VANCOUVER, BC / ACCESSWIRE / September 27, 2023 / AZARGA METALS CORP. ("Azarga Metals" or the "Company") (TSX-V:AZR) reports that it has settled the final C$560,857 shareholder loan by the issuance of 3,739,049 common shares (the "Shares") at a deemed price of $0.15. The Shares issued are subject to a four-month and one day hold period from the date of issuance.

This completes the restructuring of the Company's balance sheet, as was previously announced (News Releases, June 5, June 27 and July 18, 2023). As a result, the Board of Directors believes that the Company will have greater flexibility in developing plans for its 100% owned Marg project (the "Marg Project"), a high-grade copper-rich Volcanogenic Massive Sulphide ("VMS") deposit located in the Keno Hill Silver District, Yukon Territory.

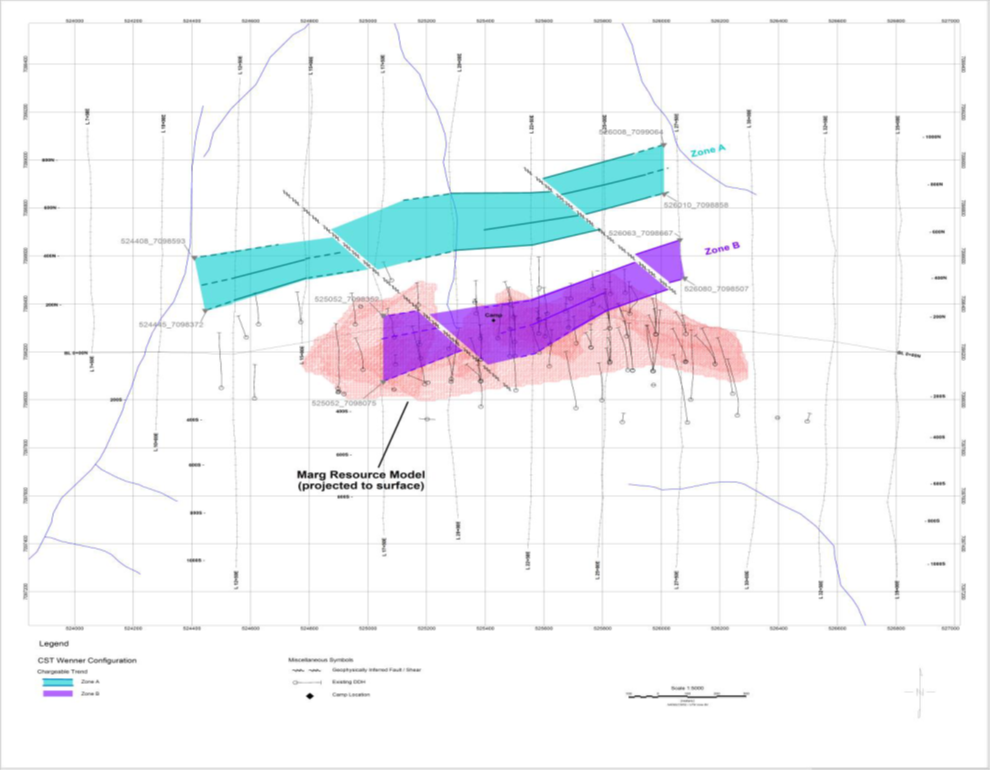

On May 23, 2023, the Company announced the results of its induced polarization ("IP") survey, completed by Abitibi Geophysics. The results of the IP work continue to suggest that significant exploration potential remains on the property.

The Marg Project's mineralization remains open at depth to the east, along strike to the west and there is evident potential downdip for further high-grade mineralization, possibly in another synclinal fold hinge. In addition to this, further opportunities exist to expand the scale of the Marg Project:

- VTEM ± geochemical data and geologic mapping have not yet been fully incorporated into the exploration model, presenting opportunities for new exploration ideas and potential discoveries.

- Historical work suggests the potential for another Marg-style deposit at the Jane Zone, which is located approximately 6km to the southwest along trend.

- Jane Zone soil geochemical anomaly is similar in scale and magnitude to that associated with the Marg deposit.

- Intermittent VTEM anomalies can be traced along the trend between the Jane Zone and Marg deposit area.

Gordon Tainton, President and CEO of Azarga Metals stated, "The Company is very excited by the prospectivity of the Marg Project. With the balance sheet restructuring completed, we can now focus on continuing to move our business forward, specifically on the Marg Project, and work to create value for our shareholders. Based on the exploration work to date, we believe the size of the mineralized zone at the Marg Project has the potential to more than double."

The next steps for the Marg Project include:

- Further review of the historical geophysical and geochemical database (incl. re-interpretation of underutilized VTEM data).

- Extension of the IP survey at the Marg Project and potentially the Jane Zone with a deeper penetrating array during the summer/autumn season (see chargeable Zones A and B in Figure 1).

- Drill test the Marg target extensions and the highly prospective Jane Zone geophysical target.

The most recent NI 43-101 Mineral Resource estimate for the Marg Project (see Table 1 below) was completed by Mining Plus Canada Consulting Ltd. in 2016 and was incorporated into a Preliminary Economic Assessment ("PEA") for the project (note: the PEA title is "Revere Development Corp, Marg Project Preliminary Economic Assessment, Technical Report, Yukon Canada" and is dated August 31, 2016).

The mineral resource estimate in the 2016 PEA was prepared in accordance with NI 43-101 standards and is considered by Azarga Metals management to be reliable. However, the resource has not been verified by Azarga Metals and is considered historical in nature. A qualified person representing Azarga Metals has not done sufficient work to classify the historical estimate as a current mineral resource and Azarga Metals is not treating it as a current mineral resource.

Table 1 - August 31, 2016 Historical Resource estimate for the Marg Project at a 0.5% copper equivalent cut-off (combining high-grade and low-grade zones)1

Category |

Tonnage (mt) |

Cu% |

Pb% |

Zn% |

Ag g/t |

Au g/t |

Indicated |

3.7 |

1.5 |

2.0 |

3.8 |

48 |

0.76 |

Inferred |

6.1 |

1.2 |

1.7 |

3.4 |

44 |

0.74 |

Note: 1. Where CuEq% was calculated = Cu% + 0.28 Pb% + 0.32 Zn% + 0.39 Au g/t + 0.0055 Ag g/t, which was assessed based on the following metal price and recovery assumptions: Cu price of 2.5 US$/lb and recovery of 80% (96.5% payable); Pb price of 0.8 US$/lb and recovery of 70% (95% payable); Zn price of 0.8 US$/lb and recovery of 90% (85% payable); Au price of 1100 US$/oz and recovery of 50% (90% payable); and Ag price of 16 US$/oz and recovery of 50% (90% payable).

Qualified Person

The technical content of this news release has been reviewed and approved by Charles J. Greig, P.Geo., a consultant to Azarga Metals and a Qualified Person as defined by NI 43-101.

AZARGA METALS CORP.

"Gordon Tainton"

Gordon Tainton,

President and Chief Executive Officer

For further information please contact: Doris Meyer, at +1 604 536-2711 ext. 3 or visit www.azargametals.com. The address of the head office of Azarga Metals is Unit 1 - 15782 Marine Drive, White Rock, BC V4B 1E6, British Columbia, Canada.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement:

This news release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "ambition", "estimate", "concluded", "offers", "objective", "may", "will", "should", "potential" and similar expressions are intended to identify forward looking statements, but not limited to, the Company's interpretation of the results of the IP survey for the Marg Project and the use of the results of the IP survey to identify drilling targets with high prospectivity with the goal to extend the known Marg mineralization to the north and east of the existing historical deposit and complete an extension of the IP survey with a deeper penetrating array during the summer/autumn months, subject to the Company having sufficient funds to complete additional exploration activities. Although the Company believes that the expectations and assumptions on which the forward looking statements are based are reasonable, undue reliance should not be placed on the forward looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with the state of equity financing markets and results of future exploration activities by the Company. Management has provided the above summary of risks and assumptions related to forward looking statements in this news release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward looking statements are made as of the date of this news release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward looking statements, whether as a result of new information, future events or results or otherwise.

SOURCE: Azarga Metals Corp.

View source version on accesswire.com:

https://www.accesswire.com/788014/azarga-metals-completes-balance-sheet-re-structure