% from a year earlier.

Leadership struck a confident note throughout. CFO Colette Kress pointed to Blackwell Ultra as the company’s top-selling product, and CEO Jensen Huang said cloud GPUs are effectively sold out. With fourth-quarter revenue projected at around $65 billion, plus or minus 2%, Nvidia’s operating rhythm looks steady and far from slowing down.

Meanwhile, analysts tracking Nvidia forecast its Q4 fiscal 2026 revenue to be $65.6 billion, and EPS is anticipated to grow 69.4% YOY to $1.44. For the full fiscal 2026, the bottom line is expected to surge 50.9% annually to $4.42 per share and rise by another 55.7% to $6.88 in fiscal 2027.

What Do Analysts Expect for Nvidia Stock?

Wall Street’s outlook on Nvidia has taken a noticeably constructive turn, led by Cantor Fitzgerald’s bullish stance. The firm recently reiterated NVDA as a “top pick,” arguing that the AI chip stock’s pullback has created an attractive entry point. With demand trends stabilizing, valuations resetting, and a new product cycle approaching, Cantor believes the market is underestimating Nvidia’s next leg of growth.

That optimism is echoed at Tigress Financial, which has grown even more confident in Nvidia’s long-term story. Last week, Tigress raised its price target to $350 from $280 and maintained a “Strong Buy” rating, calling NVDA stock the “premier AI investment” on the market.

Tigress points to Nvidia’s dominance in data center computing as the foundation, but sees additional upside from expanding use cases in areas like autonomous driving and healthcare. A steady stream of record quarters reinforces Nvidia’s role as the core engine behind global infrastructure buildouts. With strong cash generation, disciplined capital allocation, and underappreciated growth drivers emerging, Tigress views Nvidia as a long-duration winner still early in its journey.

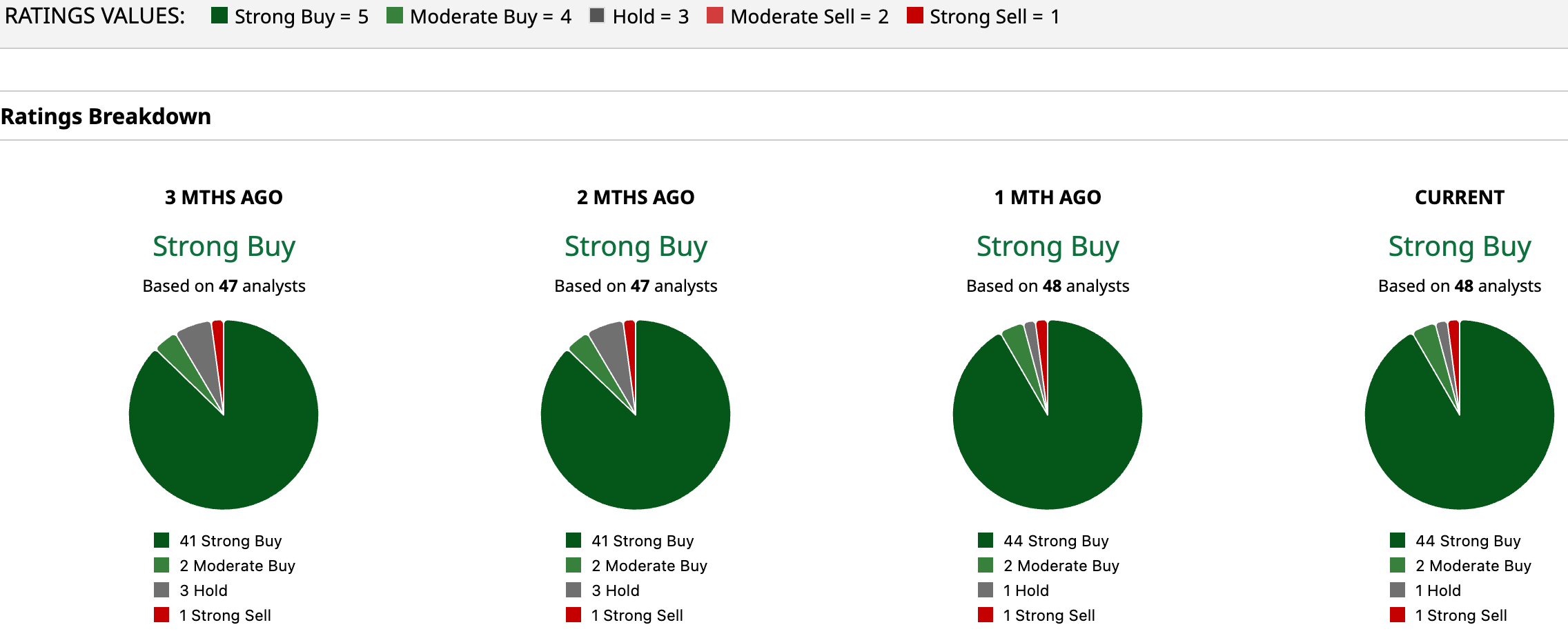

Overall, analysts are bullish about NVDA’s growth prospects, giving the stock a consensus rating of “Strong Buy.” Of the 48 analysts covering the stock, 44 advise a “Strong Buy,” while two suggest “Moderate Buy,” one advises a “Hold,” and only one suggests a “Strong Sell.”

The average analyst price target for NVDA is $256, indicating potential upside of 34.36%. Evercore ISI’s Street-high target price of $352 suggests that the stock could rally as much as 84.75% from here.

Final Thoughts on NVDA

As 2026 approaches, the questions around Nvidia are less about demand and more about how much of it ultimately flows through the income statement. Data centers remain the anchor, but attention is steadily shifting toward what comes next – Rubin chips, expanding backlogs, and deeper penetration across infrastructure layers.

Management has already flagged a massive $500 billion order backlog tied to chips and networking, with a significant portion of it expected to land in 2026 alone. Big customers are not slowing either, with hyperscalers set to pour hundreds of billions into infrastructure. Meanwhile, deals like Anthropic’s long-term compute agreement add visibility. Beyond that, Nvidia is quietly expanding into CPUs, software, and inference through partnerships and strategic moves like the reported Groq acquisition.

Competition is clearly rising, and geopolitical risks cannot be ignored. Still, Nvidia enters this phase with a solid balance sheet, expanding markets, and a relentless focus on R&D and long-horizon bets across areas like robotics and quantum computing. Those strengths help reinforce its staying power, which is why Cantor's analyst projects NVDA poised for gains in 2026.

For long-term investors, the recent pullback looks less like a red flag and more like a chance to add exposure to a market leader as it gears up for its next chapter.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart