With a market cap of $30.1 billion, Verisk Analytics, Inc. (VRSK) is a global provider of data analytics and technology solutions focused primarily on the insurance industry. Its offerings span underwriting, claims, fraud detection, catastrophe modeling, and workflow optimization for insurers worldwide.

Shares of the Jersey City, New Jersey-based company have underperformed the broader market over the past 52 weeks. VRSK stock has declined nearly 22% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 13.7%. Moreover, shares of the company are down 20.5% on a YTD basis, compared to SPX’s 13.4% gain.

Focusing more closely, shares of the insurance data provider have lagged behind the Industrial Select Sector SPDR Fund’s (XLI) 8.2% return over the past 52 weeks.

Despite reporting better-than-expected Q3 2025 adjusted EPS of $1.72, Verisk shares sank 10.4% on Oct. 29 after the company cut its 2025 revenue forecast to $3.05 billion - $3.08 billion, below expectations, and posted Q3 revenue of $768.3 million, missing consensus. Demand for its property claims estimating tool weakened as exceptionally low severe weather and the first Atlantic hurricane season in a decade with no U.S. landfalling hurricanes sharply reduced claims activity.

For the fiscal year ending in December 2025, analysts expect Verisk Analytics’ adjusted EPS to grow 4.5% year-over-year to $6.94. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

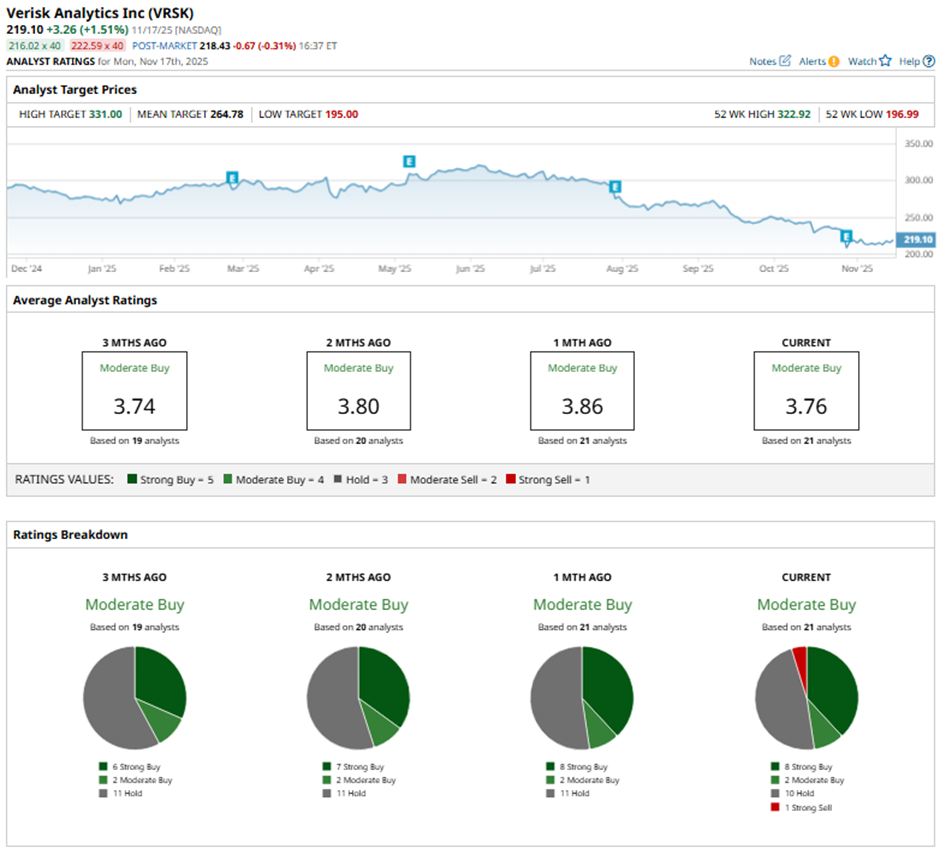

Among the 21 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on eight “Strong Buy” ratings, two “Moderate Buy,” 10 “Holds,” and one “Strong Sell.”

This configuration is more bullish than three months ago, with six “Strong Buy” ratings on the stock.

On Oct. 30, JPMorgan analyst Andrew Steinerman lowered Verisk’s price target to $250 while maintaining an “Overweight” rating.

The mean price target of $264.78 represents a premium of 20.8% to VRSK's current price. The Street-high price target of $331 suggests a 51.1% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Think AI Stocks Are Overvalued? Invest in These Data Center Power Trades for the Next Growth Phase.

- This High-Yield Dividend Stock Is Beaten Down, But Wall Street Still Loves It

- Unusual Options Activity Shows 71,000 Calls Hit the Tape for Applied Digital Stock – How You Should Play APLD Here

- AMD Is Powering the New Steam Machine. Will It Move the Needle for AMD Stock?